Effortless Reconciliation of StarTrack Shipping Invoice with Cointab

Effecient Reconciliation of StarTrack Shipping Invoice with Cointab

StarTrack: Reliable Domestic and International Shipping Solutions

StarTrack, a subsidiary of Australia Post, is a leading provider of comprehensive parcel, freight, and logistics services. They specialize in domestic freight, courier services (including sensitive shipping), 3PL (Third-Party Logistics), and supply chain management, ensuring timely deliveries for businesses of all sizes.

Minimize Errors and Maximize Efficiency with Automated Invoice Verification

Managing high volumes of shipments can be a challenge. Manually verifying StarTrack invoices against ERP reports, shipping invoices, pincode zones, SKU reports, and rate cards is time-consuming and prone to errors.

Automated invoice verification software simplifies this process, streamlining reconciliation and ensuring you’re charged accurately. This software compares key data points like:

Pincode Zones:

Assigned based on origin and destination postcodes.

SKU Reports:

Unique identifiers for each order based on weight and dimensions.

Rate Cards:

Shipping costs calculated according to weight and destination zone.

StarTrack Delivery Invoices:

These include details like order ID, billing zone, product type, weight, and applied charges.

By reconciling these elements, automated software identifies discrepancies and ensures you’re not being overcharged.

SKU Report:

Cointab’s Reconciliation software optimizes shipping processes by harnessing SKU codes from ERP reports to access precise product weight and dimensions. In the absence of weight data in the ERP report, the software seamlessly references the weight column in the invoice. When product dimensions are available, the software employs an accurate volumetric weight calculation method, utilizing the “Length x Width x Height” formula with measurements specified in centimeters. This computed value is then divided by the provided divisor from the divisor card, defaulting to 5000 if unspecified. Subsequently, the calculated weight undergoes rounding to ascertain the final weight category, ensuring precise and efficient shipping computations.

