Venmo simplifies money transfers between friends and businesses alike. But managing those pesky transaction fees manually can be a time-consuming nightmare, leading to errors and potential financial losses. Cointab Reconciliation is here to save the day with its automated solution, ensuring accurate fee verification and freeing up your valuable time.

The Problem with Manual Venmo Fee Reconciliation:

Time-Consuming:

Manually entering data from Venmo invoices, bank statements, website reports, and ERP systems is a tedious and error-prone process.

Prone to Errors:

Even small mistakes can throw off your financial records, leading to discrepancies and potential losses.

Inefficient Use of Resources:

Your finance team’s time could be better spent on strategic tasks instead of tedious data entry.

Cointab Reconciliation: Your Automated Solution

Our innovative software automates the entire Venmo fee reconciliation process, eliminating manual work and ensuring accuracy. Here’s how it works:

Seamless Data Integration:

Cointab securely connects to your existing systems, including Venmo, bank accounts, ERP software, and your website platform.

Automated Data Matching:

Our software automatically cross-references transaction data from all sources, identifying any inconsistencies or potential overcharges.

Comprehensive Analysis:

Cointab provides a detailed breakdown of all Venmo transactions, highlighting discrepancies and potential fee errors.

User-Friendly Interface:

Easily reconcile matched transactions and investigate any flagged inconsistencies with a few clicks.

Benefits of Cointab Reconciliation:

Reduced Errors:

Eliminate human error from the reconciliation process.

Improved Efficiency:

Free up your finance team for more strategic tasks.

Cost Savings:

Identify and prevent potential overcharges from Venmo fees.

Enhanced Accuracy:

Gain complete confidence in the accuracy of your financial records.

Increased Productivity:

Spend less time on reconciliation and more time growing your business.

Demystifying Venmo Reconciliation Reports:

Venmo Payment Report:

This report details all transactions processed through the Venmo platform, including the source of the payment (credit card, debit card, etc).

Venmo Rate Card:

This document outlines the specific fees associated with Venmo transactions, including flat fees and percentage-based charges.

Cointab Reconciliation offers a powerful and automated solution to streamline your Venmo fee verification process. Gain peace of mind, ensure accurate financial records, and free up your finance team to focus on what truly matters. Contact Cointab today and see how we can help you simplify your Venmo reconciliation!

Result

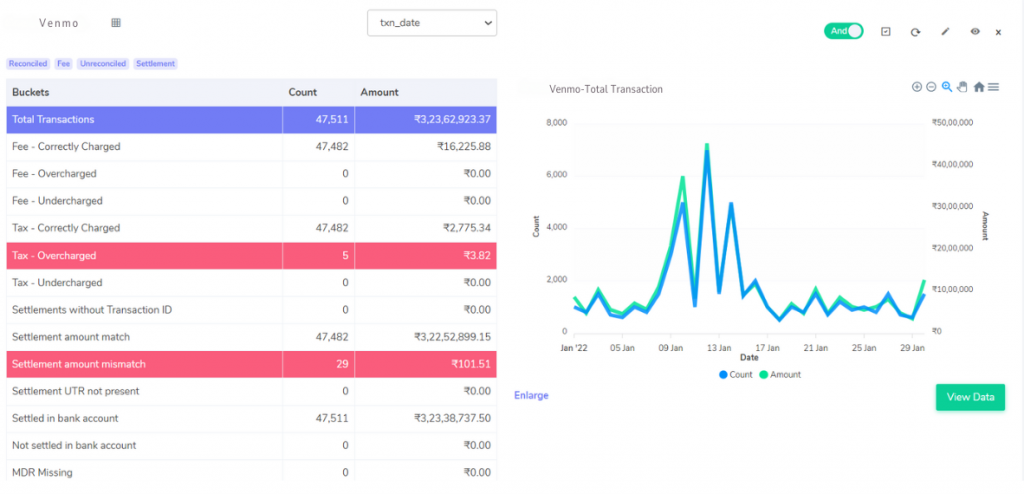

Managing Venmo transactions can be smooth, but ensuring accurate fees and taxes requires proper reconciliation. Here’s a breakdown of key results to help you identify discrepancies:

Venmo Fee Charges:

Fee Correctly Charged:

This occurs when the fee reflected in the Venmo settlement report matches the amount calculated using the Venmo rate card. This signifies accurate fee application.

Fee Overcharged:

This situation arises when the Venmo settlement report shows a higher fee compared to the rate card calculation. You might want to investigate potential reasons like:

Incorrect Transaction Classification:

Did Venmo categorize the transaction incorrectly, leading to a mismatched rate?

Promotional Rate Expired:

Ensure you’re using the most recent Venmo rate card, as promotional rates might have expired.

Fee Undercharged:

In this case, the Venmo settlement report reflects a lower fee than the rate card calculation. While seemingly beneficial, it could indicate a potential future billing adjustment from Venmo.

Venmo Tax Charges:

Tax Correctly Charged:

This occurs when the tax amount in the Venmo settlement report matches the calculated tax based on your region’s tax rates.

Tax Overcharged:

This situation arises when the Venmo settlement report shows a higher tax amount compared to the calculated value. You might want to investigate potential reasons like:

Incorrect Tax Location:

Ensure your Venmo account reflects your business location for accurate tax application.

Tax Rate Changes: Verify if recent tax rate updates haven’t been reflected in your calculations.

Tax Undercharged:

Similar to fee undercharges, a lower tax amount in the Venmo settlement report compared to calculations might indicate a future tax liability adjustment.

Settlement Amount:

Settlement Amount Match:

This occurs when the calculated settlement amount (total amount minus fees and taxes) matches the amount reflected in the Venmo settlement report. This signifies a complete and accurate transaction.

Settlement Amount Mismatch:

A discrepancy between the calculated settlement amount and the Venmo report requires investigation. Potential reasons include:

Missing Transactions:

Ensure all transactions are considered in your calculations and match those reported by Venmo.

Rounding Differences:

Slight rounding variations might exist between your calculations and the Venmo report.

Bank Reconciliation:

Settled in Bank Reconciliation:

This confirms that the transaction reflected in the Venmo settlement report has been deposited into your bank account. This signifies a complete financial cycle.

Not Settled in Bank Reconciliation:

Transactions present only in the Venmo settlement report and absent from your bank statement require investigation. Here’s why this might occur:

Outstanding Deposits:

The funds might be in transit between Venmo and your bank and will appear in your statement soon.

Bank Statement Errors:

Investigate any potential errors or discrepancies within your bank statement.

Simplify Your Venmo Reconciliation with Cointab

Cointab Reconciliation automates the process of comparing Venmo reports, rate cards, bank statements, and other relevant data sources. This eliminates manual work and ensures error-free results.

Our software provides a clear overview of all transactions, highlighting potential discrepancies and allowing you to investigate and rectify any issues. Streamline your Venmo reconciliation process, gain valuable financial insights, and achieve efficient financial management with Cointab.

Don’t waste time and risk errors with manual reconciliation. Choose Cointab for a smoother and more accurate Venmo fee verification process.