In today’s competitive e-commerce landscape, efficient and cost-effective shipping is crucial for business success. GFS, a leading UK-based carrier management partner established in 2001, processes over 20 million packages annually. They offer a comprehensive suite of services designed to streamline your deliveries, but managing the logistics and costs of millions of shipments can be complex.

This is where automated invoice verification software comes in. Manual invoice reconciliation for high-volume shipping can be time-consuming and prone to errors. Reconciliation discrepancies can lead to overpayments or underpayments to your carrier, impacting your bottom line.

Cointab Reconciliation Software simplifies and automates the GFS invoice verification process, ensuring accuracy and saving you valuable time and resources.

Benefits of Automated GFS Invoice Verification with Cointab:

Enhanced Accuracy:

Eliminate manual errors and discrepancies in invoice reconciliation.

Reduced Costs:

Identify and rectify overpayments or underpayments to GFS.

Improved Efficiency: Automate the verification process, freeing your team for other critical tasks.

Streamlined Workflows:

Integrate seamlessly with your existing ERP systems and reports.

Increased Transparency:

Gain a clear view of your shipping costs and ensure you’re getting the best rates.

How Cointab Works with GFS Invoices:

Cointab software seamlessly integrates with your existing systems to streamline GFS invoice verification. Here’s how it works:

Data Gathering:

Cointab automatically retrieves relevant data from your ERP reports, shipping invoices, pincode master, SKU reports, and GFS rate cards.

Zone Verification:

Cointab verifies the pincode zone reports, ensuring accurate zone allocation based on origin and destination postcodes.

Product Identification:

Using SKU reports, Cointab identifies each product’s unique code to determine weight and dimensions.

Rate Verification:

Cointab compares the weight and zone information with the GFS rate card to confirm the appropriate shipping charges are applied.

Invoice Comparison:

Cointab meticulously compares the calculated charges with the charges listed on the GFS invoice, flagging any discrepancies.

Error Correction:

Cointab empowers you to easily identify and rectify any errors in the invoice, ensuring accurate billing.

Key Reports for GFS Invoice Verification:

Cointab leverages various reports for a comprehensive GFS invoice verification process:

Pincode Zone Report:

This report specifies the zone assigned based on source and destination postal codes, impacting shipping costs.

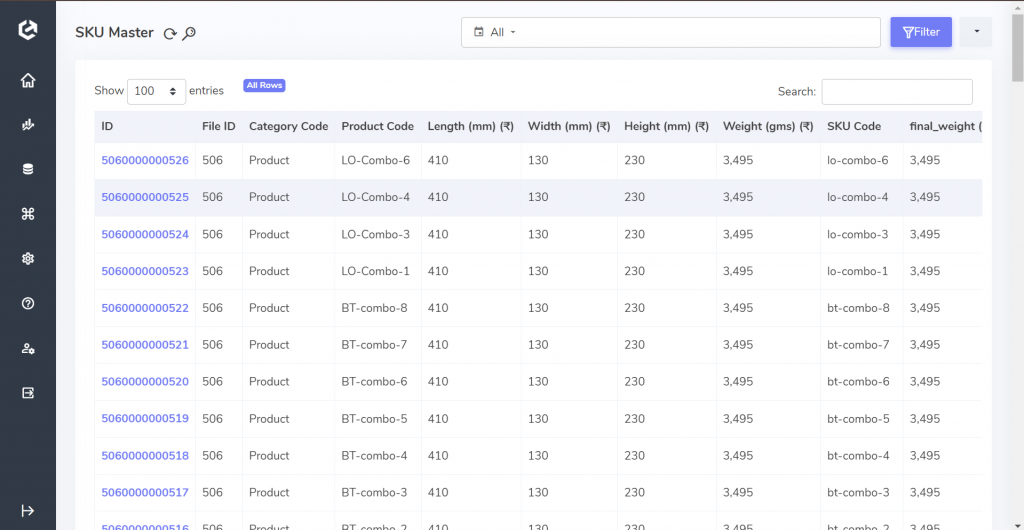

SKU Report:

Each product has a unique SKU code that helps determine its weight and dimensions, crucial for accurate rate calculations.

