In today’s rapidly evolving digital landscape, the success of online businesses hinges on efficient payment processing systems. Enter Mollie, a trailblazer in the European payment industry, renowned for its innovative solutions tailored to businesses of all sizes. With a relentless focus on user experience and security, Mollie has emerged as a trusted partner for merchants seeking seamless and reliable payment processing capabilities.

As consumers increasingly turn to online shopping, the demand for flexible, secure, and user-friendly payment solutions has never been greater. Mollie rises to the occasion, offering a comprehensive suite of services designed to meet the diverse needs of modern businesses. From effortless payments and seamless checkout experiences to robust security measures and detailed analytics, Mollie empowers merchants to navigate the complexities of online commerce with confidence.

Mollie Payment Gateway Reconciliation Results:

Mollie Settlement Reports:

These reports serve as the cornerstone of your financial oversight. They detail orders placed and payments received, providing a comprehensive overview of your transaction history.

Mollie’s Return Reports:

Cancellation of orders is a part of business reality, and these reports offer insights into refunded orders. Understanding the reasons behind cancellations can help identify areas for improvement in your product offerings or customer service.

Website Report:

Your website is often the primary touchpoint for customers. This report provides valuable data on customers’ order details placed through the website, helping you analyze customer behavior and optimize your online storefront.

ERP Report:

Internally, your organization relies on accurate and detailed reporting. The ERP report acts as an internal ledger, presenting information item-wise. This report is invaluable for financial management and strategic decision-making.

Bank Statement:

The bank statement is a critical document that provides a summary of the transactions received via the payment gateway. It serves as a bridge between your online transactions and your financial institution, offering transparency and accountability.

By harnessing the insights provided by these reports, businesses can gain a deeper understanding of their financial performance, customer behavior, and operational efficiency. Whether it’s optimizing the checkout process, refining product offerings, or fine-tuning financial strategies, leveraging Mollie’s reports can empower businesses to thrive in the competitive landscape of online commerce.

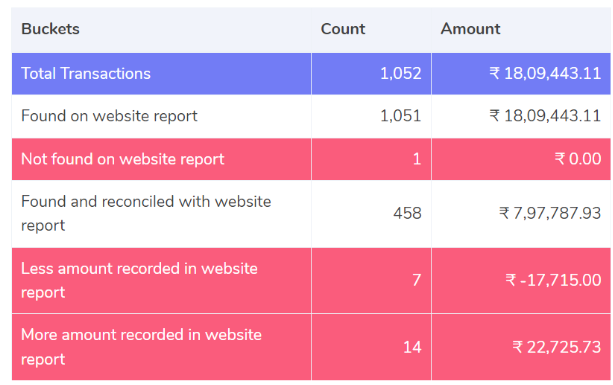

Leveraging Website Reports for Enhanced Transaction Insights:

Found on Website Report:

Transactions captured on Mollie’s settlement reports and website reports provide a comprehensive overview of your financial transactions. By cross-referencing data from both sources, businesses can gain a deeper understanding of customer purchasing behavior and transaction patterns.

Not found on the Website Report:

Identifying transactions recorded in Mollie’s settlement report but omitted from website reports is crucial for ensuring data accuracy and completeness. These discrepancies may signify potential issues in data synchronization or reporting processes, warranting further investigation and reconciliation.

Found and Reconciled with Website Report:

Efficient reconciliation is key to maintaining accurate financial records. Transactions that are reconciled in both website reports and Mollie settlement reports indicate alignment between internal and external transaction records, enhancing transparency and accountability.

Less Amount Recorded in Website Report:

Discrepancies in transaction amounts between website reports and Mollie settlement reports can have significant implications for financial analysis and decision-making. Identifying instances where less amount is recorded in website reports highlights potential revenue leakage or reporting errors that require prompt resolution.

More Amount Recorded in Website Report:

Conversely, instances where more amount is recorded in website reports compared to Mollie settlement reports may indicate revenue overstatement or inaccuracies in reporting processes. Addressing these discrepancies is essential for maintaining data integrity and ensuring compliance with financial regulations.

