As a business, continual growth and increased profitability are primary objectives. Despite being strategically positioned in a thriving market or having widespread brand recognition, there are inherent limits to your reach. This is where online selling becomes crucial. Leveraging platforms such as your own website or well-known marketplaces like Flipkart, Amazon, or Myntra enables businesses to significantly expand their customer base.

Selling online opens up access to a wider audience, crossing geographical boundaries and gaining visibility among consumers in different cities across India. Additionally, it provides convenience to shoppers in remote areas, allowing them to quickly buy desired products and enjoy doorstep delivery. As a result, online selling not only attracts more customers but also boosts overall profitability.

Nevertheless, similar to any business venture, online selling comes with its own set of obstacles. One notable challenge revolves around accurately assessing the varied fees levied by online marketplaces such as Flipkart. Imagine a situation where a business sells around 100,000 products on Flipkart every month, averaging Rs. 500 per order, resulting in a monthly revenue of Rs. 5 crore. If Flipkart imposes fees amounting to 40% of this revenue, the total monthly fee sums up to Rs. 2 crore.

A mere 5% discrepancy in fee calculations could mean an extra expense of Rs. 10 lakh per month for the business. Given the complexity of these charges, carefully examining each transaction becomes increasingly difficult. With a multitude of orders to handle, ensuring the accuracy of each fee becomes a formidable undertaking.

This is where the importance of Cointab’s Automated Reconciliation System lies, as it simplifies the verification process. By automatically cross-checking charges, Cointab’s software reduces the need for manual verification, enabling businesses to focus on sales activities. The software efficiently handles data loading, cleaning, and reconciliation, guaranteeing the precision of fees imposed by Flipkart. In cases of overcharging, the system quickly identifies discrepancies, allowing the finance team to raise disputes and reclaim any overcharged amounts promptly.

The Reconciliation of Flipkart Charge verification is done as follows:The reconciliation process for verifying Flipkart charges proceeds as outlined below:

Shipping Fee verification:

The shipping fee calculation entails comparing weights supplied by Flipkart with those in the SKU master data (i.e., weights specified by the client). The weight reported by Flipkart is compared to the weight derived from the Client SKU, with the higher value being deemed the final weight.

Flipkart regards the higher value between volumetric weight and gross weight as the final weight.

Every order is categorized into a weight slab according to Flipkart’s reported weight, and a rate card is generated accordingly. Utilizing this rate card, the shipping fee is computed and subtracted from the Flipkart shipping fee to derive the final results.

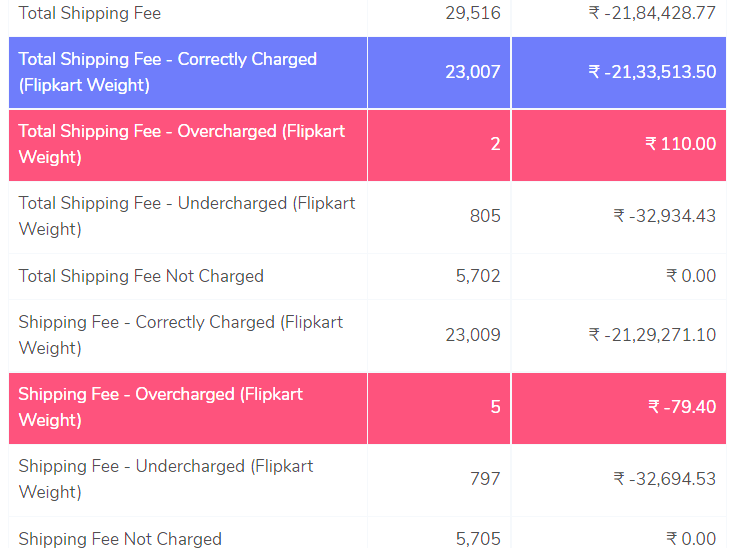

Based on Flipkart’s reported weight:

Every order is allocated to a weight category based on Flipkart’s reported weight, and a rate card is formulated accordingly. The shipping fee is then determined using this rate card and subtracted from the Flipkart shipping fee to yield the final results.

