Stop Wasting Time and Money on Manual Fee Verification

Processing payments through Chase’s electronic payment gateway keeps your business running smoothly. But managing those transactions and ensuring you’re not being overcharged can be a tedious task. Manually comparing invoices, bank statements, and website reports is time-consuming, prone to errors, and can lead to missed discrepancies.

Cointab Reconciliation:

Streamline Your Chase Fee Verification

Cointab Reconciliation takes the hassle out of verifying your Chase payment gateway fees. Our automated software seamlessly compares your Chase payment report with your ERP reports, bank statements, and website reports, identifying any inconsistencies or potential overcharges.

Benefits of Cointab Reconciliation for Chase Payment Gateway Users:

Reduced Risk of Overcharges:

Catch discrepancies early and avoid unnecessary fees.

Improved Efficiency:

Free up your finance team’s time for more strategic tasks.

Increased Accuracy:

Eliminate human error from the verification process.

Simplified Workflow: Streamline your reconciliation process with automated tools.

Essential Reports for Chase Payment Gateway Verification:

Chase Payment Report:

Provides a detailed breakdown of transactions processed through Chase.

Chase Rate Card:

Outlines the fees associated with different transaction types and volumes.

Choose Cointab Reconciliation for a Simple and Efficient Fee Verification Process

Don’t let manual reconciliation processes slow you down. By leveraging Cointab’s automated tools, you can ensure accurate fee verification and free up your team to focus on what matters most. Contact Cointab today to learn more!

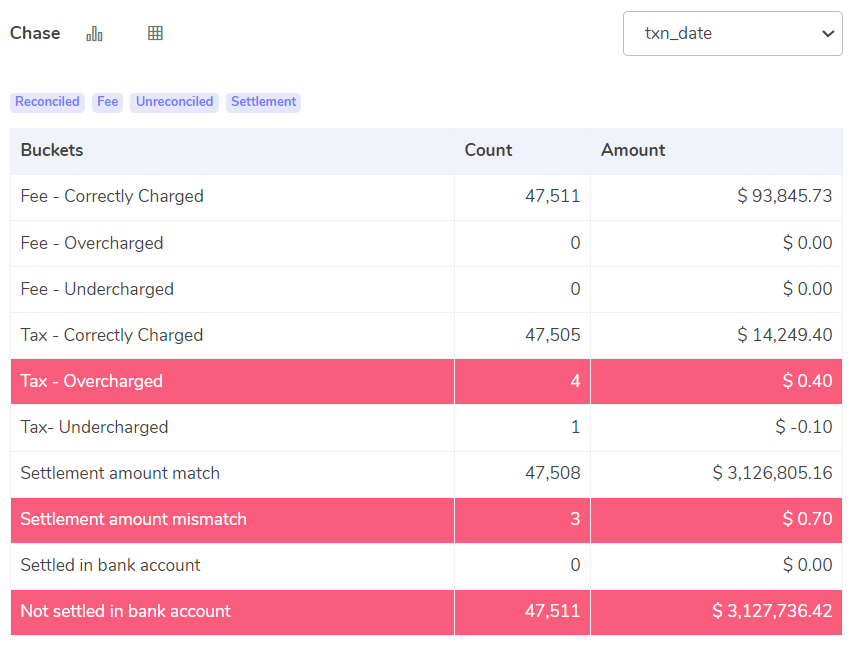

Results:

Understanding your Chase payment gateway fees is crucial for accurate financial management. This guide breaks down key terms you’ll encounter during reconciliation, along with the importance of using an automated tool like Cointab Reconciliation.

Fee Verification:

Matched Fee:

The fee charged by Chase aligns perfectly with the amount calculated using your Chase rate card. This indicates accurate billing.

Overcharged Fee:

The fee on your Chase report exceeds the calculated amount based on the rate card. You may have a discrepancy requiring investigation.

Undercharged Fee:

The fee on your Chase report is less than the calculated amount. While seemingly beneficial, it could indicate an error that needs correction.

Tax Verification:

Matched Tax:

The tax amount on your Chase report matches the calculated tax based on your tax rate.

Overcharged Tax:

The tax amount on your Chase report is higher than the calculated amount. This could signify an error requiring resolution.

Undercharged Tax:

The tax amount on your Chase report is lower than the calculated amount. While it seems favorable, it could lead to tax liabilities later.

Settlement Amount:

Matched Settlement:

The settlement amount (total amount minus fees and tax) in your calculations matches the settlement amount on your Chase report. This indicates accurate reconciliation.

Mismatched Settlement:

The calculated settlement amount differs from the Chase report. This highlights a potential discrepancy needing investigation.

Bank Reconciliation:

Settled in Bank Reconciliation:

The transaction appears in both your Chase settlement report and your bank account, signifying a complete transaction.

Not Settled in Bank Reconciliation:

The transaction exists only in your Chase report and not your bank account. This requires investigation to determine if it’s a pending transaction or an error.

Streamlining Reconciliation with Cointab:

Manual reconciliation of Chase fees is time-consuming and prone to errors. Cointab Reconciliation automates the process, comparing your Chase payment report, ERP reports, bank statements, and website reports. This ensures:

Reduced Risk of Errors:

Automated verification minimizes human error.

Improved Efficiency:

Free up your team’s time for core financial tasks.

Enhanced Accuracy:

Gain confidence in your financial data.

Simplified Workflow:

Streamlined reconciliation saves time and resources.

Embrace Efficiency with Cointab Reconciliation

Don’t let manual reconciliation slow you down. Cointab offers a seamless solution for accurate fee verification and efficient reconciliation. Contact Cointab today to learn more and take control of your financial processes!

Why Choose Cointab?

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensures precise reconciliation, getting rid of human errors and any discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation

Check Cointab

Effortless Reconciliation: Simplify complex financial processes with our automated solution, saving your team valuable time.

Accuracy: Ensures precise reconciliation, getting rid of human errors and any discrepancies to maintain the integrity of your financial data.

Build Custom Workflows: Build unique reconciliation workflows and custom rules that adapt to your business requirements seamlessly.

Dashboard Insights: Access comprehensive dashboard insights for a clear overview of your reconciled and unreconciled transactions with ease.