Website with Mollie Reconciliation:

Uncovering Transaction Insights: Leveraging Website Report Data

Transactions documented in both Mollie’s settlement reports and website reports offer a panoramic view of your financial landscape. By meticulously cross-referencing data from these sources, businesses can unlock profound insights into customer purchasing behavior and transactional trends. This holistic approach empowers businesses to make informed decisions and tailor strategies to meet evolving market demands.

Identifying Discrepancies: Transactions Missing from Website Reports

The absence of transactions in website reports despite being recorded in Mollie’s settlement report raises red flags regarding data accuracy and completeness. These discrepancies underscore the importance of meticulous data synchronization and robust reporting processes. Addressing these discrepancies through thorough investigation and reconciliation is paramount to maintaining data integrity and financial transparency.

Achieving Alignment: Reconciling Transactions with Website Reports

Efficient reconciliation lies at the heart of sound financial management practices. Transactions harmoniously reconciled in both website reports and Mollie settlement reports signify alignment between internal and external transaction records. This alignment not only enhances transparency but also fosters accountability, enabling businesses to navigate financial complexities with confidence and precision.

Unveiling Revenue Discrepancies: Less Amount Recorded in Website Reports

Discrepancies in transaction amounts between website reports and Mollie settlement reports can significantly impact financial analysis and decision-making processes. Instances where less amount is recorded in website reports may indicate potential revenue leakage or reporting inaccuracies. Prompt resolution of these discrepancies is imperative to uphold financial accuracy and mitigate potential risks.

Ensuring Compliance: Addressing Excessive Amounts in Website Reports

Conversely, instances where more amount is recorded in website reports compared to Mollie settlement reports demand scrutiny. These discrepancies may signal revenue overstatement or reporting errors, posing compliance risks and jeopardizing financial integrity. By addressing these discrepancies proactively, businesses can uphold regulatory compliance and instill confidence in stakeholders.

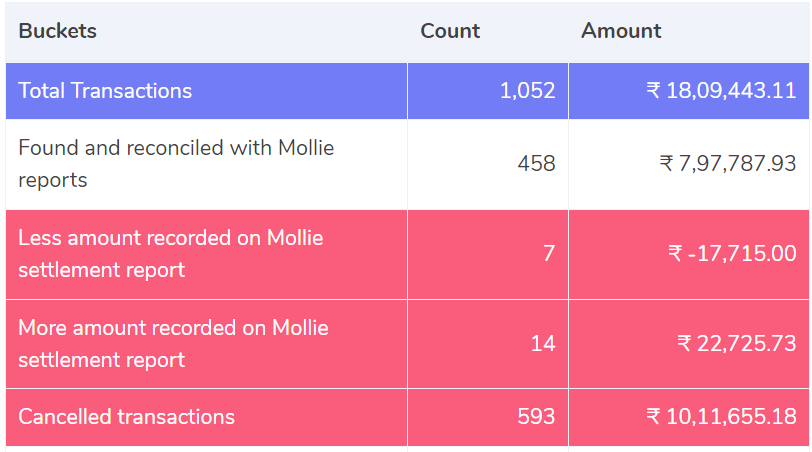

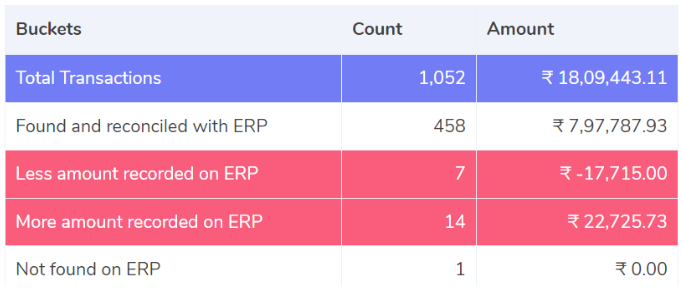

Mollie Reconciliation with ERP:

Reconciliation Across Platforms: Integrating ERP Reports with Mollie Settlement Reports

Efficient reconciliation hinges on the seamless integration of data from diverse sources. Transactions that are meticulously found and reconciled on both ERP reports and Mollie settlement reports signify alignment and accuracy in financial records. This integration streamlines reconciliation processes, fostering transparency and accountability in financial management practices.