Based on Client SKU weight:

The client’s SKU weight (supplied by the client) is employed for calculation, taking into account both gross weight and volumetric weight determined from product dimensions. Like the preceding process, orders are sorted into weight categories, and a rate card is formulated for fee computation. This is then subtracted from Flipkart’s shipping fee to yield the results.

The Results are calculated as follows:

- If the shipping fee calculated based on our rate card matches Flipkart’s shipping fee, it is considered the Correct Shipping fee.

- If Flipkart’s shipping fee surpasses our calculated fee based on the rate card, it qualifies as an Overcharged Shipping fee.

- On the contrary, if Flipkart’s shipping fee is less than our calculated fee based on the rate card, it indicates an Undercharged Shipping fee.

The Result shown is as below:

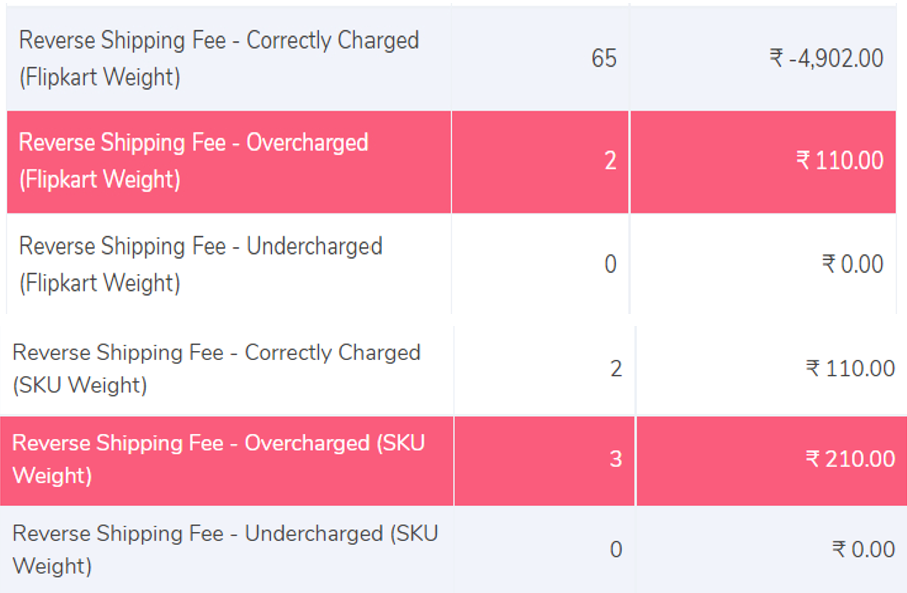

Reverse Shipping Fee

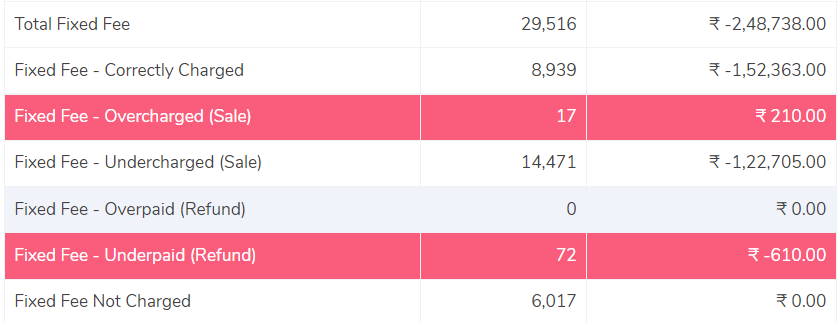

Fixed Fee

The Fixed Fee is determined according to the order’s item price. This fee is reimbursed to the merchant if Flipkart refunds the order to the customer. There may be exceptions if Flipkart is running promotional offers for sellers, in which case this fee might be waived. A rate card is created to compute the Fixed Fee for each order. Once the Fixed Fee is calculated, we subtract it from the fixed fee reported by Flipkart to identify any differences. Similar to the procedure for the Shipping fee, a result page is generated for the Fixed Fee, and we verify if the fee is reimbursed by the company.

For Sale Orders

- If Flipkart’s charged fee aligns with our calculated fee from the rate card, the order is deemed Correctly Charged.

- If Flipkart’s charged fee surpasses our calculated fee from the rate card, the order is classified as Overcharged.

- If Flipkart’s charged fee is less than our calculated fee from the rate card, the order is classified as Undercharged.

