In the digital commerce era, establishing online stores, particularly for small businesses, can be daunting. Crafting your own digital storefront presents numerous challenges. This is where platforms like Shopify step in, offering to construct online stores for companies seeking to operate through a web interface. Many businesses opt for Shopify over self-built solutions due to the technical complexity and financial investment required for starting from scratch. Additionally, Shopify offers enhanced security features compared to individual efforts. Through Shopify, companies can manage sales, distribution, and marketing of their products. The platform’s popularity stems from its accessible features, user-friendly interface, minimal initial investment, and ongoing technical support. To explore Shopify’s capabilities, a 14-day trial is provided, followed by subscription options tailored to the company’s needs.

After launching a Shopify store, effectively managing daily orders becomes paramount for e-commerce companies to mitigate potential losses. The complexity increases with the management of multiple payment gateways and cash on delivery (COD) vendors. Ensuring precise payments, assessing fees, and handling returns can be challenging, particularly when dealing with different reporting formats and sharing data across teams.

Addressing the Challenges of Website Reconciliation:

- Diverse Settlement Reports

- Integrating Website with Multiple Software Systems

- Manual Data Retrieval from Various Platforms

- Managing Multiple Spreadsheets

- Analyzing Complex Reports

- Sharing Reports Efficiently

- Dealing with Repetitive Lengthy Procedures

Cointab’s Website Reconciliation software streamlines this process for e-commerce entities by integrating Shopify, order management systems, payment gateways, COD vendors, and banking transactions. By consolidating data from these sources, Cointab generates comprehensive reconciliation reports. Its flexibility allows customization for different payment gateways, COD partners, and internal systems, simplifying information processing and enhancing clarity in reporting.

Benefits of Cointab Software for Website Reconciliation:

- Seamless integration of Website, Order Management, Payment Gateway, and COD Partner Reports

- Clear, easily understandable Reports

- Simplified Order Verification

- Accurate comparison between Payment Gateway Settlements and Shopify’s Internal Records

- Effortless Report Sharing and Analysis

- Elimination of Manual Data Transfer

- Time-saving Automation

Reconciliation Process:

Scope / Entities

- Shopify

Customers shop for their desired items on the Shopify website. Once items are added to the cart, customers are redirected to the payment page, where they can choose between two options: Payment Gateway or Cash on Delivery (COD). The primary function of the Shopify website is to facilitate purchases. Additionally, it generates its own report for all orders placed on the website.

- Unicommerce Uniware order management system

The Cointab reconciliation system seamlessly reconciles Shopify with any Order Management System. If you’re utilizing the Unicommerce Uniware order management system, our system can integrate with it as well, facilitating reconciliation against Shopify, Payment Gateways, and COD partners.

- Payment gateway

A Payment Gateway is a service provider responsible for processing debit card or credit card payments for online stores or e-businesses. Examples include Razorpay, Payu, Paytm, and more.

Upon selecting the payment gateway option for a transaction, an order ID and payment ID are generated to monitor payments. Cointab’s software meticulously verifies and cross-references the payment gateway report with the Unicommerce report and the bank statement to ensure accurate payment amounts for each order. This process guarantees that the due settlement is received in the bank account as expected.

- COD remittance

Cash on Delivery (COD) is a widely-used payment method wherein customers make payments upon receiving their orders. Companies collaborate with vendors for COD transactions, receiving payments periodically. Cointab’s Software connects COD remittance files with Unicommerce reports and bank statements to confirm the receipt of expected amounts in the bank account.

- Bank Statement

With the high volume of daily transactions, verifying settlement amounts in the bank account is crucial. Payment gateway and COD partners commit specific amounts based on settlement reports, necessitating confirmation of actual receipt in the bank. Cointab’s software meticulously reconciles Unicommerce reports, internal company reports, Payment Gateway reports, COD remittance reports, and bank statements, flagging any discrepancies for resolution. This enables companies to accurately track payments and ensure correct settlements from all partners. Any discrepancies or outstanding settlements are promptly highlighted for attention.

Cointab’s software efficiently reconciles various reports, including the Unicommerce report, the company’s internal report, Payment gateway reports, COD remittance reports, and the bank statement. It alerts the company of any unsettled amounts, enabling them to track payments accurately and ensure correct settlements with all partners. Any discrepancies or outstanding settlements are promptly highlighted for attention, ensuring transparency and financial accuracy.

