Revolut is a global neo-bank and financial technology company that offers banking services, including a payment gateway. One of the significant advantages of Revolut’s payment gateway is its simplicity and ease of use. It helps businesses to quickly set up their payment gateway account and also offers competitive transaction fees, making it an affordable option for businesses of all sizes. Revoluts payment gateway supports transactions in multiple currencies, and it targets mainly the UK and Europe.

As a business when you partner with Revolut, there are certain transactions that are taking place. These transactions include the payments made by the customer. During this process, there might be some discrepancies present, and these miscalculations need to be rectified in order to have error-free transactions, utilizing an automated system will help to reconcile these transactions easily.

Revolut Payment Gateway Reconciliation Results:

Revolut settlement reports:

These reports include the order which has been placed, and for which payments are also processed.

Revolut refund reports:

It consists of the amounts which have been refunded after the order has been cancelled.

Website reports:

The website reports include the orders that have been placed by customers through the website.

ERP reports:

It is the internal report of the company, where the information is placed item-wise.

Bank Statement:

These include the reports of transactions in which the bank has received payment via Payment Gateway.

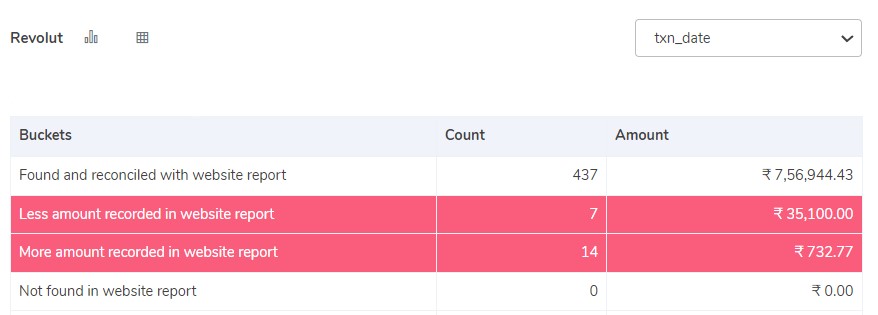

Revolut with website Reconciliation:

Found and reconciled with website report:

These transactions are found and reconciled in the Revolut settlement reports and the website report.

Less amount recorded on website report:

The amount recorded on the website report is less than the Revolut settlement report.

More amount recorded on website report:

The amount recorded on the website report is more than the Revolut settlement report.

Not found in the website report:

These transactions are missing in the website report but are recorded on the Revolut settlement report.

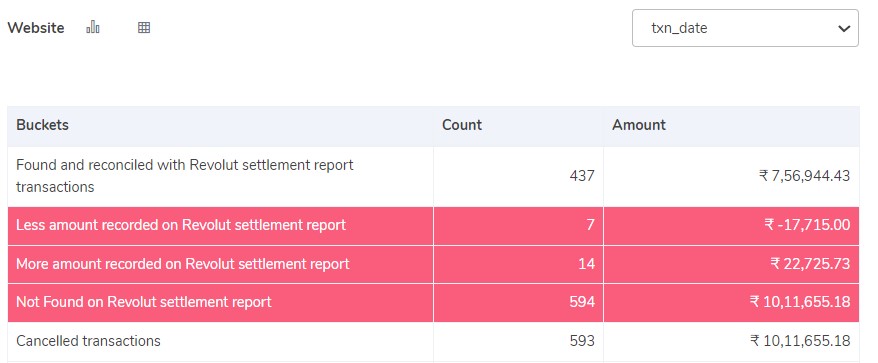

Website with Revolut Reconciliation:

Found and reconciled with Revolut settlement report transactions:

The transactions are found and reconciled on Revolut reports as well as on the website report.

Less amount recorded on the Revolut settlement report:

The amount recorded on the Revolut report is seen to be less than the website report.

More amount recorded on the Revolut settlement report:

The amount recorded on the Revolut report is seen to be more than the website report.

Cancelled transactions:

These consist of the orders which have been cancelled by the customers and are recorded on the website report but have not been recorded on the Revolut settlement report.

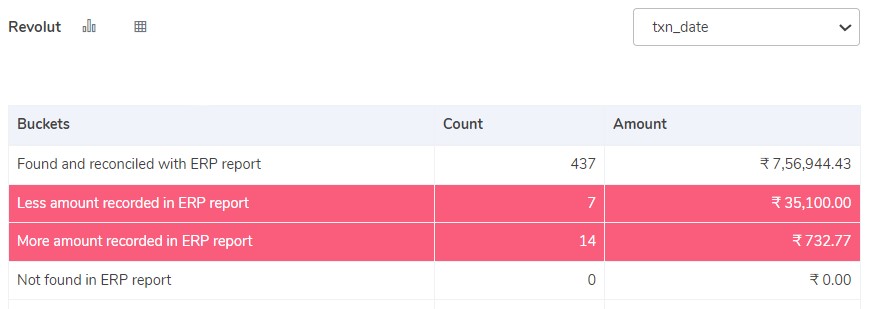

Revolut Reconciliation with ERP:

Found and reconciled with ERP reports:

These transactions have been found and reconciled on the Revolut report as well as on the ERP report.

