First Data: Powering Global Commerce

First Data Corporation, a financial services powerhouse headquartered in Georgia, USA, is a global leader in payment and financial technology. They serve thousands of institutions and millions of merchants and businesses, providing secure and reliable payment processing solutions.

First Data Payment Gateway: A Streamlined Transaction Hub

Many businesses leverage First Data’s robust payment gateway to handle their transactions. However, with high transaction volumes, ensuring accurate accounting records can become a challenge. Miscalculations can occur, leading to discrepancies and wasted time for your finance team.

Cointab Reconciliation Software: Automate for Efficiency

This is where Cointab reconciliation software steps in. Our automated solution eliminates the tedious, error-prone process of manual reconciliation.

.

First Data, allowing you to effortlessly reconcile transactions across various sources:

First Data Settlement Reports:

Verify payments received from customers.

First Data Refund Reports:

Ensure accurate tracking of customer refunds processed by the gateway.

Website Reports:

Match website orders with corresponding payment records.

ERP Reports:

Reconcile First Data transactions with your internal sales data for a holistic view.

Bank Statements:

Confirm deposits received by your bank from the payment gateway.

Beyond Reconciliation: Gain Valuable Insights

Cointab not only automates reconciliation but also provides valuable insights. Identify trends, analyze transaction patterns, and gain a deeper understanding of your customer behavior. This empowers you to make data-driven decisions to optimize your business processes and boost profitability.

Simplify First Data Reconciliation with Cointab

Cointab empowers you to streamline First Data reconciliation, ensuring accurate financial records and freeing up your finance team’s valuable time. Focus on strategic initiatives while maintaining complete financial control. Schedule a free demo today and experience the power of automated reconciliation!

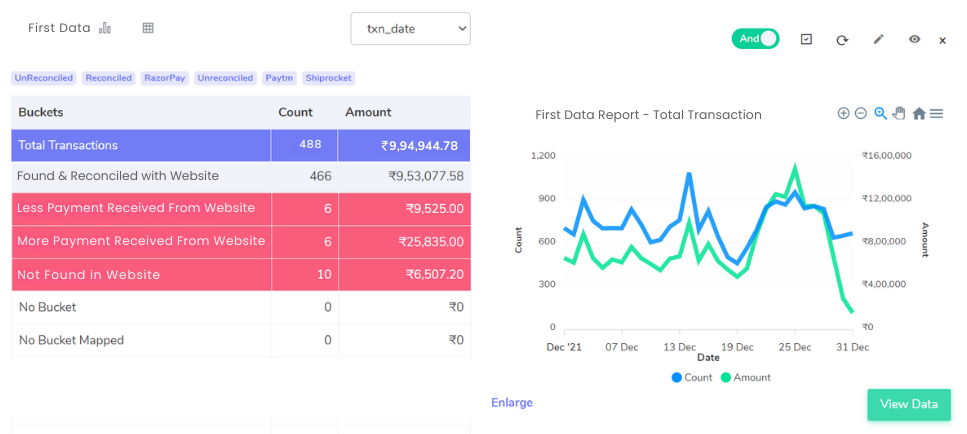

First Data with Website Reconciliation:

First Data Reconciliation Statuses: Ensuring Accurate Financial Records

Reconciling your First Data transactions with your website reports is crucial for maintaining accurate financial records. This process identifies any discrepancies between the two data sources.

Here’s a breakdown of common reconciliation statuses:

Matched Transactions:

These transactions appear in both the First Data settlement reports and your website report with matching values. This signifies a successful and accurate transaction.

Discrepancies:

This category highlights inconsistencies between the reports.

There are two subcategories:

Lower Website Amount:

The amount recorded on your website report is lower than what’s reflected in the First Data settlement report. This could indicate missing website orders or data entry errors.

Higher Website Amount:

The amount on your website report is higher than the First Data settlement report. This might point to website order duplication or incorrect pricing on your website.

