Streamline your Business with Automated Sales Management

Gone are the days of manual transaction reconciliation. Businesses today value their time and need efficient tools to make strategic decisions. This is where automated solutions like Zettle by PayPal and Cointab Reconciliation software come in.

Zettle by PayPal: A one-stop shop for your business needs

Originally known as iZettle, Zettle by PayPal is a Swedish fintech company offering a comprehensive suite of financial products. Whether you need to accept payments, manage your point of sale (POS), or leverage funding options, Zettle by PayPal has you covered. Their Zettle app goes beyond simple transactions, providing valuable sales recording, management, and analysis tools.

Effortless Reconciliation with Cointab Software

Cointab Reconciliation software takes automation to the next level. This well-established platform caters to all your reconciliation needs. Upload data seamlessly using your preferred method, be it API, SFTP, or even email. Cointab’s flexibility allows you to build custom workflows for a perfect fit within your business, delivering comprehensive results to empower your decision-making.

Zettle Payment Gateway Reconciliation Results:

Zettle Settlement Reports:

Track Completed Sales:

Gain insights into successfully processed orders and received payments with Zettle settlement reports.

Zettle Refund Reports:

Monitor Refunds:

Utilize Zettle refund reports to track the amount refunded to customers through the payment gateway.

Website Reports:

Analyze Online Sales:

Leverage website reports to understand customer behavior and optimize your online store’s performance.

ERP Reports:

Detailed Business Insights:

ERP reports provide a granular view of your business operations, including itemized data for informed decision-making.

Bank Statements:

Reconcile Transactions:

Easily reconcile your transactions by matching bank statements with your payment gateway activity.

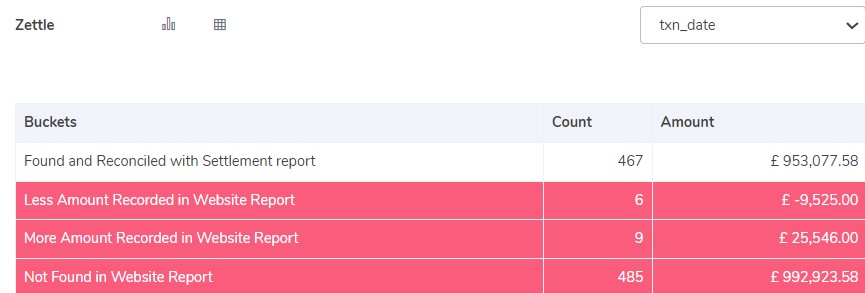

Zettle with website Reconciliation:

Matched Transactions:

These transactions appear in both Zettle settlement reports and the website report, with matching amounts.

Discrepancies:

Lower Website Amount:

Some transactions show a lower amount recorded on the website report compared to the Zettle settlement report.

Higher Website Amount:

A few transactions have a higher amount recorded on the website report than the Zettle settlement report.

Missing from Website:

Certain transactions are present in the Zettle settlement reports but missing from the website report.

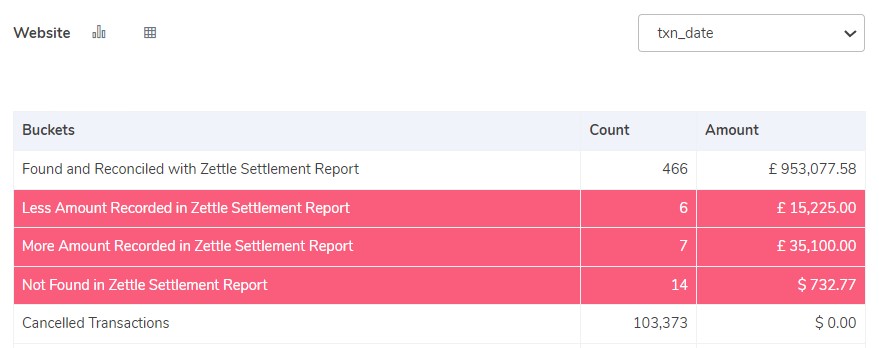

Website with Zettle Reconciliation:

Understanding discrepancies between your sales data sources is crucial for accurate financial reporting. Here’s a breakdown of common findings when comparing Zettle settlement reports and website reports:

Matched Transactions:

These transactions appear in both reports with matching amounts, reflecting completed sales processed through Zettle.

