Building an online store for your business to flourish seems like a necessity nowadays, but it can certainly be a chore to build your online store. A lot of factors need to be fulfilled to build an attractive, secure and strong online store. Unfortunately, building an online store is much more difficult than you might imagine especially for smaller companies. More businesses are now able to go take their business online due to e-commerce solutions like Shopify. Shopify builds online stores for companies while offering many facilities. Companies prefer using Shopify instead of building the online store themselves as it has minimal initial investment plus they provide constant technical support and maintain the security of your site. Hence Shopify is increasingly gaining popularity.

Ecommerce companies that use Shopify, a multitude of transactions happen every minute on their site. They rely on different payment gateways and COD vendors depending on the ones they find handy. It is challenging to find out whether vendors have made the right payments or if the correct fees are charged. Plus using different payment gateways and COD vendors produce reports in different formats and analyzing this information is not easy.

Issues faced during Website Reconciliation

- Multiple vendors leading to multiple reports

- Combining the reports

- Difficulty in analyzing

- Complexity in sharing reports with the team

- Repeating this complex process again and again

- Time consuming

Cointab’s software simplifies this process for companies. The software integrates the company’s internal report, order management system report, payment gateway report and COD remittance report and then reconciles these reports against each other to produce a simplified final output which can easily be understood. It ends up saving a lot of essential time and assists the finance team in the analysis.

Benefits of using the Cointab Software for Website Reconciliation

- Integration of the multiple reports

- Time-saving

- Final report produced in an easy-to-understand format

- Reconciles the various reports against each other

- Analyzing and Sharing reports with the team becomes uncomplicated.

- No need to manually upload information or check it.

RECONCILIATION PROCESS

Scope / Entities

- Shopify

On the Shopify website, customers can purchase the items they require. The customer is led to the payment page after adding an item to the cart, where they can pick between two payment options: Payment Gateway or COD. The primary purpose of the Shopify website is to make purchases easier. It also generates a report for all orders placed through its website.

- Increff Software

Increff is a software used for order management to keep a track of orders placed and all transactions that occur on company website.

To check payments and charges made the Increff report is reconciled against the Shopify report, payment gateway report and the COD remittance report using Cointab’s Software.

- Payment gateway

Payment gateway is used by many e-commerce companies to conduct payments through debit card, credit card, net banking etc.

To check if the payments are received from the payment gateway partner for the orders fulfilled, Cointab reconciles the payment gateway report with the Shopify report and the bank statement

- COD remittance

Cash on delivery is a post-paid option that allows customers to pay after their order has been delivered. However, in order to make this option available, e-commerce businesses must work with a COD provider. The vendor then collects the money at the time of delivery and later deposits it into the company’s bank account. In the COD remittance report, the payments are documented.

To ensure that payments are made correctly, Cointab’s software reconciles the COD remittance report with the Shopify Report and the bank statement.

- Bank Statement

Cointab’s software reconciles the bank account with the Payment Gateway report and the COD remittance report to verify if all the vendors have deposited the right amounts in the company’s bank account

Reports used for Reconciling:

- Shopify order report

This report contains all orders received in a given period on the Shopify website. It is used to reconcile orders with the Increff order report.

- Increff order report

Customer Orders placed on company website are recorded by Increff in its order report which is then reconciled with the Shopify report , COD remittance report and Payment Gateway report.

- Increff Sales tax report

It is a tax report filled while dispatching each order.

- Increff Return tax report

This is a tax report filled when received a product back (customer return / RTO)

- Increff Cancellation tax report

This is a tax report filled for orders which were made and then cancelled.

- Increff SKU master

The number of products that are kept in stock and the respective product details are recorded in this report.

- Payment gateway settlement report

The bank statement and the Increff report is reconciled with the payment gateway report.

- Payment gateway rate card

The tax rates to be charged on every purchase made by customers through the payment gateway are given in this rate card.

- COD remittance reports from courier partner

The payments made by the COD partners are recorded in this report.

- Bank statements

The bank statement is reconciled with the payment gateway report and COD remittance report to check if the expected amount is paid.

RECONCILIATION RESULT:

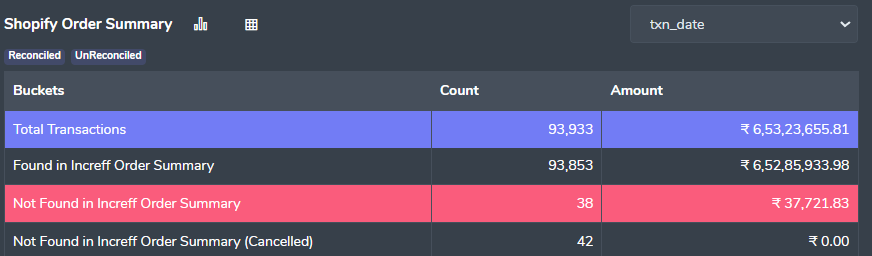

Shopify vs Increff Reconciliation

- Forward Reconciliation

Found in Increff Order Summary-

It showcases the transactions that are found in the Increff report consisting of the fulfilled orders for which payment will be received

Not Found in Increff Order Summary-

This consists of orders which will not be delivered as the orders do not originate from the Increff report. So these transactions need to be checked

Not Found in Increff Order Summary (Cancelled)-

Here the orders not found in the Increff report and cancelled are displayed in this box. These orders will not be delivered as the orders do not originate from the Increff report but later these orders were cancelled so it can be ignored.

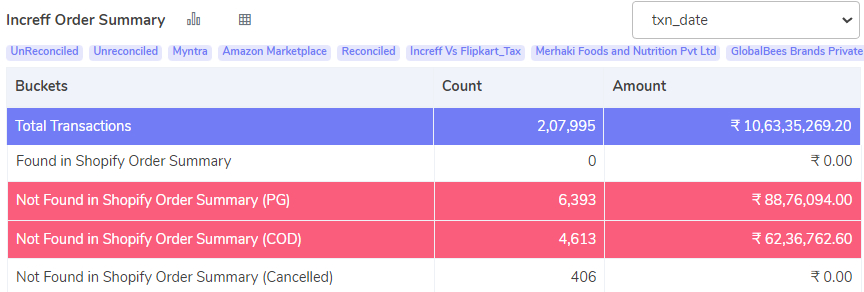

- Backward Reconciliation

Found in Shopify Order Summary-

Here the transactions found in the Increff report and the Shopify report are shown. It consists of the orders that company fulfilled and will be paid for.

Not Found in Shopify Order Summary (PG)-

The Increff report and Shopify report are compared using the our software and the transactions not found in the Shopify report are presented here. This shows the orders completed for which payment will not be received from the PG partner.

Not Found in Shopify Order Summary (COD):

The Increff report and Shopify report are compared using the Cointab software and the transactions not found in the Shopify report are presented here. This shows the orders completed for which payment will not be received from the COD partner.

Not Found in Shopify Order Summary (Cancelled):

The Increff report and Shopify report are compared using the Cointab software and the transactions not found and cancelled in the Shopify report are presented here. This shows the orders completed for which payment will not be received from the COD partner but later these orders were cancelled so no checking required.

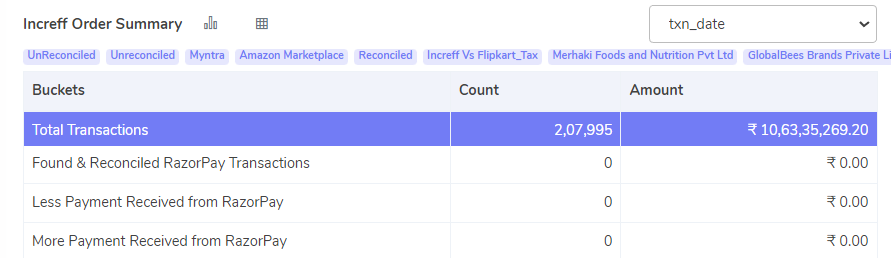

Increff vs Payment Gateway (example: Razorpay)

- Forward Reconciliation

Reconciled with PG:

The orders in the Increff report and the Payment Gateway report that are the same are shown here. That means payments are received for the orders delivered.