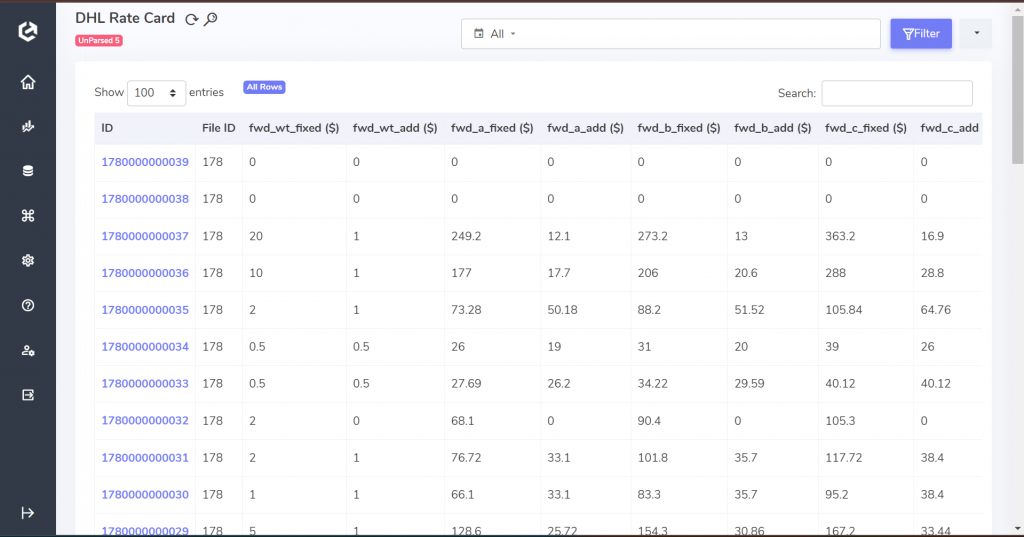

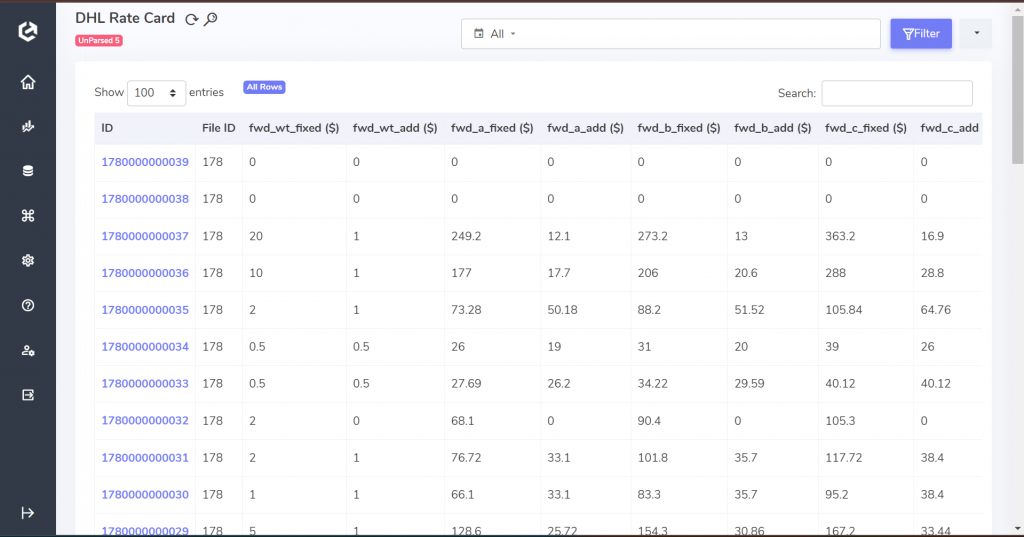

Rate Card:

The GFS rate card outlines the shipping charges based on weight and zone, ensuring you’re billed correctly.