- In instances where the Fixed Fee is not applied by the company, we will designate these orders as Fixed Fee Not Charged.

For Return Orders

- In cases where the Fixed Fee is not imposed by the company, we will mark these orders as Fixed Fee Not Charged.

- If Flipkart’s charged fee aligns with our calculated reimbursement fee from the rate card, the payment is deemed Correct.

- If Flipkart’s charged fee surpasses our calculated reimbursement fee from the rate card, the payment is labeled as Overpaid.

- If Flipkart’s charged fee is lower than our calculated reimbursement fee from the rate card, the payment is categorized as Underpaid.

The result is shown below:

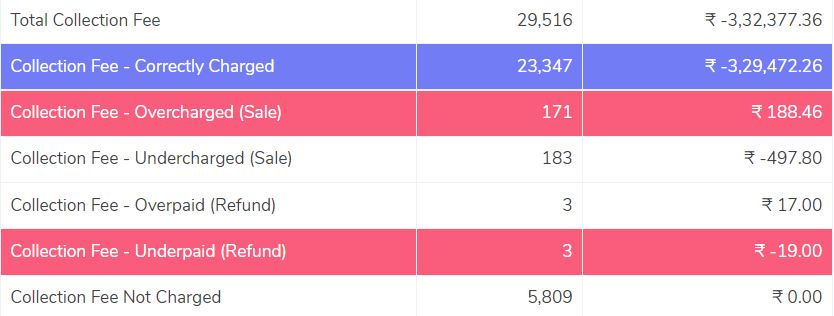

Collection Fee

Flipkart applies the Collection Fee based on the item price and reimburses it if the order is refunded to the customer. This fee may be waived during promotional offers for sellers.

The fee fluctuates based on the transaction:

- For Prepaid Orders, Flipkart levies a 2% charge on the Sale Amount.

- For Post-paid orders with item prices below 750, Flipkart imposes a flat fee of Rs. 15.

- For item prices exceeding 750, they apply a charge of 2% of the Sale Amount.

Using this information, we establish the rate card, calculate the Collection fee, and then deduct it from the Flipkart Collection Fee.

The result is shown below:

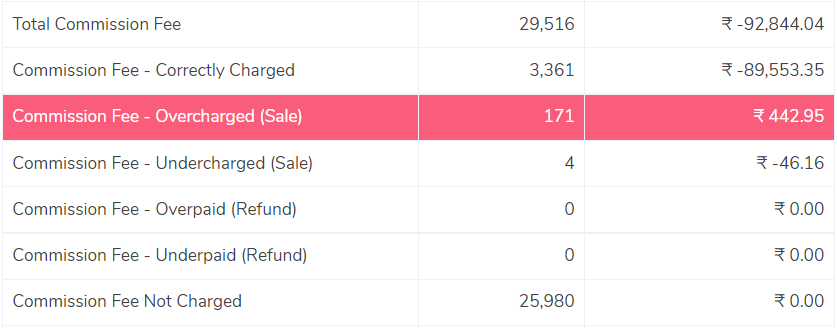

Commission Fee

To compute the Commission Fee, we utilize the fee imposed by Flipkart, which is determined by the product category and the item price. Flipkart charges a certain percentage of the Sale amount.

The Settlement Report specifies the percentage charged for each item. This fee is reimbursed by Flipkart if the order is refunded to the customer. If Flipkart is offering any promotional offers for sellers, they may waive this fee.

To determine this fee, we multiply the Sale amount by the commission rate provided by the company.

Likewise, the displayed result will be as follows: :

Flipkart also imposes additional fees such as installation, pick and pack, tech visit, etc. These fees will be consolidated into a single line in the results labeled ‘Other Misc. Fees’.

To see the Marketplace reconciliation process (click here).

Get started with Cointab!

Why Choose Cointab?

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensure precise reconciliation, rid of human errors and discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.

Recent Posts

- A Detailed Overview of Blackline Account Reconciliation

- How Account Reconciliation Software Helps Manage Financial Clarity

- Best Bank Reconciliation Software for Small and Medium Enterprises (SMEs)

- Reconcile Finance: Tools to Streamline Your Financial Operations

- Financial Reconcile: Simplifying the Process with Automation