Third-Party Reconciliation

Ensuring Accurate Financial Settlements with Automation

Accurate third-party reconciliation is critical for financial stability, especially for businesses managing complex supply chains and external vendors. Ensuring that payments, invoices, and service records align with internal financial records is essential. However, manual reconciliation is inefficient, error-prone, and leads to financial mismatches.

Cointab’s automated reconciliation solution eliminates these challenges by improving accuracy, reducing manual workload, and ensuring seamless financial management across industries like supply chain management and construction.

Challenges of Third-Party Reconciliation

Manual reconciliation presents obstacles that impact financial accuracy and efficiency

Inconsistent Data Formats

Differences in invoice formats, payment schedules, and reporting structures create challenges in aligning vendor records with financial data.

High Transaction Volumes

Businesses handling multiple vendors process thousands of transactions monthly, making manual reconciliation resource-intensive and time-consuming.

Error-Prone & Time-Consuming

Spreadsheet-based reconciliation increases risks of discrepancies, misallocations, and financial misstatements.

Lack of Real-Time Insights

Without automation, businesses struggle to track outstanding payments, discrepancies, and reconciliation status, delaying financial reporting.

Discrepancy Identification Challenges

Ensuring payments comply with tax laws, contracts, and international financial reporting standards is difficult without automation.

How Cointab Automates Third-Party Reconciliation

Cointab’s automation enhances speed, accuracy, and efficiency:

Seamless Data Integration

Connects with financial systems, vendor payment platforms and bank records to automate data collection.

Bank vs. Vendor Payment Matching

Cross-verifies vendor payments with bank transactions, ensuring all payments are processed correctly and comply with financial reporting standards.

Customizable Reconciliation Rules

Configurable reconciliation rules align with contract terms, payment structures, and accounting policies for compliance.

Intelligent Transaction Matching

Uses algorithms match third-party invoices with purchase orders and payments, flagging discrepancies for quick resolution.

Comprehensive Reporting

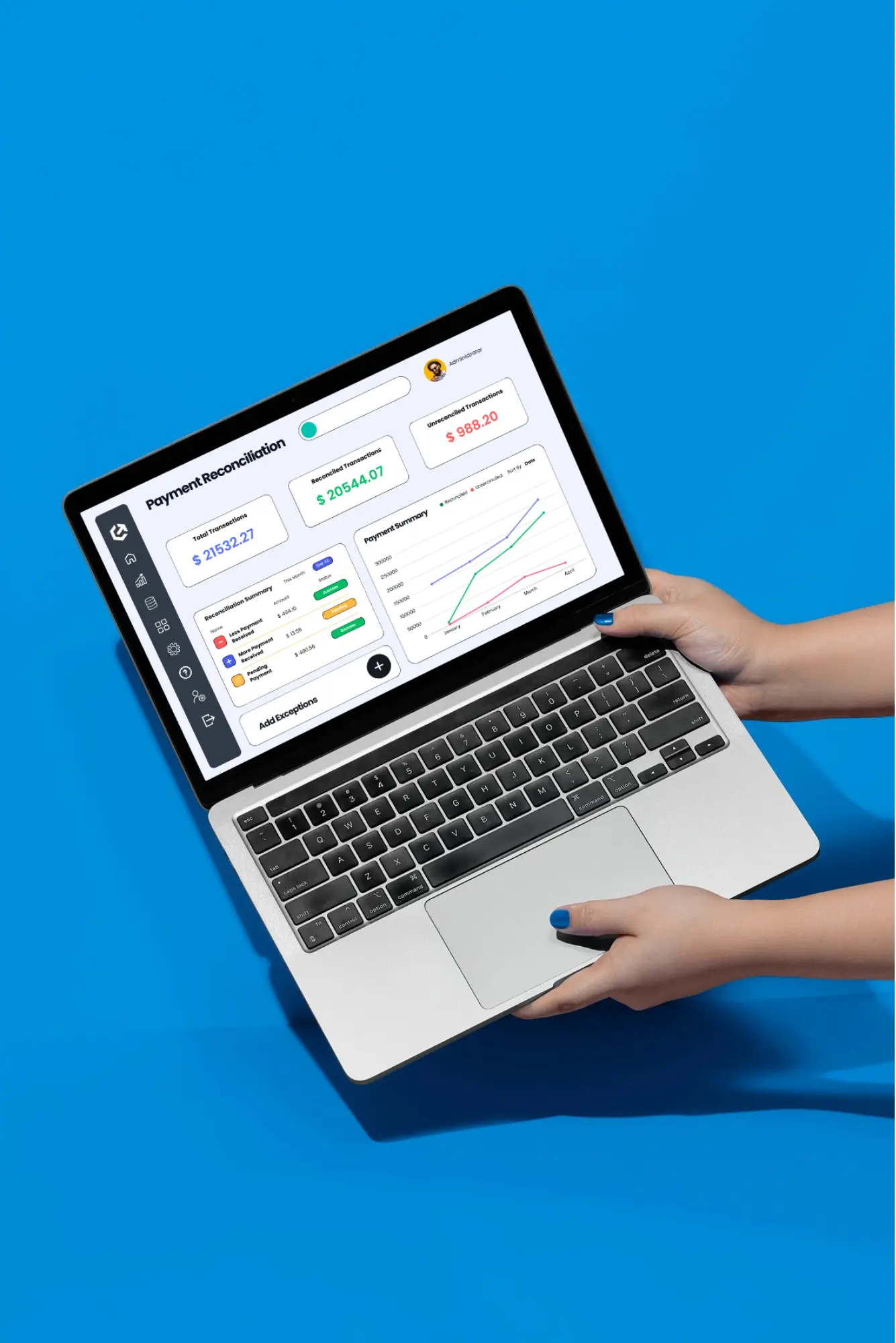

Provides real-time financial reports and interactive dashboards for clear insights into reconciled, pending, and disputed transactions.

How Cointab Automates Third-Party Reconciliation

Efficient Matching Algorithms

Uses intelligent algorithms to match transactions across different systems and detect inconsistencies instantly.

Automated Data Collection

Eliminates manual data entry by fetching financial records from ERP systems, banks, and payment platforms.

Scheduled Reconciliation

Businesses can automate reconciliation runs, ensuring timely and accurate financial reporting without manual intervention.

Audit-Ready Documentation

Maintains detailed financial records, simplifying compliance audits and regulatory reporting.

Automated Discrepancy Alerts

Detects missing payments, overpayments, and settlement delays, providing actionable insights for quick resolution.

Key Stats on the Importance of Automated Reconciliation

75% of businesses report experiencing delays or discrepancies in withdrawal processing due to manual tracking

68% of financial teams struggle with mismatched transactions and missing settlements

Automating reconciliation reduces financial discrepancies by 60% and saves up to 65% of time spent on manual tracking

Conclusion

Manual third-party reconciliation is time-consuming, error-prone, and inefficient. Cointab’s automated solution streamlines the process, ensuring accurate settlements, real-time discrepancy detection, and seamless integration with financial systems.

Discover how Cointab can optimize your third-party reconciliation—Schedule a consultation today!