As a business, the biggest goal is to constantly grow. This helps earn better profits too. However, even if you are situated in a prime spot in a busy market or are well-known, your reach will be limited. This is where selling online helps. Where, either you can sell on your website, or marketplaces such as Flipkart, Amazon, Myntra, etc.

When a business sells online, it can increase the number of people it can reach, and become visible to customers in other cities of India as well. Also, shoppers from other cities who like the products will not have to wait to visit in person to be able to shop. They can simply go online, buy products and enjoy home delivery too. So, when you sell online, not only does it help get more customers, but it also increases your overall profits too.

Everything has its pros and cons and so does selling online. One such specific and hidden problem relates to verifying various types of fees charged by online marketplaces such as Flipkart. Consider a business that sells around 1,00,00 products on Flipkart in a month with an average selling price of Rs. 500 per order. Their monthly revenue will be Rs. 5Cr and if Flipkart takes 40% as part of various charges, the total Flipkart fee in a month will be Rs. 2Cr.

Now out of this if there is an error of even 5% in terms of the charge calculation, a business might end up paying Rs. 10L more every month. And as these charges are levied in a very complicated manner, it is extremely difficult to verify every charge for every single order. As for so many orders, there will be that many individual data entries to go through and confirm.

This is where Cointab’s Automated Reconciliation System comes into the picture where it can help verify all these charges automatically so that the business can focus on selling more and Cointab’s software takes care of all the heavy work of data loading, cleaning, and reconciling to check if all the fees charged by Flipkart is correct or not and in case they have overcharged on any order across any type of fee then highlight the same in time so that the Finance team of the business can easily raise a dispute with Flipkart and try to recover the overcharged amount with ease.

The Reconciliation of Flipkart Charge verification is done as follows:

This process would be based on Flipkart’s Settlement Order report where they charge the following types of fees:

Shipping Fee verification:

Calculation of shipping fee is done with weights reported by Flipkart and weight as per the SKU master (which means weight and item identification given by the client).

Flipkart considers the weight, whichever is higher between volumetric weight and Gross weight we call this weight the final weight.

The calculation is done by the system using both parameters which are the weight reported by Flipkart and the weight based on the Client SKU.

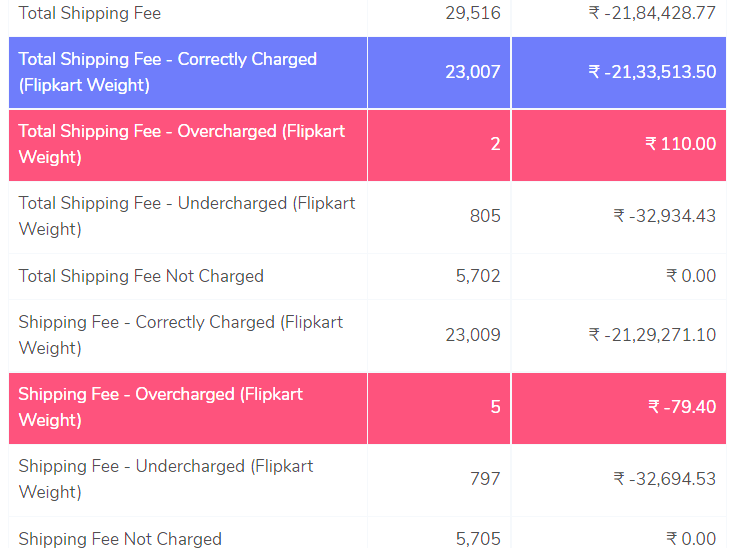

Based on Flipkart’s reported weight:

The calculation is done by using Flipkart’s reported weight and every order is allocated to a weight slab, based on this a rate card is made. Based on this rate card we calculate the shipping fee and subtract it from the Flipkart shipping fee. We then Calculate the results.

Based on Client SKU weight:

The calculation is done by using the client’s SKU weight, meaning the weight given by the client (gross weight and volumetric weight by using the length breadth, and height of the product). Every order is then allocated to a weight slab, based on this a rate card is made. Based on this rate card we calculate the shipping fee and subtract it from the Flipkart shipping fee. We then Calculate the results.

