Payment Gateway Charges Verification

Verify the fee and tax charged on each order along with the final settlement amount

Features

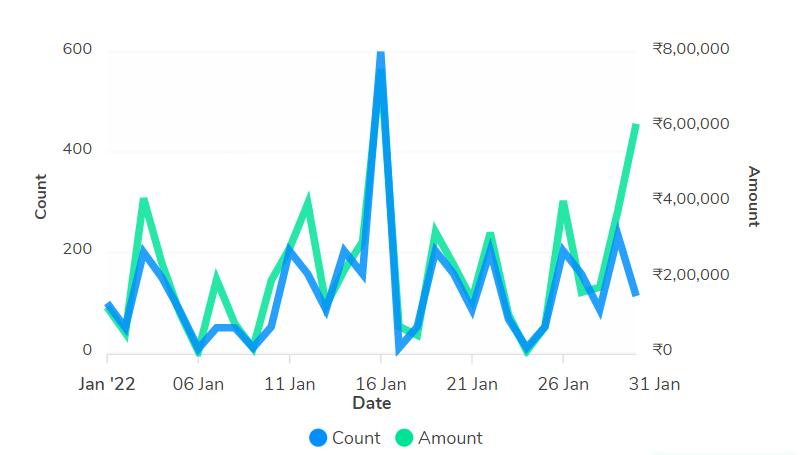

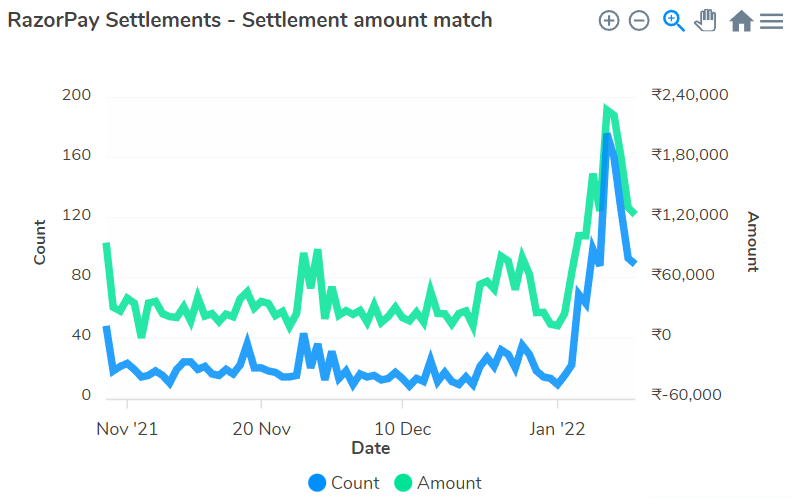

Result

The final result is shown in the form of tables and graphs which makes it easy to analyze for the company

Easy Customize

The input conditions and business rules can be easily customized to project company needs

Secured

The input and export data is a 100% secured and kept confidential

Time Saving

As the reconciliation process carried out is completely automated, data can be reconciled at the click of a button

Verify Your Payment Gateway Charges with Our Automated Reconciliation Software

Verify Your Payment Gateway Charges

It helps easily verify fee charged on each transaction by your payment gateway partner