Reports Used For Reconciling:

- Shopify order report

This report consolidates all orders received within a designated timeframe on the Shopify website. Its primary objective is to reconcile these orders with the Unicommerce order report.

- Unicommerce order report

This report encompasses all customer orders documented by Unicommerce within its order management system, playing a crucial role in reconciling orders against both the Shopify Order Report and partner reports.

- Unicommerce sales tax report

Produced during order dispatch, this report provides a breakdown of the relevant sales taxes applicable to each transaction.

- Unicommerce return tax report

This is a tax report filled when received a product back (customer return / RTO)

- Unicommerce cancellation tax report

This is a tax report filled for orders which were made and then cancelled.

- Unicommerce SKU master

A comprehensive inventory catalog that includes master SKUs along with the weight and volumetric dimensions of each product.

- Payment gateway settlement report

This report serves as a tool for reconciling bank statements and the Unicommerce report, offering comprehensive information regarding settlements processed through the payment gateway.

- Payment gateway rate card

This document outlines the charges linked to every customer transaction handled via the payment gateway.

- COD remittance reports from courier partner

These reports act as documentation for all payments received from customers through the Cash on Delivery method, detailing the corresponding amounts that the COD partner needs to reimburse to the company.

- Bank statements

Critical for confirming whether the payment gateway or COD partners have met their financial obligations by depositing the agreed-upon sums into the company’s bank account.

Reconciliation Result:

Shopify vs Unicommerce Reconciliation

-

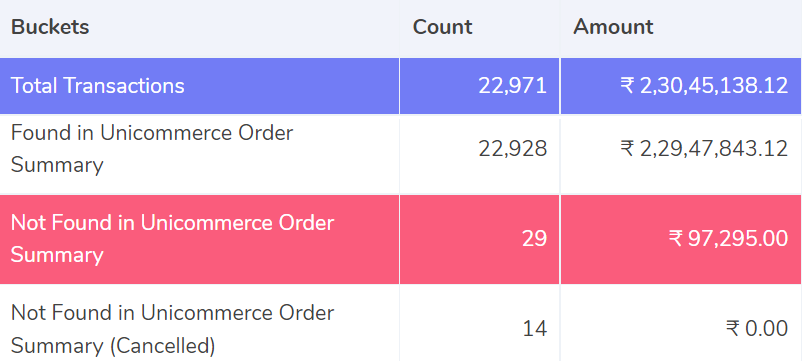

Forward Reconciliation

Found in Unicommerce Order Summary:

In the Unicommerce Order Summary, Cointab’s software identifies and displays orders that are found in both the Unicommerce report and the Shopify report. This section emphasizes orders that align consistently across both platforms.

Not Found in Unicommerce Order Summary:

Cointab’s software scrutinizes both the Unicommerce report and the Shopify report, identifying orders absent in the Unicommerce report. Despite being recorded in Shopify, these orders lack documentation in Unicommerce, potentially leading to unfulfilled orders despite customer payment. Therefore, manual confirmation of these orders by the company is necessary.

Not Found in Unicommerce Order Summary (Cancelled):

This aspect of Cointab’s software compares the Unicommerce report with the Shopify report, identifying orders missing in Unicommerce that were later cancelled. Although not initially recorded by Unicommerce, their cancellation addresses any potential issues, making them irrelevant and suitable for dismissal.

-

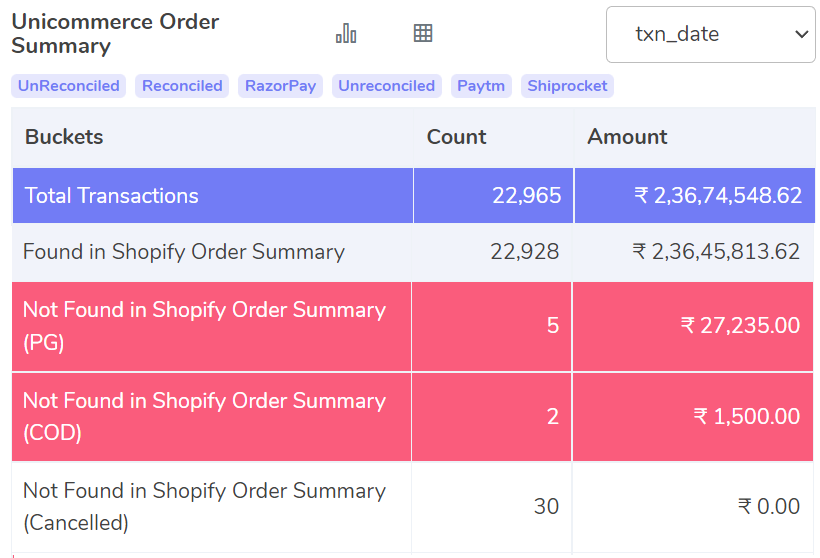

Backward Reconciliation

Total Shopify Transactions:

This section presents the total number of transactions documented in the Unicommerce report.

