Opayo, a leading payments provider in the UK, offers businesses the tools they need to expand their online presence and securely accept payments from customers with speed and efficiency. Formerly known as Sage Pay and now under the ownership of Elavon, Opayo provides a comprehensive payments processing service tailored to meet the diverse needs of modern businesses.

Opayo’s versatile array of standalone and integrated terminals enables businesses to facilitate Chip & PIN card payments both in-store and on-site, ensuring seamless transactions across various platforms.

While Opayo’s services are invaluable, it’s important to consider the associated fees and taxes involved. Due to the frequent deduction of these charges from payments, businesses may face the challenge of reconciling multiple transactions manually, which can be time-consuming and prone to errors.

To streamline the reconciliation process and mitigate the risk of errors, businesses can leverage automated software solutions such as Cointab reconciliation software. This innovative tool efficiently reconciles transactions, providing automated reports to identify any discrepancies in charges and taxes.

Opayo offers businesses essential reports to aid in the verification of payment gateway charges, ensuring transparency and accuracy in financial transactions.

These reports serve as valuable tools for businesses to analyze their payment activities and understand the breakdown of fees associated with using Opayo’s services.

Opayo Payment Report:

This report provides comprehensive insights into total transactions processed through the Opayo payment gateway. It offers detailed information on the volume of transactions, including the total number and value of transactions conducted within a specified period. Additionally, the report categorizes transactions based on their respective modes, such as online payments, in-store transactions, or other channels supported by Opayo. By examining this data, businesses can gain a clear understanding of their transaction volume and distribution across different payment channels, enabling them to make informed decisions regarding their payment strategies.

Opayo Rate Card:

The Opayo Rate card is a detailed document that outlines the various payment modes supported by Opayo, along with the associated fees and percentages. This includes fees charged for different types of transactions, such as card-present transactions, card-not-present transactions, international payments, and other specialized services offered by Opayo. Additionally, the rate card provides clarity on the percentage-based fees applied to transactions, ensuring businesses are fully aware of the cost implications associated with using Opayo’s payment gateway.

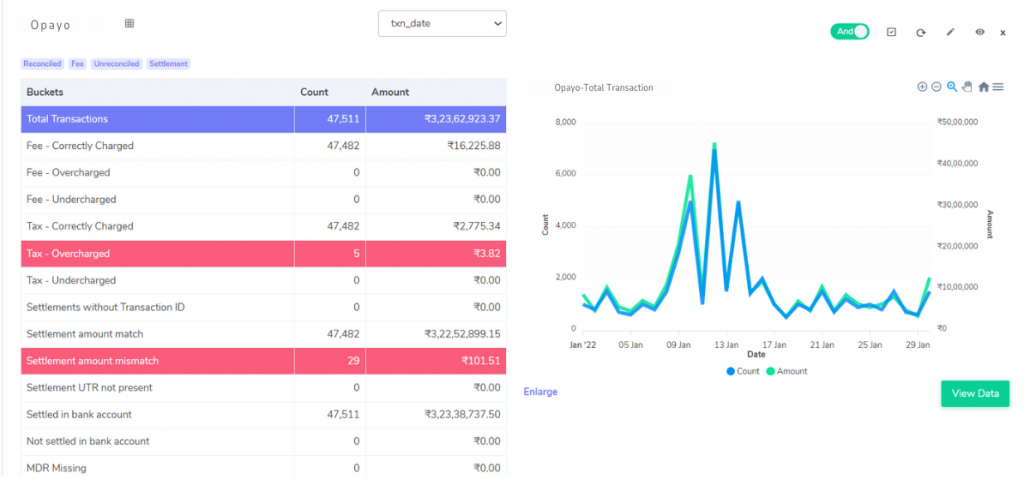

RESULT

Fee correctly charged:

Opayo ensures that the fees billed align precisely with the rates outlined in the Rate Card, offering transparency and accuracy in financial transactions.

Fee overcharged:

Instances where Opayo’s fees surpass the calculated amounts specified in the Rate Card, potentially leading to financial discrepancies for businesses.

Fee undercharged:

In situations where Opayo’s fees fall below the calculated amounts stated in the Rate Card, potentially resulting in unexpected financial implications for businesses.

Tax-correctly charged:

Opayo accurately records taxes in the Payment Report, adhering to GST guidelines and ensuring compliance with regulatory standards.

Tax- overcharged:

Occurrences where the taxes recorded in the Payment Report exceed the calculated amounts based on GST guidelines, necessitating further scrutiny to rectify discrepancies.

Tax- undercharged:

Instances where the taxes recorded in the Payment Report are lower than the calculated amounts based on GST guidelines, highlighting potential compliance issues that require attention.

Settlement UTR not present:

Identified in the Settlement report, the absence of a Unique Transaction Reference (UTR) warrants investigation to ensure completeness and accuracy in financial records.

Settlement amount match:

Following deductions for fees and taxes, the settlement amount reported aligns precisely with the calculated total, demonstrating consistency and reliability in financial reporting.

Settlement amount mismatch:

Inconsistencies arise when the settlement amount reported fails to correspond with the calculated total after deductions, prompting further investigation to reconcile discrepancies.

Settled in bank account:

It is imperative that the UTR referenced in the settlement report also appears in the corresponding Bank Statement, ensuring seamless tracking and reconciliation of financial transactions.

Not settled in bank account:

Instances where a transaction’s UTR is present in the settlement report but remains absent from the bank statement, requiring thorough investigation to address potential discrepancies or processing errors.

Leveraging automated software such as Cointab Reconciliation Software streamlines the reconciliation process for fees and taxes associated with transactions through Opayo. By automating verification procedures, businesses can promptly identify instances of overcharging or undercharging by Opayo, facilitating efficient resolution and potential claims. Automating Opayo payment charges verification through software optimizes operational efficiency, conserving valuable time and resources for businesses.

In conclusion, embracing automation in payment charges verification not only enhances accuracy and efficiency but also empowers businesses to uphold financial integrity and compliance standards effectively.