Effortless Reconciliation of Toll Shipping Invoice with Cointab

Effortless Reconciliation of Toll Shipping Invoice with Cointab

Tired of spending hours manually verifying Toll invoices?

Toll, a leading Australian logistics provider, offers a complex network of road, sea, and air freight services. With millions of deliveries and charges to track, ensuring accurate billing can be a daunting task. Here’s where Cointab Reconciliation steps in.

Effortless Toll Invoice Verification

Cointab Reconciliation automates the entire Toll invoice verification process, freeing up your finance team’s valuable time. Our software eliminates manual data entry and tailors itself to your specific needs.

Say goodbye to errors and overcharges.

Cointab automatically cross-checks your ERP reports, SKU reports, rate cards, and pin code master data against Toll’s invoices. This comprehensive approach ensures you identify any discrepancies, including overcharges, for a seamless verification process.

Understanding the Required Reports:

- Pincode Zone Report: This report identifies origin pincodes, destination pincodes, and the corresponding zone based on the combination.

- SKU Report: Each product receives a unique SKU number that reflects its weight and dimensions.

- Rate Card: This document outlines the specific rate assigned to each product based on its weight and zone.

- Toll Invoice: Toll’s invoice provides crucial details like billing zone, weight, SKU, product type, billing pincode, order ID, RTO (Return To Origin), applied weight slab, and the final charged amount.

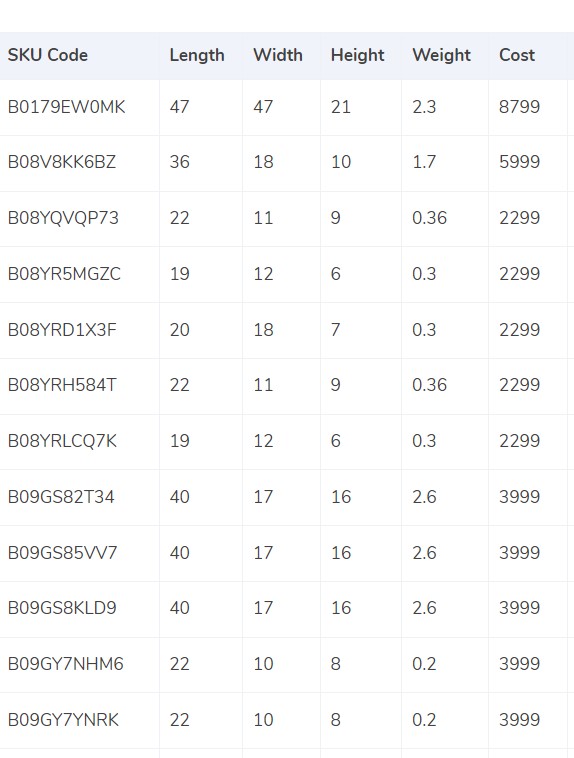

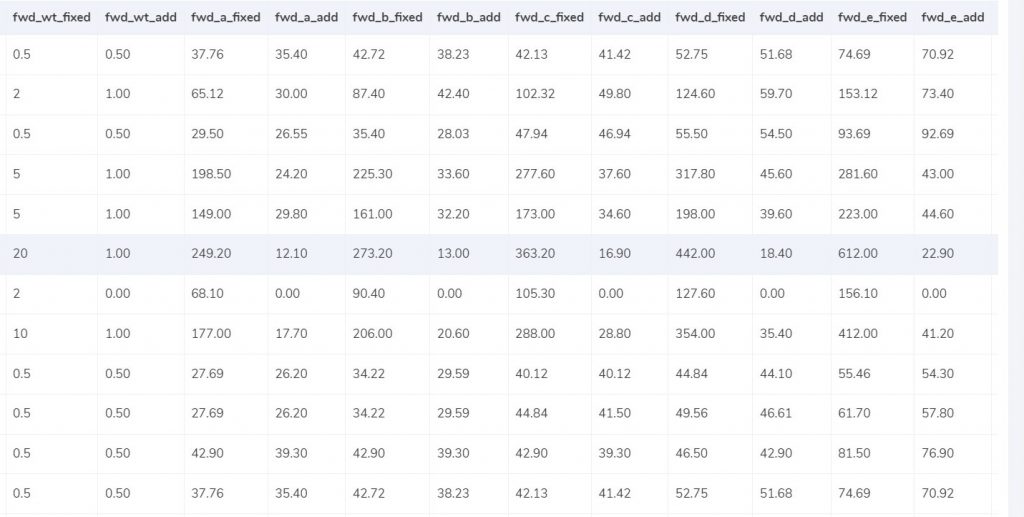

SKU Report

Determining Product Weight:

The SKU report plays a crucial role. It assigns a unique SKU number to each product, containing essential information like weight and dimensions.

