Correos is a state-owned company in Spain that is responsible for providing postal service, mail services, logistics services and many more. It is also responsible for providing communication and documentation management services for other companies.

Ensuring accurate financial transactions and fee calculations is crucial for every shipping company. However, managing a high volume of deliveries on a daily basis can lead to the charges being overcharged or undercharged. To easily verify these transactions and to resolve any discrepancies use Cointab’s automated reconciliation software.

Our software seamlessly compares and matches data from all your crucial platforms, ensuring that your financial information is always precise and error-free. With our automated process, we avoid manual errors and incase of any discrepancies you can raise a dispute with Correos.

Required Reports for Correos Invoice Verification Process

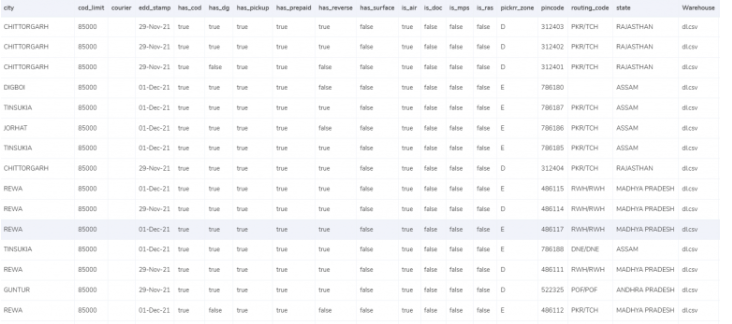

Pincode Zone Report

This report consists of the zone and the pincode of each delivery so that it gets easier to locate the location and track it with ease.

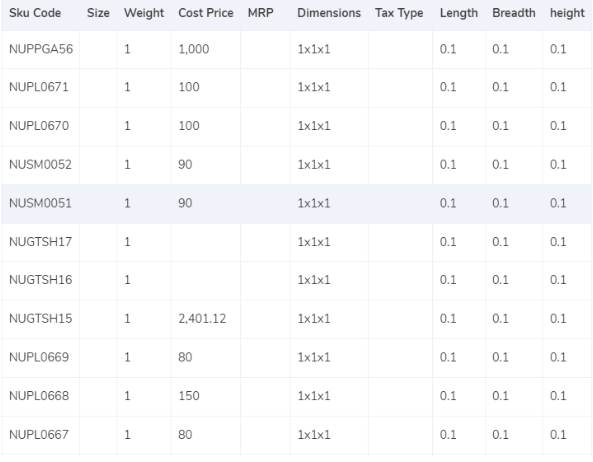

SKU report

Each product has a SKU number allotted to them that shows the weight and the dimension of the product.