Addressing Discrepancies: Identifying Less Amount Recorded on ERP Reports

Discrepancies in transaction amounts between ERP reports and Mollie settlement reports warrant attention. Instances where the amount recorded on ERP reports is less compared to Mollie settlement reports may indicate potential revenue loss or reporting inaccuracies. Addressing these discrepancies promptly is essential to maintain financial integrity and ensure accurate financial reporting.

Exploring Revenue Variances: Unveiling More Amount Recorded on ERP Reports

Conversely, instances where the amount recorded on ERP reports exceeds that of Mollie settlement reports demand scrutiny. These discrepancies may signify revenue overstatement or inaccuracies in reporting processes. By delving into the root causes of these variances, businesses can mitigate risks and uphold financial transparency.

Resolving Missing Transactions: Transactions Not Found on ERP Reports

Transactions documented in Mollie’s settlement reports but omitted from ERP reports highlight potential gaps in data synchronization or reporting processes. These discrepancies underscore the importance of thorough data analysis and reconciliation efforts. Addressing these missing transactions ensures completeness and accuracy in financial records, enhancing overall financial oversight.

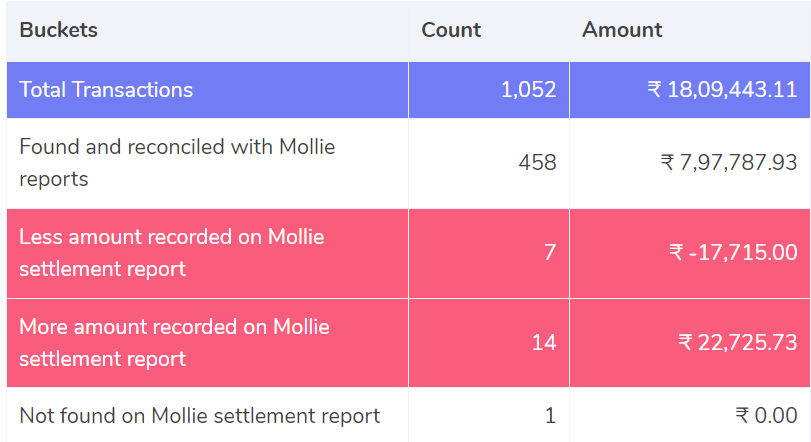

ERP Reports with Mollie Reconciliation:

Achieving Alignment: Matching Transactions on ERP and Mollie’s Settlement Reports

Efficient reconciliation involves matching transactions across various platforms. When transactions are found and reconciled on both ERP reports and Mollie’s settlement reports, it signifies alignment and accuracy in financial records. This alignment streamlines financial processes and enhances transparency in financial management.

Addressing Discrepancies: Identifying Less Amount Recorded on Mollie’s Settlement Report

Discrepancies in transaction amounts between Mollie’s settlement reports and ERP reports require attention. Instances where the amount recorded on Mollie’s settlement reports is less than that on ERP reports may indicate potential revenue loss or reporting inaccuracies. Resolving these discrepancies promptly ensures financial integrity and accurate reporting.

Exploring Revenue Variances: Unveiling More Amount Recorded on Mollie’s Settlement Report

Conversely, instances where the amount recorded on Mollie’s settlement reports exceeds that on ERP reports demand scrutiny. These variances may signal revenue overstatement or reporting errors. By investigating these discrepancies, businesses can mitigate risks and ensure compliance with financial regulations.

Resolving Missing Transactions: Transactions Not Found on Mollie’s Settlement Report

Transactions documented in ERP reports but absent from Mollie’s settlement reports highlight potential gaps in data synchronization. Addressing these missing transactions ensures completeness and accuracy in financial records. Thorough reconciliation efforts are essential for maintaining financial transparency and integrity.

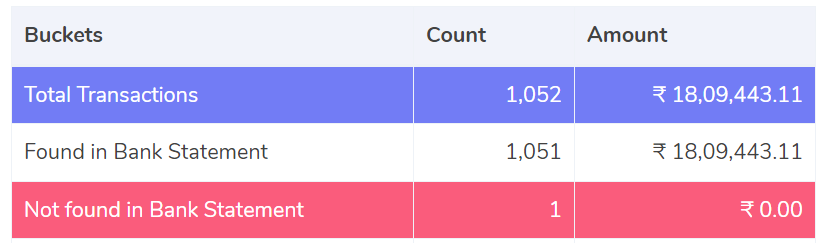

Mollie with Bank reconciliation:

Achieving Alignment: Matching Transactions on Bank Statements and Mollie’s Settlement Reports

Efficient financial oversight involves aligning transactions across multiple platforms. When transactions are successfully matched on both bank statements and Mollie’s settlement reports, it indicates synchronization and accuracy in financial records. This alignment streamlines reconciliation processes and enhances transparency in financial management.

