ANZ Worldline is a trusted payment gateway solution in Australia, empowering businesses to accept payments securely and conveniently. With the increasing volume of daily transactions, however, ensuring financial accuracy becomes paramount. Manual reconciliation of vast amounts of data can be tedious and error-prone. This is where Cointab Reconciliation steps in, offering an automated solution to streamline your ANZ Worldline payment processing and financial management.

Cointab Reconciliation: A Tailored Solution for Accurate Payment Reconciliation

Cointab Reconciliation provides a comprehensive software solution designed specifically for ANZ Worldline users. Our software automates data entry and meticulously cross-checks ANZ Worldine invoices with various data sources, including:

Bank Statements:

Streamline reconciliation by automatically matching transactions processed by ANZ Worldline with your corresponding bank statements.

ERP Reports:

Ensure your internal Enterprise Resource Planning (ERP) reports align seamlessly with your ANZ Worldline settlement reports for comprehensive financial oversight.

Website Reports:

Reconcile website orders and payments with corresponding entries in the ANZ Worldline settlement reports, eliminating discrepancies.

Cointab Reconciliation’s automated approach offers several key benefits:

Enhanced Efficiency:

Automating data entry saves you significant time and resources compared to manual reconciliation processes.

Error Reduction:

Eliminate the risk of human error inherent in manual data entry.

Improved Accuracy:

Gain peace of mind with precise reconciliation, ensuring your financial records are up-to-date and reliable.

Fraud Prevention:

Early identification of discrepancies helps prevent potential fraudulent activities.

Data-Driven Decisions:

Leverage accurate financial data for informed business decisions.

Understanding ANZ Worldline Payment Gateway Reconciliation Results

Cointab Reconciliation empowers you to interpret ANZ Worldline reconciliation results effectively across various reports:

ANZ Worldline Settlement Reports:

These reports detail orders placed and successfully paid for through the ANZ Worldline gateway.

ANZ Worldline Refund Reports:

Track refunded or canceled orders within the ANZ Worldline platform.

Website Reports:

Analyze website order data for a comprehensive view of your online sales activity.

ERP Reports:

Gain insights into internal order data maintained within your ERP system.

Bank Statements:

Monitor all transaction settlements reflected in your bank account.

ANZ Worldline with website reconciliation

Reconciliation Scenarios: Identifying Discrepancies

By comparing data from ANZ Worldline with your website, ERP system, and bank statements, Cointab Reconciliation helps identify potential discrepancies:

ANZ Worldline with Website Reconciliation:

Found and Reconciled:

Transactions present in both the settlement report and website report.

More Amount in Website Report:

The website report reflects a higher transaction value compared to the settlement report.

Less Amount in Website Report:

The website report reflects a lower transaction value compared to the settlement report.

Not Found in Website Report:

Transactions present in the settlement report are missing from the website report.

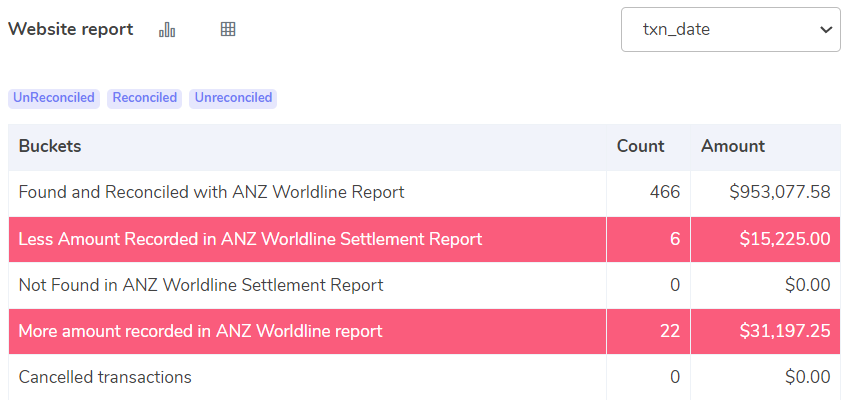

Website with ANZ Worldline reconciliation:

Found and Reconciled:

Transactions present in both the website report and settlement report.

Less Amount Received in ANZ Worldline Settlement Report:

The settlement report reflects a lower transaction value compared to the website report.

Not Found in ANZ Worldline Settlement Report:

Transactions present in the website report are missing from the settlement report.

More Amount Received in

ANZ Worldline Settlement Report:

The settlement report reflects a higher transaction value compared to the website report (potentially due to refunds or adjustments).

Canceled Transactions:

Orders canceled by the customer may only be reflected in the website report.

ANZ Worldline reconciliation with ERP

Found and Reconciled:

Transactions are present and match in both the settlement report and ERP report.

More Amount in ERP Report:

The ERP report reflects a higher transaction value compared to the settlement report.

Less Amount in ERP Report:

The ERP report reflects a lower transaction value compared to the settlement report.

