Managing High-Volume Canada Post Shipments?

Ensuring accurate billing for high-volume Canada Post shipments can be a complex task. Cointab Reconciliation software simplifies this process by automating invoice verification and eliminating manual errors.

Cointab: Your Canada Post Verification Solution

Cointab streamlines the entire Canada Post invoice reconciliation process. It seamlessly integrates with your existing data and compares key reports to ensure accurate billing:

ERP Reports:

Cointab verifies invoice data against your internal Enterprise Resource Planning (ERP) system for consistency.

Delivery Invoices:

The software scrutinizes Canada Post invoices for any discrepancies.

Pincode Masters:

Cointab utilizes pincode data to confirm accurate zone calculations for deliveries.

SKU Reports:

Product information (weight, dimensions) from SKU reports is used for precise fee verification.

Rate Cards:

Cointab compares invoice charges against official Canada Post rate cards to identify any overcharges.

SKU Report:

Cointab Reconciliation software optimizes weight management for Canada Post invoice verification, ensuring accurate billing based on product dimensions. Here’s how it works:

SKU Integration:

Cointab leverages SKU data to identify product weight and dimensions automatically.

ERP Weight Priority:

If the ERP report provides weight information, it takes precedence for invoice verification.

Volumetric Weight Calculation:

For products lacking weight data in the ERP, Cointab calculates volumetric weight using the formula: Length (cm) x Width (cm) x Height (cm).

Divisor Consideration:

The software applies the divisor specified in the divisor card for volumetric weight calculations. If no divisor is present, a default value of 5,000 is used.

Data Consistency:

Calculated volumetric weight is reflected in both the ERP report and the invoice for seamless reconciliation.

Final Weight Rounding:

Cointab rounds the final weight to determine the appropriate weight slab for billing purposes.

Pincode Master:

Cointab Reconciliation software optimizes zone verification for Canada Post invoices, ensuring accurate billing based on shipment locations. Here’s a breakdown:

Zone Definition:

A unique zone is assigned based on the combination of the shipment’s origin (pickup) and delivery locations.

Invoice Linking:

Cointab automatically extracts origin and destination details from the invoice to determine the corresponding zone.

Zone Classification:

Canada Post utilizes a zone system categorized as regional, local, etc., each with specific identifiers (a, b, c).

Benefits of Cointab’s Zone Verification:

Accurate Billing:

Ensures invoices reflect the appropriate zone for accurate shipping cost calculations.

Automated Zone Identification:

Eliminates manual zone lookup, saving time and reducing errors.

Data Consistency:

Maintains consistent zone data across reports for seamless reconciliation.

Cointab: Effortless Verification, Guaranteed Efficiency

Cointab streamlines invoice verification by automating zone identification, preventing errors and ensuring efficient processing of Canada Post invoices.

Rate card:

Cointab Reconciliation software empowers businesses to achieve accurate rate verification for Canada Post invoices. Here’s how it optimizes the process:

Dynamic Rate Matching:

Cointab compares invoice charges against weight and zone data in the Canada Post rate card. As rates vary based on weight limits, the software ensures the applied rate aligns with the product’s weight category.

Data Verification:

Cointab verifies specific invoice columns (“courier,” “zone,” “fwd_wt_fixed,” and “divisor”) against corresponding data in the rate card. This ensures accurate application of rates and identifies potential invoice discrepancies.

Temporary Rates and Delivery Dates:

Cointab acknowledges that rate card pricing may be temporary and emphasizes the importance of delivery dates aligning with the quoted rates.

Charges:

Cointab Reconciliation software simplifies the calculation of expected charges for Canada Post invoices, ensuring accurate billing. Here’s a breakdown of key concepts:

Forward Charges:

Weight Limits and Slabs:

The rate card specifies weight limits for different “forward charge” slabs.

Fixed vs. Additional Weight:

If the calculated weight falls within the slab limit (“fwd_wt_fixed”), the “fwd_fixed” fee applies based on the zone.

If the weight exceeds the limit, an additional charge (“fwd_add”) per extra kilogram applies based on the zone.

Expected Forward Charge Formula: Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

RTO (Return to Origin) Charges:

Weight Limits and Slabs:

Similar to forward charges, the rate card defines weight limits for RTO slabs (“rto_wt_fixed”).

Fixed vs. Additional Weight:

If the calculated weight falls within the slab limit (“rto_wt_fixed”), the “rto_fixed” fee applies based on the zone.

If the weight exceeds the limit, an additional charge (“rto_add”) per extra kilogram applies based on the zone.

Expected RTO Charge Formula: Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected Final Amount:

Cointab calculates the final expected invoice amount by combining the expected forward charge, RTO charge, and any applicable tax percentage.

Benefits of Cointab’s Invoice Verification:

Effortless Calculations:

Automates complex forward and RTO charge calculations, saving time and resources.

Data Accuracy:

Ensures accurate invoice charges based on weight limits and zone pricing.

Error Detection:

Identifies potential discrepancies in invoice calculations for timely correction.

Cost Control:

Minimizes the risk of overpayments by verifying charges against the rate card.

Cointab: Streamline Verification, Maximize Savings

Cointab empowers businesses to achieve efficient and accurate Canada Post invoice verification, ensuring optimal shipping costs.

