Numerous businesses and companies leverage Flipkart’s extensive reach as one of the premier e-commerce platforms today, facilitating daily product sales. While tapping into Flipkart’s marketplace enhances a business’s exposure across a wide demographic, challenges persist, particularly in ensuring timely and accurate payments.

The sheer volume of transactions on Flipkart daily presents a significant hurdle for businesses to manage. Handling such vast data necessitates meticulous analysis, often consuming substantial time and resources for reconciliation. Payment failures, technical glitches, or verification issues by Flipkart compound these challenges, potentially resulting in financial losses for businesses.

In addressing these complexities, Cointab offers an Automated Reconciliation System, streamlining the arduous task of data processing and reconciliation. This adaptable system requires minimal configuration to accommodate various data formats. Once configured, businesses input the relevant data for reconciliation, with the system promptly generating outputs detailing accurately reconciled transactions and highlighting any discrepancies.

With this information at hand, businesses can empower their finance teams to address discrepancies promptly, raising disputes with Flipkart to rectify errors and recover funds for disputed transactions. Cointab’s solution simplifies the reconciliation process, mitigating potential losses and ensuring smoother financial operations for businesses operating on Flipkart’s platform.

Flipkart payment reconciliation process:

Flipkart Payment Reconciliation Process:

Essential Data for Reconciliation:

- Flipkart Order Report

- Flipkart Sales Report

- Flipkart Settlement Report

- Flipkart Returns Report

Flipkart Order report

Every placed order on Flipkart is logged into the Order Report, detailing item-wise information for each order, including quantities.

Flipkart Sales Report

This document comprises two sheets and may alternatively be referred to as a GST Tax report. It includes:

- Detailed information on each item ordered.

- Data indicating the number of fulfilled orders.

- The count of orders that were canceled.

- The quantity of orders returned by customers.

- The total invoice amount collected from customers.

- Additionally, the second sheet, titled “Sales Cashback,” contains data regarding cashback amounts debited or credited to the seller by Flipkart.

Flipkart Settlement Report

This document comprises multiple sheets, including:

- Orders

- Ads

- Non-Order SPF

- TDS

The “Orders” sheet delineates settlement details for each order, encompassing various charges such as commission fees, fixed fees, shipping fees, collection fees, etc., along with applicable taxes like TDS, TCS, and others. It also specifies the final settlement amount after deductions for each order.

The “Ads” sheet itemizes deductions for advertisements run on Flipkart by the business.

The “Non-Order SPF” sheet outlines charges for storage in the warehouse and reparations for damaged inventory.

Lastly, the “TDS” sheet provides information on TDS payments made by Flipkart.

Return report

This document contains information on returned order items retrieved by Flipkart from customers. This report serves the purpose of verifying whether inventory is returning to the warehouse in cases of RTO and customer returns. These reports are essential for conducting the required reconciliation.

Configuration process:

Utilizing the Order report, we generate a summary report at the Order Number level. Subsequently, for each order, we reference the Sales report to compute the Expected Amount. In the Sales report, the Invoice Amount column is interpreted differently based on the Event Sub Type: rows with “Sale” or “Return Cancellation” are considered positive Invoice Amounts (akin to sales), while rows with “Return” or “Cancellation” are regarded as negative Invoice Amounts (resembling credit notes). The Sales Cashback report supplements this process by providing Credit Note and Debit Note amounts. By aggregating these rows with positive and negative invoice values, we derive the Expected Amount that Flipkart owes to a business for each Order Number. This computation is executed for all Order Numbers.

Furthermore, for each order, we cross-reference the Settlement report to determine the Payment Amount. Within the Settlement report, the sum of Sale Amount, Total Offer Amount, My Share, and Customer Shipping Amount constitutes Payment Received, while Refund Amount represents Payment Refunded. Summing these two values yields the Payment Amount.

Reconciled Output

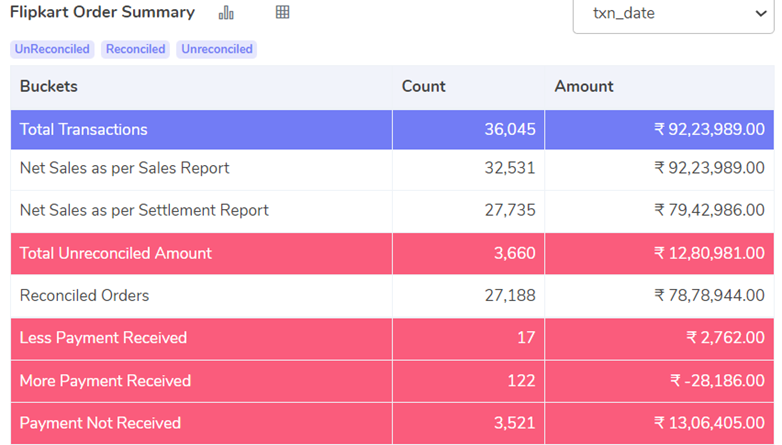

An order will be classified as a “Reconciled Order” if its Expected Amount matches the Payment Amount. This indicates that Flipkart is fulfilling payment for the order according to its Invoice Amount from the sales report.

If the Expected Amount exceeds the Payment Amount, the order will be labeled as a “Less Payment Received Order.” This signifies that Flipkart’s payment falls short in comparison to the order’s Invoice Amount as per the sales report.

Conversely, if the Expected Amount is less than the Payment Amount, the order will be categorized as a “More Payment Received Order.” In this scenario, Flipkart’s payment surpasses the order’s Invoice Amount from the sales report.

Orders without payment entries in the Settlement Report, despite expectations, will be highlighted as “Payment Not Received.”

Any orders lacking entries in the Sales Report, or with a net invoice amount of 0 and no payment received as per the Settlement report, are deemed “Canceled transactions.”

The result shown is as follows (for a particular date range):

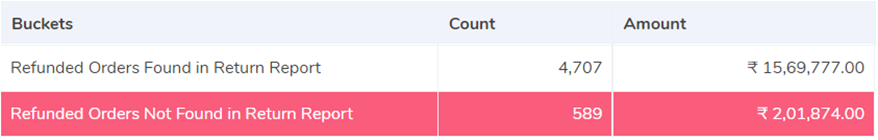

Inventory Return Verification

If a Credit Note appears in the Sales report, we anticipate the return of inventory via the Return report. A check has been implemented to ensure that inventory is retrieved for RTO/Customer Returns, verifying the process.

Bank Statement Reconciliation

Following the completion of payment reconciliation, we verify whether the settlement amount promised by Flipkart is accurately reflected in the bank statements. This reconciliation process involves comparing data between the Flipkart settlement report and the bank statement. Initially, we extract the bank UTR from the NEFT ID column in the settlement report, followed by a similar extraction of UTRs from the bank statement’s narration column. Subsequently, we correlate the extracted UTRs from both the bank statements and Flipkart settlement reports.

Next, we introduce a column labeled ‘Partner Amount’ in the bank statement, where we aggregate all settlement amounts corresponding to each UTR from the settlement report. Then, by subtracting this ‘Partner Amount’ from the transaction amount, we determine the variance between the two amounts. This evaluation enables us to ascertain whether Flipkart is crediting the correct amount to the bank account.

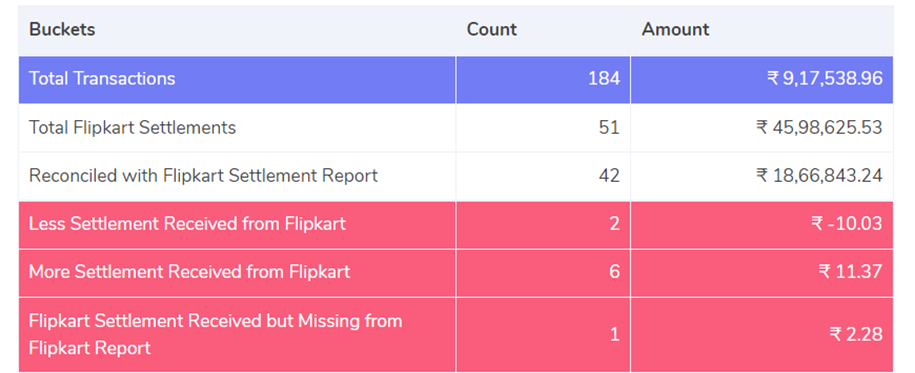

The result is shown as follows:

Total Flipkart Settlements

These represent all bank transactions where the narration includes the keyword “Flipkart.”

Reconciled with Flipkart Settlement Report

These denote bank transactions where the settlement amount promised by Flipkart matches the credited amount in the bank statement.

Less Settlement Received from Flipkart

These refer to bank transactions where the credited amount is lower than the settlement amount promised by Flipkart.

More Settlement Received from Flipkart

These indicate bank transactions where the credited amount exceeds Flipkart’s promised settlement amount.

Flipkart Settlement Received but Missing from Flipkart Report

These encompass bank transactions where the UTR (Unique Transaction Reference) associated with the credited amount is absent in the Flipkart settlement report.

Flipkart Fee Verification

For a comprehensive understanding of how Flipkart fees are verified, please refer to this page.

———————–

Cointab’s Automated Reconciliation System performs Flipkart marketplace payment reconciliation with meticulous attention to detail, a task that is arduous to execute manually.

If you encounter any challenges with Flipkart reconciliation, please feel free to reach out to us for assistance.

Why Choose Cointab?

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensure precise reconciliation, rid of human errors and discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.