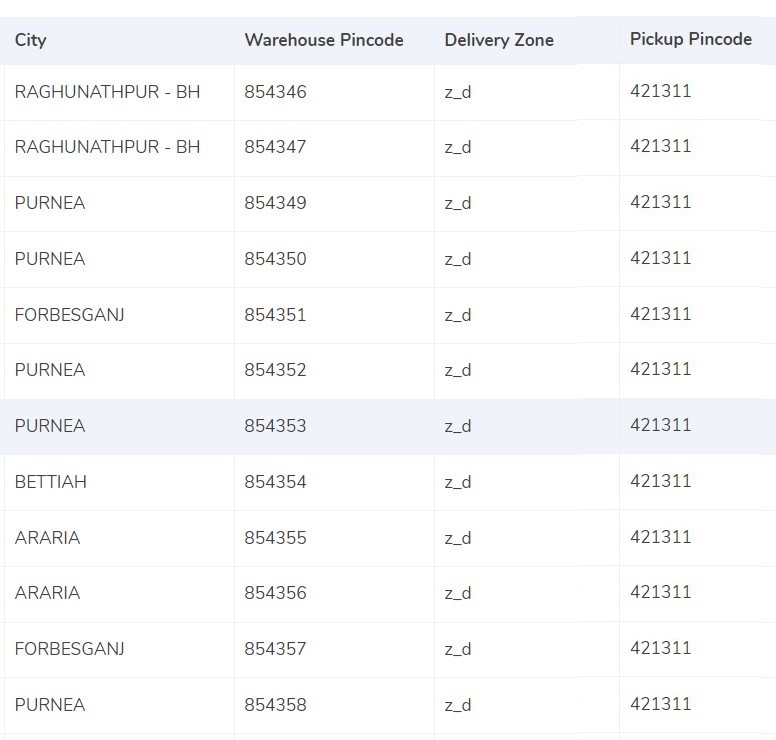

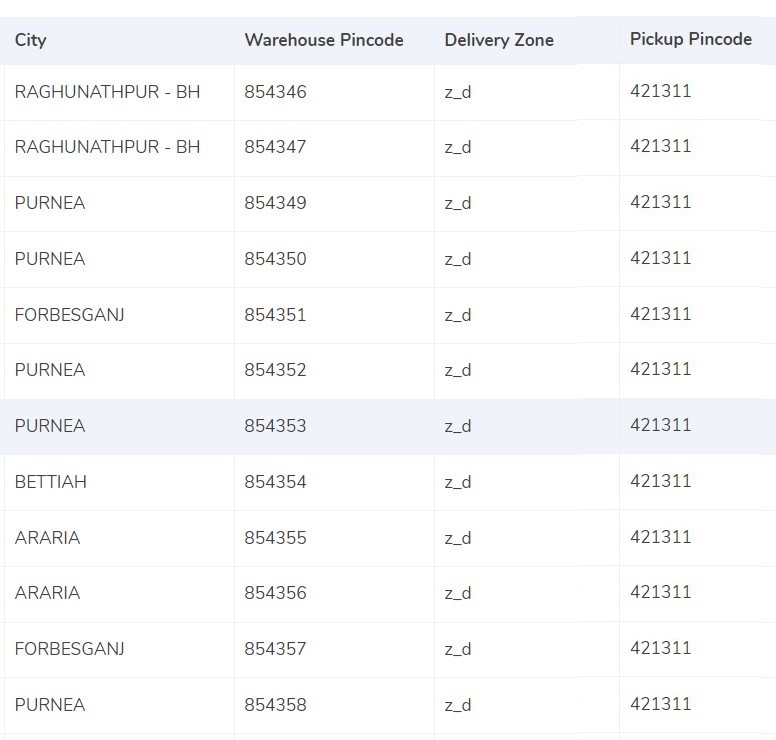

Pincode Master:

Streamline Your Supply Chain with Automated Zone Assignment

Efficient logistics rely on accurate zone identification. This report outlines a system that assigns specific zones to origin-destination pairings within your invoices. This data is crucial for:

Cost Calculation:

Different zones often incur varying shipping rates.

Delivery Timelines:

Zones can influence estimated delivery windows.

Performance Analysis:

Zone-based data helps analyze regional shipping trends.

Automating Zone

Determination for Enhanced Efficiency

By comparing origin and destination locations within your invoices, the system automatically assigns the appropriate zone. This eliminates manual verification, saving time and minimizing errors.

Granular Categorization: Regional, International, and Beyond

The system further categorizes locations into regional, international, and potentially more specific groupings (e.g., zones a, b, c). This granular breakdown empowers you to:

Tailor Your Shipping Strategy:

Refine your approach based on regional or international shipping needs.

Benchmark Performance:

Track zone-specific delivery times and costs for performance optimization.

Gain Actionable Insights: Unearth valuable data trends to inform strategic logistics decisions.