Result:

Managing Canada Post invoices efficiently can be challenging. Cointab Reconciliation software simplifies the process by automating invoice verification and eliminating discrepancies. Here’s how it works:

Automated Data Collection:

Cointab seamlessly integrates with your existing systems to gather key data points:

ERP Reports:

Internal data on orders and shipments.

Pincode Master:

Information on destination zones for accurate calculations.

Rate Card:

Official Canada Post fees based on weight and zone.

Expected Fee Calculation:

Using the collected data, Cointab calculates the expected fee you should be charged based on Canada Post’s rate card.

Invoice Reconciliation:

Cointab then compares the expected fee with the amount charged on your Canada Post invoice.

Detailed Reports:

The software generates comprehensive reports highlighting any discrepancies between the expected and actual charges.

Canada Post invoice – ERP

Accurate order verification is crucial for efficient Canada Post invoice processing. Cointab Reconciliation software automates this process, identifying potential discrepancies:

Matched Orders:

Verified Entries:

Cointab confirms that order entries present in the Canada Post invoice are also found in your ERP reports, ensuring data consistency and facilitating smooth verification.

Missing Orders:

Unverified Entries:

Cointab flags orders listed on the invoice but absent in your ERP reports. This discrepancy requires investigation to prevent potential billing errors.

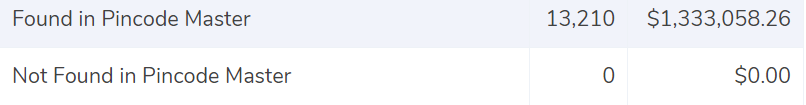

Canada Post Invoice – Pincode Master

Found in Pincode master

It is essential for the order entries to be present in the Pincode master as well as in the invoice provided by Canada Post in order to be verified, and in this case the order entries are present in both the records.

Not found in Pincode master

In order to get verified, the order entries should be present in the ERP report as well as Canada Post invoice, in this case the records can not be verified as the order entries are not present in the Pincode master.

Canada Post Invoice – Rate Card

Cointab Reconciliation software streamlines Canada Post invoice verification by guaranteeing accurate rate application. Here’s how it safeguards your costs:

Matched Rates:

Verified Rates: Cointab confirms that the services listed on the Canada Post invoice correspond with the rate card. This ensures you’re billed for the correct shipping options.

Unidentified Rates:

Discrepancy Detection:

Cointab flags any services on the invoice that are not found in the rate card. This might indicate missing information or potential errors, prompting further investigation.

Benefits of Cointab’s Rate Verification:

Cost Control:

Minimizes the risk of overpayments by ensuring accurate rate application based on the official rate card.

Enhanced Accuracy:

Streamlines verification by identifying potential discrepancies in service charges.

Proactive Error Detection:

Flags potential rate mismatches for timely correction.

Improved Transparency:

Provides clear insights into shipping costs based on the rate card.

Cointab: Your Canada Post Verification Solution

Cointab empowers businesses to achieve efficient and accurate Canada Post invoice verification, optimizing shipping costs and ensuring transparency.

Fee verification of Canada Post Invoice:

Cointab Reconciliation software empowers businesses to achieve accurate Canada Post invoice verification, ensuring optimal shipping costs. Here’s how it detects potential discrepancies:

Matched Weight & Zone:

Correctly Charged:

Cointab verifies that invoice charges align with the rate card for the product’s weight and zone, ensuring accurate billing.

Discrepancies:

Cointab flags potential overcharges or undercharges based on mismatches between invoice data and expected charges:

Zone Match, Weight Match:

Overcharged:

Invoice charges exceed the expected rate for the product’s weight and zone, indicating a potential overpayment.

Undercharged:

Invoice charges are lower than expected, potentially resulting in missed revenue for Canada Post.

Zone Mismatch:

Overcharged/Undercharged:

Invoice zone and weight don’t match ERP data, potentially leading to over/undercharges.

Benefits of Cointab’s Verification:

Cost Control:

Minimizes the risk of overpayments by identifying discrepancies between invoice charges and expected rates.

Revenue Protection:

Identifies potential undercharges on Canada Post invoices.

Enhanced Accuracy:

Streamlines verification by highlighting potential errors for timely correction.

Data-Driven Insights:

Provides detailed reports for informed decision-making regarding shipping costs.

Cointab: Your Canada Post Verification Partner

Cointab empowers businesses to achieve efficient and accurate Canada Post invoice verification, optimizing shipping costs and maximizing profitability.

Unlock Streamlined Canada Post Invoice Processing

By leveraging Cointab Reconciliation software, your business can achieve:

Effortless Invoice Verification:

Automate the entire verification process, freeing up valuable resources and minimizing human error.

Cost Control & Revenue Protection:

Identify potential overcharges and undercharges on Canada Post invoices, ensuring optimal shipping costs and maximized revenue.

Enhanced Accuracy:

Streamline verification by highlighting discrepancies for swift correction, leading to accurate billing and data integrity.

Data-Driven Insights:

Gain valuable insights into Canada Post billing practices for informed decision-making regarding shipping strategies.

Dispute Resolution Power:

Utilize Cointab’s flagged discrepancies to raise strong, data-backed disputes with Canada Post when necessary.

Cointab: Your Canada Post Verification Solution

Don’t settle for time-consuming manual invoice verification and potential billing errors. Choose Cointab for a smoother, more efficient Canada Post invoice processing experience.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation