Optimize Reconciliation of DHL Express Shipping Invoice with Cointab

Optimize Reconciliation of DHL Express Shipping Invoice with Cointab

Stop Wasting Time on Manual Verification:

Automate Your DHL Invoices with Cointabs

Gone are the days of drowning in paperwork and spending hours verifying DHL invoices. Traditional methods are error-prone and inefficient, especially for businesses with high shipment volumes. Cointabs offers a smarter solution – automated invoice verification that saves you time, money, and frustration.

The Challenge: A Sea of Invoices and Limited Resources

Imagine sifting through mountains of invoices, meticulously checking every weight, zone, and rate. With thousands of DHL deliveries, even the most dedicated team can struggle. Manual verification is slow, tedious, and susceptible to human error. Discrepancies can lead to overpayments or delays in resolving issues.

Cointabs: Your Digital Invoice Superhero

Cointabs swoops in to transform your invoice verification process. This powerful software automates the heavy lifting, freeing you to focus on more strategic tasks. Here’s how it works:

Effortless Data Integration:

Cointabs seamlessly integrates with your existing systems, extracting relevant data from your DHL invoices and internal records.

Intelligent Report Generation:

It generates crucial reports like Pin Zones, SKUs, and Rate Cards, providing a comprehensive overview of your shipments and applicable charges.

Automated Verification Engine:

Cointabs compares invoice details with your data and the current rate card, ensuring every weight, zone, and rate is applied correctly.

Crystal-Clear Insights:

You get a clear and concise breakdown of your invoice, highlighting any discrepancies for easy resolution.

Benefits Beyond Efficiency:

Cointabs isn’t just about saving time. It empowers you with:

Enhanced Accuracy:

Eliminate manual errors and ensure you pay the correct charges for every shipment.

Improved Visibility:

Gain valuable insights into your shipping costs and identify potential areas for optimization.

Peace of Mind:

Focus on growing your business with the confidence that your DHL invoices are accurate.

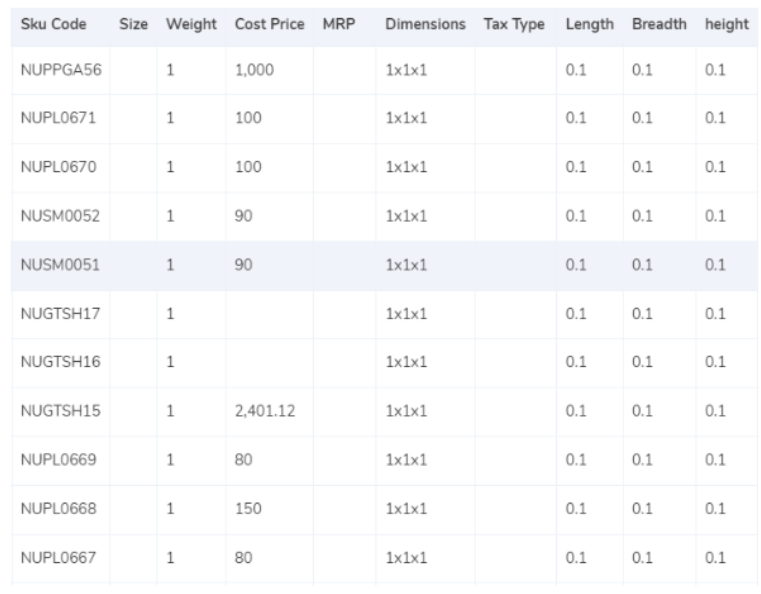

SKU Report:

Determining Chargeable Weight

Cointabs considers two factors to determine the weight used for billing on your DHL invoice:

Item SKU:

This code identifies the product and often includes its gross weight and dimensions.

Dimensions: If the SKU doesn’t provide dimensions, you can use the values directly from the invoice (expected weight column).

Volumetric Weight Calculation (if applicable):

When product dimensions are available, Cointabs calculates the volumetric weight using the formula: Length (cm) x Width (cm) x Height (cm). This is important because shipping costs can be based on whichever weight is higher – the actual weight or the volumetric weight.