GFS Invoice:

This invoice details each shipment, including order ID, billing zone, product type, weight, and applied charges.

SKU Report:

Managing e-commerce logistics involves meticulous handling of weight and dimension (W&D) data. Inconsistencies in W&D information can lead to significant discrepancies in GFS invoices, impacting your bottom line. Cointab’s automated W&D management system simplifies GFS invoice verification, ensuring accurate billing and cost optimization.

Prioritizing Reliable Data: ERP as the Primary Source

Cointab prioritizes W&D data from your existing Enterprise Resource Planning (ERP) system. The SKU code in the ERP report serves as a unique identifier, allowing Cointab to efficiently retrieve the product’s weight and dimensions directly from your product database. This approach leverages the most reliable source of W&D information, minimizing the risk of errors.

Addressing Missing Data: Leveraging Invoice Information

In instances where the ERP report lacks weight information, Cointab seamlessly extracts the value directly from the GFS invoice’s weight column. This ensures uninterrupted processing even when there are minor data gaps in your ERP system.

Volumetric Weight Calculation: Optimizing for Accurate Billing

For irregularly shaped products, actual weight might not always reflect their shipping cost. Cointab offers the option to calculate volumetric weight using the industry-standard formula: Length x Width x Height. Crucially, dimensions must be entered in centimeters to ensure accurate calculations. This functionality helps optimize GFS billing by accounting for the product’s space occupied during transportation, preventing potential overcharges.

Divisor Application: Aligning with Carrier Specifications

When using volumetric weight calculations, Cointab considers the divisor specified by GFS in the divisor card. The divisor is a factor used to convert volumetric weight into a billable weight, ensuring consistency with GFS’s pricing structure. If no divisor is provided, Cointab applies a default value of 5,000, adhering to industry standards.

Data Consolidation: Streamlining Workflows and Ensuring Consistency

Once weight and dimension calculations are complete, Cointab automatically populates the data in both the GFS invoice and your ERP report. This eliminates manual data entry, minimizes errors, and guarantees consistency across your systems.

Rounding for Slab Determination: Optimizing Cost Calculations

Finally, Cointab rounds off the final weight to determine the applicable weight slab used by GFS for cost calculation. This ensures you’re billed based on the correct weight tier, preventing potential overpayments due to rounding errors.

Beyond Automation: The Benefits of Cointab’s W&D Management

Cointab’s automated W&D management goes beyond simply streamlining GFS invoice verification.

Here’s how it benefits your business:

Reduced Billing Discrepancies:

Eliminate errors and discrepancies in weight and dimension data, leading to accurate GFS billing.

Cost Optimization:

Ensure you’re billed correctly by GFS, preventing both overpayments and underpayments.

Improved Efficiency:

Automate W&D handling, freeing your team to focus on core business activities.

Enhanced Data Integrity:

Maintain consistent W&D information across your ERP and GFS systems.

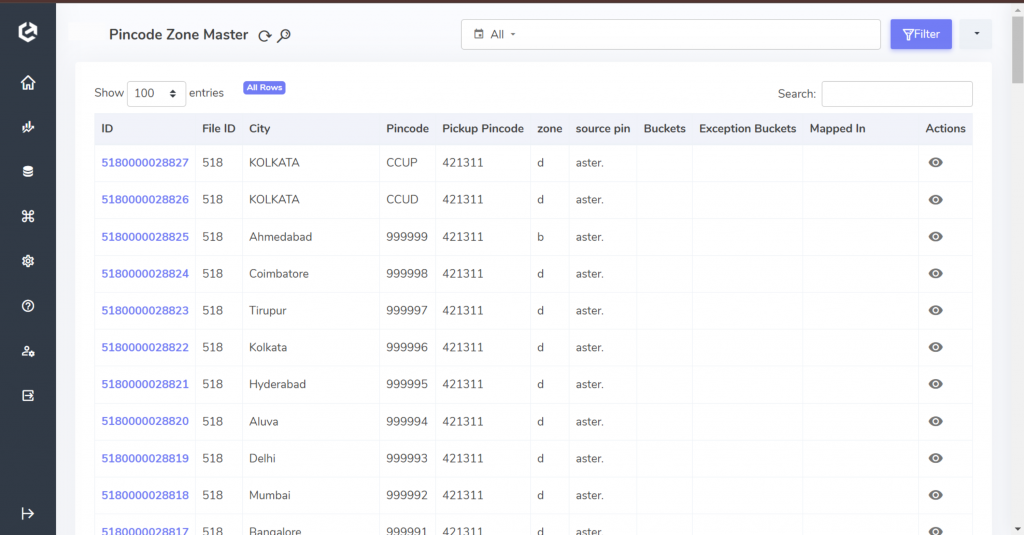

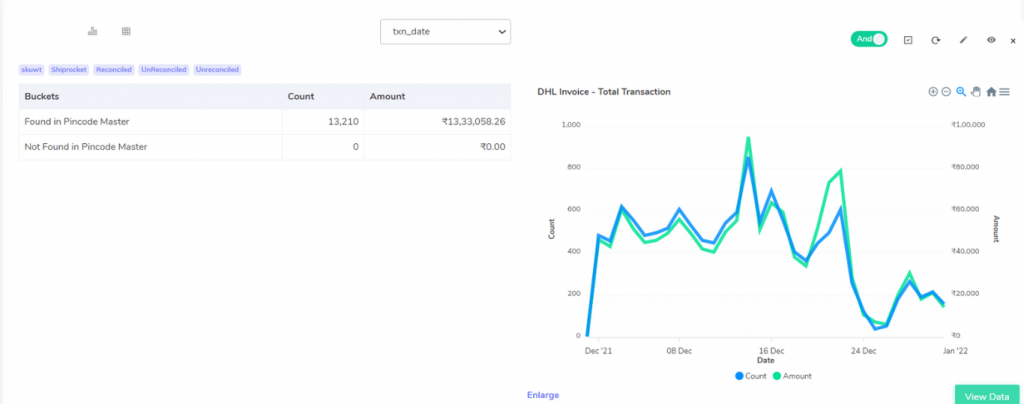

Pincode Master:

Effortless Zone Determination for Accurate GFS Billing with Cointab

Accurate zone identification is crucial for GFS invoice verification and cost calculation. Cointab automates zone mapping, ensuring you’re billed correctly based on the origin and destination of your shipments.

Leveraging Pincode Master Data

Cointab utilizes the “Pincode Master” report, a comprehensive database that links origin and destination postcodes (postal codes) to specific zones. This eliminates the need for manual zone lookup, streamlining the verification process.

Precise Zone Assignment

For each invoice, Cointab extracts the origin and delivery location details. By referencing these locations within the Pincode Master, the software automatically assigns the appropriate zone. This ensures consistent and accurate zone application across all your GFS invoices.

Enhanced Efficiency and Cost Control

Cointab’s automated zone mapping eliminates manual errors and streamlines invoice verification.

This translates to:

Reduced Processing Time:

Faster invoice processing frees your team to focus on other critical tasks.

Improved Accuracy:

Eliminate the risk of human error in zone identification, leading to accurate GFS billing.

Cost Optimization:

Ensure you’re billed based on the correct zone, preventing potential overcharges.

Rate Card:

Eliminate Billing Errors with Cointab’s Automated Rate Verification for GFS Invoices

In the world of e-commerce shipping, accurate rate application is vital for cost control. Cointab simplifies GFS invoice verification by automating rate verification, ensuring you’re billed correctly based on your shipments’ weight, zone, and applicable rates.

Leveraging the GFS Rate Card

Cointab integrates seamlessly with GFS’s rate card, a comprehensive reference guide outlining shipping charges based on zone and weight. This eliminates the need for manual rate lookups and ensures consistent application of GFS’s pricing structure.

Matching Invoice Data with Rate Card

Cointab meticulously compares key data points on your GFS invoice with the corresponding information in the rate card.

Navigating Financial Precision: Cointab Reconciliation Software Metrics

2M

1.6B

$37B

Here’s what’s verified:

Courier:

Cointab confirms the chosen courier matches the service specified on the invoice.

Zone:

The software ensures the invoice zone aligns with the origin and destination postcodes as designated by the Pincode Master report (explained earlier).

Weight:

Cointab verifies the weight on the invoice falls within the weight range applicable to the chosen rate. This prevents potential overcharges that might occur if the weight exceeds the acceptable limit.

Divisor (Optional):

For volumetric weight calculations, Cointab checks if a divisor is applied on the invoice and compares it to the value specified in the GFS divisor card. If no divisor is present on the invoice, Cointab applies a default value to ensure accurate calculations.

Beyond Rate Verification: Optimizing Your GFS Strategy

Cointab’s automated rate verification goes beyond simply identifying errors.

It empowers you to:

Reduce Billing Discrepancies:

Eliminate inconsistencies between invoice charges and applicable rates.

Gain Cost Visibility:

Identify potential cost-saving opportunities by analyzing zone distribution and weight thresholds within your shipping data.

Ensure Service Level Adherence:

Verify that the chosen rates align with the expected delivery timeframe.

Charges:

Achieve Accurate GFS Billing with Cointab’s Automated Charge Verification

Cointab simplifies GFS invoice verification by automating the calculation of forwarding charges, return-to-origin (RTO) charges, and cash-on-delivery (COD) charges. This ensures you’re billed correctly based on your shipments’ weight, zone, and applicable rates.

Optimizing Forwarding Charges

Cointab analyzes the final weight slab after calculation. Here’s how forwarding charges are determined:

Within Weight Limit (“fwd_wt_fixed”) – If the final weight falls within or below the “fwd_wt_fixed” limit specified in the GFS rate card, the forwarding charge equals the “fwd_fixed” amount designated for the corresponding zone.

Exceeding Weight Limit – If the final weight surpasses the “fwd_wt_fixed” limit, the shipment incurs an additional charge for the excess weight. This charge is calculated using the “fwd_add” rate per zone, as defined in the rate card.

Formula for Expected Forwarding Charge:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

Calculating Expected RTO Charges

Similar to forwarding charges, Cointab automates RTO charge calculations:

Within Weight Limit (“rto_wt_fixed”) – If the final weight is less than or equal to the “rto_wt_fixed” limit in the rate card, the RTO charge equals the “rto_fixed” amount for the corresponding zone.

Exceeding Weight Limit – If the final weight surpasses the “rto_wt_fixed” limit, an additional charge applies based on the excess weight. This charge is calculated using the “rto_add” rate per zone, as defined in the rate card.

Formula for Expected RTO Charge:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Determining Expected COD Charge

Cointab calculates the expected COD charge by comparing two factors:

COD Fixed Charge (“cod_fixed”) – A flat fee specified in the rate card.

COD Rate (%) – A percentage of the order value defined in the rate card.

The higher value between “cod_fixed” and the calculated percentage of the order value using “cod_rate” is considered the expected COD charge.

Calculating Expected Final Amount

Cointab takes the verified forwarding charge, RTO charge, COD charge, and GST percentage to calculate the expected final amount on your GFS invoice.

Benefits of Automated Charge Verification with Cointab

Cointab’s automated charge verification system offers several advantages:

Reduced Billing Errors:

Eliminate discrepancies between invoice charges and calculated forwarding, RTO, and COD charges.

Improved Efficiency: Streamline invoice verification, freeing your team to focus on core business activities.

Cost Control:

Gain greater transparency into your GFS billing, allowing you to identify potential cost-saving opportunities.

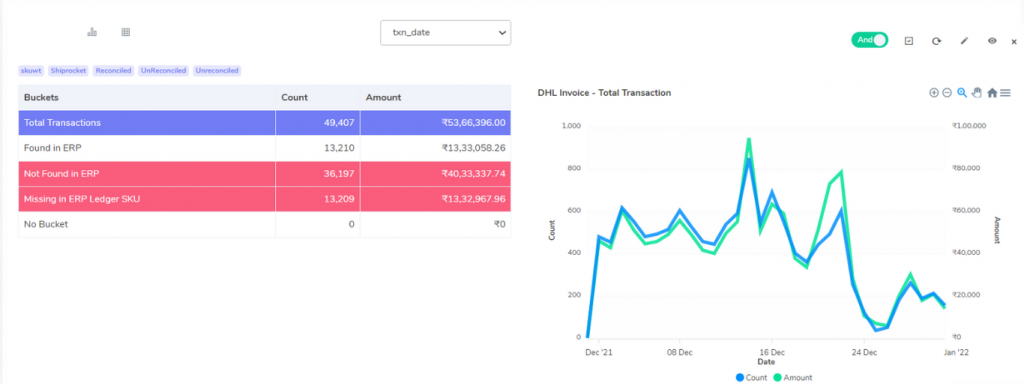

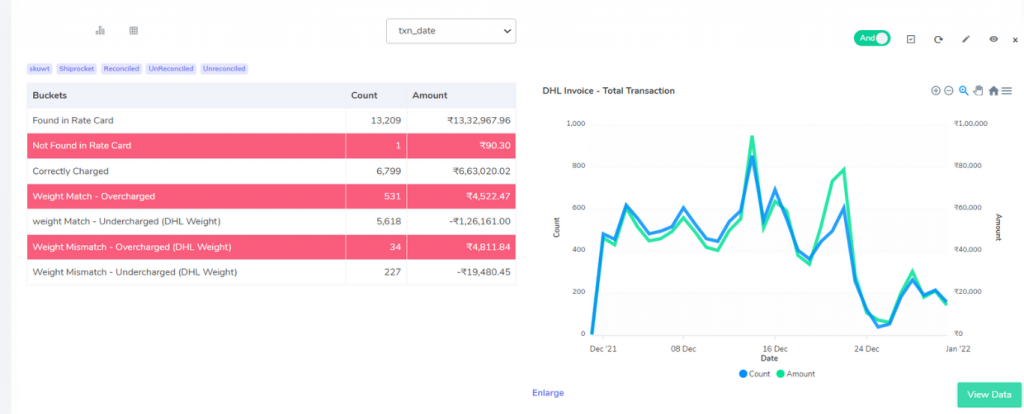

Result:

Eliminate Discrepancies with Cointab’s Comprehensive GFS Invoice Verification

Achieving accurate GFS billing requires meticulous verification. Cointab goes beyond weight and zone calculations, offering a multi-point verification system for complete peace of mind.

Cross-Referencing for Maximum Accuracy

Cointab leverages your existing data sources to verify the information on your GFS invoice.

Here’s how it works:

ERP Report Comparison:

Cointab matches product details, weight, and other relevant information on the GFS invoice with your internal ERP report, ensuring consistency across your systems.

Pincode Master Integration:

Cointab references the Pincode Master report to confirm zone allocation based on origin and destination postcodes, preventing zone-related billing errors.

Rate Card Verification:

Cointab compares the charges on the GFS invoice with the corresponding rates in the GFS rate card, ensuring you’re billed based on the correct weight, zone, and applicable rates.

Benefits of Cointab’s Multi-Point Verification

This comprehensive approach offers several advantages:

Reduced Errors:

Eliminate discrepancies between invoice data and your internal systems.

Improved Accuracy:

Ensure you’re billed correctly based on the agreed-upon rates.

Cost Control:

Identify potential overcharges and prevent unnecessary costs.

ERP:

Verify Order Details and Weight with Enterprise Resource Planning (ERP) System

Matching Orders in ERP Confirm Delivery and Weight:

When an order from a GFS invoice matches within the ERP system, it signifies successful delivery. Additionally, the ERP system can provide the product weight for further verification.

Missing ERP Orders Require Further Investigation: If GFS invoice orders are absent from the ERP system, order fulfillment cannot be confirmed.

Further investigation is necessary to ensure order accuracy.

Benefits:

Improved Transparency:

Matching orders in the ERP system enhances transparency by confirming delivery and weight details.

