Streamline Your Payoneer Payment Tracking

Payoneer, a leading payment gateway provider, offers efficient international and local payment solutions for businesses, freelancers, marketplaces, and SMBs. However, managing a high volume of transactions can be complex, raising concerns about accuracy and potential overcharges.

Ensuring Accurate Payoneer Charges

This guide outlines the reports you need to verify your Payoneer fees:

Payoneer Payment Report:

This report details your transaction history, including payment methods and total amounts.

Payoneer Rate Card:

The rate card clearly outlines the fees associated with different payment methods, including percentage charges and fixed fees.

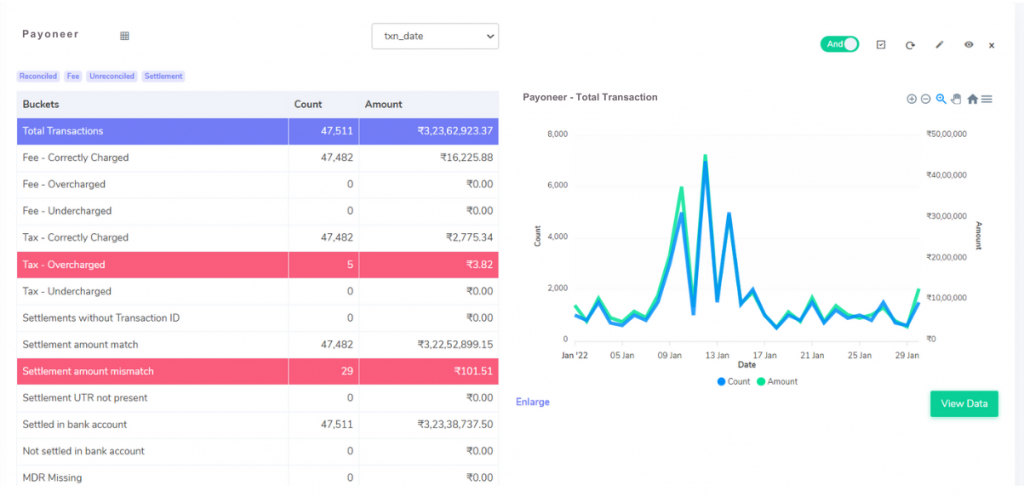

Result

Managing your finances efficiently requires close scrutiny of transaction details. This guide empowers you to confidently verify fees, taxes, and settlement amounts associated with your Payoneer transactions.

Matching Charges with Transparency:

Fee Verification:

Download the latest Payoneer rate card, readily available on their website. This document outlines the specific fees applicable to various transaction types (e.g., receiving payments, sending withdrawals). Carefully compare the fees deducted from your transactions with the corresponding rates on the card. Any discrepancies warrant further investigation.

Tax Accuracy:

Understanding your region’s tax regulations (e.g., GST) is crucial. Calculate the expected tax amount based on the transaction details and compare it to the tax reflected in your Payoneer payment report. A mismatch indicates a potential issue that requires clarification from Payoneer.

Identifying Discrepancies and

Taking Action:

Fee Overcharges:

If fees exceed those outlined in the rate card, don’t hesitate to contact Payoneer’s customer support. Explain the discrepancy and provide relevant details (transaction IDs, timestamps) to facilitate a swift resolution.

Tax Overcharges:

Similar to fee discrepancies, if the tax amount appears higher than your calculated GST or other applicable taxes, reach out to Payoneer’s support. Having all transaction information readily available will expedite the process of rectifying any errors.

Settlement Amount Mismatch:

Calculate the expected settlement amount by subtracting the total fees and taxes from the total transaction amount (Settlement Amount = Total Amount – Fees – Tax). If this calculated value doesn’t match the settlement amount displayed in your Payoneer report, investigate further. Contact Payoneer’s support and provide the calculated and reported settlement amounts for a thorough examination.

Ensuring Settlements Reflect in Your Bank Statements:

Reconciliation Confirmation:

Once a transaction settles in Payoneer, it should also appear in your connected bank account statement. Regularly reconcile your Payoneer settlement report with your bank statements to ensure all transactions are present and match the amounts.

Investigating Missing Settlements:

If a transaction appears settled in your Payoneer report but is missing from your bank statement, don’t panic. Factors like processing timelines or bank holidays can sometimes cause a slight delay. However, if the discrepancy persists after a reasonable timeframe, contact Payoneer’s support to ensure the transaction was successfully processed.

Additional Considerations for Peace of Mind:

Settlement UTR:

The presence of a Settlement UTR (Unique Transaction Reference) in your payment report signifies a successfully completed transaction. If a UTR is missing, contact Payoneer’s support to verify the transaction’s status.

By implementing these verification practices, you gain peace of mind knowing your Payoneer transactions are accurate and transparent. Regularly reviewing fees, taxes, and settlements empowers you to identify and address any discrepancies promptly, ensuring optimal financial control. Remember, a well-maintained financial system is the backbone of any successful business. By taking charge of your Payoneer transaction verification, you can free yourself from tedious manual processes and focus your valuable resources on driving business growth.

Step into the future of reconciliation. Fill out the form to request your demo now!