Struggling to keep up with a mountain of receipts and financial statements? Manually verifying Apple Pay charges can be a real hassle, leaving you vulnerable to potential errors and lost revenue.

This is where Cointab steps in. Our powerful software streamlines the verification process for your Apple Pay transactions, saving you valuable time and ensuring financial accuracy.

Here’s how Cointab simplifies Apple Pay charge verification:

Automated Data Entry:

Cointab automates data entry, eliminating manual work and potential human error.

Customizable Solutions:

We tailor our software to your specific needs, seamlessly integrating with your existing ERP reports, website reports, and bank statements.

Comprehensive Verification:

Cointab meticulously cross-references your data to identify any overcharges or undercharges in your Apple Pay invoices.

Essential Reports for Verification:

Apple Pay Payment Report:

Gain a clear view of your payment methods and total transaction history.

Apple Pay Rate Card:

Easily understand your percentage charges, payment mode fees, and overall costs.\

Result:

Fee Verification Made Simple

Managing Apple Pay transactions can be a breeze, but ensuring accurate fees can become a time-consuming headache. Cointab simplifies the process, automating verification and saving you the hassle of manual calculations.

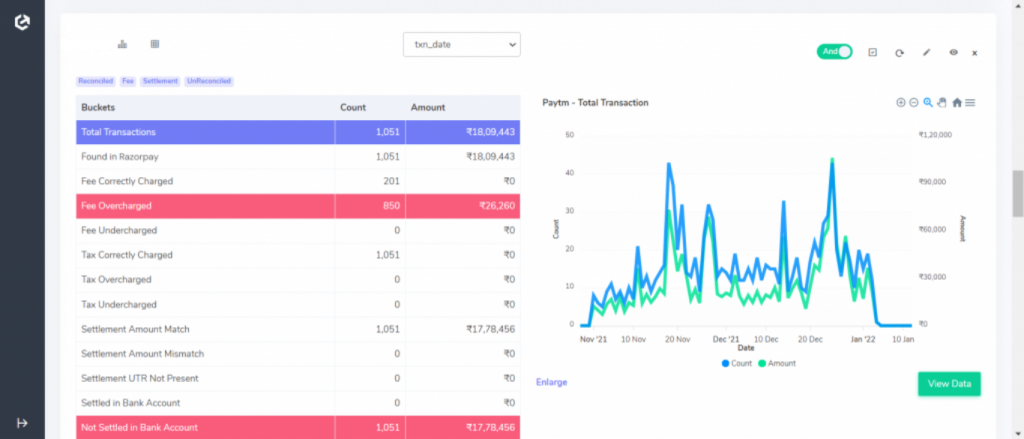

Fee Correctly Charged:

When the fee in the Apple Pay settlement report matches the rate card, you can rest assured you’re paying the agreed-upon amount. Cointab provides a clear comparison, highlighting any discrepancies for further investigation.

Fee Overcharged:

Human error or system glitches can sometimes lead to overcharges. Cointab identifies these discrepancies where Apple Pay charges exceed the rate card amount, ensuring you don’t overpay. We flag these transactions for your review, allowing you to recoup any excess fees.

Fee Undercharged:

Undercharges happen too. Cointab catches instances where Apple Pay undercharges fees, so you don’t lose out on revenue. Our software helps you identify these discrepancies and ensures you receive the correct amount for every transaction.

Simplify Your Finances with Cointab Reconciliation Software!

Request a Demo:

Simplify Your Finances with Cointab Reconciliation Software!

Request a Demo:

Tax Verification & Settlement Accuracy

Tax compliance is crucial for any business. Cointab ensures your Apple Pay transactions adhere to regulations and avoid penalties.

Tax Correctly Charged:

Cointab verifies if the tax amount on your payment report aligns with GST guidelines. We perform a thorough comparison to ensure you’re not overpaying or underpaying taxes.

Tax Overcharged:

Paying more than necessary in taxes can significantly impact your bottom line. Cointab identifies instances of tax overcharges compared to GST regulations. We highlight these discrepancies, allowing you to claim any tax rebates you may be entitled to.

Tax Undercharged:

Undercharged taxes can lead to hefty penalties down the line. Cointab helps you uncover any undercharged taxes, ensuring compliance and avoiding potential issues with tax authorities.

Settlement Amount Match:

Cointab verifies if the final settlement amount (total amount minus fees and tax) matches the Apple Pay report. This ensures your financial records are accurate and avoids confusion during reconciliation.

Settlement Amount Mismatch:

Discrepancies between the calculated settlement amount and the one provided by Apple Pay can indicate errors. Cointab flags these mismatches, prompting you to investigate the cause and rectify any discrepancies.

Seamless Reconciliation with Cointab

Reconciling Apple Pay transactions with bank statements can be a tedious task. Cointab automates this process, saving you valuable time and resources.

Settled in Bank Reconciliation:

Transactions found in both the settlement report and your bank statements are marked as reconciled by Cointab. This eliminates the need for manual verification and provides peace of mind.

Not Settled in Bank Reconciliation:

Cointab identifies transactions present only in the Apple Pay report but missing from your bank statements. These discrepancies require further investigation, potentially indicating fraudulent activity or missing deposits. Cointab flags these transactions for your attention, allowing you to take prompt action.

Cointab: Your Automated Reconciliation Partner

Cointab goes beyond simple verification. Our robust software streamlines the entire reconciliation process by automatically comparing Apple Pay settlement reports, rate cards, website reports, ERP reports, and bank statements. This eliminates manual work and minimizes errors, saving you valuable time and resources.

Embrace Cointab to gain a crystal-clear view of your transactions, optimize workflows, and ensure precision in charge verification. Start your journey towards financial efficiency with Cointab today!

Additional Benefits of Cointab:

Improved Cash Flow Management:

With accurate data and timely reconciliation, Cointab empowers you to make informed financial decisions and optimize cash flow.

Enhanced Security:

Cointab’s automated verification process helps identify fraudulent transactions and potential security risks, safeguarding your business.

Scalability and Growth:

As your business grows, Cointab seamlessly scales to meet your evolving needs, ensuring efficient reconciliation regardless of transaction volume.

Don’t wait any longer. Let Cointab take the burden of Apple Pay charge verification and reconciliation off your shoulders. Sign up for a free trial today and experience the difference!