Divisor and Final Weight:

The volumetric weight is then divided by a divisor, typically found in a separate “divisor card.”

If no divisor is specified, a default value of 5,000 is used.

Synchronization and

Rounding:

Finally, Cointabs ensures both the ERP report and DHL invoice reflect the chosen weight (actual or volumetric). The final weight is rounded off to the nearest whole unit for billing purposes.

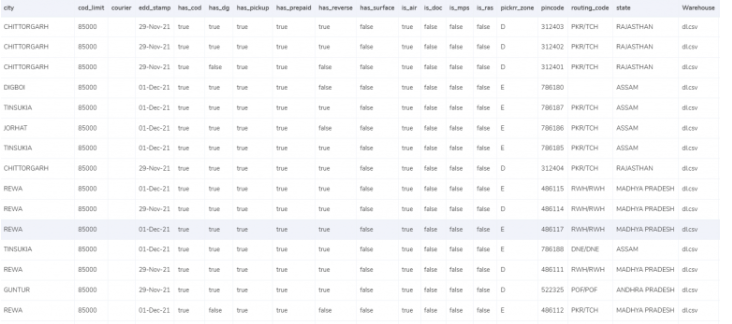

Zone:

This section will likely discuss how the zone (geographic location) impacts shipping costs. We can discuss that in the next section.

Delivery Zones and Billing:

DHL uses zones to categorize delivery locations based on their distance from the origin. This helps determine shipping costs. The billing pin code on your invoice helps identify the zone.

Zone Determination:

Cointabs uses the billing pin code to match it with a predefined zone mapping. This ensures the expected zone on the invoice is accurate.

Pincode Categories:

Pin codes can have additional classifications like region, local, national, etc. These categories might be used for internal purposes but don’t directly affect zone determination for billing.

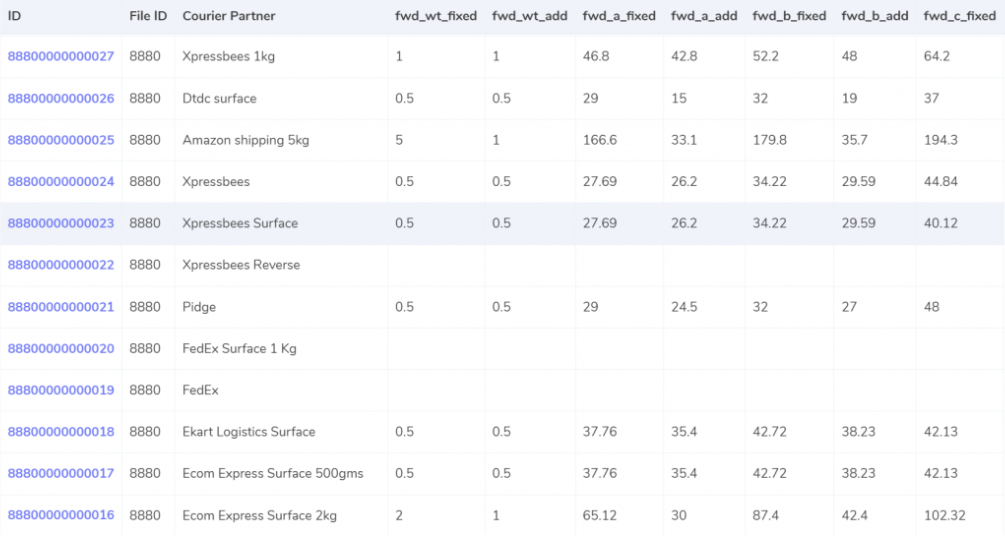

Rate Card (separate section):

The rate card is a reference document that outlines shipping costs based on factors like weight, zone, and service type. Cointabs uses the rate card along with the determined zone to ensure the correct charges are applied on your DHL invoice.

Understanding Rate Cards and Charges

As mentioned earlier, the rate card is crucial for accurate invoice verification. It details shipping costs based on:

Delivery Zone:

Costs vary depending on the distance between origin and destination.