Unmatched Transactions:

These transactions are present in the First Data settlement reports but not found in your website report.

This could be due to:

Missing Website Orders:

Orders processed through external channels (phone or social media) might not be reflected on your website.

Data Integration Issues:

Technical errors during data transfer between systems could lead to missing website data.

By effectively addressing these reconciliation statuses, you can ensure the accuracy of your financial data and gain valuable insights into your sales performance.

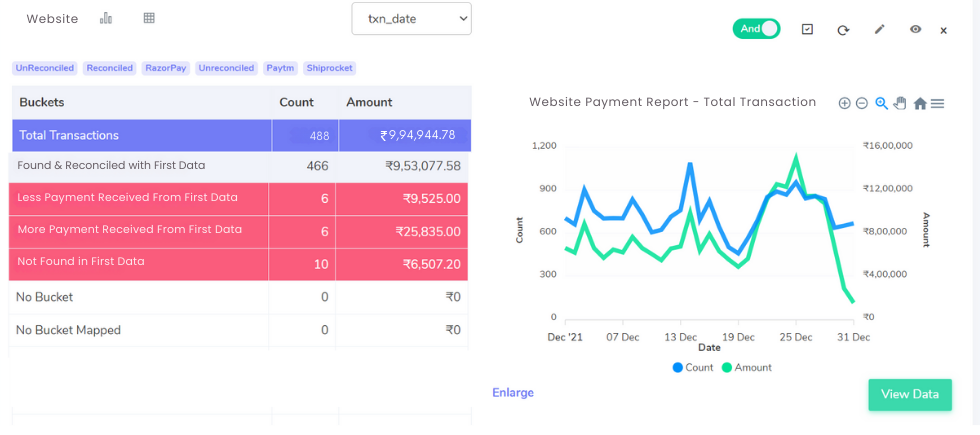

Website Reconciliation with First Data:

Reconciling your website with First Data settlement reports ensures accurate financial data.

Here’s a breakdown of common reconciliation statuses:

Matched Transactions:

These transactions appear in both the First Data settlement report and your website report with identical amounts. This signifies a successful and accurate transaction.

Discrepancies:

This category highlights inconsistencies between the reports:

Lower First Data Amount:

The amount on the First Data report is lower than your website report.

Reasons could include:

Website Order Discounts:

Discounts applied at checkout might not be reflected in the initial First Data report.

Shipping Charges:

Shipping charges added on the website might not be displayed in the First Data report initially.

Higher First Data Amount:

The amount on the First Data report is higher than your website report.

Reasons could include:

Tax Adjustments:

Sales tax applied by First Data might not be reflected in the initial website total.

Return Processing:

First Data might reflect a full chargeback, while your website shows a partial refund.

Unmatched Transactions – Website Only:

These transactions are present on your website report but not in the First Data settlement report.

This could be due to:

Cancelled Orders:

Orders cancelled before payment processing wouldn’t show on First Data reports.

Internal Website Orders:

Orders processed outside the online payment gateway (phone calls) might not be synced.

Streamline your Financial Reconciliation Now!

Request a Demo!