Found in Shopify Order Summary:

In the Shopify Order Summary, Cointab’s software identifies and presents orders that match and are present in both the Shopify report and the Unicommerce report.

Not Found in Shopify Order Summary (PG):

Cointab’s software juxtaposes the Shopify report with the Unicommerce report, emphasizing orders missing in the Shopify report but logged as prepaid in Unicommerce. These orders, originating from sources external to the Shopify system, have been processed without payment received via the payment gateway. By identifying these orders, the company is prompted to conduct further investigation.

This section of Cointab’s software compares the Shopify report with the Unicommerce report, revealing orders not found in the Shopify report but recorded as Cash on Delivery (COD) in Unicommerce. These post-paid orders have been fulfilled without payment from the COD partner, originating outside the Shopify system. The company is prompted to review these orders accordingly.

Not Found in Shopify Order Summary (Cancelled):

Cointab’s software analyzes both the Shopify report and the Unicommerce report, highlighting orders absent in the Shopify report that were subsequently cancelled. While these orders did not originate from Shopify and thus wouldn’t yield payment, their cancellation prevents any issues. Displaying these orders ensures transparency and ease of management.

Unicommerce vs Payment Gateway (example: Razorpay):

-

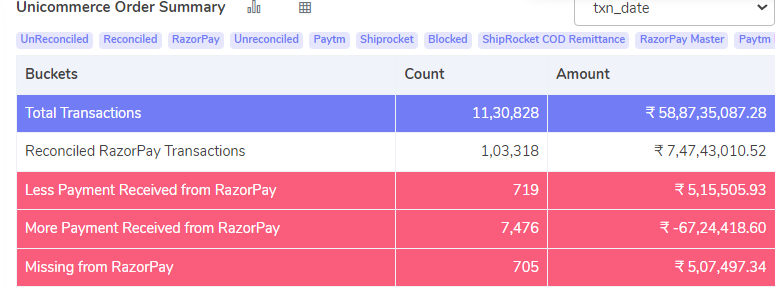

Forward Reconciliation

Reconciled with Payment Gateway:

In this segment, Cointab’s Software performs a comparison between the Unicommerce report and the Payment Gateway report, verifying that the recorded amounts align across both sources. This functionality is crucial to guaranteeing that all purchase payments processed through the payment gateway have been accurately received.

Example: Order amount Rs. 100, payment gateway collected Rs. 100 from customer

Less Payment Received from Payment Gateway:

Cointab’s Software examines the Unicommerce report and the Payment Gateway report, identifying orders where the payment received from the payment gateway falls short of the expected amount.

Example: Order amount Rs. 100, payment gateway collected Rs. 90 from customer

More Payment Received from Payment Gateway:

In this section, Cointab’s Software contrasts the Unicommerce report with the Payment Gateway report, pinpointing orders where the payment received from the payment gateway surpasses the anticipated amount.

Example: Order amount Rs. 100, payment gateway collected Rs. 110 from customer

Missing from Payment Gateway:

Presented in this box are orders that have been completed, yet payment is not reflected in the records of the payment gateway.

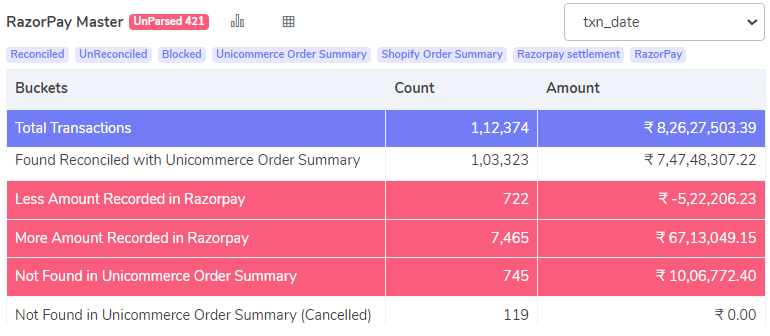

Backward Reconciliation

Reconciled with Unicommerce Order Summary:

In this section, Cointab’s Software juxtaposes the payment gateway report with the Unicommerce report, revealing orders that correspond to the Unicommerce report. This functionality emphasizes orders that have been correctly settled.