Weight from SKU Report:

If the ERP report doesn’t specify the weight, the invoice weight is used.

Volumetric Weight Calculation (if dimensions provided):

When product dimensions are available, the volumetric weight is calculated using the formula: Length x Width x Height (all measurements in centimeters).

This calculated value is then divided by a divisor, typically found in the “divisor card.” If the divisor card is unavailable, a standard divisor of 5,000 is used.

Weight Synchronization:

The calculated volumetric weight (if applicable) is then incorporated into both the Toll invoice and the ERP report.

Final Weight Determination:

Finally, the weight (actual or volumetric) is rounded to determine the appropriate weight slab for billing purposes.

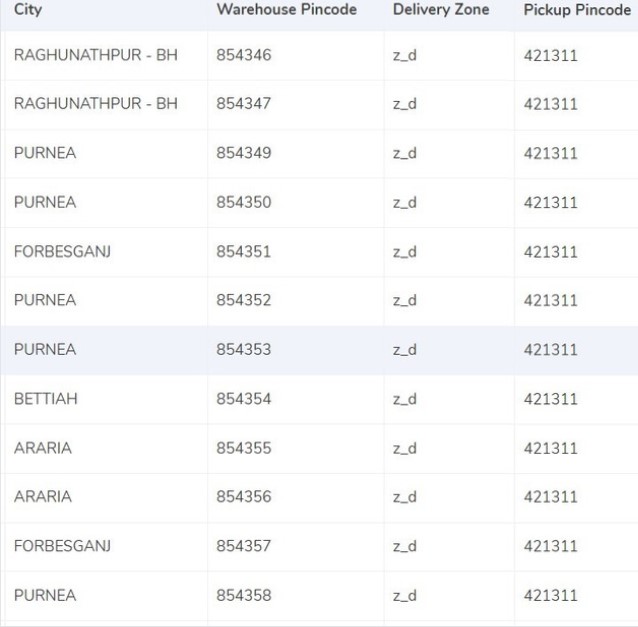

Pincode Master

Zone Determination:

Zones play a vital role in calculating delivery fees. Each invoice has an assigned zone based on the combination of its origin and delivery location. This information is linked from the invoice details to identify the appropriate zone for each shipment.

Delivery Zones and Categories:

Orders are grouped and delivered based on designated zones, such as local, regional, or broader areas. Additionally, within each zone, further categorization might occur using identifiers like “a,” “b,” or “c.” These additional categories could represent specific delivery speeds, service levels, or other factors relevant to your business.

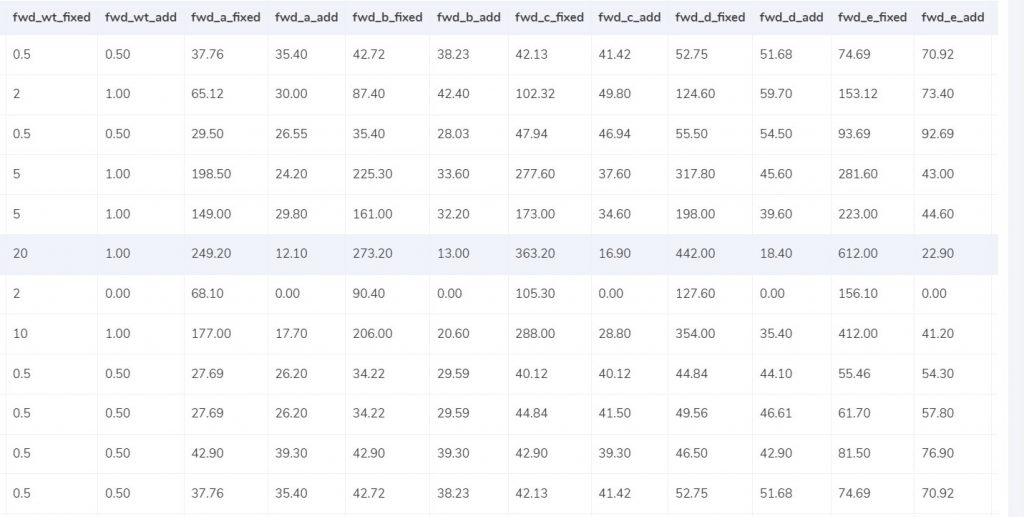

Rate card

Verifying Rates and Delivery Dates

The rate card is your reference for determining delivery charges. It outlines rates based on product weight and zone. These rates typically apply within a specific weight range, and charges may increase for heavier items.

