Subscription-Based Model Reconciliation with Cointab

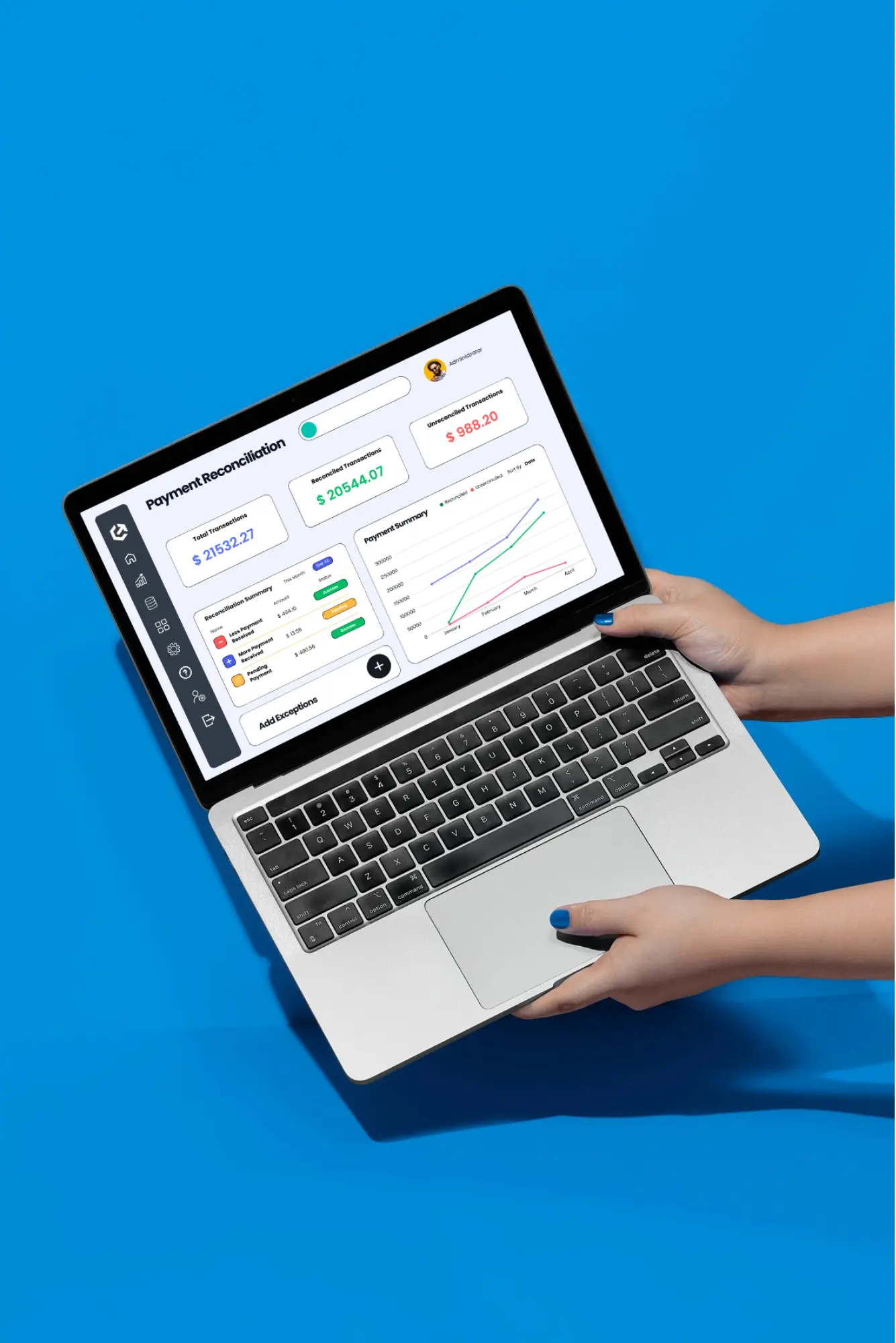

Streamline your subscription revenue reconciliation process.

The subscription-based model has become one of the most prominent business models worldwide. Whether for SaaS platforms, e-commerce subscription services, or digital media, companies are increasingly relying on recurring revenue streams. However, managing subscription payments, billing cycles, and customer data can be highly complex, especially as businesses scale. A well-managed reconciliation process is essential to maintaining accuracy, profitability, and compliance, which is where Cointab comes in, offering a game-changing solution for reconciliation.

