ANZ Worldline, a leading European payment provider, empowers businesses across industries with advanced payment solutions for in-store and online transactions. However, managing the vast number of daily transactions processed through ANZ Worldline necessitates a robust reconciliation system. This ensures accurate charges and error-free calculations, safeguarding your financial health.

Cointab Reconciliation: The Key to Effortless Verification

Cointab Reconciliation offers a solution designed to optimize your reconciliation process, boosting your finance team’s productivity. Our software is highly customizable, catering to your specific needs. It automates data entry and meticulously cross-references ANZ Worldline invoices with bank statements, ERP reports, and other platform records. This comprehensive approach facilitates the swift identification of errors or overcharges, guaranteeing the accuracy of your financial records and preventing potential losses.

Essential Reports for Verifying ANZ Worldline Charges

For efficient verification of ANZ Worldline charges, two key reports are crucial:

ANZ Worldline Payment Report:

This report provides a detailed breakdown of all transactions processed through your ANZ Worldline gateway. It specifies the payment mode used (debit card, credit card, etc.) for each transaction.

ANZ Worldline Rate Card:

This document outlines the specific fees and percentages charged for each supported payment method. The rate card serves as the benchmark for verifying the accuracy of fees applied to your transactions.

Results:

Understanding Your Reconciliation Results

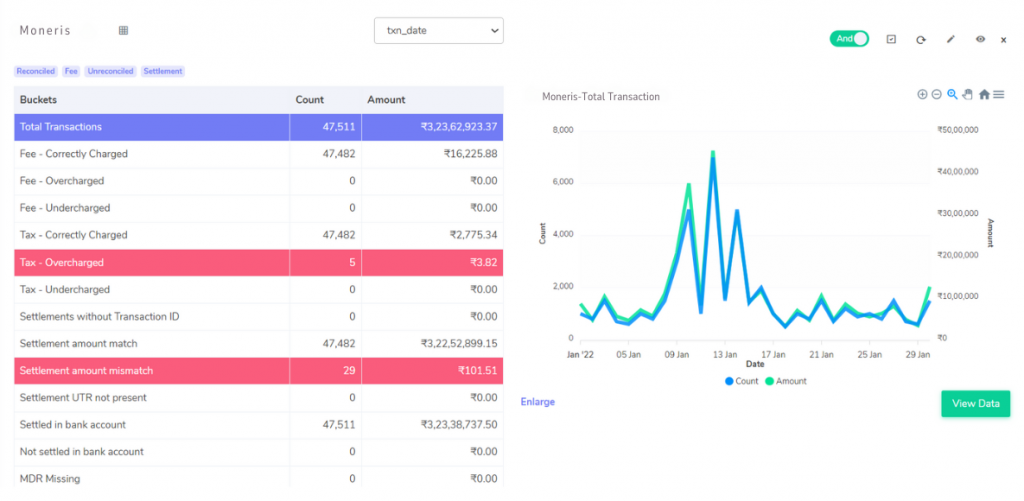

Cointab Reconciliation delivers in-depth results, categorized as follows, empowering you to analyze your charges effectively:

Fees Correctly Charged:

This category identifies transactions where the fees levied by ANZ Worldline perfectly match the amount calculated using your rate card.

Fees Overcharged/Undercharged:

Discrepancies are highlighted in this section. Here, you’ll find transactions where ANZ Worldline fees deviate from the calculations based on your rate card. This aids in identifying potential billing errors or misinterpretations of the rate card.

Tax Accuracy:

Cointab Reconciliation verifies the taxes charged against the relevant tax regulations in your region. This section flags transactions with overcharges, undercharges, or correctly calculated taxes.

Settlement Amount Match/Mismatch:

The settlement amount refers to the final amount deposited into your bank account after deducting fees and taxes from the total transaction value. This section verifies if the settlement amount matches the figure displayed in the ANZ Worldline report. Any discrepancies here warrant further investigation.

Settled in Bank Reconciliation:

Cointab Reconciliation facilitates reconciliation between the ANZ Worldline report and your bank statements. This section confirms whether settled amounts appear on both documents, ensuring transparency and completeness of your financial records.

Not Settled in Bank Reconciliation:

This section identifies transactions listed in the ANZ Worldline report but missing from your bank statements. These discrepancies require prompt investigation.

Benefits of Cointab Reconciliation

Cointab Reconciliation simplifies and streamlines the verification process by offering the following advantages:

Effortless Automation:

Our software automates the entire reconciliation process, eliminating manual data entry and saving your team valuable time.

Enhanced Accuracy:

Cointab ensures precise verification based on your rate card and relevant tax regulations, minimizing the risk of human error inherent in manual calculations.

Detailed Insights:

Gain a comprehensive overview of your data, enabling you to identify potential areas for cost optimization and negotiation with ANZ Worldline.

Improved Workflow Efficiency:

Streamline your reconciliation tasks and free up your finance team to focus on more strategic initiatives.

Peace of Mind:

Gain control of your finances and ensure accurate processing with Cointab Reconciliation. Avoid potential losses due to discrepancies in charges.

Embrace Financial Efficiency with Cointab Reconciliation

Don’t let tedious manual reconciliation tasks hinder your financial efficiency. Embrace automation and gain complete control of your ANZ Worldline charges with Cointab Reconciliation. Experience the difference and optimize your reconciliation process today!