In this age of digital commerce, building an online store can be quite a challenge, especially for a small company. So, services like Shopify help people build their online stores. It’s not just useful for new companies as more advanced businesses may also stand to benefit from the features available! If you have your own company, it makes sense to let someone else handle things like building the store site and maintaining its security etc. So that you can focus on the core competencies of the firm.

Shopify facilitates the selling, delivery and promotion of your products too. Although companies that use Shopify need to pay a subscription price for their products or services to be available on this platform it is worth it, as long as the yield from taking Shopify’s help to build a website leads directly back into improving your company, its overall potential and generating more sales.

An e-commerce company may receive a large number of orders daily. Which if not handled in the right way, could lead to great financial losses over time. Businesses use different payment gateways and different Cash on Delivery vendors depending on what’s easily accessible to them. Evaluating the payments made by all these vendors and determining any missing orders tends to be extremely difficult. Different partners deliver reports in various formats which complicates the process even more. Hence checking if the amounts charged by all vendors are accurate or if there are any invalid reports is tiresome.

RECONCILIATION PROCESS

Scope / Entities

- Shopify

On the Shopify site , customers purchase the things they need which they add to the cart. From thereon they are directed to the payment page. They choose their preferred method of payment from the options given which are Payment gateway and COD. The orders placed on the site recorded by Shopify in its report.

- Payment gateway

Debit card, credit card, net banking etc. are authorized for online payments through the payment gateway.

Our software checks and compares the payment gateway report against the Shopify report and the bank statement. This is to make sure the amounts are paid correctly by the Payment Gateway partner.

- COD remittance

The cash-on-delivery option is a post-paid option that lets customers pay once the order is delivered. However to enable this option e-commerce companies to partner with a COD vendor. The vendor then collects the cash on delivery and transfers it to the company’s bank account later. The payments are recorded in the COD remittance report.

The Shopify Report and the bank statement are reconciled with the COD remittance report to verify if right payments are made.

- Bank Statement

A company carries out many transactions, so it’s vital to determine if the expected settlement amount from the COD and PG vendors is deposited into the bank account. Hence the Bank statement is reconciled against the Shopify report, Payment Gateway report and the COD remittance by Cointab’s software

Reports Used for Reconciling:

- Shopify order report

This report keeps a record of all the orders placed on the Shopify website during a given period of time. It is used to reconcile against the Payment Gateway report or COD remittance report.

- Payment gateway settlement report

This report is used to reconcile with the bank statement and the Shopify report

- Payment gateway rate card

This is the rate card that consists of the tax rates to be charged on every purchase made by customers through the payment gateway.

- COD remittance reports from courier partner

This report is a record of all the payments made by customers through the Cash on delivery method which the COD partner has to pay back to the company.

- Bank statements

This is used to check if payment gateway or COD partners have paid the promised amount to the company’s bank account

Shopify vs Payment Gateway (Example- Razorpay)

Forward Reconciliation

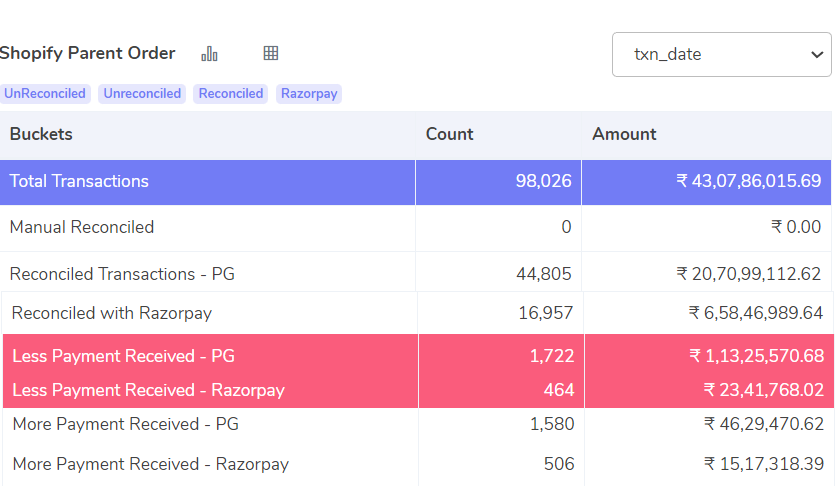

Reconciled Transactions – PG:

Our Software compares the Shopify report and the Payment Gateway report and shows the orders for which the company will receive payments for the orders completed.

Less Payment Received in PG:

Our software compares the Shopify report and the Payment Gateway report to determine whether the payments received were less than what was promised.