The Challenges with Traditional Methods like Excel

Before automating reconciliation, many businesses relied on Excel as their primary tool. While Excel has long been a standard for financial reconciliation, its capabilities are limited when scaling to handle the complexities of subscription-based revenue models. Here’s where things typically fall short:

Data Overload

As transaction volumes grow, managing and analyzing data in Excel becomes more error-prone and less efficient.

Complexity of Recurring Payments

Subscription models are often subject to fluctuations such as upgrades, downgrades, free trials, and refunds, making reconciliation cumbersome.

Lack of Integration

Excel doesn’t integrate easily with other financial systems, leading to silos of data and potential inconsistencies.

Manual Reconciliation Process

Excel requires manually matching subscription payments, fees, and cancellations, which can be incredibly time-consuming.

While Excel remains a great tool for small businesses, as subscription-based models scale, businesses often realize they need something more robust. The automation of reconciliation processes is no longer a luxury; it’s a necessity.

Why Cointab is a Game-Changer for Subscription-Based Businesses

Cointab isn’t just another tool; it’s a strategic solution that allows businesses to reconcile their subscription payments seamlessly, saving valuable time, reducing errors, and providing full transparency.

With Cointab, businesses benefit from:

Scalability

As your subscription business grows, Cointab grows with you, handling thousands of transactions without compromising on speed or accuracy.

Global Compliance

Meet international standards and regulatory requirements, ensuring your financial operations are compliant across multiple regions.

Real-Time Reporting

Access up-to-date financial data to make quicker, more informed decisions.

Automation

Reconcile recurring payments automatically without manual intervention, improving speed and accuracy.

Multi-Currency Handling

Simplify global transactions with multi-currency reconciliation, reducing the risk of conversion errors and discrepancies.

How Cointab Streamlines Reconciliation for Subscription-Based Models

Cointab automates the entire reconciliation process, ensuring faster, more accurate financial reporting, and enabling companies to focus on growth. Here’s how Cointab revolutionizes subscription-based reconciliation:

Seamless Accounting System Integration

Cointab integrates with popular accounting systems, automatically updating reconciled subscription payments and financial data. This prevents discrepancies between reconciled transactions and accounting books, creating a smooth workflow.

Multi-Currency Reconciliation

For global subscription businesses, Cointab handles multi-currency transactions, conversions, and international payment fees, ensuring accuracy and consistency across financial records. This addresses the challenge many CFOs face with managing foreign exchange.

Time-Saving Automation

Cointab automates the entire reconciliation process, freeing finance teams from manual data entry and minimizing human error. This allows resources to be allocated to strategic activities, addressing the fact that many finance teams spend a significant portion of their time on manual tasks.

Transparent and Accurate Financial Reporting

Cointab generates automated reports providing real-time insights into key metrics like revenue growth, churn rates, and lifetime value. This data-driven transparency enables informed decision-making.

Automated Recurring Payment Reconciliation

Cointab automates the reconciliation of recurring payments against bank records, invoices, and payment gateways (Stripe, PayPal, Razorpay, etc.), eliminating manual intervention and reducing errors. This ensures accurate reconciliation of all recurring transactions, even with monthly variations due to usage, discounts, or plan changes.

Complex Pricing Structure Handling

Cointab automatically handles complex pricing models like tiered pricing, pay-as-you-go, and volume discounts, ensuring accurate transaction alignment with subscription plans. This eliminates reconciliation headaches caused by variable pricing.

Key Stats About the Need for Automated Reconciliation

The subscription economy is booming, and companies in various sectors need to automate their recurring billing and reconciliation to keep pace. The projected $155 billion market size for subscription software highlights the scale of this trend.

Automation delivers substantial efficiency improvements for subscription businesses. The Zuora study's 30% efficiency gain statistic emphasizes the benefits of automation, and Cointab is positioned as a solution to achieve these gains.

Conclusion

Subscription-based businesses need reliable, scalable, and automated solutions to manage their growing volume of recurring payments and complex pricing structures. Cointab is the ultimate tool for automating your subscription reconciliation process, improving efficiency, and ensuring accuracy across your financial operations.

Don’t get bogged down by the complexities of manual reconciliation. Request a Demo today and discover how Cointab can transform your subscription-based business, ensuring smooth financial operations and helping you stay ahead of the competition.