Not Found in ERP Report:

Transactions present in the settlement report are missing from the ERP report.

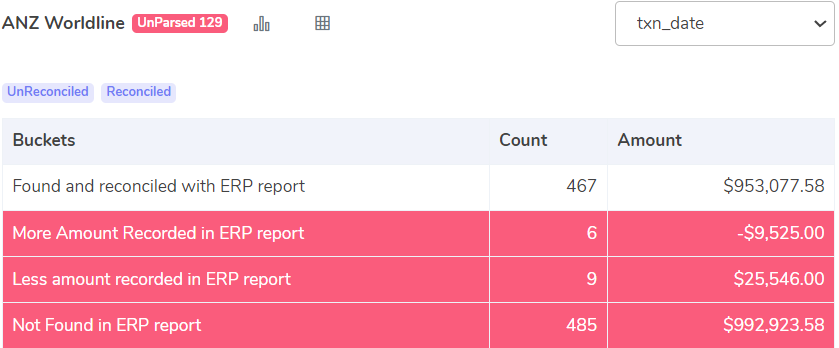

ERP report with ANZ Worldline reconciliation

Found and Reconciled:

Transactions are present and match in both the settlement report and ERP report.

Less Amount Received from ANZ Worldline Settlement Report:

The settlement report reflects a lower transaction value compared to the ERP report.

More Amount Received from ANZ Worldline Settlement Report:

The settlement report reflects a higher transaction value compared to the ERP report.

Not Found in ANZ Worldline Settlement Report:

Transactions present in the ERP report are missing from the settlement report.

Canceled Transactions:

Orders canceled by the customer may only be reflected in the ERP report.

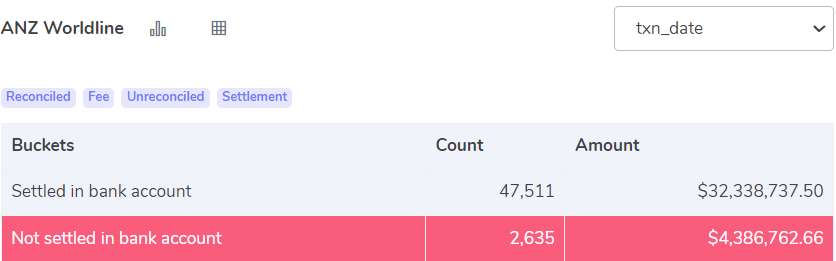

ANZ Worldline with Bank reconciliation

Matched Transactions:

These transactions appear in both the ANZ Worldline settlement report and your bank statement, confirming successful settlement and fund transfer. This is the ideal scenario.

Unmatched Transactions (Not Settled in Bank Account):

Some transactions might be present in the settlement report but missing from your bank statement. This could indicate:

Pending Transactions:

The funds might still be in transit between ANZ Worldline and your bank. Allow for some processing time (usually 1-3 business days) before investigating further.

Data Entry Errors:

Discrepancies in reference numbers or transaction amounts between the settlement report and bank statement could signify a data entry mistake. Investigate both sources to identify the error.

Chargebacks or Refunds:

If a customer initiates a chargeback or receives a refund, the settlement report might reflect the initial transaction, while the bank statement shows the reversed funds.

Bank reconciliation with ANZ Worldline:

Higher Amount in ANZ Worldline:

The settlement report might show a larger sum compared to your bank statement.

Potential reasons for this include:

Pending Fees:

ANZ Worldline may have assessed fees that haven’t yet reflected in your bank statement.

Refunds or Chargebacks:

The settlement report could reflect the initial transaction amount, while the bank statement shows a processed refund or chargeback that reduces the final received amount.

Lower Amount in ANZ Worldline:

The settlement report shows a lower amount compared to your bank statement.

This could be due to:

Discounts or Promotions:

Discounts or promotions offered to customers might not be reflected in the settlement report but are deducted in your bank statement.

Data Entry Errors:

Discrepancies in reference numbers or transaction amounts can occur. Investigate both sources to pinpoint the error.

Missing Transactions (Not Found in ANZ Worldline):

Transactions present in your bank statement might be missing from the settlement report.

This could indicate:

Unrecorded Transactions:

The transaction might not have been processed by ANZ Worldline yet.

Bank Errors:

Investigate with your bank to rule out any potential errors on their end.

By leveraging Cointab Reconciliation’s automated features, you can efficiently uncover and address discrepancies, ensuring the utmost accuracy in your financial records with ANZ Worldline. Our seamless data processing empowers you with a comprehensive view of all transactions, allowing you to make data-driven decisions with confidence.

Why Choose Cointab?

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensures precise reconciliation, getting rid of human errors and any discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation

Check Cointab

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensures precise reconciliation, getting rid of human errors and any discrepancies to maintain the integrity of your financial data.