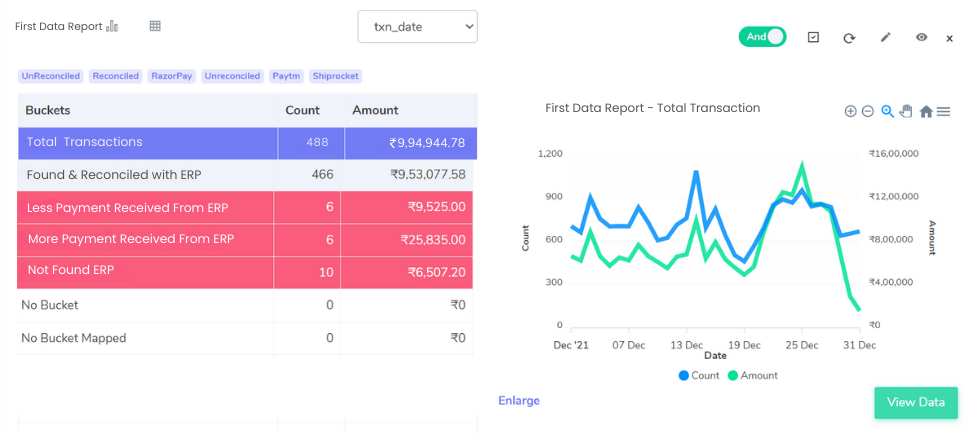

First Data Reconciliation with ERP:

Reconciling your First Data transactions with your Enterprise Resource Planning (ERP) reports is essential for a cohesive financial view. This process ensures your data aligns across different systems.

Here’s a breakdown of common reconciliation statuses for ERP reports:

Matched Transactions:

These transactions appear in both the First Data settlement reports and your ERP reports with matching values. This signifies a successful and accurate transaction.

Discrepancies:

This category highlights inconsistencies between the reports:

Lower ERP Amount:

The amount recorded on your ERP report is lower than the First Data report.

This could indicate:

Missing Entries in ERP:

Transactions might be missing from your ERP due to data entry errors or integration issues.

Discounts or Refunds:

Discounts or refunds applied after the initial sale might not be reflected in the initial ERP record.

Higher ERP Amount:

The amount on your ERP report is higher than the First Data report.

This might point to:

Incorrect Pricing in ERP:

Pricing discrepancies between your ERP and First Data could cause this difference.

Early Revenue Recognition:

Revenue might be recognized early in the ERP system before reflecting in First Data settlements.

Unmatched Transactions – First Data Only:

These transactions are present in the First Data settlement reports but not found in your ERP reports.

This could be due to:

External Sales Channels:

Sales processed outside the integrated system (e.g., phone orders) might not be recorded in the ERP.

Data Integration Issues:

Technical errors during data transfer between systems could lead to missing ERP data.

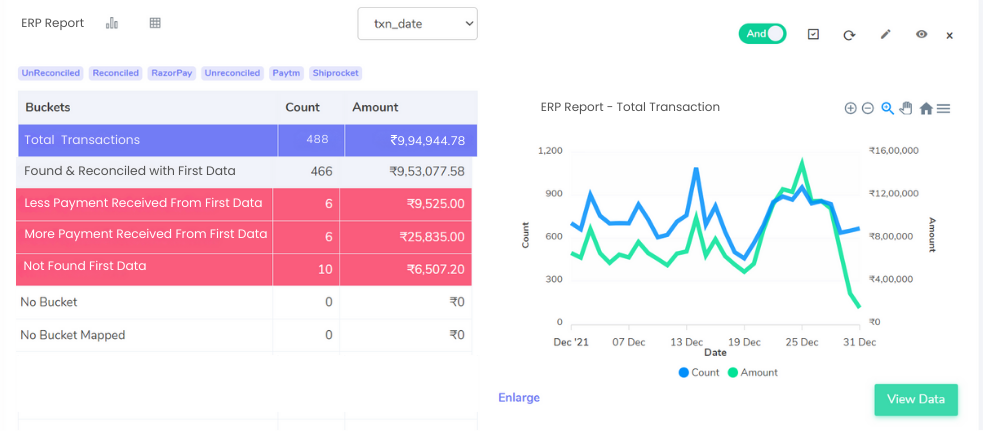

ERP Reports with First Data Reconciliation:

Reconciling your First Data settlement reports with your Enterprise Resource Planning (ERP) system ensures data consistency across your financial ecosystem. Here’s a breakdown of common reconciliation statuses to optimize your financial data:

Matched Transactions:

These transactions appear in both the First Data settlement reports and your ERP reports with identical amounts. This signifies a successful and accurate transaction.