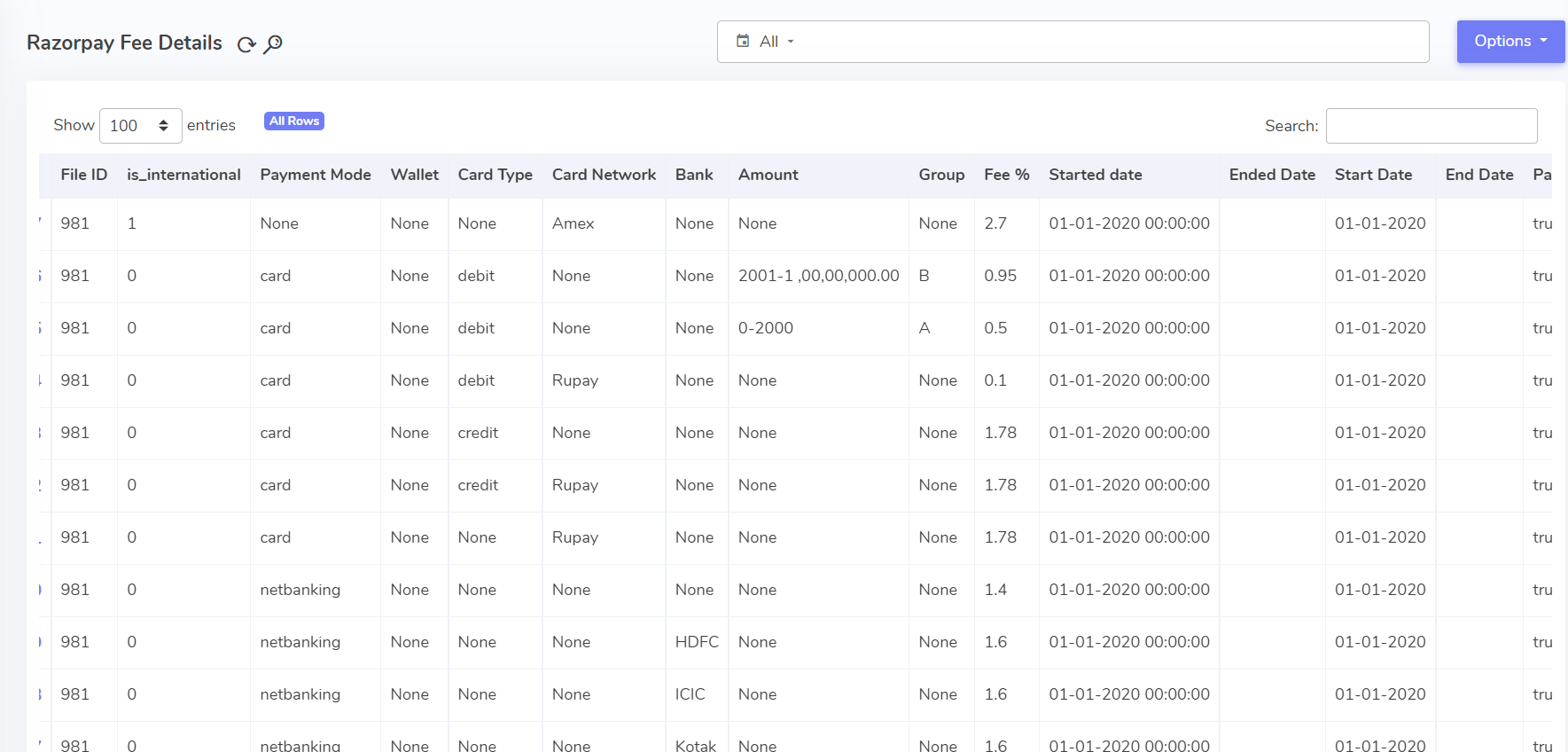

Configure Rate Card

Multiple Rate cards submitted in any format can be configured to match the formulation and business logic