Less Payment Received in PG:

Cointab’s Software compares the Increff report and the Payment Gateway report and it essentially shows which payments are not received. When the amount recorded in Increff is more than the one recorded by the payment gateway it means the payments received are less than how much was supposed to be received.

More Payment Received in PG:

This box shows items’ paid amount recorded in Increff is less than the one recorded by the payment gateway. This feature helps find out if customers have paid more via the payment gateway.

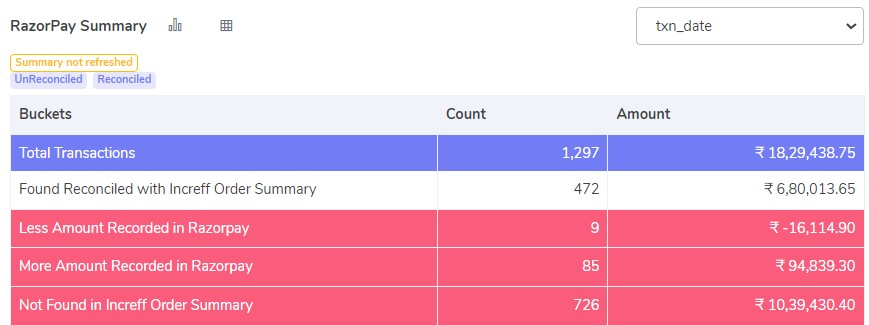

- Backward Reconciliation

Found Reconciled with Increff Order Summary

Here Cointab’s Software compares the payment gateway report with the Increff report and orders that match with the Increff report are displayed in this box. This feature shows the orders which have been rightly paid for.

Less Amount Recorded in Payment Gateway

Here Cointab’s Software compares the payment gateway report with the Increff report and orders for which less amount is recorded Payment Gateway report than in the Increff report is displayed in this box. This feature helps the company know for which orders the right amount has to still be paid.

More Amount Recorded in Payment Gateway

Here Cointab’s Software compares the payment gateway report with the Increff report and orders for which more amount is recorded Payment Gateway report than the amount in the Increff report is displayed in this box. This feature lets the company know which orders they have received an extra amount from the payment gateway so that they can maintain their accounts correctly or refund the extra amount.

Not found in Increff Order Summary

After comparing the payment gateway report with the Increff report the orders not found in the Increff report are displayed in this box. This feature lets the company know which orders will not be fulfilled but for which they received payment. This is an important value as not fulfilling customers’ orders that they have already paid for will make the company lose out on priceless customers.

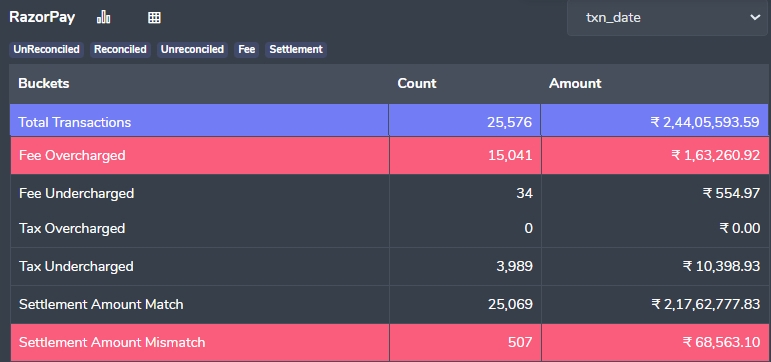

Payment Gateway Fee Verification

Fee Overcharged:

Here , transactions are displayed in which the fee charged by the payment gateway exceeds the decided amount as per the business contract. It is beneficial as company finds out they are paying more than required, allowing them to take measures to avoid that.