Discrepancies:

This category highlights inconsistencies between the reports:

Lower First Data Amount:

The amount on the First Data report is lower than your ERP report. Reasons could include:

Post-Sale Adjustments:

Discounts, refunds, or chargebacks applied after the initial sale might not be reflected in the initial First Data report.

Shipping or Tax Differences:

Shipping charges or sales tax calculations might differ between systems.

Higher First Data Amount:

The amount on the First Data report is higher than your ERP report. Reasons could include:

Early Revenue Recognition:

Revenue might be recognized earlier in the ERP system before reflecting in First Data settlements.

Payment Processing Fees:

First Data might reflect additional fees not initially captured in the ERP.

Unmatched Transactions:

Here, discrepancies exist in where transactions are recorded:

Missing in ERP:

Transactions present in First Data reports but not in the ERP.

This could be due to:

External Sales Channels:

Sales processed outside the integrated system (e.g., phone orders) might not be recorded in the ERP.

Data Integration Issues:

Technical errors during data transfer between systems could lead to missing ERP data.

Missing in First Data:

Transactions present in ERP reports but not in First Data settlement reports.

This could be due to:

Cancelled Orders:

Orders cancelled before payment processing wouldn’t show on First Data reports.

Inventory Issues:

Out-of-stock items reflected in the ERP might not be removed from the sales channel, leading to missing First Data data.

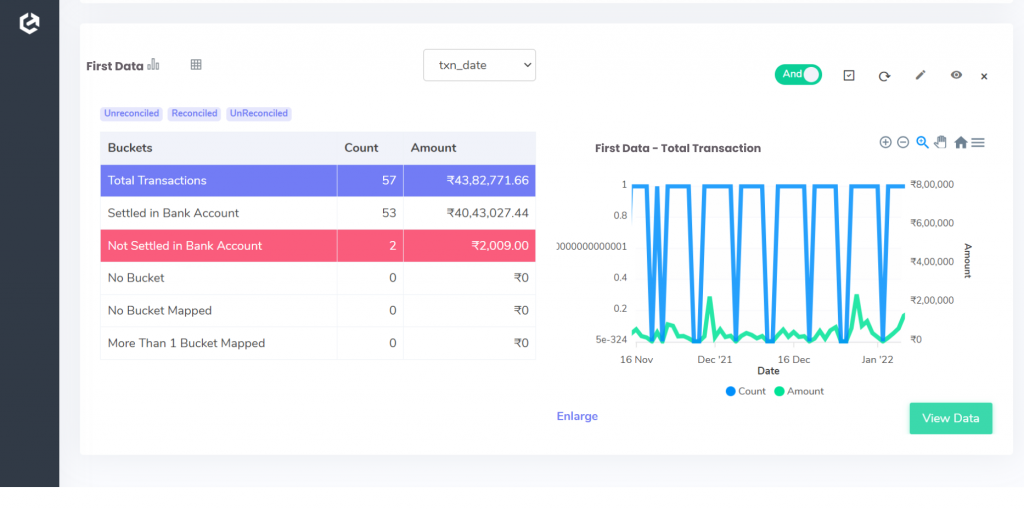

First Data with Bank Reconciliation:

Reconciling your First Data settlement reports with your bank statements is crucial for accurate cash flow management. This process verifies that recorded transactions are reflected in your bank accounts.

Here’s a breakdown of common reconciliation statuses for bank statements:

Matched Transactions:

These transactions appear in both the First Data settlement reports and your bank statements with matching values. This signifies a successful and accurate transaction.

Unmatched Transactions – First Data Only:

These transactions are present in the First Data settlement reports but not found in your bank statements.

This could be due to:

Pending Deposits:

First Data might reflect settled transactions that haven’t yet reached your bank account.

Processing Delays:

Bank processing times might cause a temporary discrepancy between reports.

Chargebacks or Refunds:

Chargebacks or refunds processed by First Data might not be immediately reflected in your bank statement.