Easy Configuration

Any Form of Rate Card is accepted

Rate Card per payment mode can be configured

Payment Gateway Charges Verification Process

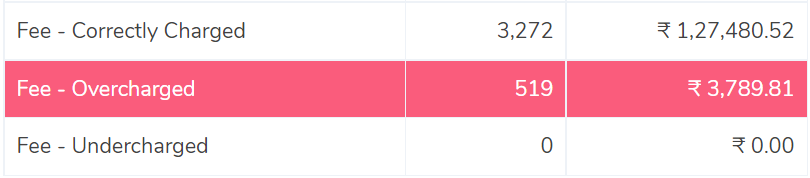

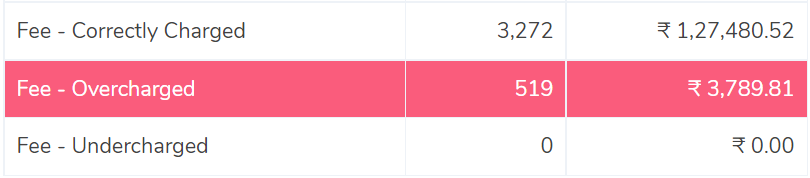

Verify Fee Charged

- Identify the transactions on which the fee amount charged is correct

- Verify if the fee amount is overcharged on any transactions

- Determine the if fee amount charged is wrong on any orders

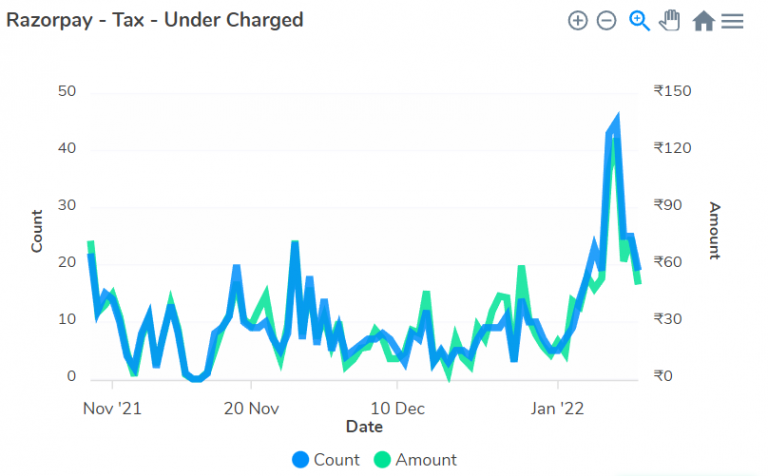

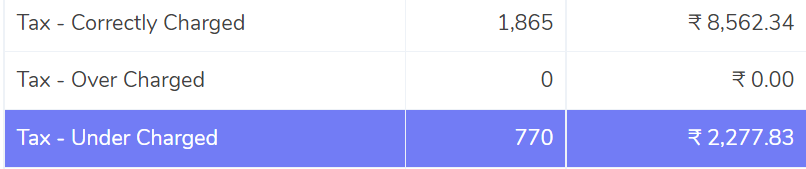

Verify Tax Charged

- Determine the orders on which the tax amount charged is correct

- Verify the tax overcharges on any transactions

- Determine the transactions on which the tax is undercharged

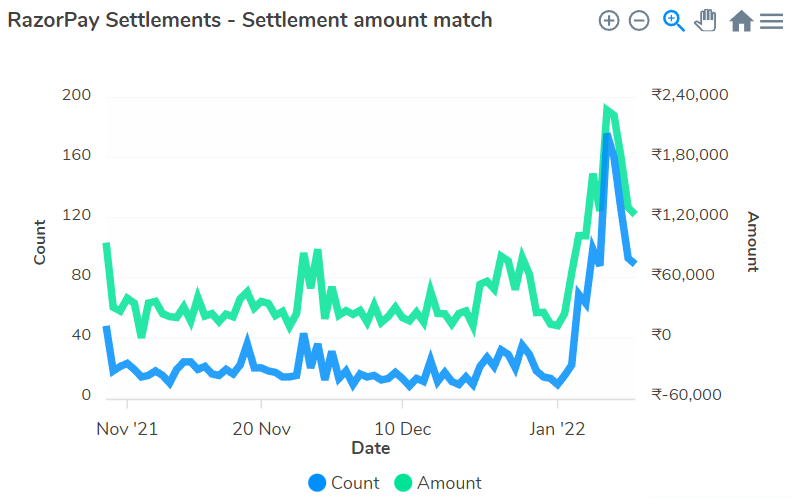

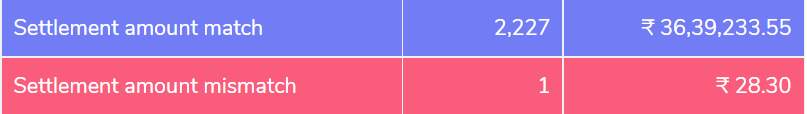

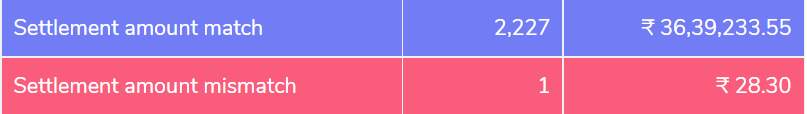

Verify the Settlement Amount

- Verify the transactions for which the final settlement amount is right

- Determine if the final settlement amount is incorrect for any transactions

- Identify the exact settlement amount

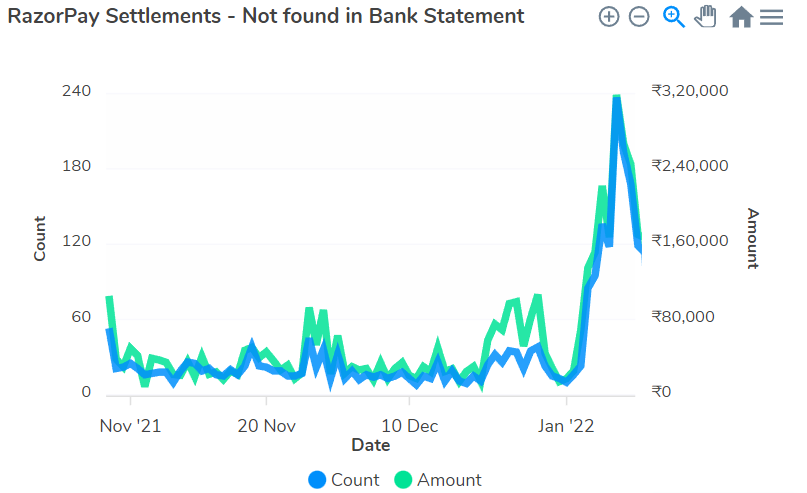

Verify Bank Settlements

- Determine which transactions are settled in your bank account by your Payment Gateway Partner

- Identify the transactions that are still pending to be settled

- Identify the bank settlements made at the UTR level