More Payment Received in PG:

This box indicates that the amount recorded in Shopify is less than the amount recorded by the payment gateway. This bucket determines whether customers have paid more through the payment gateway, which allows the company to provide faster assistance to customer problems if the amount is known ahead of time.

Backward Reconciliation

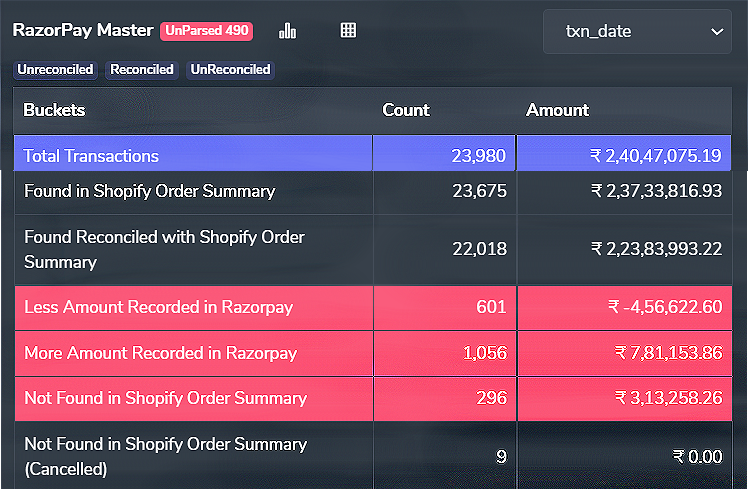

Found in Shopify Order Summary

Here our Software compares the payment gateway report with the Shopify report and the orders found in the Shopify report are displayed here. These are the prepaid orders which are fulfilled for which the company will receive payment.

Found Reconciled with Shopify Order Summary

Cointab’s software compares the payment gateway report to the Shopify report, and orders that match are displayed in this box. This feature displays completed orders that have been appropriately paid for.

Less Amount Recorded in Payment Gateway

In this bucket, our software compares the payment gateway report to the Shopify report and displays orders for which less payments are recorded in the Payment Gateway report than in the Shopify report. This feature assists the company in determining which orders still require payment.

More Amount Recorded in Payment Gateway

In this box, Cointab’s Software compares the payment gateway report to the Shopify report. The orders for which the company received an additional amount from the payment gateway are shown here. Allowing them to properly maintain their accounts or reimburse the additional amount.

Not found in Shopify Order Summary

This box displays orders that were not found in the Shopify report after comparing the payment gateway report with the Shopify report. This informs the company of orders that are not completed but, the payment for those orders has been received. This is an important value because failing to fulfil customers’ orders that they have already paid for will cost the company valuable customers.

Not found in Shopify Order Summary (Cancelled)

Here the software compares the payment gateway report with the Shopify report. It shows the post-paid orders, that would not be fulfilled as they are not recorded in the Shopify report but then these orders were cancelled so no problems occur.

Payment Gateway Fee Verification

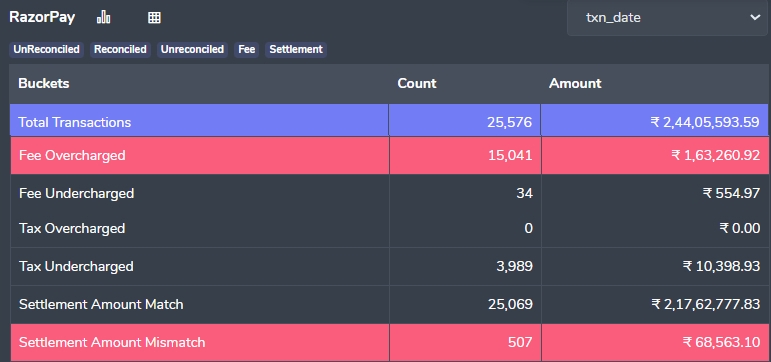

Fee Overcharged:

Cointab’s software checks the payment gateway report and shows in this row when the fee charged is more than the amount decided beforehand.

Fee Undercharged:

Our software checks the payment gateway report and shows the company undercharged amount so the company can keep a track of it to avoid underpaying which would be a violation of the agreement.

Tax Overcharged:

The bank account settlement amount is used to verify if tax is charged more. The tax is calculated using the GST and the fee. If the tax amount exceeds the settlement amount, the overcharged amount is calculated and presented in this bucket.

Tax Undercharged:

The transactions where the tax charged by the Payment Gateway is less agreed upon rate are displayed here. The tax is calculated using the GST and the fee. The payment gateway report is used to verify if tax is charged more. If the tax amount exceeds the settlement amount, the undercharged amount is calculated and presented in this box.