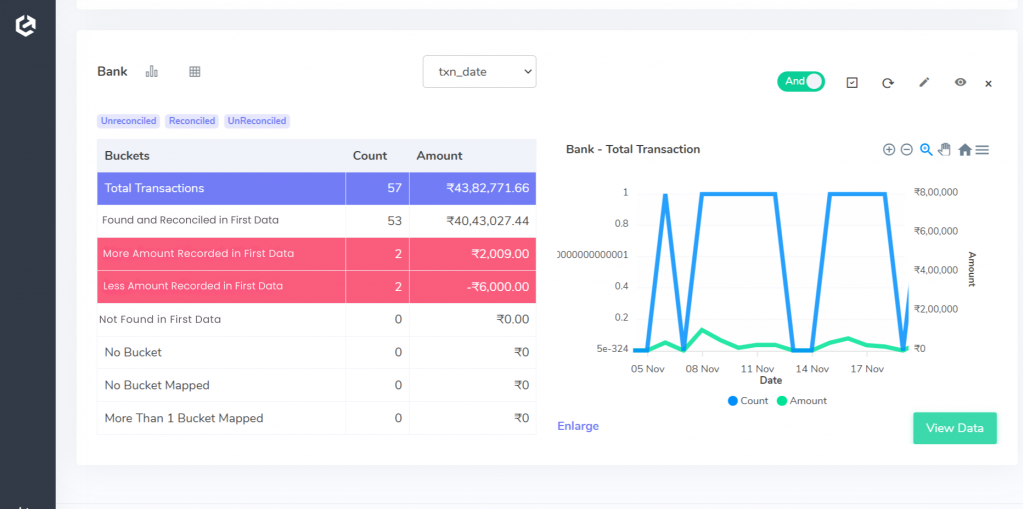

Bank Reconciliation with First Data:

Reconcile First Data with Bank Statements for Accurate Financials

Reconciling your First Data settlement reports with bank statements is vital for accurate cash flow management. This process ensures recorded transactions match your bank account activity.

Here’s a breakdown of common reconciliation statuses:

Matched Transactions:

These transactions appear in both the First Data settlement reports and your bank statements with identical amounts. This signifies a successful and accurate transaction.

Discrepancies:

This category highlights inconsistencies between the reports:

Higher First Data Amount:

The amount on the First Data report is higher than your bank statement.

Reasons could include:

Pending Credits:

First Data might reflect settled transactions that haven’t yet reached your bank (processing delays).

Chargeback Adjustments:

First Data might reflect additional fees associated with chargebacks not shown on the bank statement.

Lower First Data Amount:

The amount on the First Data report is lower than your bank statement.

Reasons could include:

Refunds Not Deducted:

First Data might not yet reflect refunds processed but shown on your bank statement.

Bank Fees:

Bank fees deducted from your account might not be reflected in the First Data report.

Cointab Reconciliation Software: Your Key to Efficiency

Manual First Data reconciliation is a tedious, time-consuming process. Cointab eliminates this burden, freeing your valuable resources to focus on strategic initiatives that drive business growth.

Effortless Reconciliation. Powerful Results.

Cointab offers a suite of features that streamline your First Data reconciliation:

Automated Data Upload:

Upload data seamlessly using APIs, SFTP, email, or your preferred format. No more manual data entry!

Customizable Workflows:

Design a reconciliation process tailored to your specific needs, ensuring a perfect fit for your business.

360° Reporting: Gain a comprehensive view of reconciled transactions, empowering data-driven decision-making.

Boost Efficiency. Unleash Growth Potential.

Cointab empowers you to achieve:

Increased Efficiency:

Save countless hours by automating manual tasks.

Improved Accuracy:

Eliminate errors and ensure the integrity of your financial data.

Strategic Focus:

Dedicate your team’s valuable time to strategic business planning.

Step into the future of reconciliation. Fill out the form to request your demo now!

Step into the future of reconciliation. Fill out the form to request your demo now!