Less Amount Recorded in Payment Gateway:

Displayed in this category are orders where the amount recorded in the payment gateway is lower than the corresponding amount in the Unicommerce report.

More Amount Recorded in Payment Gateway:

In this section, Cointab’s Software juxtaposes the payment gateway report with the Unicommerce report, unveiling orders where the payment gateway indicates a higher amount than recorded in the Unicommerce report. This functionality notifies the company of instances where they have received an overpayment from the payment gateway, allowing them to ensure accurate accounting or process refunds as necessary.

Not found in Unicommerce Order Summary:

This segment displays orders missing from the Unicommerce report following a comparison with the payment gateway report. This information is vital for the company, indicating orders that won’t be fulfilled despite receiving payment. Failing to fulfill orders for which customers have already paid could result in substantial customer dissatisfaction and financial loss.

Not found in Unicommerce Order Summary (Netoff):

Cointab’s software detects orders absent from the Unicommerce report that have been cancelled. Although not initially documented by Unicommerce, these orders were automatically refunded by the payment gateway, resolving any potential concerns. Hence, they can be disregarded without adverse effects.

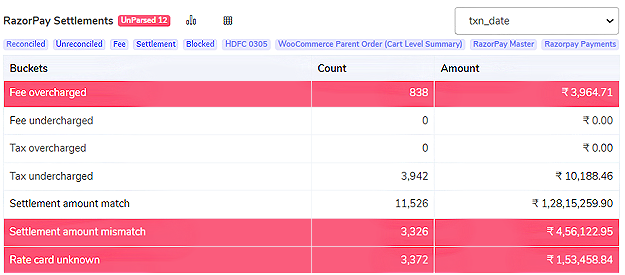

Payment Gateway Fee Verification:

Fee Overcharged:

In this classification, Cointab’s software scrutinizes the payment gateway report, identifying transactions where the fees imposed by the Payment Gateway partner surpass the agreed-upon amount outlined in the business agreement. This functionality acts as a protective measure, notifying the company of potential overcharges and empowering them to prevent unnecessary expenses.

Fee Undercharged

Cointab’s software examines the payment gateway report, pinpointing transactions where the fees assessed by the Payment Gateway are lower than the agreed-upon amount specified in the business agreement. This capability is advantageous as it informs the company of any undercharged amounts, ensuring adherence to contractual terms. Moreover, it facilitates communication with the payment gateway partner, fostering a reliable relationship.

Tax Overcharged:

In this segment of Cointab’s software, the payment gateway report is examined to identify transactions where the tax levied by the Payment Gateway surpasses the agreed-upon rate stipulated in the business agreement. The software utilizes a calculation of GST at 18% of the fee for this comparison.

Tax Undercharged:

Likewise, Cointab’s software scrutinizes the payment gateway report, uncovering transactions where the tax imposed by the Payment Gateway is lower than the agreed-upon rate specified in the business agreement. GST is calculated at 18% of the fee for this assessment.

Settlement Amount Match:

Ensuring alignment between the settlement amount in the payment gateway settlement report and the calculated amount derived from customer payments, fees, and taxes is paramount. Cointab’s software conducts this calculation and flags cases where the calculated settlement amount matches the amount provided by the payment gateway.

Settlement Amount Mismatch:

If the calculated settlement amount doesn’t match the directly provided settlement amount, Cointab’s software flags a “Settlement Amount Mismatch,” signaling a disparity that necessitates further investigation.

Rate Card Unknown

This segment exhibits transactions made through a payment method lacking a rate card for verification within the software.

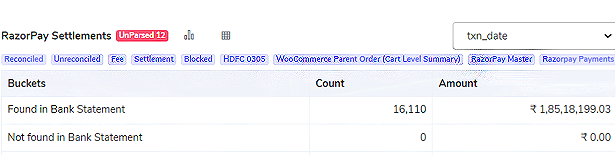

Payment Gateway vs Bank Statement

-

Forward Reconciliation

Found in Bank Account:

This section presents transactions in which the settlement amount has been received in the bank successfully. It allows companies to track the quantity of payments processed and the corresponding amounts received from the payment gateway partner.

Not Found in Bank Account:

In this section, transactions are displayed where the settlement amount has not yet been received in the bank. It aids the company in identifying the number of outstanding transactions awaiting deposit into the company’s bank account by the payment gateway partner.

-

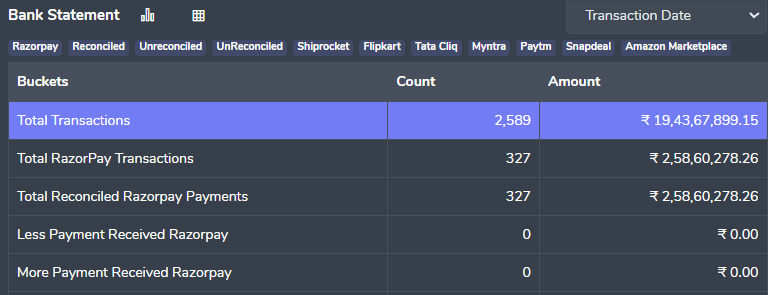

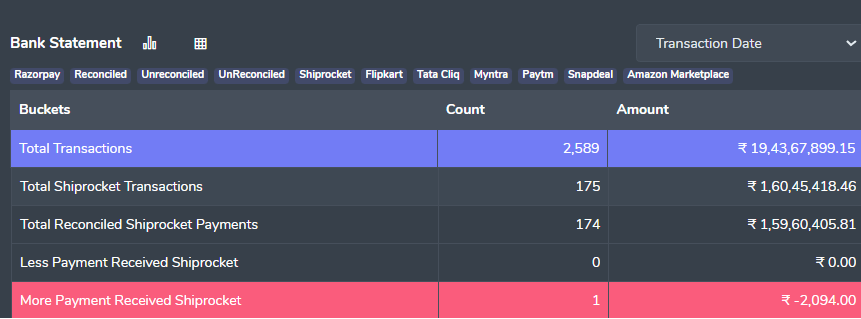

Backward reconciliation

Total Payment Gateway Transactions:

Cointab’s software examines the bank statement to ascertain the total count of transactions processed through the Payment Gateway.

Reconciled Payment Gateway Settlements:

Cointab’s software cross-references the bank statement with the payment gateway report. When the bank credit amount aligns with the promised settlement amount by the partner, the system labels them as “Reconciled.”

Less Payment Received Payment Gateway:

After comparing the bank statement and the payment gateway report if it is seen that the amount of settlement made is less in the bank statement than that recorded in the Payment Gateway report, then that amount is displayed in this row. This feature helps company know by how much they are being underpaid by the payment gateway partner.

Payment Received Payment Gateway:

Cointab’s Software compares the bank statement and the payment gateway report and when the amount of settlement made is more in the bank statement than the payment gateway report then that amount is displayed in this row.

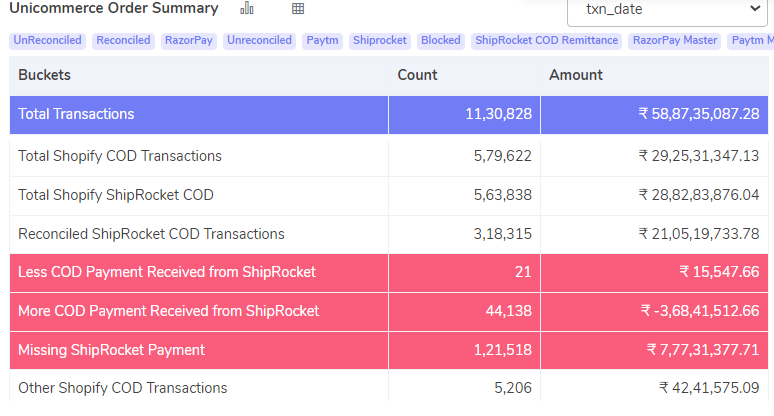

Unicommerce vs COD Remittance:

-

Forward Reconciliation

Reconciled COD Transactions:

This section displays transactions where the sale amount recorded in Unicommerce aligns with the Cash on Delivery (COD) remittance provided by the partner.

Less Payment Received from COD Partner:

This section presents transactions where the sale amount recorded in Unicommerce exceeds the amount recorded in the Cash on Delivery (COD) remittance provided by the partner. This indicates that the partner collected less amount from the customer than required.

More Payment Received from COD Partner:

This section displays transactions where the sale amount recorded in Unicommerce is lower than the amount recorded in the Cash on Delivery (COD) remittance provided by the partner. This indicates that the partner collected more amount from the customer than required.