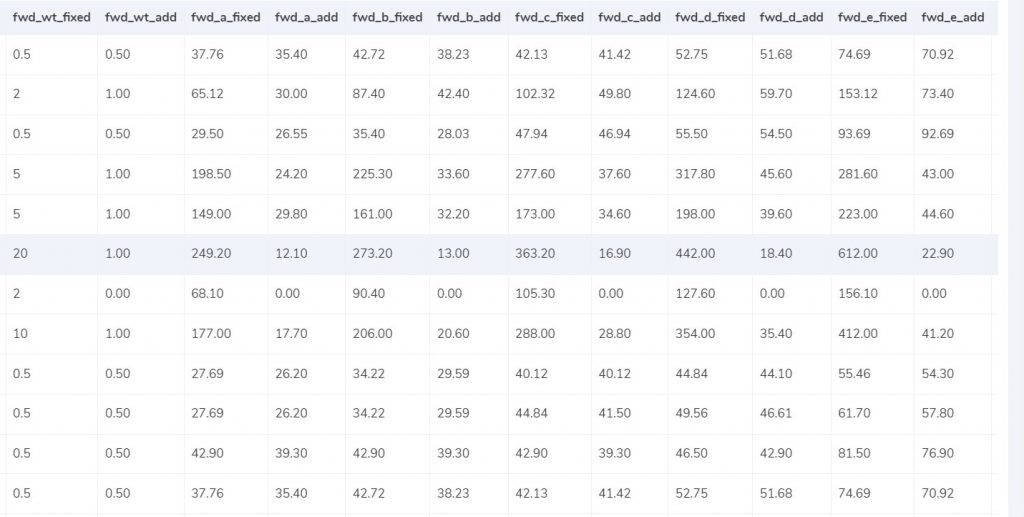

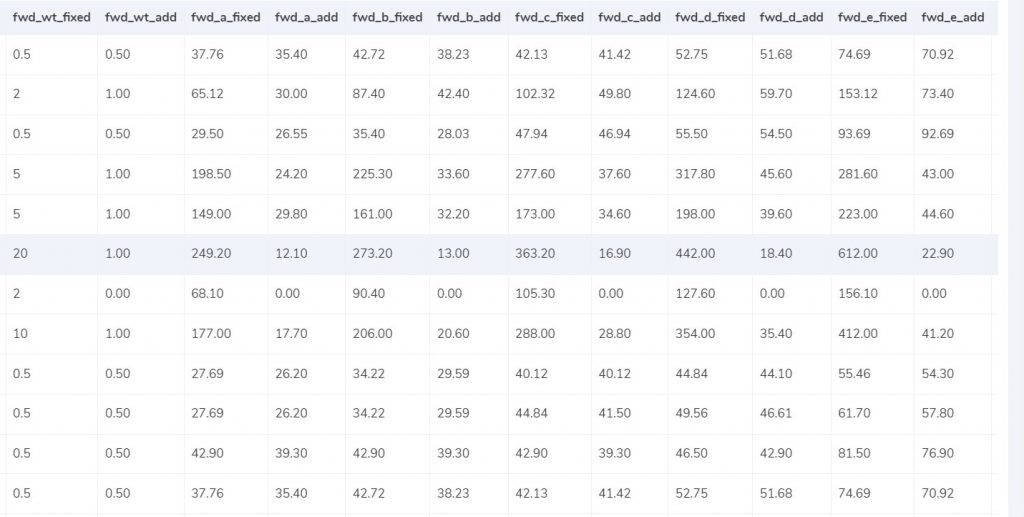

Rate Card:

Australia Post rate cards establish shipping costs based on a product’s weight and destination zone. These rates are subject to change and have specific validity periods.

Streamline Invoice Verification with Automated Rate Card Matching

Automated invoice verification software can streamline the process by comparing key data points from your invoices with the corresponding rate card. This includes columns like:

Courier:

The specific service used (e.g., Express Post, Regular Parcel Post).

Zone:

The destination zone as assigned by Australia Post.

fwd_wt_fixed: This potential column might indicate a fixed charge applied for exceeding a weight threshold.

Divisor:

A factor used in calculating the final cost (may not be present in all invoices).

By matching these values, the software ensures accurate application of rates based on weight and zone.

Time-Bound Rates: Ensuring Validity for Accurate Billing

Since rates are subject to change and have specific validity periods, automated verification helps identify potential discrepancies due to outdated rate application. This safeguards against overcharges and ensures accurate billing.

Charges:

Startrack invoices often include “Forward Charge” fees, which can be a source of confusion. This section clarifies these charges and provides formulas for calculating expected costs.

Forward Charge Explained:

The Forward Charge is a weight-based fee applied to parcels. It’s determined by two key factors:

Weight Slab:

The final weight category your parcel falls into after dimensional calculations.

fwd_wt_fixed: A weight limit specified in the Startrack Post rate card.

Calculating Forward Charge:

Compare Weight Slab and fwd_wt_fixed:

If the weight slab is less than or equal to fwd_wt_fixed, the Forward Charge equals “fwd_fixed” according to the zone.

If the weight slab exceeds fwd_wt_fixed, an additional charge applies for the excess weight.

Formula for Expected Forward Charge:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

fwd_add: This value represents the fee charged per additional weight unit within your specific zone (found in the rate card).

Expected RTO Charge (Return to Origin):

Similar to the Forward Charge, the RTO Charge applies when undeliverable parcels are returned to the sender. It’s calculated using an “rto_wt_fixed” weight limit and “rto_add” per-unit charge based on the zone (obtained from the rate card).

Formula for Expected RTO Charge:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected Final Amount:

The final invoice amount is a combination of the Forward Charge, RTO Charge (if applicable), and any applicable taxes.

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

Result:

Effortless Invoice Verification: Cointab Simplifies StarTrack Billing

Managing high-volume StarTrack shipments requires efficient invoice verification. Cointab reconciliation software streamlines this process by comparing key data points from your invoices with:

Expected Amounts:

Calculated based on product weight and delivery zone using industry-standard formulas.

ERP Reports:

Enterprise Resource Planning data provides order details for accurate cost allocation.

