2Checkout: Streamlined Payments for Businesses of All Sizes

2Checkout is passionate about making online commerce easier for businesses. They provide a secure and user-friendly checkout experience for customers, boosting confidence and conversions.

Their platform allows businesses of all sizes to accept payments for physical and digital products in over 200 countries and multiple currencies. This global reach makes it a versatile solution for businesses with international ambitions.

Partnership with 2Checkout

As a payment gateway, 2Checkout charges fees and taxes for processing transactions. While these deductions are transparent, occasional miscalculations can occur. Manually reconciling these discrepancies can be a tedious task for your finance team.

This rewrite focuses on the benefits for businesses and simplifies the information about fees and potential miscalculations.

Reports Required for 2Checkout Payment Gateway Charges Verification:

2Checkout Payment Reports:

Get a clear view of your sales activity with 2Checkout’s payment reports. These reports show you the total number of transactions and how customers paid (e.g., credit card, debit card, digital wallet). This information helps you understand your customer preferences and optimize your payment options.

2Checkout Rate Card:

The 2Checkout rate card outlines the fees associated with each payment method. This includes the specific payment mode (e.g., Visa, Mastercard, PayPal) and the corresponding fee structure (e.g., a flat fee or a percentage of the transaction amount). Knowing these fees helps you accurately predict your revenue and make informed decisions about your payment processing strategy.

Results:

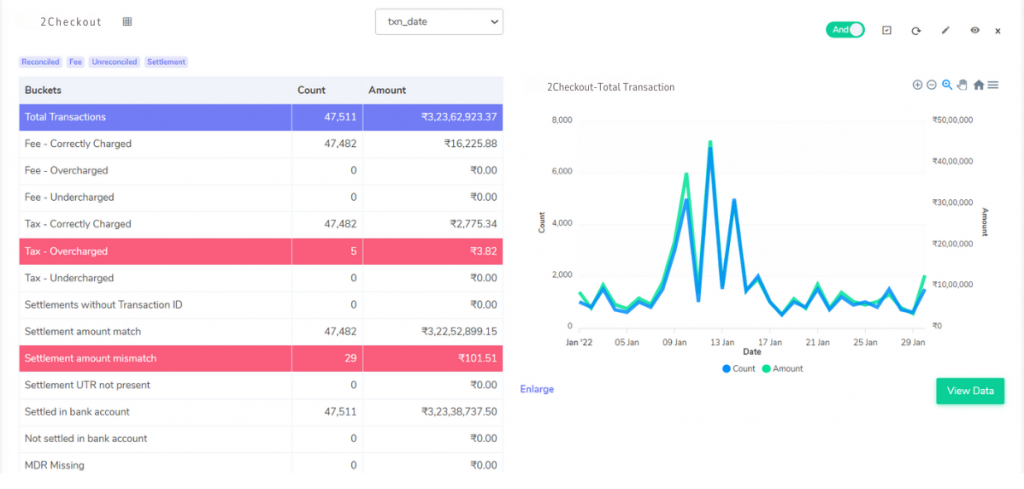

Fee Reconciliation:

Match:

The fees on your 2Checkout report exactly match the amount calculated using the rate card.

Overcharged:

The fees on your report are higher than what the rate card specifies. You may be due a refund.

Undercharged:

The fees on your report are lower than what the rate card specifies. 2Checkout may invoice you for the difference.

Tax Reconciliation:

Match:

The tax amount on your report matches the calculation based on relevant tax guidelines (e.g., GST).

Overcharged:

The tax amount on your report is higher than the calculated amount. You may be due a refund.

Undercharged:

The tax amount on your report is lower than the calculated amount. You may be liable for additional tax payments.

Settlement Reconciliation:

Settlement UTR Missing:

The unique transaction reference (UTR) for a settlement is missing from your report.

Settlement Amount Match:

The settlement amount (total amount minus fees and taxes) you calculate matches the amount on your 2Checkout report.

Settlement Amount Mismatch:

The calculated settlement amount doesn’t match the one on your report. Investigate the discrepancy.

Settled in Bank Account:

The UTR from the settlement report matches a transaction in your bank statement.

Not Settled in Bank Account: The UTR from the settlement report is not found in your bank statement. Investigate the missing settlement.

Consider using automated reconciliation software like Cointab to streamline this process. It can quickly verify transactions, eliminate human error, and identify discrepancies for potential refunds or additional charges. This can save you time and ensure accurate financial records.

By implementing automated reconciliation software, you can ensure the smooth flow of your finances and avoid potential financial losses due to unnoticed discrepancies. This allows you to focus on what matters most – running and growing your business.