Less amount recorded on ERP reports:

The amount recorded on the ERP report is less than the Revolut report.

More amount recorded on ERP reports:

The amount recorded on the ERP report is more than the Revolut report.

Not found on ERP reports:

The transactions are missing on the ERP reports, but are found on the Revolut report.

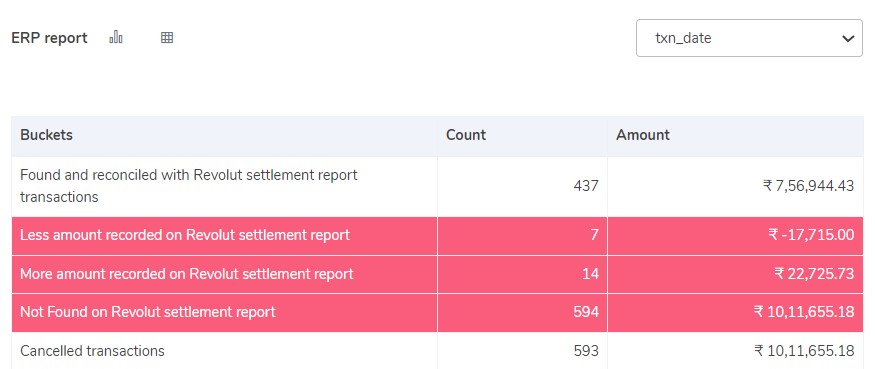

ERP Reports with Revolut reconciliation:

Found and reconciled with Revolut settlement report:

The transactions are found and reconciled on the ERP reports and also on the Revolut settlement reports.

Less amount recorded on Revolut settlement report:

The amount recorded on Revolut settlement reports is seen to be less as compared to ERP reports.

More amount recorded on Revolut settlement report:

The amount recorded on Revolut settlement reports is seen to be more than on ERP reports.

Not found on the settlement report:

The transactions are recorded on ERP reports but not on Revolut settlement reports.

Cancelled transactions:

The transactions are recorded on the Revolut settlement reports, but these orders were canceled by the customers and hence were not recorded in the ERP reports.

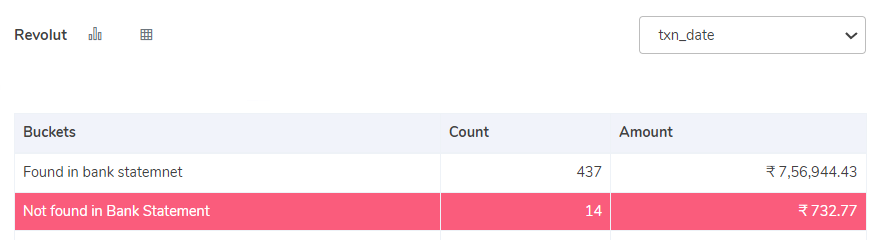

Revolut with Bank reconciliation:

Found in bank statement:

The transactions are found on bank statements and on Revolut settlement reports.

Not found in bank statement:

These transactions are found on Revolut settlement reports, but not on the bank statements.

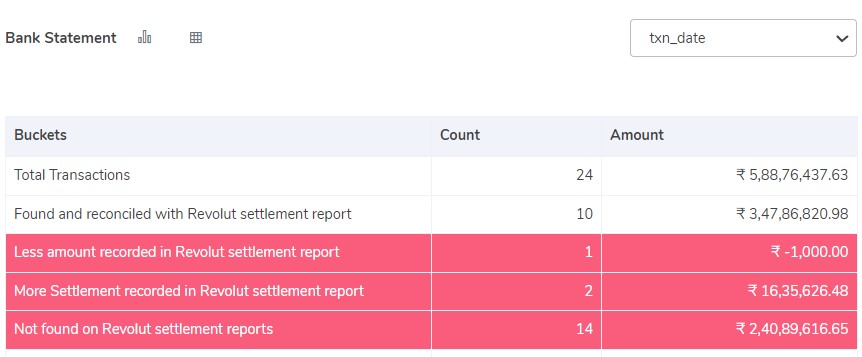

Bank reconciliation with Revolut:

Found and reconciled with Revolut settlement report:

The transactions are found and reconciled on the bank statement and the Revolut settlement reports.

More amount recorded on Revolut settlement report:

The amount recorded on Revolut settlement reports is seen to be more as compared to the bank statement.

Less amount recorded on Revolut settlement report:

The amount recorded on Revolut settlement reports is noticed to be less as compared to the amount on the bank statement.

Not found on Revolut settlement report:

The transactions are not found on Revolut settlement reports but are present on the bank statement.

As we can see from the above results, how upgrading to automated software can help you to reconcile your transactions with the utmost accuracy. You can easily verify the settlement report, refund report, website report, ERP report and bank statements, etc. And if any discrepancies are arising then the above-provided result will help you to make a claim with Revolut. With the help of the software, the reconciliation process can be efficiently carried out.