Settlement Amount Match:

Our software checks the payment gateway report and shows the number of transactions and the expected settlement amount received from Payment Gateway. This feature helps to see and verify how much of the settlement amount is actually received.

Settlement Amount Mismatch:

This buket shows the transactions where the expected settlement amount and amount actually received from Payment Gateway is different. The total amount of mismatch is shown in the corresponding box. This helps avoid underpayment and receive the amount due because if gone undetected might accumulate and lead to huge losses.

Payment Gateway vs Bank Statement

Forward Reconciliation

Settled in Bank Account:

This row shows the transactions for which the settlement amount is received in the bank. This helps companies to keep a track of the number of payments made and the amount received from the payment gateway partner that reaches the bank.

Not Settled in Bank Account:

This row shows the transactions for which the settlement amount is not received in the bank. This helps the company to know the number of transactions that have to still be made to the company’s bank account from the payment gateway partner.

Backward Reconciliation

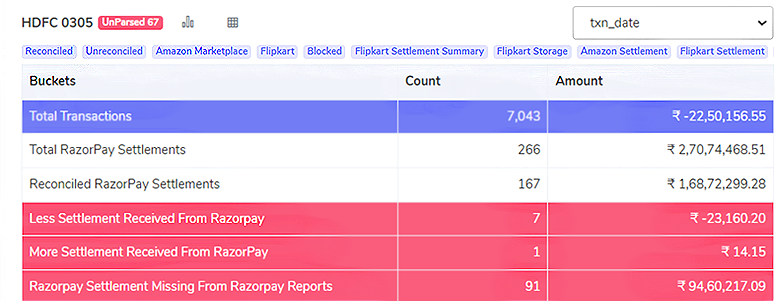

Total Payment Gateway Settlements:

This shows the total amount of transaction settlements that the payment gateway has made.

Reconciled Payment Gateway Settlements:

Cointab’s software compares the bank statement to the payment gateway report, the transactions that are same in both reports are reconciled. So these transactions are presented in this row.

Less Settlement received by Payment Gateway

The amount of settlements made in the bank statement is less than that recorded in the Payment Gateway report after comparing the bank statement and the payment gateway report, then that amount is displayed in this row. This feature informs the company of how much is paid less by the payment gateway partner.

More Settlement received by Payment Gateway

The settlements in the bank statement is more than that recorded in the Payment Gateway report, that amount is displayed in this row. This feature informs the company of how much is overpaid by the payment gateway partner.

Payment Gateway Settlements Missing from Payment Gateway:

The Cointab Software compares the bank statement and the payment gateway report, and when payments on a few orders still to be made they are as indicated in this bucket.

Shopify vs COD Remittance (example: Ship Rocket)

Forward Reconciliation

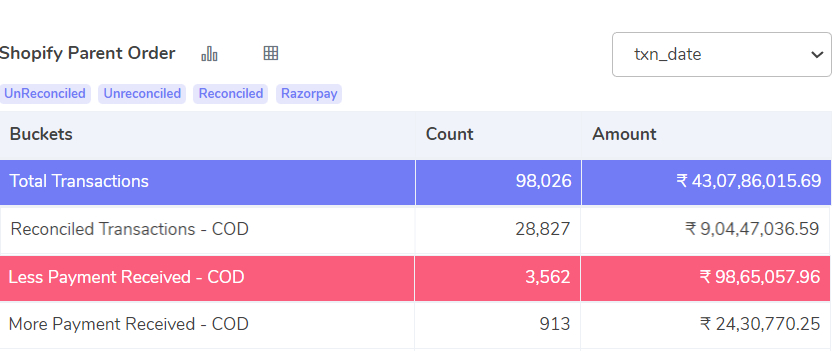

Reconciled Transactions – COD:

Our software compares the Shopify report and the COD remittance report and shows that the amount recorded by Shopify and the amount recorded by the COD partner matched. This shows that the company will receive payments from the COD partner for the orders fulfilled.

Less Payment Received in COD:

When the amount recorded in Shopify exceeds the payment gateway amount, it means that the payments received were less than what was expected. That amount is displayed here.

More Payment Received in COD:

When the sale amount recorded in Shopify lesser than the payment gateway amount, it means that the payments received were more than what was expected, which is shown here.

Backward Reconciliation

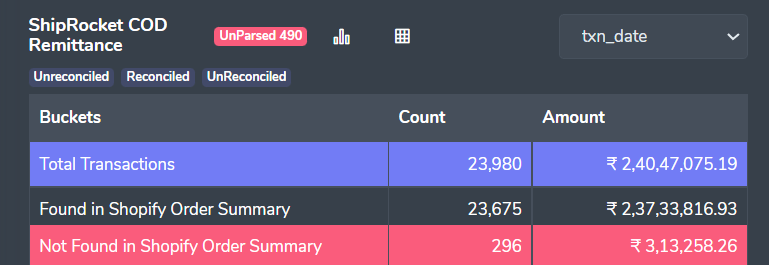

Found in Shopify Order Summary

Cointab compares the COD Remittance report to the Shopify report, and the matching orders are displayed in this row. This bucket displays the post-paid orders that were completed and for which the company received payment from the COD partner.

Not found in Shopify Order Summary:

Our compares the COD Remittance report to the Shopify report. Orders that are not found in the Shopify software are displayed in this row. It displays the unfulfilled post-paid orders for which the company has got payment from the COD partner. As a result, the company must physically review these transactions.

COD Remittance vs Bank Statement

Forward Reconciliation

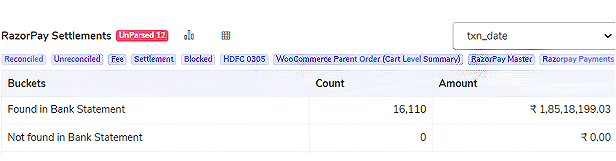

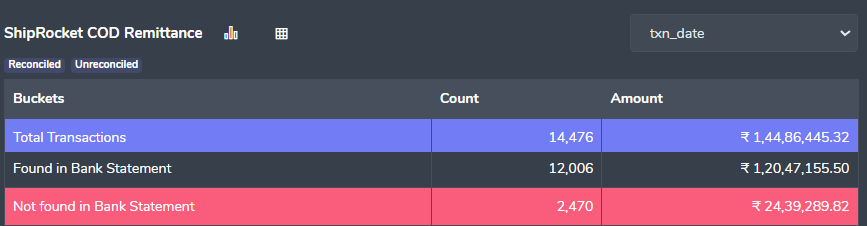

Found in Bank Statement:

This bucket represents the post-paid orders that the company has completed and for which they have received payment from the COD partner. Hence, this is important because it informs the company which orders payments were completed correctly.

Not Found in Bank Statement:

The COD remittance Report is evaluated by comparing it with the Bank statement by Cointab’s software. The orders paid for in the Bank statement are displayed in this box. This value represents the post-paid orders that the company has completed and for which they have not received payment from the COD partner.

Backward Reconciliation

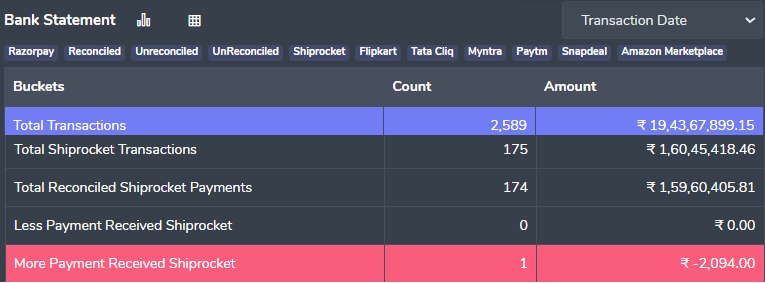

Total COD Transactions:

The transactions recorded in the bank account which are post paid, completed and obtained payment from the COD partner are shown here.

Total Reconciled COD Payments:

The transactions which are same in the Bank statement and the COD remittance report are said to be reconciled are displayed in this box.

Less Payment Received from COD Partner:

The amount shown in the Bank Statement is less than the one recorded by the COD partner. It indicates that the payments received are less than what was expected to be received from the COD partner in the company’s bank account which is shown in this box

More Payment Received from COD Partner:

Comparing the Bank statement with the COD remittance Report, the payment amount reflected in the Bank Statement is greater than the amount recorded in the COD remittance report. It shows that more payments have been collected than the exact value from the COD partner.

RECONCILIATION RESULT:

The above result tables show the output generated by Cointab’s software which integrates Shopify report- Payment gateway- COD Remittance- Bank Statement. After which it produces a complete output consisting of the necessary information that can be used by the Finance department of the company. After receiving the output the finance departments can analyze the result and can track the payments made, the taxes and the fees charged.

So if you are interested and want to make your business more efficient to improve its overall performance then Cointab’s Software will be a good fit for you!

Click on any other Shopify Reconciliation processes to view them.

Shopify – Unicommerce

Shopify – EasyEcom

Get Started with Cointab!

Why Choose Cointab?

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensure precise reconciliation, rid of human errors and discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.