A Dutch Payment Gateway, founded in 2006 by Pieter van der Does and Arnout Schuijff. with a focus on the payment needs of global businesses. And building infrastructure, which is directly connected to card networks and other payment methods. Adyen offers merchants online services to accept credit cards, bank-based payments and other digital transactions. Their platform acts as a payment gateway and payment service provider. Adyen provides the service of online payments, point-of-sale in-store payment terminals, and card issuing.

When you partner with Adyen, as a payment gateway it charges you a certain amount of fees and taxes. These charges are deducted from the payment made by the customers and the rest is transferred to your enterprise account. But during this transaction, certain miscalculations might take place and you might either be undercharged or overcharged. Manually tracking these discrepancies can be tedious and prone to error, but by automating your reconciliation with Cointab you can be rest assured that you have clearer bookkeeping.

When you partner with Adyen, as a payment gateway it charges you a certain amount of fees and taxes. These charges are deducted from the payment made by the customers and the rest is transferred to your enterprise account. But during this transaction, certain miscalculations might take place and you might either be undercharged or overcharged. Manually tracking these discrepancies can be tedious and prone to error, but by automating your reconciliation with Cointab you can be rest assured that you have clearer bookkeeping.

Reports Required for Adyen Payment Gateway Charges Verification:

Adyen payment report:

It provides you with the report of total transactions and from which mode the transaction has been carried out.Adyen Rate card:

The rate card consists of the fee, percentage which are charged and the payment mode, which is used.Results:

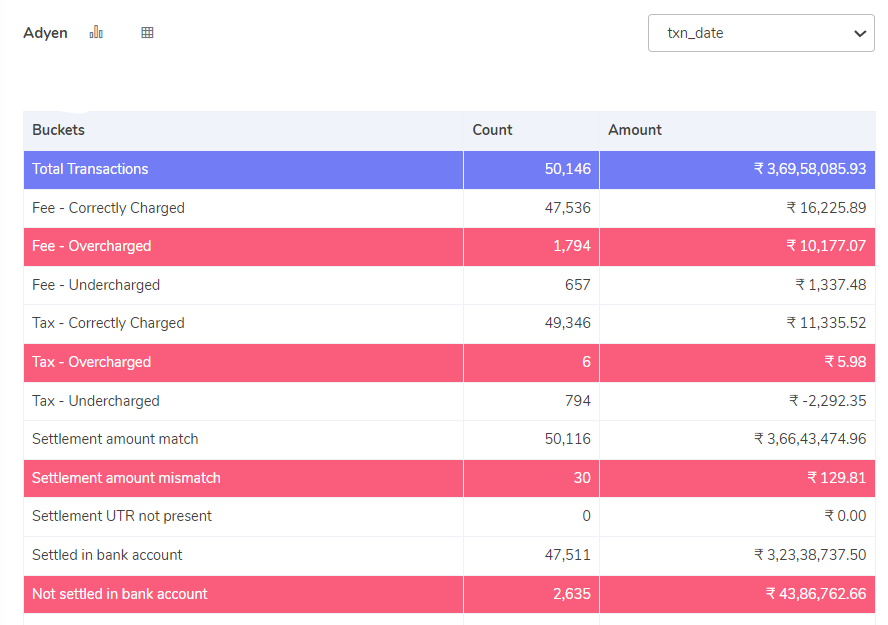

Fee correctly charged:

The fees charged by Adyen correctly match the amount calculated using the rate card.Fee overcharged:

Here Fees have been overcharged by Adyen, and are seen to be more than the amount calculated using the rate card.Fee undercharged:

In this case, the fees charged by Adyen are seen to be less than the amount calculated using the rate card.Tax-correctly charged:

The tax in the payment report matches the tax amount calculated as per the GST guidelines.Tax- overcharged:

The tax amount in the payment report is seen to be more than the amount calculated using GST guidelines.Tax- undercharged:

The tax amount recorded in the Payment report is seen to be less than the amount calculated using GST guidelines.Settlement UTR not present:

UTR is not present in the Payment report for these given transactions.Settlement amount match:

The settlement amount is the total amount from which tax and fees are deducted. The settlement amount calculated Should match the settlement amount received from the Adyen report then it is said that the settlement amount matches.(Settlement Amount = Total Amount – Fees – Tax)

Settlement amount mismatch:

The settlement amount refers to the total amount from which tax and fees are deducted. If the settlement amount calculated does not match the settlement amount received from the Adyen report, it is said that the settlement amount is mismatched.Settled in bank account:

The UTR is present in the settlement reports and is also found in bank statements.Not settled in bank account:

The UTR is present in the settlement Report but is not found in the Bank’s statements.As we can see, how utilising automated software can help you get rid of verifying the enormous amount of transactions manually and it will help your team to utilise this time on focusing on other aspects of your business. Cointab reconciliation software helps you to reconcile transactions effortlessly and if there are any discrepancies, these results will help you to make a claim with Adyen. Getting the above results takes a matter of minutes and the results generated are easy to understand.

Checkout our latest articles:

2Checkout Payment Gateway Reconciliation

Mollie Payment Gateway Reconciliation

2Checkout Payment Gateway Reconciliation

Mollie Payment Gateway Reconciliation

Pingback: Revolut Payment Gateway reconciliation - Cointab

Pingback: Eway Payment Gateway Charges Verification - Cointab

Pingback: Zettle Payment Gateway Reconciliation - Cointab

Pingback: Trust Payments Payment Gateway Reconciliation - Cointab

Pingback: Moneris Payment Gateway Charges Verification - Cointab

Pingback: Monzo Payment Gateway Reconciliation - Cointab

Pingback: Reconciliation of Monzo Payment Gateway - Cointab

Pingback: Reconciliation of Zettle Payment Gateway - Cointab