Empowering Australian Small Businesses with Streamlined Payments

Pin Payments offers a reliable and efficient payment processing solution for Australian small businesses. It simplifies everyday transactions, allowing businesses to focus on what they do best. However, with millions of transactions processed daily, reconciling Pin Payments transactions can become time-consuming. Maintaining accurate financial records is crucial, and timely reconciliation helps prevent inconsistencies.

Cointab Reconciliation:

The Solution for Faster and More Accurate Reconciliations

Cointab Reconciliation streamlines the Pin Payments reconciliation process, boosting your finance team’s efficiency. Our customizable software automates data entry and meticulously compares Pin Payments invoices with various reports, including:

- Bank Statements

- ERP Reports

- Website Reports

- Other Platform Reports

This comprehensive comparison helps identify errors and overcharges, ensuring the accuracy of your financial data and safeguarding your business from potential losses.

Essential Reports for Verifying Pin Payments Charges

To guarantee accurate reconciliation, utilize the following reports:

Pin Payments Payment Report:

This report details the payment methods used through the Pin Payments gateway.

Pin Payments Rate Card:

This document outlines the fees, percentages, and rates charged for transactions.

Result

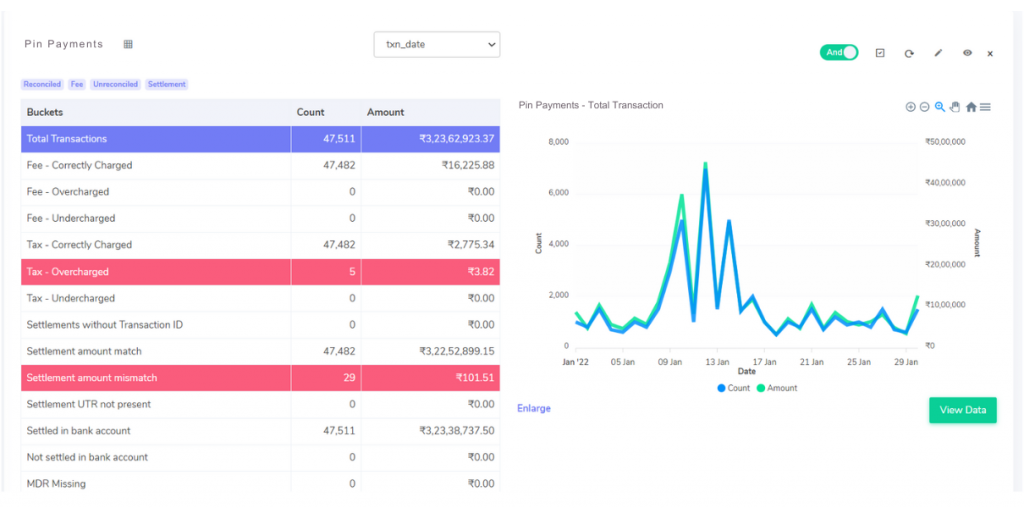

Reconciliation Results: Identifying Discrepancies

The reconciliation process helps identify various scenarios:

Fee Correctly Charged:

The fee matches the rate card, confirming an accurate charge.

Fee Overcharged:

The charged fee exceeds the calculated amount based on the rate card.

Fee Undercharged:

The charged fee falls below the calculated amount based on the rate card.

Tax Correctly Charged:

The tax amount aligns with the rate card and the Pin Payments settlement report.

Tax Overcharged:

The tax amount in the payment report is higher than the calculated amount.

Tax Undercharged:

The tax amount in the payment report is lower than the calculated amount

Settlement Amount Match:

The settlement amount (total amount minus fees and tax) matches the Pin Payments settlement report, indicating accurate processing.

Settlement Amount Mismatch:

The calculated settlement amount doesn’t match the Pin Payments settlement report, signifying a discrepancy.

Settled in Bank Reconciliation:

Transactions are present in both the bank statements and the Pin Payments settlement report.

Not Settled in Bank Reconciliation:

Transactions exist only in the Pin Payments settlement report, not reflected in bank statements.

Cointab Reconciliation: Your Gateway to Financial Efficiency

Cointab Reconciliation simplifies data management with exceptional precision. Its automated features guarantee error-free results, while seamless data processing and loading provide a comprehensive view of your transactions.

Leverage Cointab Reconciliation to:

Optimize Operations:

Streamline your reconciliation process and free up valuable time for your finance team.

Ensure Accuracy:

Eliminate errors and discrepancies in your financial data for informed decision-making.

Enhance Charge Verification:

Identify and address any overcharges or undercharges associated with Pin Payments fees and taxes.

Embrace Financial Efficiency Today with Cointab Reconciliation

Reconciling Pin Payments transactions manually can be a tedious and error-prone process. Cointab Reconciliation eliminates this burden, allowing you to focus on running your business. Imagine the peace of mind that comes with knowing your financial records are accurate and up-to-date. Cointab Reconciliation empowers you to make informed decisions with confidence. Don’t waste another minute struggling with manual reconciliation. Sign up for a free trial of Cointab Reconciliation today and experience the difference!

Step into the future of reconciliation. Fill out the form to request your demo now!