Established as a leading Indian online retailer of baby products, FirstCry offers a vast selection of high-quality merchandise for parents and caregivers. With over 380 stores across the country, FirstCry provides a seamless omnichannel shopping experience. Their marketplace features a wide range of products including toys, diapers, clothes, footwear, and more, catering to the needs of babies and children. This extensive product selection, coupled with exceptional customer service, makes FirstCry a trusted destination for parents and a prime platform for sellers in the baby and kids’ product industry.

For businesses venturing into online sales of these products, FirstCry presents a lucrative opportunity with its high daily transaction volume. However, managing such a large number of transactions can be a challenge, requiring reconciliation to ensure accurate processing of payments, fees, and overall sales data.

Cointab’s automated reconciliation software streamlines this process for FirstCry sellers by automatically scheduling data uploads, performing data cleaning and extraction, and delivering analysis-ready reports. This innovative solution saves sellers valuable time and effort, allowing them to verify transactions with ease and make data-driven decisions to optimize their business growth.

The Essential Reports for Reconciliation:

FirstCry Invoice Report: This report provides a comprehensive breakdown of all transaction order details for orders shipped through the FirstCry marketplace. It serves as the foundation for reconciliation, ensuring all dispatched orders are accounted for.

FirstCry Debit Note: This report details any orders that have been returned or cancelled. By including these details in the reconciliation process, sellers can ensure accurate tracking of their final revenue.

FirstCry Payment Report: This report acts as the final piece of the puzzle, outlining all transactions for which FirstCry has settled payments with the seller. This allows for a clear picture of received funds.

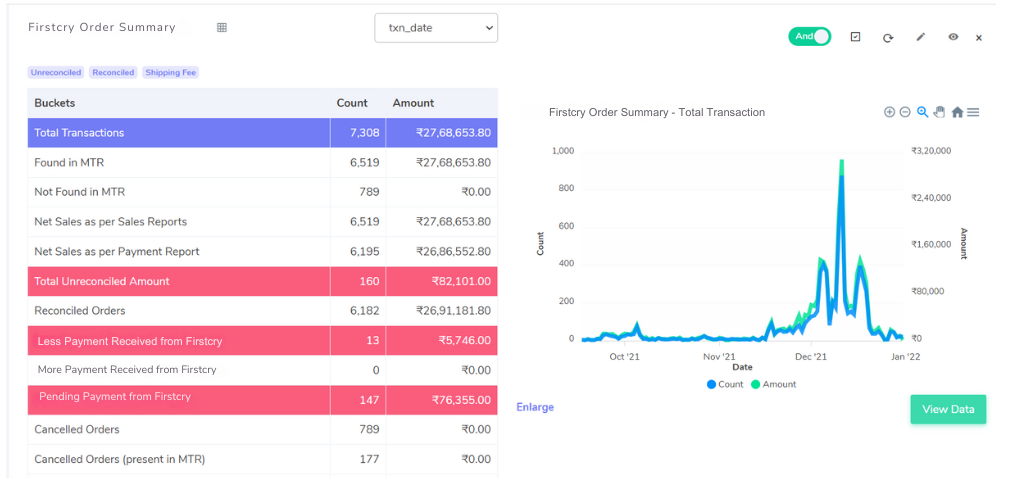

Payment Reconciliation: Since payments are issued a few days after order delivery, keeping track of numerous transactions can be difficult. FirstCry reconciliation addresses this concern by matching order details across various reports. This process, facilitated by Cointab’s software, guarantees all crucial information – including item prices, charges, and received payments – is captured and presented in a clear, summarized format.

The Result Displayed is as follows

Total Payment Received: This section provides a clear picture of all transactions where payment has been successfully received from FirstCry.

Total Payment Not Received: This section flags any outstanding payments for dispatched transactions. By proactively identifying these discrepancies, sellers can reach out to FirstCry for faster resolution.

Partial Sale Return Received: This metric highlights instances where the received payment amount (recorded in the payment report) is lower than the original invoice amount. This could indicate partial returns or adjustments, allowing sellers to reconcile their records accordingly.

Total Sales Return: All customer returns and cancellations post-shipment are categorized here. This ensures sellers have a complete picture of their final sales figures.

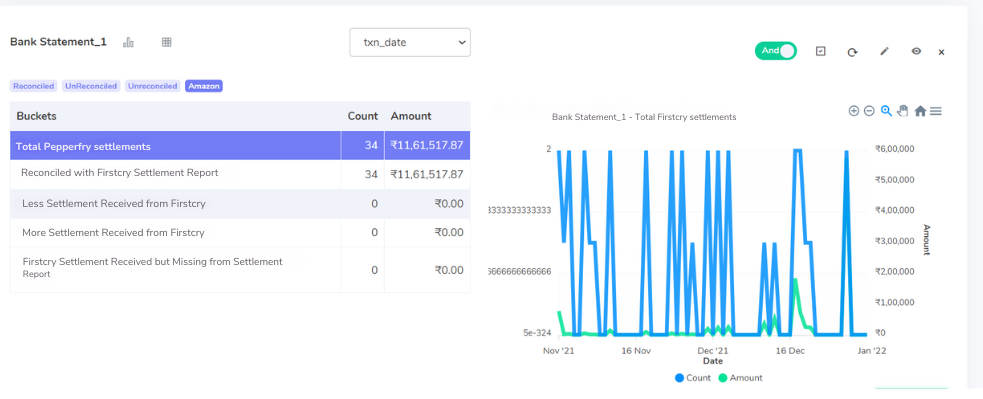

Bank Reconciliation:

FirstCry goes a step further by offering integrated bank reconciliation. This crucial process verifies that every payment sent by FirstCry is accurately received in the seller’s bank account. Technical or human errors can sometimes lead to missed or inaccurately credited payments. By matching transaction amounts between the settlement report and the seller’s bank statement, the system identifies any discrepancies. This proactive approach safeguards sellers against potential financial losses and ensures accurate account settlements.

Reconciled with Settlement:

This category highlights bank transactions that perfectly match the settlement amount guaranteed by FirstCry. This confirms smooth and accurate payment processing.

Less Payment in Bank: This metric identifies situations where the bank account balance falls short of the promised settlement amount. Sellers can leverage this information to investigate potential discrepancies with FirstCry.

More Payment in Bank: In some instances, the deposited amount in the bank might exceed the expected settlement sum. This could indicate additional payments or refunds processed by FirstCry, allowing sellers to reconcile their records accordingly.

Missing in FirstCry: This category flags bank transactions where the received payment isn’t reflected in the FirstCry settlement report. This could indicate a technical error or processing delay. By highlighting these discrepancies, sellers can proactively address them with FirstCry for swift resolution.

FirstCry marketplace reconciliation takes the hassle out of managing your finances. The automated software eliminates manual data entry and analysis, leaving you with just one task: running the reconciliation process. This generates an easy-to-understand report that empowers you to make informed business decisions. By leveraging accurate, data-driven insights, you’ll save valuable time, avoid potential risks, and propel your business toward continued growth. Contact Cointab Today!