In today’s thriving e-commerce environment, fostering a seamless customer experience is paramount. Stripe, a leading payment gateway solution, empowers businesses of all sizes to accept a wide range of payment methods – credit cards, debit cards, digital wallets, and bank transfers – with ease. This translates into a familiar and trusted checkout process for your customers, minimizing friction and maximizing conversion rates. However, managing the complexities of transaction fees and taxes, particularly for businesses experiencing high daily sales volumes, can quickly become a burden. Even minor discrepancies can lead to significant financial losses.

Introducing Cointab, the automated reconciliation software that eliminates these reconciliation headaches. Cointab streamlines the entire process, freeing your valuable finance team from the tedious tasks of manual data entry and verification. This translates into significant time savings and increased efficiency, allowing your team to focus on higher-value activities that drive business growth. Furthermore, Cointab ensures the utmost accuracy in your financial records, fostering confidence in your financial data and empowering you to make informed decisions.

By integrating Stripe with Cointab, you unlock a winning combination – a frictionless payment experience for your customers coupled with effortless reconciliation, empowering you to focus on what matters most: scaling your business and achieving your financial goals.

Essential Reports for Seamless Verification:

Stripe Payment Report: This report provides a detailed breakdown of each transaction, including date, amount, tax, payment method, and issuing bank details.

Stripe Rate Card: Stay informed about current fee structures with easy access to your Stripe rate card information.

Effortless Analysis of Stripe Transactions:

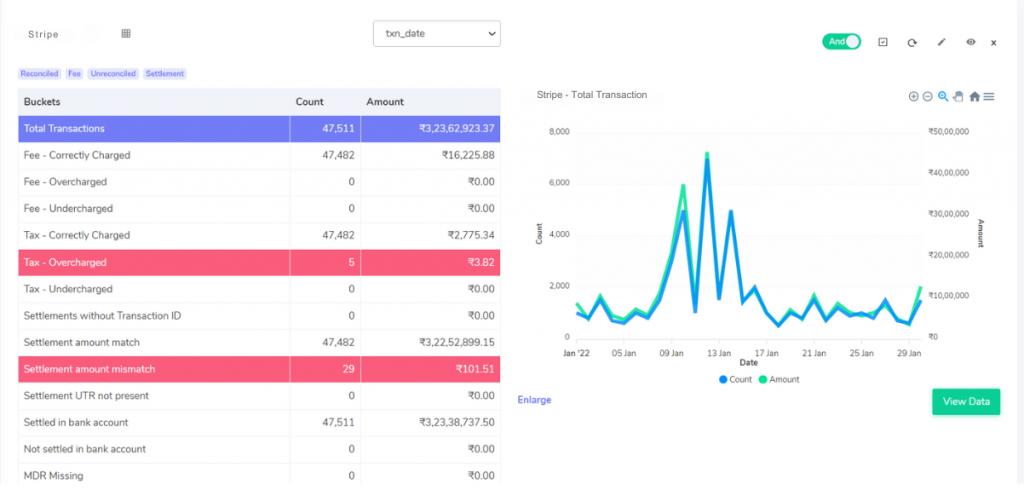

Cointab simplifies the process with a user-friendly interface. This interface provides a crystal-clear breakdown of key transaction metrics like fees, taxes, and settlement amounts. Imagine the time saved and the strategic edge gained by having complete visibility into your Stripe transactions! Cointab eliminates manual analysis and errors, boosting efficiency and empowering data-driven decision-making. Focus on your business while Cointab handles Stripe reconciliation complexities.

Stripe Payment Gateway Fee Verification Result

Fee Accuracy:

Fee Correctly Charged: This status signifies a perfect match between the fee calculated by Cointab and the fee amount listed on your invoice. These transactions represent a seamless alignment between your agreed-upon rate and the actual charges applied.

Fee Overcharged: Cointab identifies potential overcharges in these instances. The software compares its fee calculations to the invoice amount, highlighting discrepancies that could be impacting your bottom line. By promptly addressing these overcharges, you can safeguard your financial resources.

Fee Undercharged: Conversely, Cointab identifies orders where the software calculates a higher fee than the amount charged on the invoice. These situations might indicate missed revenue opportunities. Cointab empowers you to ensure you are collecting the appropriate fees and minimizing potential revenue leakage.

Tax Accuracy:

Tax Correctly Charged: Transactions in this category represent instances where the tax amount on the invoice (typically 18% GST on the fee) perfectly aligns with Cointab’s calculations. This confirms that taxes are being applied accurately.

Tax Overcharged: Similar to fee overcharges, Cointab identifies situations where the tax amount on the invoice exceeds the tax calculated using the correct rate. These discrepancies could lead to excess tax payments. By leveraging Cointab’s insights, you can potentially recover any overpaid taxes.

Tax Undercharged: Orders with potential tax undercharges are identified by the software. Addressing these discrepancies helps ensure compliance with tax regulations and avoids potential future tax liabilities.

Settlement Amount:

Settlement Amount Match: This status signifies transactions where the settlement amount calculated by Cointab (amount collected from customer – fee – tax charge) perfectly matches the amount reflected in your Stripe report. This confirms that settlements are being processed accurately.

Settlement Amount Mismatch: Cointab highlights discrepancies between the calculated settlement amount and the amount in your Stripe report. These require further investigation to identify the source of the mismatch and ensure accurate settlements.

Settlement Tracking:

Settlement UTR not present: A UTR (Unique Transaction Reference) number is assigned to every payment sent to the bank. This category identifies transactions where a UTR number is missing, potentially indicating that the payment was not successfully transferred to the bank. By promptly addressing these situations, you can minimize settlement delays and ensure your funds are properly accounted for.

Bank Settlement:

Settled in Bank Account: These transactions represent successful settlements, where the order amount in your Stripe report matches the corresponding amount in your bank statement. This confirms a healthy cash flow and accurate financial records.

Not Settled in Bank Account: Cointab identifies discrepancies between the amount in your bank statement and the amount in your Stripe report. These require investigation to resolve any settlement issues and ensure all transactions are properly accounted for.

Eliminate the hassle of manual Stripe reconciliation. Our automated solution ensures precision and frees up your finance team to focus on strategic insights. Gain complete control over your finances, boost profits, and drive long-term success. Don’t let manual errors hold you back. Embrace automation and unlock the full potential of your Stripe transactions.

Step into the future of reconciliation. Fill out the form to request your demo now!