Enhanced Order Verification:

ERP data allows for efficient verification of order fulfillment and product weight.

Revolutionize Your Financial Accuracy with Cointab's Cutting-Edge Reconciliation Software!

Request a Demo!

Revolutionize Your Financial Accuracy with Cointab's Reconciliation Software!

Request a Demo!

Pincode Master:

Found in Pincode Master:

Great news! When the pincode information on the GFS invoice matches the pincode master data and the rate card, it signifies a valid delivery zone. This allows for further verification of the order details.

Not Found in Pincode Master:

If the pincode information on the GFS invoice is missing from the pincode master data or the rate card, it raises a red flag. This inconsistency prevents further verification of the order’s delivery zone and potentially the associated shipping charges.

Fee Verification using ERP- GFS:

Deep Dive into GFS Invoice Verification with ERP and Rate Card Data

Building upon the previous rewrite, let’s delve deeper into GFS invoice verification using ERP and rate card data:

Automated Verification Process:

Streamlined Workflow:

Our software automates the invoice verification process, saving businesses valuable time and resources.

Data Integration:

Seamless integration with your ERP system allows for effortless data retrieval for order details.

Rate Card Matching:

The software automatically compares invoice charges with pre-defined rates in your rate card, ensuring adherence to agreed-upon pricing.

Detailed Discrepancy Analysis:

Zone Discrepancy:

Potential Impact:

Zone inconsistencies can lead to significant cost discrepancies, especially for long-distance deliveries.

Actionable Insights:

The software highlights zone mismatches, allowing you to investigate potential errors in routing or zone calculations.

Weight Discrepancy:

Importance of Accuracy:

Accurate weight data is crucial for determining appropriate shipping costs.

Action Steps:

Weight discrepancies might indicate errors in package measurement or invoicing. Our software flags these discrepancies for further review and potential adjustments.

Beyond Basic Verification:

Advanced Anomaly Detection: The software goes beyond basic verification by identifying unusual patterns in invoice data. This can uncover potential fraudulent activity or systematic errors in GFS invoicing.

Customizable Alerts:

Set up customized alerts to receive notifications only for specific discrepancy types that require your immediate attention.

Benefits for Businesses:

Cost Savings:

Identify and rectify overcharges, leading to significant cost savings on shipping expenses.

Improved Cash Flow:

Catch undercharges to ensure you receive the full amount owed for shipping services.

Enhanced Vendor Relationships:

Proactive invoice verification fosters trust and transparency with your shipping provider.

Data-Driven Decision Making:

Gain valuable insights into invoice accuracy for better cost management strategies.

Conquer GFS Invoice Reconciliation with Cointab’s Automated Powerhouse

Don't waste time on manual financial reconciliation. Let our Reconciliation software do the work for you.

Tired of tedious, manual GFS invoice reconciliation?

Cointab’s innovative software automates the entire process, freeing you from time-consuming calculations and error-prone spreadsheets.

Experience Unmatched Efficiency:

Effortless Data Upload:

Upload data in your preferred format – API, SFTP, or even email. No complex configurations needed.

Customizable Workflows:

Craft a reconciliation process that perfectly suits your business needs.

Automated Fee Verification:

Eliminate manual calculations and ensure accurate invoice pricing with our built-in rate card comparison.

Sharp Eye for Discrepancies:

Red Flag Alerts:

Cointab highlights potential overcharges and undercharges in clear red flags, simplifying error identification.

Actionable Insights:

Gain valuable data on invoice accuracy, empowering you to make informed decisions and potentially file claims with GFS.

Beyond Basic Reconciliation:

Advanced Anomaly Detection:

Our software goes beyond basic verification, flagging unusual patterns that might indicate fraudulent activity or systematic errors.

Data-Driven Optimization:

Leverage the insights from Cointab to identify areas for cost savings and optimize your GFS invoicing strategy.

Stop Reconciling Manually, Start Thriving:

It’s time to say goodbye to manual reconciliation and hello to automated efficiency. Cointab empowers you to focus on what truly matters – growing your business.