The Results are calculated as follows:

- If the Flipkart Shipping fee is equal to our calculated fee based on the rate card, then it’s the Correct Shipping fee charged.

- If Flipkart Shipping fee is higher than our calculated fee based on the rate card, then it is an Overcharged Shipping fee.

- If Flipkart Shipping fee is lower than our calculated fee based on the rate card, then it is an Under charged Shipping fee.

- If the shipping fee is not charged by the company, we will highlight these orders as Shipping Fee Not Charged.

The Result shown is as below:

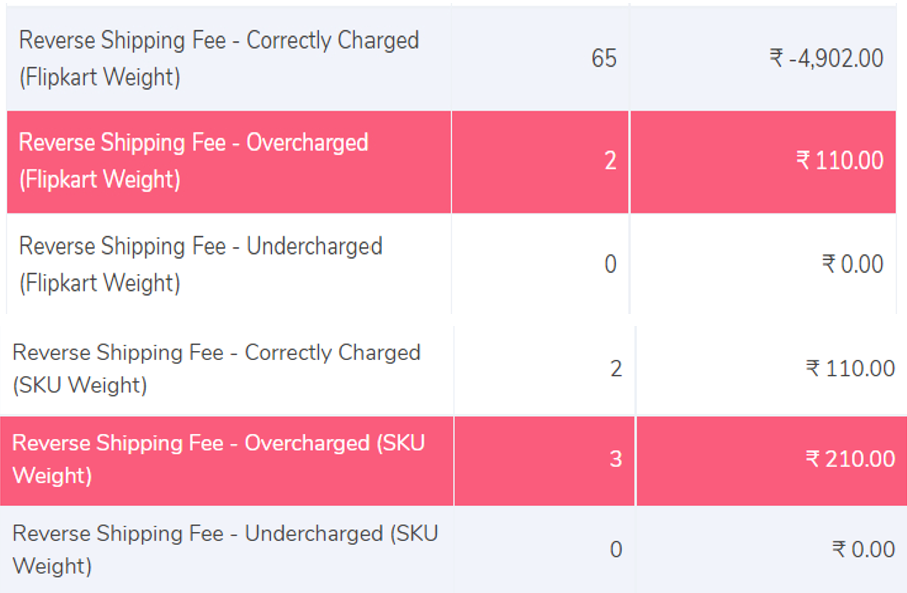

Reverse Shipping Fee

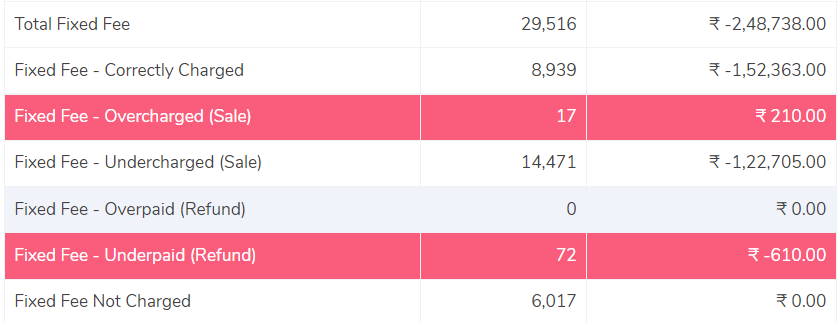

Fixed Fee

To calculate the Fixed Fee, we have to use the item price of the order. The fixed Fee gets reimbursed to the merchant if the order is refunded by Flipkart to the customer. If Flipkart is running any promotional offer for sellers, they may not charge this Fee.

A rate card will be set up for this and a Fixed fee will be calculated for the said order. Once the Fixed fee is Calculated, we will subtract it from the fixed fee reported by Flipkart to get the difference.

Similarly, we will create the result page for the fixed Fee as we have created for the Shipping fee. We will also check if the Fixed Fee is reimbursed by the company.

For Sale Orders

- If Flipkart charged fee is equal to our calculated fee based on the rate card, then it is the Correct Charged order.

- If Flipkart charged fee is higher than our calculated fee based on the rate card then it is Over Charged order.

- If Flipkart charged fee is lower than our calculated fee based on the rate card then it is Under Charged order.

- If the Fixed Fee is not charged by the company, we will highlight these orders as Fixed Fee Not Charged.

For Return Orders

- If the Fixed Fee is not charged by the company, we will highlight these orders as Fixed Fee Not Charged

- If Flipkart charged fee is equal to our calculated reimbursement fee based on the rate card, then it is Correctly paid.

- If Flipkart charged fee is higher than our calculated reimbursement fee based on the rate card then it is Overpaid.

- If Flipkart charged fee is lower than our calculated fee based on the rate card then it is Underpaid.

The result is shown below.

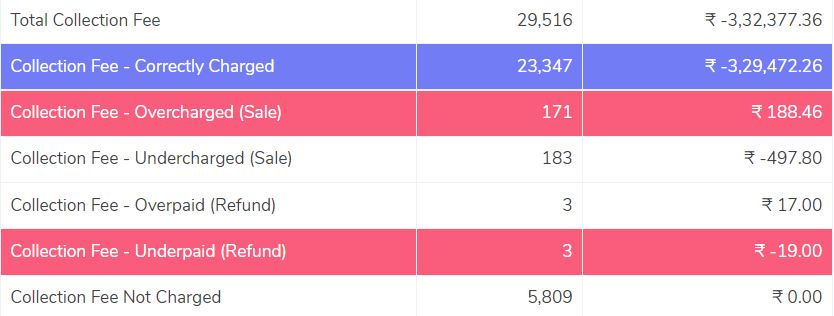

Collection Fee

This Fee is Charged by Flipkart based on the item price. This Fee is reimbursed by Flipkart in case the order is Refunded by Flipkart to the Customer. If Flipkart is running any promotional offer for sellers, they may not charge this Fee.

This Fee is varied by transaction,

- For Prepaid Orders Flipkart charges 2% of the Sale Amount.

- For Post-paid orders for item prices less than 750 they charged a flat 15 Rs.

- For item prices above 750, they charge 2 % of the Sale Amount.

Based on this we create the rate card Calculate the Collection fee and then Subtract it from Flipkart Collection Fee.

The result is shown below:

Commission Fee

To calculate the Commission Fee, we use the fee charged by Flipkart based on the product category and the item price, they charge some percent on the Sale amount.

Settlement Report contains what percentage they are charging for the said item. This Fee gets reimbursed by Flipkart if the order is Refunded by Flipkart to the Customer. If Flipkart is running any promotional offer for sellers, they may not charge this Fee.

To calculate this fee, we simply multiply the Sale amount by the commission rate given by the company.

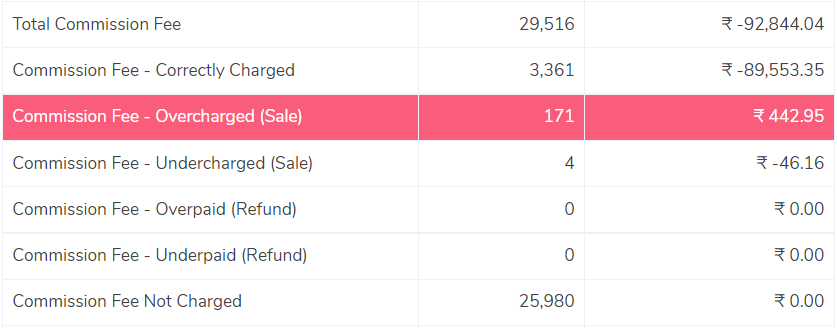

Similarly, the result shown will be as below:

Flipkart also charges other Fees like installation, pick and pack, tech visit, etc. We will simply put all these fees in a single Result line called ‘Other Misc. Fees’.

To see each fee verification process Click Here