Discrepancies:

Lower Zettle Amount:

Some transactions might show a lower amount on the Zettle report compared to the website report. This could indicate partial refunds, discounts applied at checkout, or website data entry errors.

Higher Zettle Amount:

A few transactions might have a higher amount on the Zettle report. This could be due to additional fees or taxes applied during processing through Zettle.

Missing from Website:

Certain transactions might be present in the Zettle reports but missing from the website report. These could be in-person sales processed through Zettle that weren’t recorded online.

Cancelled Transactions:

Orders cancelled by customers might still show up on the website report but not in the Zettle settlement report since the payment wasn’t finalized.

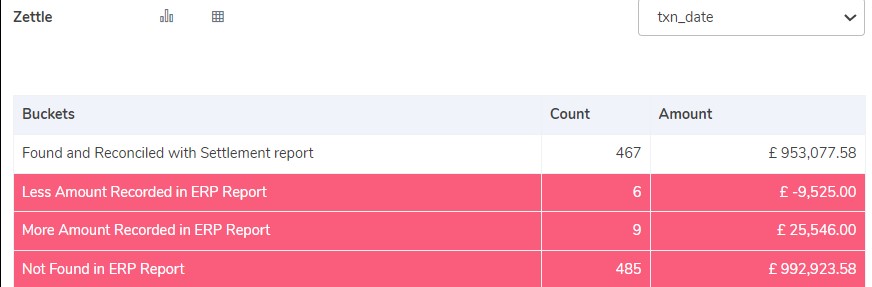

Zettle Reconciliation with ERP:

Matched:

Transactions found in both reports with matching amounts.

Discrepancies:

Lower ERP:

Amounts on the ERP report are lower than Zettle, possibly due to discounts, returns, or data entry errors.

Higher ERP:

Amounts on the ERP report are higher than Zettle, possibly due to added taxes, shipping costs, or missing data in Zettle.

Missing from ERP:

Transactions present in Zettle but missing from the ERP, likely one-time sales or not yet integrated.

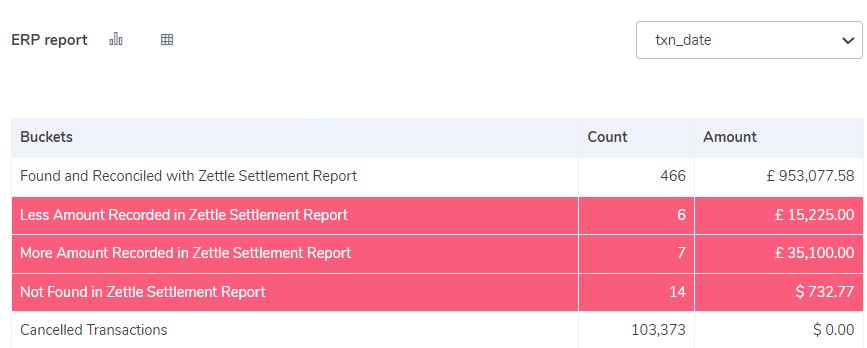

ERP Reports with Zettle reconciliation:

Maintaining accurate sales records requires careful reconciliation between different data sources. This guide explores common discrepancies you might encounter when comparing Zettle settlement reports and your Enterprise Resource Planning (ERP) system:

Matched Transactions:

These transactions appear in both reports with matching amounts, indicating a successful data flow between Zettle and your ERP.

Discrepancies:

Lower Zettle Amount:

Transactions might show a lower amount on the Zettle report compared to the ERP. This could be due to:

Discounts or Refunds:

Discounts applied later in the ERP system or refunds processed that haven’t yet been captured in Zettle.

Data Entry Errors:

Ensure both systems reflect the correct sales amount.

Higher Zettle Amount:

Transactions with a higher amount on the Zettle report could be due to:

Taxes or Shipping Costs:

These might be added in Zettle but not yet reflected in the ERP.

Missing Data in ERP:

The ERP might be missing information captured in Zettle.

Missing from ERP:

Transactions present in Zettle reports but missing from the ERP reports could be:

One-Time Sales:

These might not be integrated into your ERP system.

New Transactions:

They might not have been synced to the ERP yet.

Cancelled Transactions:

Orders cancelled by customers might appear in Zettle reports (reflecting the attempted transaction) but not in the ERP since the sale wasn’t finalized.