Order Weight:

Charges are tiered based on weight brackets. Lighter items may have a fixed rate, while heavier ones incur additional charges per weight extension.

These rates apply to both forward charges (standard deliveries) and RTO charges (failed deliveries or returns).

Verification Process:

Cointabs verifies the invoice against the rate card by comparing specific columns:

Courier:

Ensures the chosen courier service matches the invoice.

Zone:

Confirms the applied zone aligns with the delivery location. fwd_wt_fixed (Forward Weight Fixed): Checks if the weight used for fixed rate calculation matches the rate card for that zone.

Divisor:

Verifies if the divisor used for volumetric weight calculation (if applicable) is correct according to the rate card.

Rate Card Validity:

Since rate cards have limited validity periods, Cointabs ensures the delivery date falls within the timeframe covered by the applied rate card. This guarantees you’re charged the correct rates.

Calculating Expected Charges

Cointabs calculates the expected charges for your DHL invoice based on weight and the rate card. Here’s how it works for forward charges and RTO charges:

Forward Charges:

The final weight slab is compared to the “fwd_wt_fixed” limit in the rate card. If the weight is less than or equal to “fwd_wt_fixed”: The charge is a fixed amount, “fwd_fixed”. If the weight exceeds “fwd_wt_fixed”: An additional charge (“fwd_a_add”) applies per unit of extra weight.

The formula for the expected forward charge is:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_a_add

RTO Charges (Return To Origin):

The calculation follows a similar logic as forward charges:

The final weight slab is compared to the “rto_wt_fixed” limit in the rate card.

If the weight is less than or equal to “rto_wt_fixed”: The charge is a fixed amount, “rto_fixed”.

If the weight exceeds “rto_wt_fixed”: An additional charge (“rto_wt_add”) applies per unit of extra weight.

The formula for the expected RTO charge is:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

COD Charges (Cash on Delivery):

The expected COD charge is determined based on:

cod_fixed: A fixed fee (if applicable).

cod_rate: A percentage of the “item_price”.

Cointabs will consider the higher of these two values for the expected COD charge.

Expected Final Amount:

The final expected amount on your invoice is the sum of:

Expected forward charge

Expected RTO charge (if applicable)

Expected COD charge (if applicable)

Expected GST (Goods and Services Tax) percentage

Verification and Reconciliation:

Once the expected final amount is calculated, Cointabs verifies the invoice by comparing:

ERP order details

Pincodes

Rate card values

This ensures all the information on the DHL invoice matches your internal data and the applicable rates.

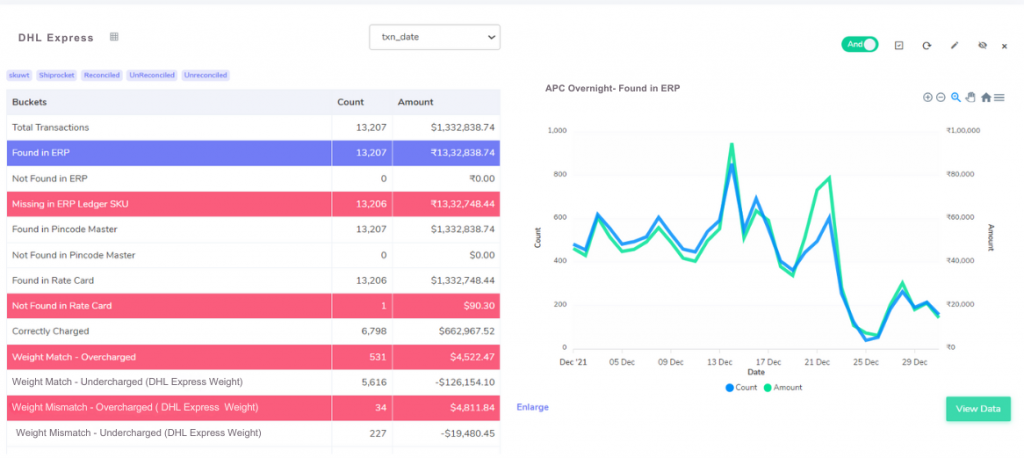

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

RESULTS

Matching Products with ERP Data

Cointabs verifies the products listed on the DHL invoice by comparing them to your ERP report. This ensures accurate invoicing:

Match Found:

If a product on the invoice matches an item in your ERP report, Cointabs can potentially calculate the weight based on the ERP data (assuming weight information is included).

Match Not Found:

If a product on the invoice isn’t found in your ERP report, Cointabs cannot verify the weight using this method. Further investigation might be needed.

Pin Code Importance:

The pin code (postal code) plays a crucial role in determining the delivery zone.

Cointabs uses the pin code to:

Identify the zone associated with the delivery location.

Look up the appropriate shipping rates from the rate card based on the zone.

This ensures you’re charged the correct shipping costs based on the delivery distance.

Pincode Master Verification

Cointabs checks the pin codes on the DHL invoice against your internal pincode master database. This ensures:

Match Found:

If a pin code is found in the master list, it confirms the delivery location’s existence and allows zone identification. The zone is crucial for determining shipping costs based on the rate card.

Match Not Found:

If a pin code is missing from your master list, Cointabs cannot verify the delivery location or zone automatically. This might require further investigation to ensure accurate zone assignment and potential rate adjustments based on the missing information.

Rate Card Integration:

The verified zone (derived from the pin code) is then used to reference the rate card. The rate card provides the shipping costs based on factors like weight and zone. Cointabs uses this information to ensure the applied charges on the DHL invoice match the established rates for the specific zone and weight of each shipment.

Rate Card Match

Cointabs verifies if the service charges applied on the DHL invoice correspond with the rates listed in your rate card. This ensures:

Match Found:

If a service charge on the invoice matches a rate in the rate card for the corresponding zone and weight, it indicates a potentially accurate charge. Cointabs can then proceed with further verification steps.

Match Not Found:

If a service charge on the invoice cannot be found in the rate card for the associated zone and weight, it signifies a potential discrepancy. Cointabs cannot verify the charge at this stage and might flag it for further investigation. This might involve contacting DHL for clarification or reviewing the validity of the applied rate card.

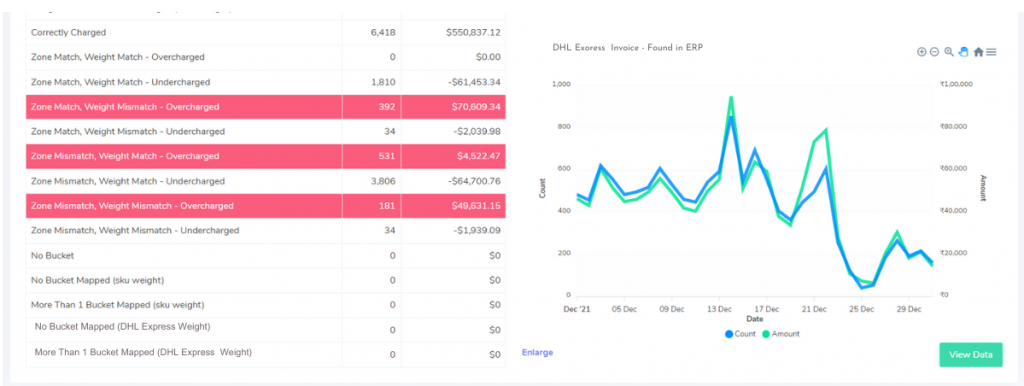

Fee Verification with ERP

In some cases, your ERP system might contain additional information about the order, such as the negotiated rates for specific products or customers. Cointabs can optionally compare the invoice charges with these negotiated rates if available in your ERP data. This provides an additional layer of verification:

Match Found (with ERP):

If the invoice charge matches the negotiated rate in your ERP, it strengthens the confidence in the accuracy of the charge.

Discrepancy with ERP:

If the invoice charge differs from the negotiated rate in your ERP, it highlights a potential issue. This might require further investigation to determine the reason for the discrepancy.

Moving Forward:

Based on the results of the verification process, Cointabs can:

Identify potential errors in the invoice for further investigation and potential correction.

Confirm accurate charges and allow for smooth invoice processing and payment.

Provide valuable insights into potential cost optimization opportunities based on identified discrepancies.

Matching Products with ERP Data

Cointabs verifies the products listed on the DHL invoice by comparing them to your ERP report. This ensures accurate invoicing:

Match Found:

If a product on the invoice matches an item in your ERP report, Cointabs can potentially calculate the weight based on the ERP data (assuming weight information is included).

Match Not Found:

If a product on the invoice isn’t found in your ERP report, Cointabs cannot verify the weight using this method. Further investigation might be needed.

Pin Code Importance:

The pin code (postal code) plays a crucial role in determining the delivery zone.

Cointabs uses the pin code to:

Identify the zone associated with the delivery location.

Look up the appropriate shipping rates from the rate card based on the zone.

This ensures you’re charged the correct shipping costs based on the delivery distance.

Pincode Master Verification

Cointabs checks the pin codes on the DHL invoice against your internal pincode master database. This ensures:

Match Found:

If a pin code is found in the master list, it confirms the delivery location’s existence and allows zone identification. The zone is crucial for determining shipping costs based on the rate card.

Match Not Found:

If a pin code is missing from your master list, Cointabs cannot verify the delivery location or zone automatically. This might require further investigation to ensure accurate zone assignment and potential rate adjustments based on the missing information.

Rate Card Integration:

The verified zone (derived from the pin code) is then used to reference the rate card. The rate card provides the shipping costs based on factors like weight and zone. Cointabs uses this information to ensure the applied charges on the DHL invoice match the established rates for the specific zone and weight of each shipment.

Rate Card Match

Cointabs verifies if the service charges applied on the DHL invoice correspond with the rates listed in your rate card. This ensures:

Match Found:

If a service charge on the invoice matches a rate in the rate card for the corresponding zone and weight, it indicates a potentially accurate charge. Cointabs can then proceed with further verification steps.

Match Not Found:

If a service charge on the invoice cannot be found in the rate card for the associated zone and weight, it signifies a potential discrepancy. Cointabs cannot verify the charge at this stage and might flag it for further investigation. This might involve contacting DHL for clarification or reviewing the validity of the applied rate card.

Fee Verification with ERP

In some cases, your ERP system might contain additional information about the order, such as the negotiated rates for specific products or customers. Cointabs can optionally compare the invoice charges with these negotiated rates if available in your ERP data. This provides an additional layer of verification:

Match Found (with ERP):

If the invoice charge matches the negotiated rate in your ERP, it strengthens the confidence in the accuracy of the charge.

Discrepancy with ERP:

If the invoice charge differs from the negotiated rate in your ERP, it highlights a potential issue. This might require further investigation to determine the reason for the discrepancy.

Moving Forward:

Based on the results of the verification process, Cointabs can:

Identify potential errors in the invoice for further investigation and potential correction.

Confirm accurate charges and allow for smooth invoice processing and payment.

Provide valuable insights into potential cost optimization opportunities based on identified discrepancies.

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Effortless Reconciliation with Cointabs:

Cointabs streamlines your invoice verification process by automatically comparing data across various sources:

- Websites

- Invoices

- ERP Reports

- Rate Cards

- SKU Reports

- Pincode Reports

This comprehensive comparison provides a clear picture of your transactions and highlights any inconsistencies.

Manual invoice verification is a tedious, error-prone process. Cointabs offers a smarter solution – automated verification that saves you time, money, and frustration.

By automating data comparison and identifying potential discrepancies, Cointabs ensures accurate invoice processing and helps you avoid overpayments. With Cointabs, you can:

Focus on strategic tasks:

Free yourself from tedious verification work and dedicate your time to more impactful activities.

Gain peace of mind:

Have confidence that your DHL invoices are accurate and you’re paying the correct charges.

Optimize your costs:

Identify potential overcharges and undercharges for informed financial management.

Ready to experience the power of automated invoice verification? Contact us today and see how Cointabs can revolutionize your DHL invoice management!