Fee Undercharged:

Here the transactions for which fee charged by payment gateway is lesser than decided amount as per the business contract. Knowing this is useful because it informs the company of the undercharged amount so that they do not cause any contract violations. They can also notify the COD partner and establish a trusting relationship.

Tax Overcharged:

The transactions for which tax charged by payment gateway is more than the decided amount as per the business contract are displayed here . The tax charged takes the GST and fee into account and the GST is calculated on the fee .Then is it verified with the rate card, calculated and reconciled with the settlement amount received by the bank.

Tax Undercharged:

The transactions for which tax charged by payment gateway is lesser than the decided amount as per the business contract are displayed here . The tax charged takes the GST and fee into account and the GST is calculated on the fee .Then is it verified with the rate card, calculated and reconciled with the settlement amount received by the bank.

Settlement Amount Match:

Amount collected from customer – fee charges – tax should be settlement amount. This is a simple check we have added in our software for reconciliation. For all rows where calculated settlement amount matches amount given by payment gateway directly, system will show settlement amount match.

Settlement Amount Mismatch:

Here, using the calculation done above we get the settlement amount. This is a simple check we have added in our software for reconciliation. For all rows where calculated settlement amount does not match amount given by payment gateway directly, system will show settlement amount mismatch.

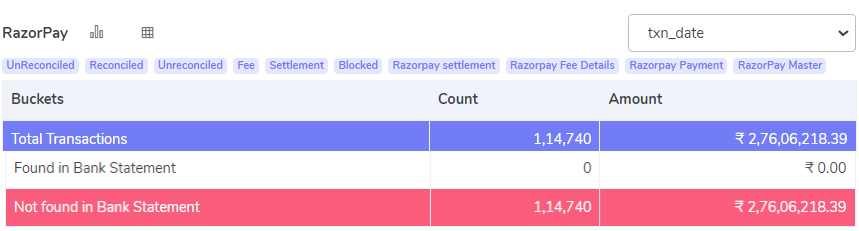

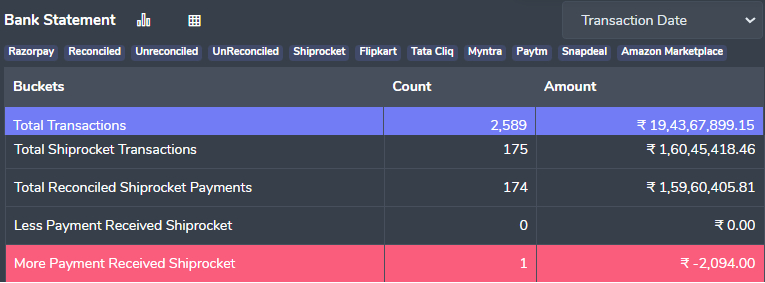

Payment Gateway vs Bank Statement

- Forward Reconciliation

Found in Bank Account:

This column displays the transactions for which the bank has received the settlement amount. This enables businesses to keep track of the number of payments made as well as the amount received from the payment gateway partner and sent to the bank. It demonstrates that payments sent to the company’s bank account by the payment gateway partner for orders fulfilled.

Not Settled in Bank Account:

This column displays the transactions for which the bank has not received the settlement amount. This enables businesses to keep track of the number of payments made as well as the amount received from the payment gateway partner and sent to the bank. It demonstrates that payments still to be sent to the company’s bank account by the payment gateway partner for orders fulfilled.

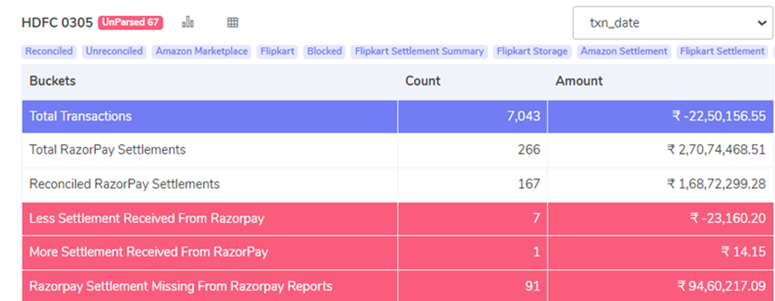

- Backward reconciliation

Total Payment Gateway Settlements:

The settlements in total that are made by the payment gateway partner to the company bank account are demonstrated here.

Reconciled Payment Gateway Settlements:

The reconciled transactions in the Bank statement and the Payment gateway are shown in this row. It means that the amounts in both the reports are the same

Less Settlement received by Payment Gateway

When the settlement amount in the bank statement is less than the amount recorded in the Payment Gateway report, that amount is presented in this row after reconciling the bank statement and the payment gateway report. This allows businesses to determine how much their payment gateway partner is underpaying them.

More Settlement received by Payment Gateway

When the settlement amount in the bank statement is more than the amount recorded in the Payment Gateway report, that amount is presented in this row after reconciling the bank statement and the payment gateway report. This tool allows businesses to see how much is overpaid.

Payment Gateway Settlements Missing from Payment Gateway:

Cointab’s Software compares the bank statement and the payment gateway report and when the payment gateway is not informed of certain orders then the settlements are not made hence that amount is shown in this row.

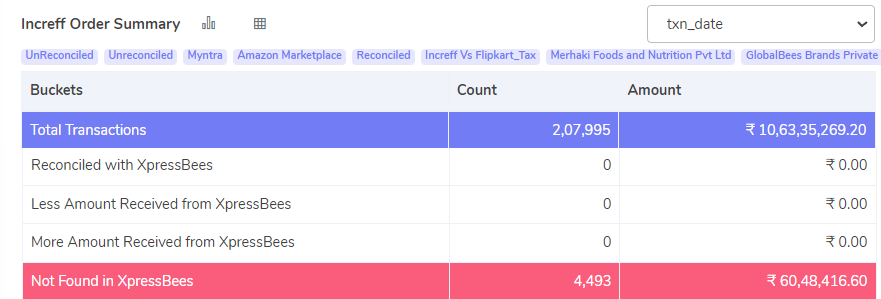

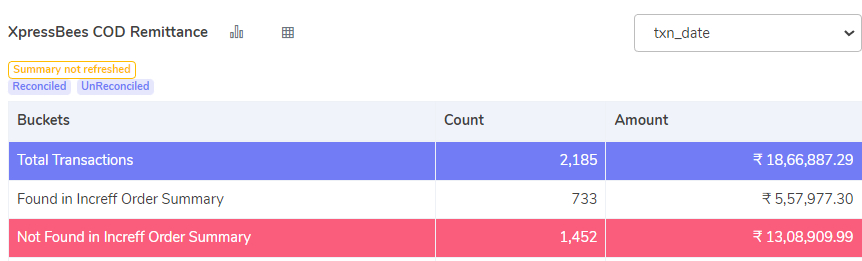

Increff vs COD Remittance

- Forward Reconciliation

Reconciled COD Transactions:

This box shows the sale amount when the number of items in the Increff report and the number of items in the COD partner Report are matched. The amount in rupees of the total reconciled transactions are displayed in the corresponding box.

Less Payment Received from COD Partner

Cointab’s software compares the Increff report and the COD remittance report. COD Remittance report shows payment of the promised amount. So, when the sale amount recorded in the Increff report is greater than that of the sale amount recorded in the COD remittance file. This feature is helpful as it lets the company know how much of the promised amount is unpaid by the COD partner.

More Payment Received from COD Partner

Our software shows if more payment is received than the promised amount. This figure is arrived at when the sale amount recorded in the Increff report is less than that of the sale amount recorded in the COD remittance file. This is beneficial as it lets the company know how much is overpaid to avoid calculation mistakes and refunding the amount builds trust with the COD partner.