Pincode Reports:

These reports (specific to India) ensure accurate zone assignment for shipments within the country.

Rate Cards:

Official StarTrack rate cards provide the foundation for calculating expected shipping costs.

Cointab’s automated verification process delivers several benefits:

Reduced Costs:

Identify and prevent billing errors for potential cost savings.

Improved Accuracy:

Eliminate manual verification errors for reliable cost tracking.

Enhanced Efficiency:

Free up valuable resources for core business activities.

Streamlined Operations:

Simplify invoice processing for faster reconciliation cycles.

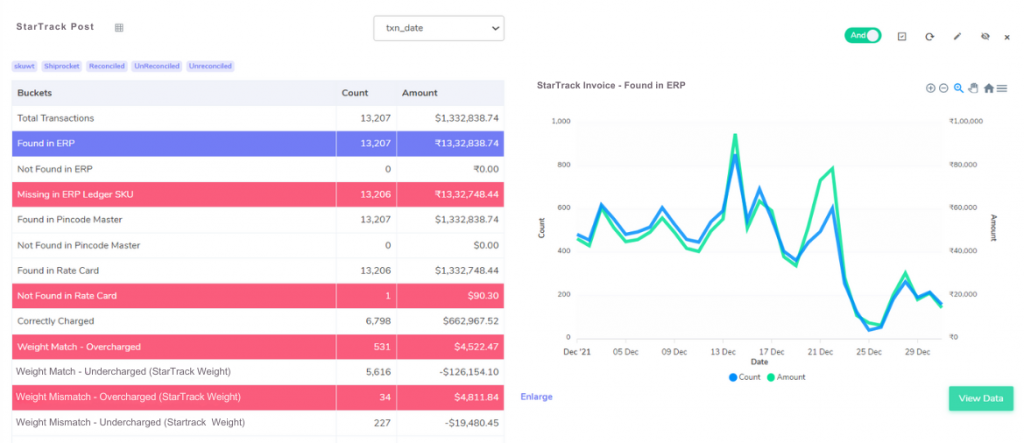

ERP:

Cointab reconciliation software plays a crucial role in verifying StarTrack invoice accuracy and identifying potential order fulfillment issues. Here’s how:

Found in ERP:

This ideal scenario indicates that the products listed on the StarTrack invoice match the order details within your Enterprise Resource Planning (ERP) system. This confirms successful order fulfillment and accurate billing.

Not Found in ERP (Discrepancy Detected):

Cointab flags a discrepancy if the StarTrack invoice lists products not found in your ERP reports. This could indicate:

Missing Order Entry:

An order might have been placed with StarTrack but not recorded in your ERP system, potentially leading to billing errors or inventory inconsistencies.

Fulfillment Issue:

Products might have been shipped unintentionally, requiring investigation into order processing or inventory management practices.

Pincode Master:

Cointab reconciliation software goes beyond basic invoice verification, ensuring accurate delivery zones for your StarTrack shipments. Here’s how:

Found in Pincode Master:

This ideal scenario indicates that the pincodes (postal codes specific to India) listed on the StarTrack invoice match those in your Pincode Master database. This confirms accurate zone assignment and potentially optimized shipping costs based on distance.

Not Found in Pincode Master (Potential Discrepancy):

Cointab flags a potential discrepancy if the StarTrack invoice lists pincodes not found in your Pincode Master. This could signify:

Incorrect Pincode Entry:

An incorrect pincode might have been used on the invoice, potentially leading to miscalculated shipping costs or delivery delays.

Missing Pincode Data:

The pincode might be new or not yet included in your Pincode Master, necessitating an update for future accuracy.

Rate card:

Cointab reconciliation software safeguards your bottom line by verifying StarTrack invoice accuracy and identifying potential rate discrepancies. Here’s how:

Found in Rate Card:

This ideal scenario indicates that the shipping rates listed on the StarTrack invoice match the corresponding rates in the official StarTrack Rate Card. This confirms accurate cost calculations based on weight, zone, and chosen service.

Not Found in Rate Card (Potential Discrepancy):

Cointab flags a potential discrepancy if the StarTrack invoice lists rates not found in the Rate Card. This could signify:

Outdated Rate Application:

The invoice might be using outdated rates, potentially leading to overcharges or undercharges.