Matching Invoice Data: Cointab Reconciliation verifies if the correct rates are applied on the Toll invoice by comparing the following columns:

Courier: Ensures the appropriate courier service is listed.

Zone: Confirms the assigned zone matches the origin and destination locations.

fwd_wt_fixed (Additional Weight for Fixed Rate Increase): Checks if the additional weight threshold for a fixed rate increase aligns with the invoice details.

Divisor: Verifies if the divisor used for volumetric weight calculations (if applicable) matches the one specified in the rate card or the default value (usually 5,000).

Delivery Date Validity: It’s crucial to ensure delivery dates fall within the validity period of the product rates listed in the rate card. Cointab Reconciliation can also flag any discrepancies in this area.

Charges

Expected Forward Charges

The final weight slab determines the forward charges. Here’s how it works:

Weight within Limit (“fwd_wt_fixed”)

If the final weight falls within or at the limit specified in the “fwd_wt_fixed” column of the rate card, the charge equals the “fwd_fixed” amount for your zone.

Weight Exceeds Limit

If the final weight surpasses the “fwd_wt_fixed” limit, the charge includes a fixed amount (“fwd_fixed”) for your zone plus an additional charge per extra weight unit (“fwd_add”).

Expected RTO Charges:

Similar to forward charges, RTO (Return To Origin) charges depend on the final weight:

Weight within Limit (“rto_wt_fixed”)

If the final weight falls within or at the limit specified in the “rto_wt_fixed” column of the rate card, the charge equals the “rto_fixed” amount for your zone.

Weight Exceeds Limit

If the final weight surpasses the “rto_wt_fixed” limit, the charge includes a fixed amount (“rto_fixed”) for your zone plus an additional charge per extra weight unit (“rto_add”).

Expected Final Amount:

The final invoice amount is calculated by combining the expected forward charge, RTO charge (if applicable), and any applicable tax percentage. Cointab Reconciliation uses these formulas to determine the expected charges and compare them to the actual charges on the Toll invoice, highlighting any discrepancies.

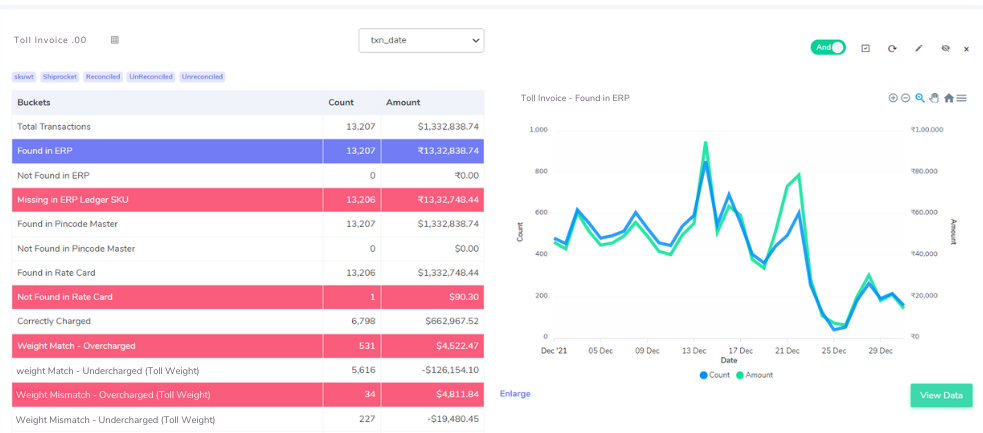

RESULT

Identifying Expected Charges: Cointab Reconciliation analyzes your ERP reports, pincode master data, and the rate card to calculate the expected fees for each delivery. This involves factors like product weight, zone, and applicable rates.

Verifying Invoice Accuracy: Once the expected fees are calculated, Cointab Reconciliation compares them against the charges listed on the Toll invoice. This comprehensive comparison helps identify any discrepancies between what you were expecting to pay and what was actually billed.

Detailed Insights :The following reports provide a breakdown of this analysis, allowing you to see a clear picture of any potential overcharges or billing errors.

ERP

Found in ERP: This indicates a successful match. The order details can be verified for accuracy.

Not Found in ERP: This signifies a discrepancy. The order appears only on the Toll invoice and is missing from your ERP reports. This requires further investigation to understand the reason for the missing data

Pincode Master

Pincode Master Verification

The Pincode master data plays a crucial role in verifying invoice accuracy. Ideally, orders should be present in both the Pincode master and the Toll invoice.