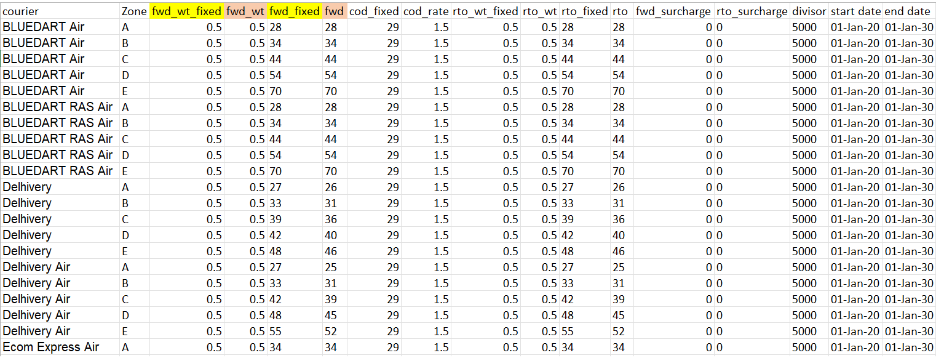

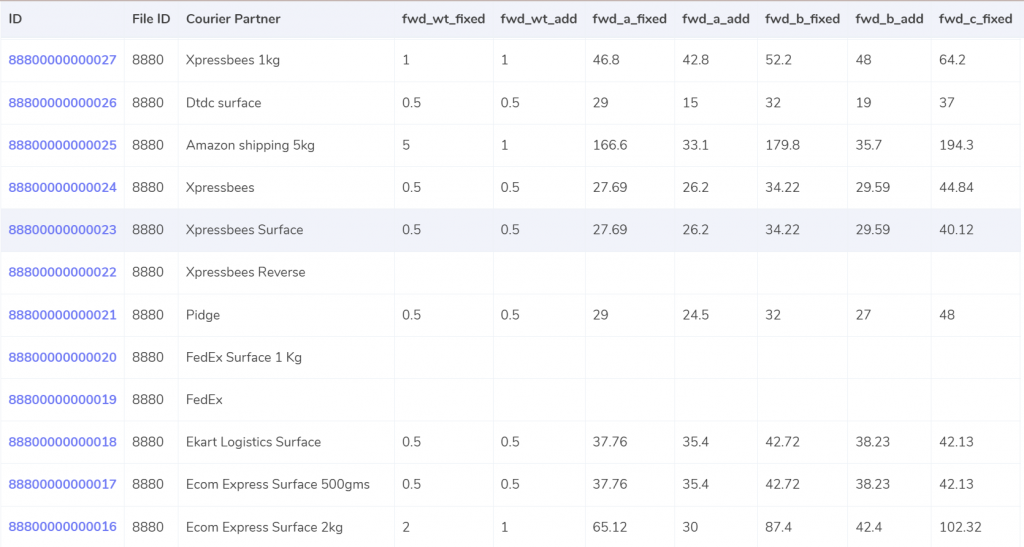

Rate card

Rate card consists of fees charged on each order on the basis of weight and zone.

Correos Invoice

Important reports like order ID, Billing zone, ERP, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged is provided by Correos in its invoice.

Invoice Verification

Our software checks if the weight, fees and zone given along with the other calculations are accurate or not. The calculations depend upon the zone, location of the delivery, weight of the product and rate percentage. The rate card is used to check if the rate applied for the particular zone and weight is right.

Let’s take a deeper dive into these aspects-

SKU report

Ensuring accurate financial transactions and fee calculations is crucial for every shipping company. However, managing a high volume of deliveries on a daily basis can lead to the charges being overcharged or undercharged. To easily verify these transactions and to resolve any discrepancies use Cointab’s automated reconciliation software.

Our software seamlessly compares and matches data from all your crucial platforms, ensuring that your financial information is always precise and error-free. With our automated process, we avoid manual errors and incase of any discrepancies you can raise a dispute with Correos.

Required Reports for Correos Invoice Verification Process

Pincode Zone Report

This report consists of the zone and the pincode of each delivery so that it gets easier to locate the location and track it with ease.

SKU report

Each product has a SKU number allotted to them that shows the weight and the dimension of the product.

Rate card

Rate card consists of fees charged on each order on the basis of weight and zone.

Correos Invoice

Important reports like order ID, Billing zone, ERP, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged is provided by Correos in its invoice.

Invoice Verification

Our software checks if the weight, fees and zone given along with the other calculations are accurate or not. The calculations depend upon the zone, location of the delivery, weight of the product and rate percentage. The rate card is used to check if the rate applied for the particular zone and weight is right.

Let’s take a deeper dive into these aspects-

SKU report

- The software takes the weight given in the ERP report that gives us the SKU number from where we can derive the weight and dimensions of the product.

- In the invoice, the weight given under the expected weight column can also be taken into consideration if the dimensions of the gross weight is not given in the ERP report.

- If the dimensions of the product are given then the volumetric weight is calculated with the help of this formula “Length x Width x Height”. It is important for the dimensions of the volumetric weight to be in centimeters in order for the calculation to work. The calculated value will be divided by the divisor given in the divisor card and if the divisor is not present in the card then it is to be divided by 5000.

- Once all these calculations are done, the value is moved to the ERP Report and the Correos invoice.

- Lastly, we get the final slab by rounding off the final weight.

- The zone denotes the location where the delivery is to be done. The billing pin code is used to get the zone of the product and then it is put under the expected zone in the invoice to get the correct zone.

- Each zone is categorized in groups like locally, regionally, nationally etc and further these groups are recognised with their respective indicators like a,b,c etc.

- In the rate card, the charges are given according to the weight of the product and the zone of the delivery. The charges can increase or differ if you add some extra weight to the existing weight. This applies to both the deliveries, forward charge and RTO charge.

- The columns “courier”, “zone”, “fwd_wt_fixed” (the additional weight on which the fixed rate increases), and the “divisor” are checked with respective columns present in the Correos invoice to verify if the right items are put in the invoice.

- The rates given in the rate card are applicable only for a particular period of time and hence it is necessary to check if the delivery date falls under those given dates.

Expected forward charge

If the final slab is equal or lower to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_a_add

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_wt_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_wt_add” according to the zone. The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

The “cod_fixed” or “cod _rate” % of “Order Value” is used as the expected COD charge, whichever one is greater.

Expected final amount

The final amount is calculated by adding the Forward charge , RTO charge, COD charge and the GST%.

RESULT

After we get the expected amount based on the weight and zone of the product, Cointabs software compares the ERP reports, Pincode reports and rate cards with the invoice values provided by Correos.

ERP

If the final slab is equal or lower to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_a_add

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_wt_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_wt_add” according to the zone. The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

The “cod_fixed” or “cod _rate” % of “Order Value” is used as the expected COD charge, whichever one is greater.

Expected final amount

The final amount is calculated by adding the Forward charge , RTO charge, COD charge and the GST%.

RESULT

After we get the expected amount based on the weight and zone of the product, Cointabs software compares the ERP reports, Pincode reports and rate cards with the invoice values provided by Correos.

ERP

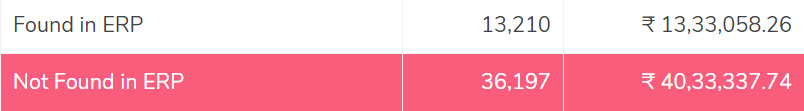

Found in ERP reports

In this case, the report shows that the order entries that are present in the Correos invoice are also present in the ERP reports. The number of products delivered for each order is present in the ERP report which helps us denote the weight of the product. Since the entries are present in both these records hence it can get verified and processed further.

Not Found in the ERP report

These reports denote that the order entries present in the Correos invoice are not present in the ERP report. The entries help in calculating the weight of the product and hence it is important, in this case the records can not be verified.

Pincode Master

In this case, the report shows that the order entries that are present in the Correos invoice are also present in the ERP reports. The number of products delivered for each order is present in the ERP report which helps us denote the weight of the product. Since the entries are present in both these records hence it can get verified and processed further.

Not Found in the ERP report

These reports denote that the order entries present in the Correos invoice are not present in the ERP report. The entries help in calculating the weight of the product and hence it is important, in this case the records can not be verified.

Pincode Master

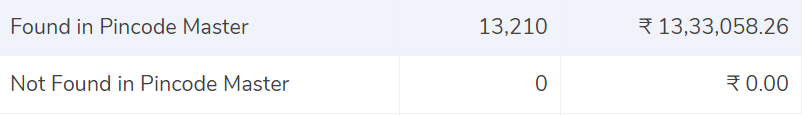

Found in Pincode master

The location of the deliveries are imposed zone-wise i.e, regionally, locally, rurally etc and hence it is essential for the zone and the pincode to be accurate and for it to be present in the ERP reports and the Pincode master. Since the zone is accurate and present in both these records, it can be verified.

Not found in Pincode master

This report denotes that the location and the zone of the delivery is present in the ERP report but not in the Pincode master and hence the records can not be verified and proceed further.

Rate card

The location of the deliveries are imposed zone-wise i.e, regionally, locally, rurally etc and hence it is essential for the zone and the pincode to be accurate and for it to be present in the ERP reports and the Pincode master. Since the zone is accurate and present in both these records, it can be verified.

Not found in Pincode master

This report denotes that the location and the zone of the delivery is present in the ERP report but not in the Pincode master and hence the records can not be verified and proceed further.

Rate card

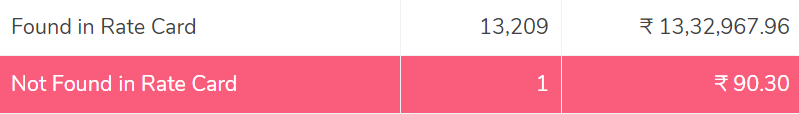

Found in rate card

In this case, the order entries present in the Correos invoice is also found in the Rate card and hence both these records can be verified and proceeded further.

Not found in rate card

These reports denote that the order entries present in the Correos invoice are not present in the Rate card and hence these records can not be verified.

Fee verification using ERP – Correos

In this case, the order entries present in the Correos invoice is also found in the Rate card and hence both these records can be verified and proceeded further.

Not found in rate card

These reports denote that the order entries present in the Correos invoice are not present in the Rate card and hence these records can not be verified.

Fee verification using ERP – Correos

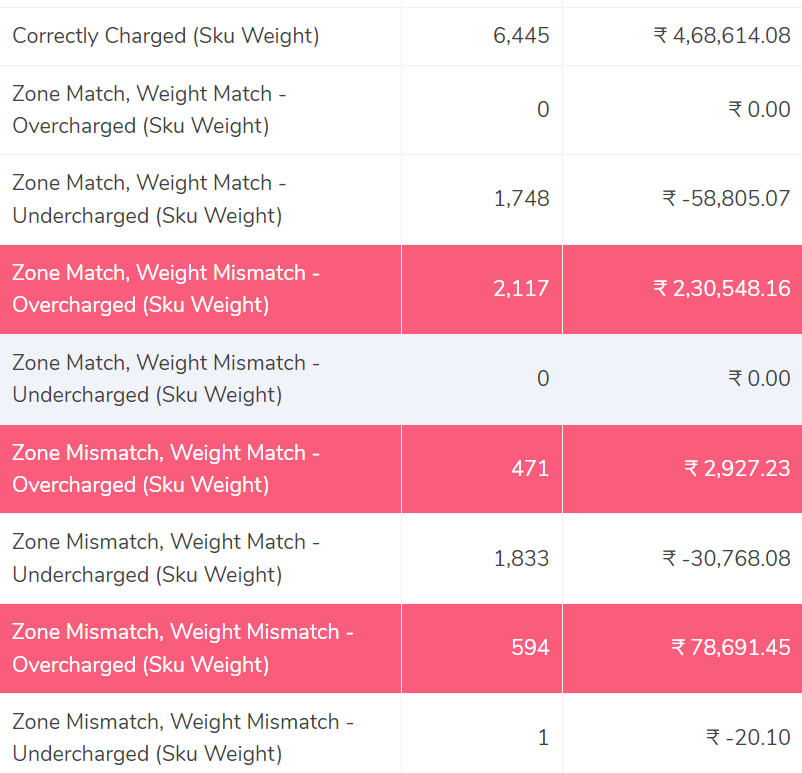

Correctly charged

The ERP report and the Correos invoice report is compared by the software and is shown that the order deliveries where the weight and the zone of the product are correct. The fee calculated with the help of the rate card matches the fee present in the Correos invoice.

Zone Match, Weight Match – Overcharged

Here, the software compares the ERP report and Correos invoice and shows that the zone and weight of the product both match but the fee charged is wrong and charged more, hence the fee is overcharged compared to the expected amount.

Zone Match, Weight Match – Undercharged

In this case, the software compares the ERP report and Correos invoice and shows that the zone and weight of the product both match but the fee charged is wrong and charged less, hence the fee is undercharged compared to the calculated amount.

Zone Mismatch, Weight Match – Overcharged

This denotes that the software compares the ERP report and Correos invoice and shows that the zone and the fee charged do not match whereas the weight matches, hence the fee is overcharged here compared to the expected amount.

Zone Mismatch, Weight Match – Undercharged

In this case, the software compares the ERP report and Correos invoice and shows that the zone and the fee charged do not match whereas the weight matches, hence the fee is undercharged here compared to the expected amount.

Zone Match, Weight Mismatch – Overcharged

The software here compares the ERP report and Correos invoice and shows that the weight of the product and the fee charged do not match whereas the zone of the product matches hence, the fee charged here is overcharged.

Zone Match, Weight Mismatch – Undercharged.

In this case, comparing the ERP report and the Correos report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is undercharged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP reports and Correos invoice that shows the weight of the product, the zone of the product and the fee charged, none of it matches. Hence the amount charged is more than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

The software here compares the ERP reports and Correos invoice that shows the weight of the product, the zone of the product and the fee charged, none of them match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

To sum it all up, Cointab helps you reconcile your data and check your fee verification process seamlessly with its automated software. With Cointabs software you can get rid of all the discrepancies and avoid the manual errors. Get a detailed overview of all your transactional activities and simplify your workload.

Click on the links below to view other Invoice Reconciliation Processes-

The ERP report and the Correos invoice report is compared by the software and is shown that the order deliveries where the weight and the zone of the product are correct. The fee calculated with the help of the rate card matches the fee present in the Correos invoice.

Zone Match, Weight Match – Overcharged

Here, the software compares the ERP report and Correos invoice and shows that the zone and weight of the product both match but the fee charged is wrong and charged more, hence the fee is overcharged compared to the expected amount.

Zone Match, Weight Match – Undercharged

In this case, the software compares the ERP report and Correos invoice and shows that the zone and weight of the product both match but the fee charged is wrong and charged less, hence the fee is undercharged compared to the calculated amount.

Zone Mismatch, Weight Match – Overcharged

This denotes that the software compares the ERP report and Correos invoice and shows that the zone and the fee charged do not match whereas the weight matches, hence the fee is overcharged here compared to the expected amount.

Zone Mismatch, Weight Match – Undercharged

In this case, the software compares the ERP report and Correos invoice and shows that the zone and the fee charged do not match whereas the weight matches, hence the fee is undercharged here compared to the expected amount.

Zone Match, Weight Mismatch – Overcharged

The software here compares the ERP report and Correos invoice and shows that the weight of the product and the fee charged do not match whereas the zone of the product matches hence, the fee charged here is overcharged.

Zone Match, Weight Mismatch – Undercharged.

In this case, comparing the ERP report and the Correos report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is undercharged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP reports and Correos invoice that shows the weight of the product, the zone of the product and the fee charged, none of it matches. Hence the amount charged is more than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

The software here compares the ERP reports and Correos invoice that shows the weight of the product, the zone of the product and the fee charged, none of them match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

To sum it all up, Cointab helps you reconcile your data and check your fee verification process seamlessly with its automated software. With Cointabs software you can get rid of all the discrepancies and avoid the manual errors. Get a detailed overview of all your transactional activities and simplify your workload.

Click on the links below to view other Invoice Reconciliation Processes-

Pingback: DPD Courier Charges Invoice Verification - Cointab