Custom Rate Negotiation:

If you have negotiated custom rates with StarTrack, ensure they are correctly reflected on the invoice.

Fee Verification using ERP- StarTrack delivery:

Cointab reconciliation software empowers you to achieve accurate StarTrack invoice verification and identify potential billing discrepancies. Here’s how Cointab streamlines this process:

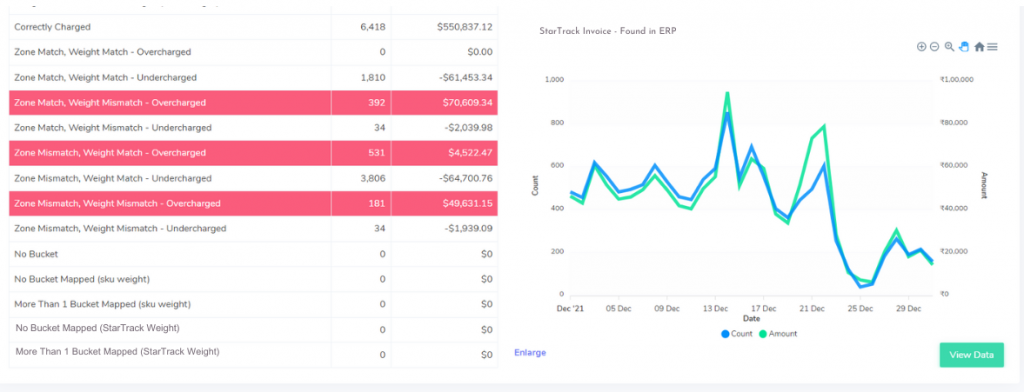

Identifying Matching and Mismatching Scenarios:

Cointab compares data points across your ERP reports, StarTrack invoices, and Rate Cards to categorize shipments into different scenarios:

Correctly Charged:

The calculated fee using the Rate Card matches the fee on the StarTrack invoice. This indicates accurate zone assignment, weight measurement, and rate application.

Zone & Weight Match Discrepancies:

Cointab flags potential discrepancies when the zone and weight on the invoice match the ERP report, but the fee differs:

Zone Match, Weight Match – Overcharged:

The invoice charges more than the calculated amount. This could be due to outdated rates or human error.

Zone Match, Weight Match – Undercharged:

The invoice charges less than the calculated amount. This might indicate a missed surcharge or promotional rate application.

Zone Mismatch Discrepancies:

Cointab identifies potential issues when the zone on the invoice differs from the ERP report, even if the weight matches:

Zone Mismatch, Weight Match – Overcharged:

The invoice zone is incorrect, leading to a higher calculated cost.

Zone Mismatch, Weight Match – Undercharged:

The invoice zone is incorrect, resulting in a lower calculated cost.

Weight Mismatch Discrepancies:

Cointab detects potential discrepancies when the weight on the invoice differs from the ERP report, regardless of the zone:

Zone Match, Weight Mismatch – Overcharged:

The invoice weight is incorrect, leading to a higher calculated cost.

Zone Match, Weight Mismatch – Undercharged:

The invoice weight is incorrect, resulting in a lower calculated cost.

Complete Mismatch:

Zone Mismatch, Weight Mismatch – Overcharged/Undercharged:

The zone, weight, and fee on the invoice significantly differ from the ERP data and Rate Card. This necessitates further investigation.

Cointab Reconciliation software revolutionizes StarTrack invoice verification, transforming a tedious task into an effortless process. Here’s how Cointab empowers you:

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Unmatched Simplicity:

The user-friendly interface makes onboarding a breeze. Simply upload your data and build a custom workflow tailored to your specific business needs.

Automated Efficiency:

Automate the entire reconciliation process, freeing up valuable resources for strategic initiatives.

Clear and Actionable Insights:

Gain comprehensive reports with errors clearly highlighted in red for swift identification and resolution.

Embrace Automation and Eliminate Manual Discrepancies

Say goodbye to the time-consuming and error-prone process of manual invoice verification. Cointab empowers you to:

Reduce Costs:

Identify and prevent overcharges for billing errors, ensuring optimal shipping spend.

Improve Accuracy:

Eliminate human error from the verification process for reliable cost tracking.

Boost Efficiency:

Free up your team to focus on core business activities and strategic growth initiatives.