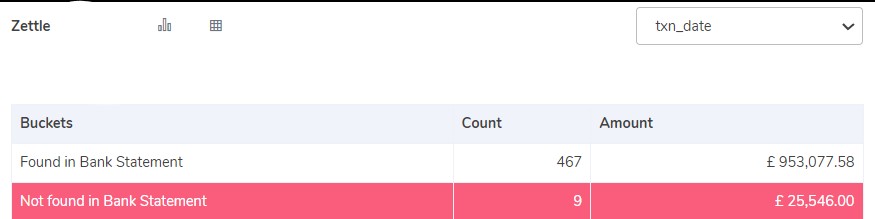

Zettle with Bank reconciliation:

Accurate sales reconciliation requires comparing data from multiple sources. Here’s a breakdown of common findings when reconciling Zettle settlement reports with bank statements:

Matched Transactions:

These transactions appear in both reports, indicating successful processing and deposit into your bank account.

Discrepancies:

Missing from Bank Statement:

Transactions found on Zettle reports but not on bank statements could be:

Pending Deposits:

These might not have cleared your bank yet. Allow processing time for the funds to appear.

Unidentified Deposits:

If the bank statement description doesn’t clearly match the Zettle transaction, investigate further to ensure proper allocation.

By understanding these discrepancies, you can efficiently reconcile your sales data and maintain accurate financial records.

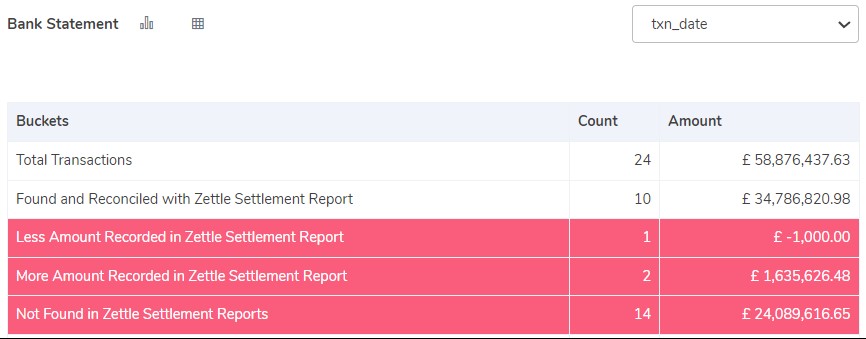

Bank reconciliation with Zettle:

Matched Transactions:

These transactions appear in both reports with matching amounts, indicating successful processing and deposit.

Discrepancies:

Higher Zettle Amount:

The Zettle report shows a higher amount compared to the bank statement. This could be due to:

Refunds:

Refunds processed through Zettle might not be reflected in the bank statement yet.

Fees:

Zettle might deduct fees before depositing funds, resulting in a lower bank statement amount.

Lower Zettle Amount:

The Zettle report shows a lower amount compared to the bank statement. This could be due to:

Pending Settlements:

Transactions might not have been settled by Zettle yet, leading to a delay in the bank deposit.

Data Entry Errors:

Double-check both reports for any potential typos or inconsistencies.

Missing from Zettle:

Transactions appear in the bank statement but not the Zettle report. These could be:

Bank Transfers:

Deposits made directly into your bank account (not through Zettle).

Chargebacks:

These are customer disputes processed by the bank, not reflected in Zettle reports.

Streamline Your Reconciliation Process and Gain Financial Control

Maintaining accurate transaction records is crucial for any business. Reconciling your Zettle sales data ensures all transactions are processed correctly and reflected in your financial reports. However, discrepancies can occur due to various reasons.

Cointab Reconciliation Software: Your Automated Solution

Cointab empowers you to automate your reconciliation process and effortlessly identify the status of your Zettle payments. This powerful software streamlines the following:

Effortless Reconciliation:

Eliminate manual work and save valuable time by automating data reconciliation across Zettle, bank statements, and your business reports.

Discrepancy Detection:

Pinpoint mismatched transactions and identify potential errors quickly.

Accurate Claim Management:

Easily determine the amount you need to claim from Zettle, ensuring you receive the correct sum for your sales.

Increased Efficiency: Optimize your financial workflow and free up resources for strategic business decisions.

Move Beyond Manual Reconciliation: Embrace Automation with Cointab

Don’t let manual reconciliation tasks hold you back. Cointab Reconciliation Software provides the automation you need to achieve accurate financial records and improve your overall business efficiency. Get started today and unlock the power of automated reconciliation!

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation