Secure E-commerce Transactions with SecurePay

SecurePay empowers businesses of all sizes to seamlessly accept online payments. Trusted by over 40,000 Australian businesses and organizations, SecurePay offers a reliable and cost-effective solution for e-commerce transactions.

Understanding Your SecurePay Charges

While SecurePay provides a valuable service, it’s important to understand the associated fees. Occasionally, discrepancies may arise. To safeguard your business’s financial health, it’s crucial to monitor potential overcharges.

Effortless Reconciliation with Cointab

Cointab Reconciliation software streamlines the reconciliation process, eliminating manual complexities. This powerful tool effortlessly handles large volumes of data in various formats, ensuring accurate reconciliation regardless of your business size.

Reconciling SecurePay Charges: A Step-by-Step Guide

For a thorough verification of your SecurePay charges, gather the following reports:

SecurePay Payment Report:

This report details your total transactions, categorized by payment methods (debit card, credit card, UPI, etc.).

SecurePay Rate Card:

The rate card outlines the fees and percentages charged based on the utilized payment mode.

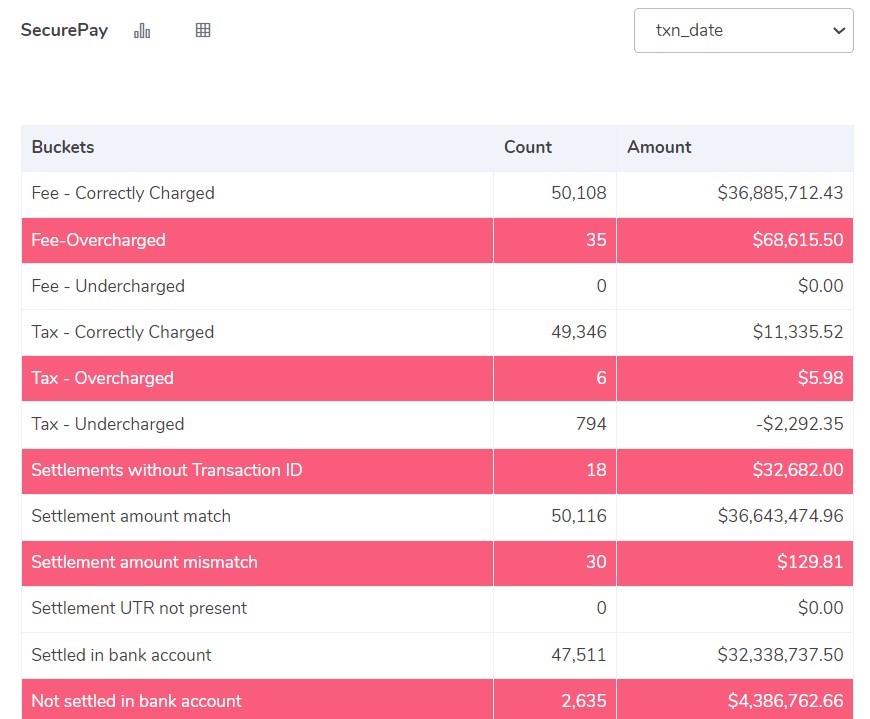

RESULTS:

Reconciliation Results Explained

The reconciliation process delivers valuable insights, categorized as follows:

Fees Correctly Charged:

Transactions where fees align precisely with the calculations based on the rate card.

Fees Overcharged:

Situations where SecurePay charges exceed the calculated amount using the rate card.

Fees Undercharged:

Instances where SecurePay charges are less than the calculated rate card amount.

Tax Verification:

Tax Correctly Charged:

When the tax recorded in the payment report matches the calculated GST guidelines.

Tax Overcharged:

Situations where the recorded tax in the payment report surpasses the GST-calculated amount.

Tax Undercharged:

Instances where the recorded tax in the payment reports falls below the GST-calculated amount.

Settlement Verification:

Settlement UTR Present:

This verifies the presence of a Unique Transaction Reference (UTR) number for each transaction within the payment report.

Settlement Amount Match:

This confirms that the settlement amount (total amount minus fees and taxes) aligns with the amount reflected in the SecurePay report.

Settlement Amount Mismatch:

This signifies a discrepancy between the calculated settlement amount and the amount shown in the SecurePay report.

Bank Account Verification:

Settled in Bank Account:

This confirms that the settlement amount appears in both the SecurePay report and your bank statement.

Not Settled in Bank Account:

This indicates that the settlement amount is present in the SecurePay report but absent from your bank statements.

Automated Reconciliation with Cointab

Cointab Reconciliation software streamlines the manual reconciliation process with its automated features.

Here’s how it simplifies verification:

Upload Data:

Effortlessly upload your data in a preferred format.

Customize Workflow:

Tailor the reconciliation process to your specific business requirements.

Error Identification:

Upon completion, Cointab highlights discrepancies in transactions for easy identification (marked in red).

Embrace Automated Reconciliation Today

With Cointab Reconciliation software, you can transform your reconciliation process from a tedious task to an automated, efficient system. Start your journey towards streamlined financial management with Cointab today!

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation