Eway is a leading payment gateway solution that empowers businesses to securely accept online payments. It offers a comprehensive suite of features to cater to various payment needs, making it a popular choice for merchants across different industries. However, as with any payment gateway, understanding and verifying the associated fees and taxes is crucial for financial transparency and control.

This guide delves into the essential aspects of Eway payment gateway charges verification. We’ll explore the reports required for reconciliation, different fee and tax scenarios, and how to identify discrepancies.

Additionally, we’ll introduce Cointab reconciliation software as a valuable tool to automate this process and streamline your financial management.

Understanding Eway Payment Gateway Fees:

When you integrate Eway into your business, you incur specific fees and taxes associated with each transaction. These charges can vary depending on factors like transaction type, payment method, and your chosen Eway plan.

While Eway strives for accuracy, occasional discrepancies may occur due to human error or system glitches. Here’s how to ensure your charges are correct:

Reports Needed for Eway Payment Gateway Charges Verification:

To effectively verify your Eway charges, you’ll need access to the following reports:

Eway Payment Report:

This report provides a detailed breakdown of all your transactions, including the total amount processed and the payment methods used (credit card, debit card, etc.).

Eway Rate Card:

This document outlines the fee structure associated with different Eway plans, including transaction fees, percentage charges, and applicable fees for specific payment methods.

Results:

Reconciling Eway Charges:

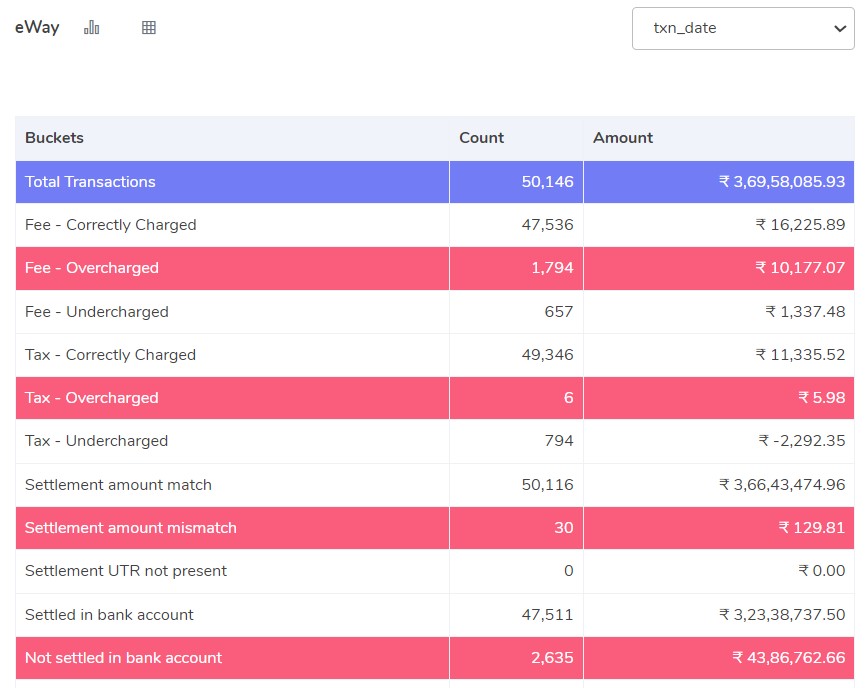

By comparing the information in these reports, you can identify discrepancies in your Eway charges. Let’s delve into various scenarios:

Fee Correctly Charged:

The fees listed on your Eway payment report match the amount calculated using the corresponding fee structure outlined in the Eway rate card.

Fee Overcharged:

If the fees on your Eway report exceed the amount calculated using the rate card, you may have been overcharged. In such cases, you can contact Eway for a refund.

Fee Undercharged:

Conversely, if the fees on your report are lower than the calculated amount, you may have been undercharged. While this might seem beneficial, it can lead to potential issues with Eway in the future.

Verifying Eway Taxes:

Similar to fees, Eway charges taxes (like GST) on transactions. Here’s how to ensure they’re applied correctly:

Tax Correctly Charged:

The tax amount on your Eway payment report aligns with the calculated tax based on current GST guidelines.

Tax Overcharged:

If the tax amount on your report exceeds the calculated GST, you may have been overcharged. You can contact Eway to rectify this discrepancy.

Tax Undercharged:

On the other hand, if the tax is lower than the calculated GST, you may have been undercharged. While this might seem favorable initially, it can lead to future tax liabilities.

Settlement Amount Verification:

The settlement amount refers to the final amount you receive after deducting fees and taxes from the total transaction value. Here’s how to ensure it’s accurate:

Settlement Amount Match:

Calculate the settlement amount by subtracting fees and taxes from the total transaction value. If this calculated amount matches the settlement amount displayed on your Eway report, it signifies a correct settlement.

Settlement Amount Mismatch:

If the calculated settlement amount differs from the one on your Eway report, a discrepancy exists. Investigate the cause of this mismatch and contact Eway for clarification.

Settled in Bank Account:

Verify if the UTR (Unique Transaction Reference) number present in your Eway settlement report corresponds with a transaction reflected in your bank statements. This confirms the successful settlement of funds.

Not Settled in Bank Account:

If the UTR exists in your Eway report but isn’t found in your bank statements, it indicates a potential settlement issue. Contact Eway to track the missing settlement.

Benefits of Automating Eway Payment Gateway Charges Reconciliation:

Manually reconciling Eway charges can be time-consuming and prone to errors, especially for businesses with high transaction volumes. Cointab reconciliation software emerges as a valuable solution to streamline this process. Here’s how it empowers you:

Effortless Reconciliation:

Cointab automates the entire reconciliation process, eliminating manual data entry and minimizing the risk of human error.

Time Savings:

By automating reconciliation, Cointab frees up your finance team’s time to focus on other critical tasks.

Improved Accuracy:

Cointab ensures accurate reconciliation by meticulously comparing data from your Eway reports and bank statements.

Enhanced Efficiency:

Say goodbye to tedious manual reconciliation of Eway charges! Cointab’s automated software streamlines your financial operations, saving your finance team precious time and resources.

Reconcile with Efficiency:

Cointab automates the entire process, freeing your team from error-prone manual data entry. Reconcile Eway charges quickly and accurately, ensuring data integrity and eliminating the risk of missed overpayments.

Boost Your Bottom Line:

Identify potential discrepancies and overcharges with ease. Seamless integration with Eway allows you to effortlessly file claims and recover any missed funds.

Focus on What Matters:

Eliminate manual reconciliation and empower your finance team to focus on strategic initiatives. Cointab ensures accurate data and efficient operations, allowing your business to thrive.

Try Cointab Today!

Experience the power of automated reconciliation and streamline your Eway charge management.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation