Myntra reigns supreme as one of India’s top e-commerce marketplaces, catering to the nation’s fashion and lifestyle needs. This rapidly growing platform boasts a staggering daily shipment volume exceeding 10,000 products across the country. Myntra prioritizes customer satisfaction by offering a hassle-free and convenient shopping experience, featuring a vast selection of brands and products on its user-friendly interface.

Empowering Sellers for Success:

Myntra empowers sellers with a comprehensive suite of tools to manage their online stores effectively. The platform provides robust cataloging support and a well-organized customer supply chain management system, allowing sellers to focus on building their brand and maximizing sales. This seller-centric approach has attracted a vast network of vendors, resulting in a high daily product volume on Myntra.

Simplifying Complexities: Effortless Reconciliation with Cointab

While Myntra offers significant benefits to sellers, managing a high volume of daily transactions and ensuring accurate payouts can be a significant challenge. Manually verifying every order against Myntra’s reports and payouts is a time-consuming and error-prone task, despite its importance.

This is where Cointab steps in. Cointab’s automated reconciliation system streamlines the process, eliminating the need for manual data entry and verification. Cointab ensures seamless integration with Myntra, allowing sellers to focus on core business activities while maintaining accurate financial records.

Regain control of your finances with Cointab’s automated reconciliation system. Simply upload your Myntra data and let Cointab handle the rest. Their system meticulously records all details, automatically verifies fees and remuneration against your expectations, and flags any discrepancies in a clear, actionable report for your finance team. This empowers you to investigate and resolve issues with Myntra efficiently, saving valuable time and resources while ensuring you receive what you’re owed. Focus on growing your business – Cointab takes care of the rest.

To ensure accurate reconciliation, you’ll need to access specific reports from your Myntra seller portal.

- Myntra Seller Order Detail Report: This report provides a comprehensive overview of all orders placed on your Myntra store within a specific month, including their final status (shipped, canceled, returned).

- Myntra Sales Revenue Report: This report focuses on the invoice numbers and Goods and Services Tax (GST) details associated with all your Myntra orders.

- Myntra PG Forward Settlement Report: This report is crucial for understanding fees associated with successful deliveries. It details logistics fees, commission charges, the final settlement amount, and the Unique Transaction Reference (UTR) for all delivered orders within a month.

- Myntra PG Reversal Settlement Report: This report focuses on canceled and exchanged orders. It provides details on the logistics fees, commission charges, settlement amount, and UTR associated with these specific orders.

- Myntra TCS Reports: These reports encompass details on Tax Collected at Source (TCS) for canceled orders, exchanged orders, and orders canceled after the shipment process began (appearing on the RTO sheet).

- Myntra Non-Order Settlement Report: This report details non-order-specific charges, such as marketing fees and compensation for fraudulent orders involving incorrect product returns. It also includes UTRs for bank verification purposes.

.

Cointab’s automated system verifies Myntra fees in two key stages:

Stage 1: Order and Invoice Verification

- Invoice Matching: Ensures the client receives invoices for all expected orders. This ensures completeness of financial records.

- Invoice Discrepancy Highlighting: The system flags discrepancies between the order amount and the invoice amount for each order, categorizing them as “Pending Payment,” “Less Received,” or “More Received.”

Stage 2: Bank Settlement Verification

- UTR Matching: Verifies if the client has received the correct funds in their bank account by comparing the UTR (Unique Transaction Reference) provided in the Myntra settlement reports with the corresponding transaction details in the client’s bank statement.

- Settlement Amount Reconciliation: Compares the settlement amounts from Myntra’s Forward Settlement report, Reversal Settlement report, and Non-Order Settlement report against the transaction amounts reflected in the bank statement.

- Discrepancy Categorization: Based on the difference between the settlement amount and the bank transaction amount, orders are categorized as “Reconciled,” “Less Payment Received,” or “More Payment Received.”

The Output is as follows

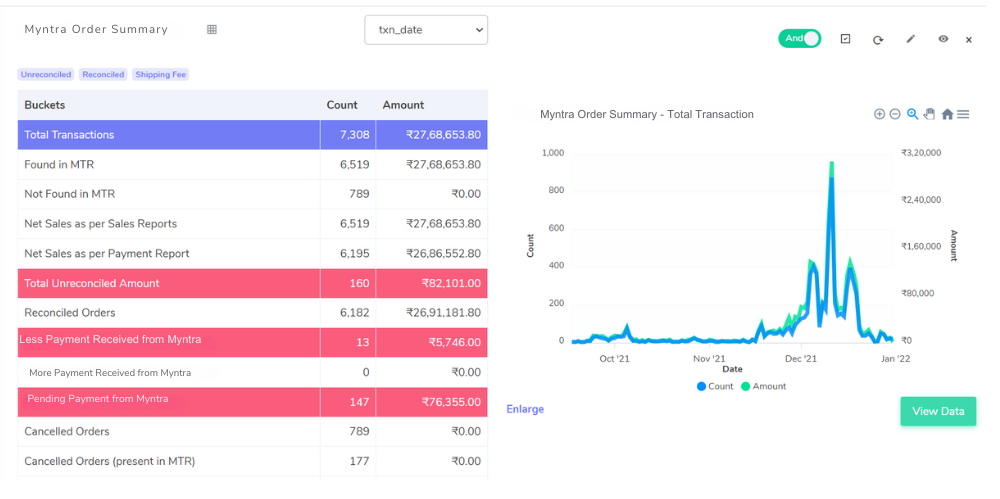

Myntra Sales Reconciliation: Understanding Your Net Sales

This section dives into the details of Myntra sales reconciliation, helping you gain a clear picture of your net sales and identify any discrepancies.

- Total Transactions: This represents the total expected amount you should receive from Myntra, based on the Myntra GST reports.

- Net Sales from Forward & Reversal Reports: This reflects the net sales calculated by combining the Myntra PG Forward Settlement report (successful deliveries) and the Reversal Settlement report (canceled/exchanged orders).

- Total Unreconciled Orders: This category highlights any orders where the expected net sale (calculated from the GST report) doesn’t match the net sales reflected in the settlement reports. These discrepancies require further investigation.

- Reconciled Orders: This represents orders where the expected net sale (calculated from the GST report) perfectly matches the net sales in the settlement reports. These orders are considered error-free in terms of net sales calculations.

Payment Discrepancies:

- Less Payment Received from Myntra: This category identifies orders where the amount received from Myntra is lower than what was reported in the Myntra GST report. These discrepancies might indicate potential underpayment issues.

- More Payment Received from Myntra: This category highlights orders where the amount received from Myntra is higher than what was reported in the Myntra GST report. These discrepancies might indicate overpayment or potential errors.

- Pending Payment from Myntra: This category identifies transactions where payment hasn’t been received from Myntra yet. These require follow-up to ensure timely payment.

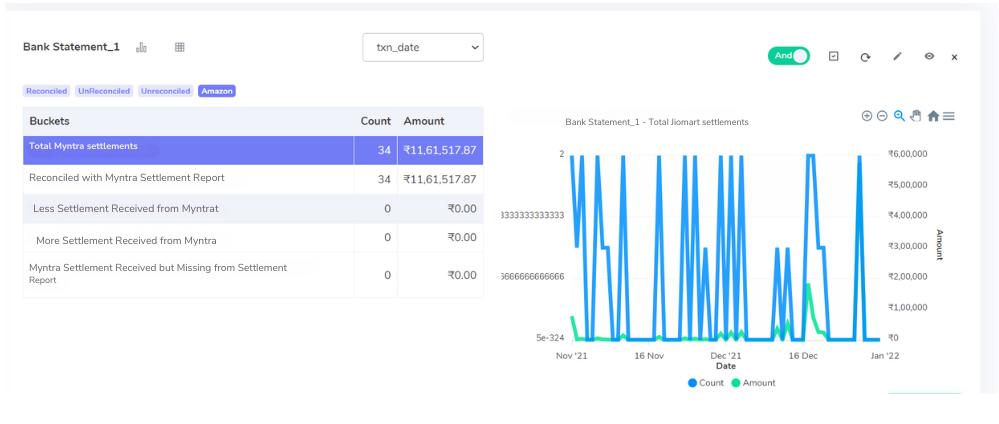

Myntra Bank Statement Reconciliation: Ensuring Accurate Financial Alignment

Achieving financial clarity with Myntra settlements is simplified through bank statement reconciliation. This process verifies if the funds received from Myntra align with what they promised.

- Total Myntra Settlements: This represents the sum of all Myntra transactions reflected in your bank statement.

- Reconciled with Myntra Settlement Report: This category highlights transactions in your bank statement that perfectly match the corresponding entries in Myntra’s settlement reports (Forward, Reversal, and Non-Order). These transactions are considered error-free in terms of recorded settlement amounts.

Identifying Discrepancies:

- Less Settlement Received from Myntra: This category flags potential underpayment issues. Here, the amount received in your bank is lower than the settlement amount promised by Myntra in their reports.

- More Settlement Received from Myntra: This category identifies potential overpayments or errors. The amount received in your bank is higher than the settlement amount promised by Myntra.

- Myntra Settlement Received but Missing from Settlement Report: This category highlights discrepancies where you received a Myntra settlement reflected in your bank statement, but the corresponding entry is missing from Myntra’s settlement reports. These discrepancies need further investigation to ensure accurate financial records.

Begin your journey of streamlined automation and reconciliation

Manual reconciliation can be a time-consuming and error-prone process for Myntra sellers. Cointab offers an automated solution that streamlines this task, saving you valuable time and ensuring financial accuracy. Simply upload your reports and receive automated verification of your Myntra transactions. This frees you to focus on what truly matters – growing your business.

Sign up for Cointab today!