- Found in Pincode Master: This indicates a successful match. The origin and destination pincodes associated with the order can be verified for accuracy.

- Not Found in Pincode Master: This highlights a potential discrepancy. The order appears on the Toll invoice but is missing from your Pincode master data. This requires further investigation to ensure the pincode information is correct.

Rate Card

- Rate Card Verification The Rate Card holds the reference rates for deliveries based on weight and zone. Ideally, orders should be linked to applicable rates in both the Rate Card and the Toll invoice.

- Found in Rate Card: This indicates a successful match. The system can verify if the charged rates on the Toll invoice correspond to the weight and zone information for the order in the Rate Card.

- Not Found in Rate Card: This highlights a potential discrepancy. The order appears on the Toll invoice but is missing a corresponding entry in the Rate Card. This could indicate missing information or a potential error in the invoice.

Fee verification using ERP- Toll

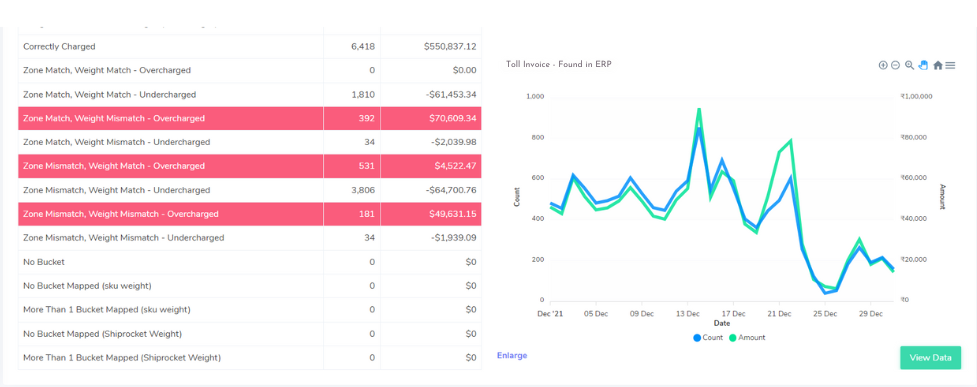

Invoice Discrepancy Analysis: Optimizing Your Toll Billing

Cointab Reconciliation goes beyond simply matching data points. It delves into potential reasons behind discrepancies, empowering you to optimize your Toll billing. Here’s a breakdown of key findings and potential causes:

Correctly Charged: This scenario indicates a seamless alignment between your ERP data, Rate Card, and the Toll invoice.

Overcharged:

Zone & Weight Match:

- Cause: Incorrect Rate Card selection during invoice creation.

- Action: Investigate the applied rate and compare it to the weight and zone in the Rate Card for the appropriate service level.

Zone Mismatch:

- Cause: Potential data entry error in Toll’s system or your ERP. Mismatched origin/destination pincodes leading to incorrect zone assignment.

- Action: Verify pincode accuracy in both systems and reconcile any discrepancies with Toll.

Weight Mismatch:

- Cause: Data entry error in weight measurement during shipment processing. Discrepancy between actual weight and dimensional weight (if applicable).

- Action: Investigate the weight discrepancy. If an error is found, contact Toll for a potential adjustment.

Undercharged:

Zone & Weight Match:

- Cause: Outdated Rate Card used during invoice creation (older rates might be lower). Potential promotional offer applied by Toll.

- Action: While beneficial, keep an eye on future invoices to ensure updated rates are reflected.

Zone Mismatch:

- Cause: Similar to overcharged zone mismatch, but in Toll’s favor.

- Action: Follow the same verification and reconciliation steps as with overcharged zone mismatch.

Weight Mismatch:

- Cause: Toll might have underestimated the weight during shipment processing.

- Action: If the weight on your ERP is demonstrably accurate, you might be eligible for a refund from Toll.

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Effortless Accuracy & Efficiency

Say goodbye to manual data entry: Seamless data loading and processing streamline the verification process.

- Minimize errors: Automated comparisons between reports ensure accuracy and catch discrepancies before they impact your bottom line.

- Clear visibility: Gain a comprehensive view of all your Toll transactions, allowing for informed decision-making.

Unlock the Benefits:

- Improved financial efficiency: Identify and recover overcharges, saving you valuable resources.

- Streamlined workflow: Free your team from tedious verification tasks, allowing them to focus on more strategic initiatives.

- Enhanced accuracy: Eliminate human error and ensure accurate billing for peace of mind.

Don’t Wait, Automate!

Start your journey towards financial efficiency today. Choose Cointab Reconciliation and experience the power of automated Toll invoice verification.