Missing COD Payment:

This box shows the transactions that are not found in the COD remittance file after comparing it with the Increff report. This amount makes up for the pending transactions that the COD partner has to still pay.

Other Shopify COD transactions:

Cointab’s software compares the Increff report and the COD remittance report and shows the transactions that are found in the COD remittance file from the other COD partners.

- Backward Reconciliation

Found in Increff Order Summary

Cointab compares the COD Remittance report against the Increff report and the orders that match are displayed in this row. This feature shows the postpaid orders that were fulfilled for which the company has received the payment from the COD partner.

Not found in Increff Order Summary:

Cointab compares the COD Remittance report to the Increff report, and any orders not identified in the Increff data are presented in this row. It reveals the unfulfilled post-paid orders for which the company has received payment from the COD partner, which is not noted in the Increff report. As a result, the organization must physically review these transactions.

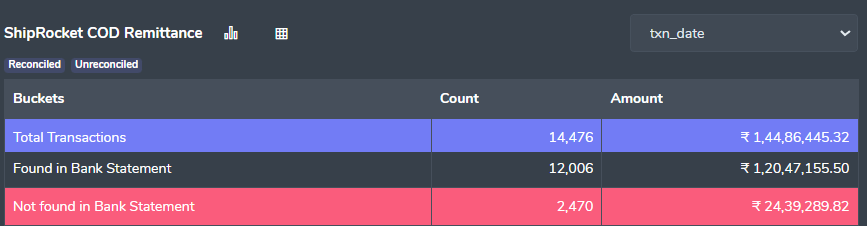

COD Remittance vs Bank Statement

- Forward Reconciliation

Found in Bank Statement:

The COD remittance Report is compared to the Bank statement by Cointab’s software, and the orders paid for in the Bank statement are presented in this box. This value represents the post-paid orders that the company has completed and for which the COD partner has paid them. This feature is significant since it informs the company whose orders have been paid correctly.

Not Found in Bank Statement:

The COD remittance Report is compared to the Bank statement by Cointab’s software, and the orders paid for in the Bank statement are presented in this box. This value represents the post-paid orders that the company has completed and for which the COD partner has to yet paid them. This feature is significant since it informs the company whose orders have not been paid as yet.

- Backward Reconciliation

Total COD Transactions:

The value of the total number of transactions done by the COD mode is shown in this box after Cointab’s software verifies the Bank statement with the COD remittance Report. It displays the number of orders that consumers have placed and paid for using the COD method, for which the company has received payment from the COD.

Total Reconciled COD Payments:

The Cointab Software reconciles the bank statement to the COD remittance report, and when the transactions in both reports match, that value is shown here. These are orders that have been completed and for which the company has been paid by the COD partner.

Less Payment Received from COD Partner:

This feature displays the amount that the COD partner has yet to pay as the amount recorded in the COD remittance report is lesser than the amount recorded in the Bank statement when Cointab’s software checks the Bank statement with the COD remittance Report.

More Payment Received from COD Partner:

This feature displays the amount that the COD partner has paid in excess as the amount recorded in the COD remittance report is more than the amount recorded in the Bank statement when Cointab’s software checks the Bank statement with the COD remittance Report.

RECONCILIATION RESULT:

Cointab’s software generates the above-given output which is presented in the form of tables. the whole reconciliation process from the Shopify report- Increff Report- Payment gateway- COD Remittance- Bank Statement are all displayed under the topics given. All the reports are reconciled with the vendor reports and the bank statement. The result generated by Cointab is formatted in such a way that it’s easy to understand and analyze. So then the finance team can use the result produced to keep a track of the payments and charges. As if any amount is wrongly paid or charged goes undetected over a period of time can lead to large losses.

So to conduct business even more efficiently and correctly then do try Cointab’s Website Reconciliation Software.