Missing COD Payment:

This section lists transactions that have been completed but are awaiting payment from the Cash on Delivery (COD) partner.

Backward Reconciliation:

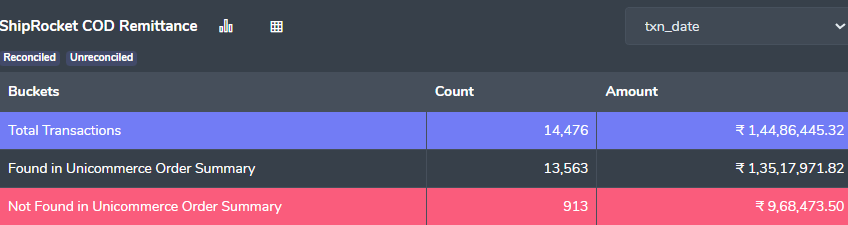

Found in Unicommerce Order Summary:

Cointab cross-references the COD Remittance report with the Unicommerce Software, displaying matched orders in this section. This feature highlights postpaid orders that have been fulfilled, with payments received from the COD partner.

Not found in Unicommerce Order Summary:

Cointab compares the COD Remittance report with the Unicommerce Software, showing orders not found in the Unicommerce software after comparison in this section.

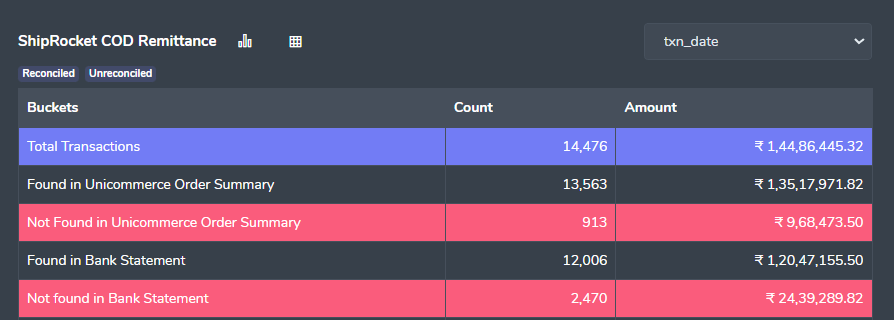

COD Remittance vs Bank Statement:

-

Forward Reconciliation

Found in Bank Statement:

Cointab’s software compares the COD Remittance Report with the Bank statement, displaying orders paid for that are found in the Bank statement within this bucket. This value indicates post-paid orders that the company has fulfilled and received payment from the COD partner. This analysis is crucial as it informs the company about orders for which payments have been successfully processed

Not Found in Bank Statement:

Cointab’s software compares the COD Remittance Report with the Bank statement, displaying orders not found in the bank statement within this bucket. This value represents post-paid orders that the company has fulfilled but has not yet received payment for from the COD partner. By highlighting this value, the company identifies precisely which order payments require further scrutiny.

-

Backward Reconciliation

Total COD Transactions:

Cointab’s software compares the Bank statement with the COD Remittance Report, and the total amount of remittance received via courier partners is displayed in this box.

Total Reconciled COD Payments:

Cointab’s software compares the Bank statement with the COD Remittance Report, and when the transaction amounts match in both reports, that value is displayed in this bucket. These represent fulfilled orders for which the company has received payment from the COD partner.

Less Payment Received from COD Partner:

Cointab’s software compares the Bank statement with the COD Remittance Report, and settlements where the amount received in the bank statement is less than the one recorded in the COD remittance report are displayed in this bucket. This feature indicates the amount still pending to be paid by the COD partner..

More Payment Received from COD Partner:

Cointab’s software compares the Bank statement with the COD Remittance Report, and settlements where the amount received in the bank statement exceeds the one recorded in the COD remittance report are displayed in this bucket. This analysis highlights the excess amount received from the COD partner.

Reconciliation Result:

Presented in the tables above is the output generated by Cointab’s Software after processing the information. The entire reconciliation process, starting from the Shopify report, Unicommerce Report, Payment Gateway, COD Remittance, to the Bank Statement, is categorized under their respective headers. The Cointab report is designed in a straightforward, user-friendly format. By leveraging this software, your business can ensure that all internal data aligns with the information received from partners. The output is provided with appropriate highlights, allowing the finance team to identify and address any issues. Otherwise, these errors may go unnoticed and accumulate, resulting in significant losses.

If you’re seeking to enhance the efficiency and accuracy of your business operations, Cointab’s software would prove to be a valuable asset.