Addressing Discrepancies: Identifying Transactions Not Found on Bank Statements

Discrepancies arise when transactions documented in Mollie’s settlement reports are absent from bank statements. These discrepancies require attention as they may indicate potential issues in transaction processing or reporting. By investigating and addressing these missing transactions, businesses can ensure completeness and accuracy in financial records.

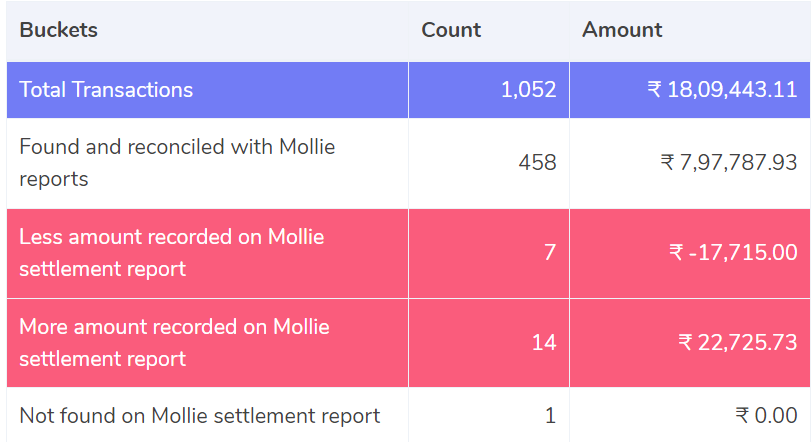

Bank reconciliation with Mollie:

Achieving Precision: Reconciliation on Bank Statements and Mollie’s Settlement Reports

Efficient financial oversight involves reconciling transactions across multiple platforms. When transactions are successfully reconciled on both bank statements and Mollie’s settlement reports, it indicates accuracy and synchronization in financial records. This alignment streamlines reconciliation processes and enhances transparency in financial management.

Addressing Variances: Identifying More Amount Recorded on Mollie’s Settlement Report

Discrepancies arise when the amount recorded on Mollie’s settlement reports exceeds that on the bank statement. These variances require attention as they may indicate potential discrepancies in transaction processing or reporting accuracy. Investigating these discrepancies ensures financial integrity and precise reporting.

Resolving Deficiencies: Noting Less Amount Recorded on Mollie’s Settlement Report

Conversely, instances where the amount recorded on Mollie’s settlement reports is less than that on the bank statement warrant scrutiny. These deficiencies may signify underreporting or inaccuracies in financial records. Addressing these discrepancies promptly ensures accurate financial reporting and compliance with regulatory standards.

Investigating Discrepancies: Transactions Not Found on Mollie’s Settlement Report

Transactions documented in Mollie’s settlement reports but absent from the bank statement raise concerns about data synchronization or reporting accuracy. Investigating these discrepancies is essential to ensure completeness and accuracy in financial records. Thorough reconciliation efforts facilitate transparency and trust in financial management practices.

In conclusion, the partnership between Mollie and Cointab represents a powerful synergy between cutting-edge payment processing and advanced reconciliation technology. By leveraging Mollie’s industry-leading payment solutions and Cointab’s innovative reconciliation software, businesses can streamline their financial operations, enhance accuracy, and unlock new avenues for growth.

In an era defined by digital innovation and rapid technological advancement, staying ahead of the curve is paramount for businesses striving to thrive in the competitive landscape of online commerce. Mollie and Cointab offer a compelling solution, empowering merchants to optimize their payment processing workflows, mitigate risks, and seize opportunities in the dynamic digital marketplace.

As businesses continue to adapt to the evolving demands of the digital economy, embracing the power of Mollie and Cointab represents a strategic investment in long-term success. By harnessing the capabilities of these innovative platforms, businesses can navigate the complexities of online payments with ease, driving efficiency, profitability, and sustainable growth in the digital age.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation