Chronopost is an international courier service in France that provides express shipping and delivery services both domestically and internationally. From parcel collection to delivery to including carriages, Chronopost promises their best service to their customers.

Manually keeping track of so many transactions and locations can be time-consuming as the increased distance between origins and destinations for the delivery varies a lot and the volume of the orders are very high. This can cause various ups and downs and possible miscalculations which can lead to delays in reconciling the data and cause discrepancies. This is where Cointab’s software steps in.

Cointab simplifies the reconciliation process for your company and helps your finance team to work with efficiency. Our software lets you load data automatically and builds a workflow suitable to your requirements. We verify all these values for you that help in tracking the exact zone and efficiency of numbers and since the software is completely automated it can reconcile your data without any manual efforts and lead it to maximum accuracy.

Required Reports for Chronopost Invoice Verification Process

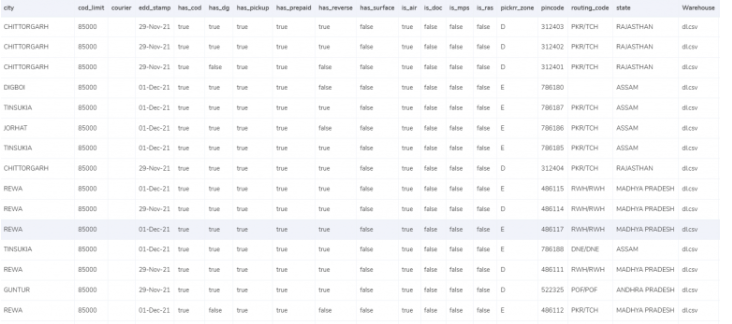

Pincode zone Report

Pincode zone reports consist of the zone of where the delivery has to be done that helps you track the location of the delivery easily.

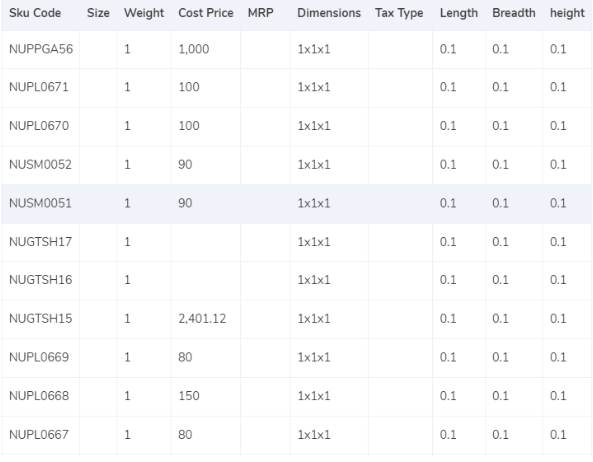

SKU report

Each product is assigned a SKU code which helps in establishing the weight and dimensions of the product.

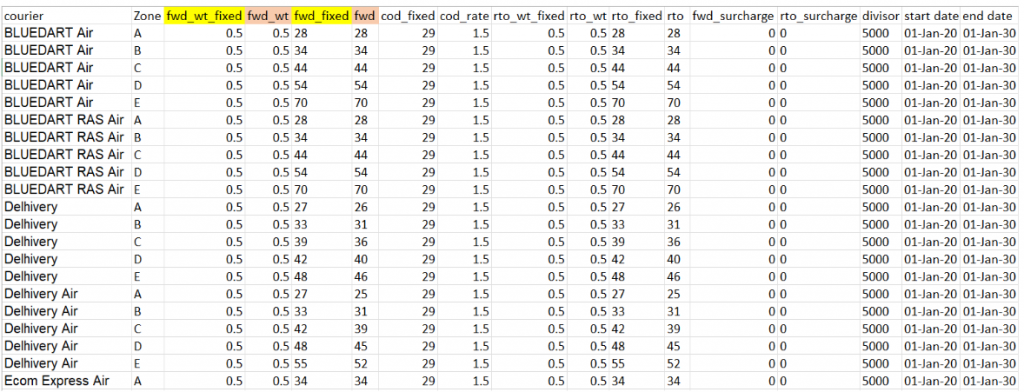

Rate card

Rate card consists of the charges applicable for each invoice on the basis of its zone and weight of the product.

Chronopost Invoice

All the important records like order ID, Billing zone,SKU, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged is provided by Chronopost that will help us get the further calculations.

Invoice verification

The software here checks if the charges calculated by the shipping company are expected charges or not and whether they reconcile. The calculations of the fee charged by Chronopost depends on weight of the product, zone and the COD percentage. The accuracy of the weight and zone is checked by us. The rate card is used to check if the rate used for the particular zone and weight is right. Let’s take a deeper dive into these aspects-

SKU report

Manually keeping track of so many transactions and locations can be time-consuming as the increased distance between origins and destinations for the delivery varies a lot and the volume of the orders are very high. This can cause various ups and downs and possible miscalculations which can lead to delays in reconciling the data and cause discrepancies. This is where Cointab’s software steps in.

Cointab simplifies the reconciliation process for your company and helps your finance team to work with efficiency. Our software lets you load data automatically and builds a workflow suitable to your requirements. We verify all these values for you that help in tracking the exact zone and efficiency of numbers and since the software is completely automated it can reconcile your data without any manual efforts and lead it to maximum accuracy.

Required Reports for Chronopost Invoice Verification Process

Pincode zone Report

Pincode zone reports consist of the zone of where the delivery has to be done that helps you track the location of the delivery easily.

SKU report

Each product is assigned a SKU code which helps in establishing the weight and dimensions of the product.

Rate card

Rate card consists of the charges applicable for each invoice on the basis of its zone and weight of the product.

Chronopost Invoice

All the important records like order ID, Billing zone,SKU, Product type, weight, RTO, Billing pincode, applied weight slab and the amount charged is provided by Chronopost that will help us get the further calculations.

Invoice verification

The software here checks if the charges calculated by the shipping company are expected charges or not and whether they reconcile. The calculations of the fee charged by Chronopost depends on weight of the product, zone and the COD percentage. The accuracy of the weight and zone is checked by us. The rate card is used to check if the rate used for the particular zone and weight is right. Let’s take a deeper dive into these aspects-

SKU report

- The software takes the SKU code from the ERP reports into consideration as it gives us the weight and dimensions of the product.

- The value displayed under the weight column in the invoice is taken into consideration if the weight is not given in the ERP reports.

- If the dimensions of the product are given then the volumetric weight is calculated with the help of this formula “Length x Width x Height”. In order to make the calculations work, the dimensions of the volumetric weight has to be in centimeters. The calculated value will be divided by the divisor given in the divisor card and if the divisor is not present in the card then it is to be divided by 5000.

- The values are moved to the ERP reports and the Chronopost invoice after all the calculations have been done.

- Lastly, the final weight is rounded off to get the final slab.

- This report consists of the origin location and delivery location and a zone is assigned to that combination. The origin and delivery location is linked to the invoice to get the desired Zone for each invoice.

- Each location is categorized into different zones like regionally, nationally, locally etc and further classified by their respective indicators i.e a,b,c etc.

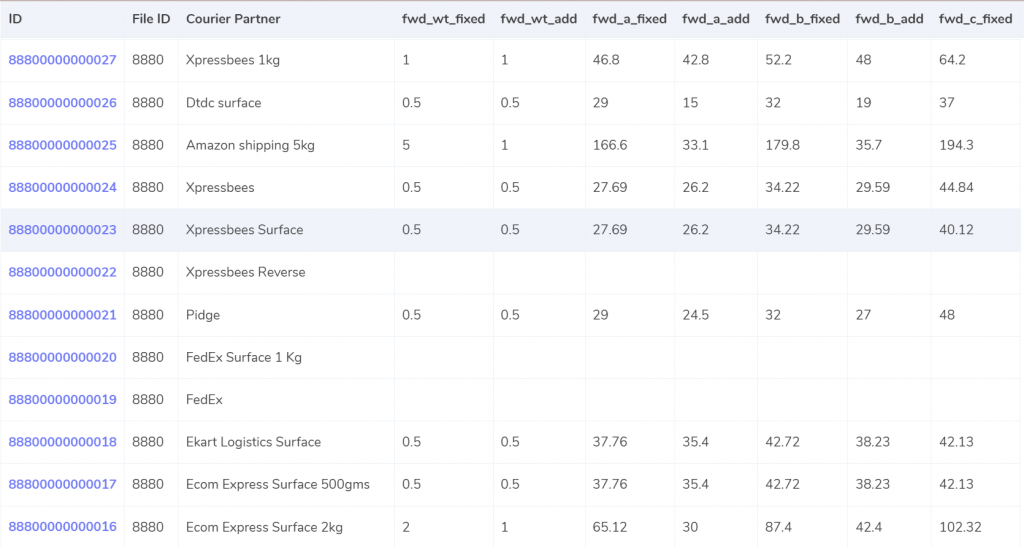

- The rates are given in the rate card on the basis of the weight of the product and the zone of the product. The charges might differ if the weight of the products increase, the rates given above are given according to an acceptable limit. The columns “courier”, “zone”, “fwd_wt_fixed” (the additional weight on which the fixed rate increases), and the “divisor” are checked with respective columns present in the Chronopost invoice to verify if the right items are put in the invoice.

- The delivery dates should fall under certain dates as the rates are applicable only for a certain amount of period.

Expected forward charge

If the final slab calculated is lower or equal to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to the zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_add” according to the zone . The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

Whichever value amongst “cod_fixed” or “cod _rate” % of “order Value” is higher, that is used as the expected COD charge.

Expected final amount

The expected final amount comes by the calculation of the Forward charge, RTO charge, COD charge and the GST%

ERP

If the final slab calculated is lower or equal to the weight limit (“fwd_wt_fixed”) given in the rate card, that means that it is equal to the “fwd_wt_fixed” then the fees charged on it is “fwd_fixed” according to the zone. If it is not equal to the “fwd_wt_fixed” column then it means that the product has more weight. The fee charged for the extra weight is “fwd_add” according to the zone. So the formula for the expected charge is:

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd_add

Expected RTO charged

If the final slab calculated is lesser or equal to the weight limit (rto_wt_fixed”) given in the rate card, that means that it is equal to the “rto_fixed” and the fee charged on it is “rto_fixed” according to the zone. If it is not equal to the “rto_wt_fixed” column then that means that the product has extra weight. The fee charged for the excess weight is “rto_add” according to the zone . The formula for the expected charge is given as:

Expected_rto_chg = rto_fixed + (extra_weight) x rto_add

Expected COD charges

Whichever value amongst “cod_fixed” or “cod _rate” % of “order Value” is higher, that is used as the expected COD charge.

Expected final amount

The expected final amount comes by the calculation of the Forward charge, RTO charge, COD charge and the GST%

RESULT

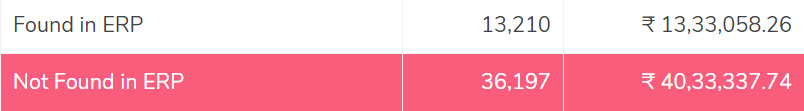

After we get the expected amount based on the zone and weight of the product, the software compares the ERP report, Pincode report and the Rate card with the invoice provided by Chronopost.ERP

Found in ERP

The number of products delivered for a particular order is present here in the ERP report. In this case, the orders present in the Chronopost invoice are also found in the ERP reports which helps in denoting the weight of the product which can be verified later since the records match.

Not found in the ERP report

In this case, the orders present in the Chronopost invoice are not present in the ERP report and hence the orders can not be verified and processed further.

Pincode Master

The number of products delivered for a particular order is present here in the ERP report. In this case, the orders present in the Chronopost invoice are also found in the ERP reports which helps in denoting the weight of the product which can be verified later since the records match.

Not found in the ERP report

In this case, the orders present in the Chronopost invoice are not present in the ERP report and hence the orders can not be verified and processed further.

Pincode Master

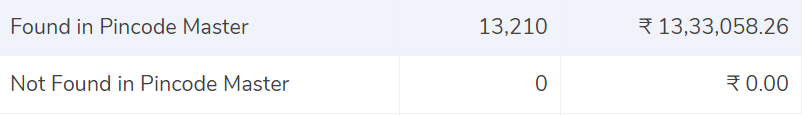

Found in Pincode master

The deliveries are made zone wise i.e regionally, locally etc and hence the correct pincode is necessary to be present in the report. In this case the orders are present in the Chronopost invoice as well as the Pincode master.

Not found in the Pincode master

These order deliveries are present in the Chronopost invoice reports but not in the Pincode report. The verification of these records are important because the deliveries are imposed zone-wise, since here the Pincode does not match with the Pin code master, the data can not be verified.

Rate Card

The deliveries are made zone wise i.e regionally, locally etc and hence the correct pincode is necessary to be present in the report. In this case the orders are present in the Chronopost invoice as well as the Pincode master.

Not found in the Pincode master

These order deliveries are present in the Chronopost invoice reports but not in the Pincode report. The verification of these records are important because the deliveries are imposed zone-wise, since here the Pincode does not match with the Pin code master, the data can not be verified.

Rate Card

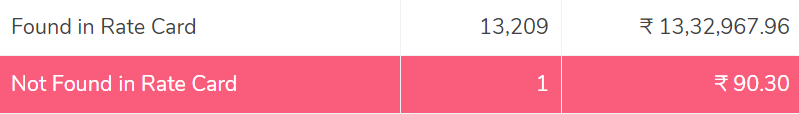

Found in Rate card

The data entries present in the Chronopost invoice are also present in the Rate card and hence the orders can be verified.

Not found in the Rate card

In this case, the order entries present in the Chronopost invoice are not present in the Rate card and hence the orders can not be verified.

Fee verification using ERP- Chronopost

The data entries present in the Chronopost invoice are also present in the Rate card and hence the orders can be verified.

Not found in the Rate card

In this case, the order entries present in the Chronopost invoice are not present in the Rate card and hence the orders can not be verified.

Fee verification using ERP- Chronopost

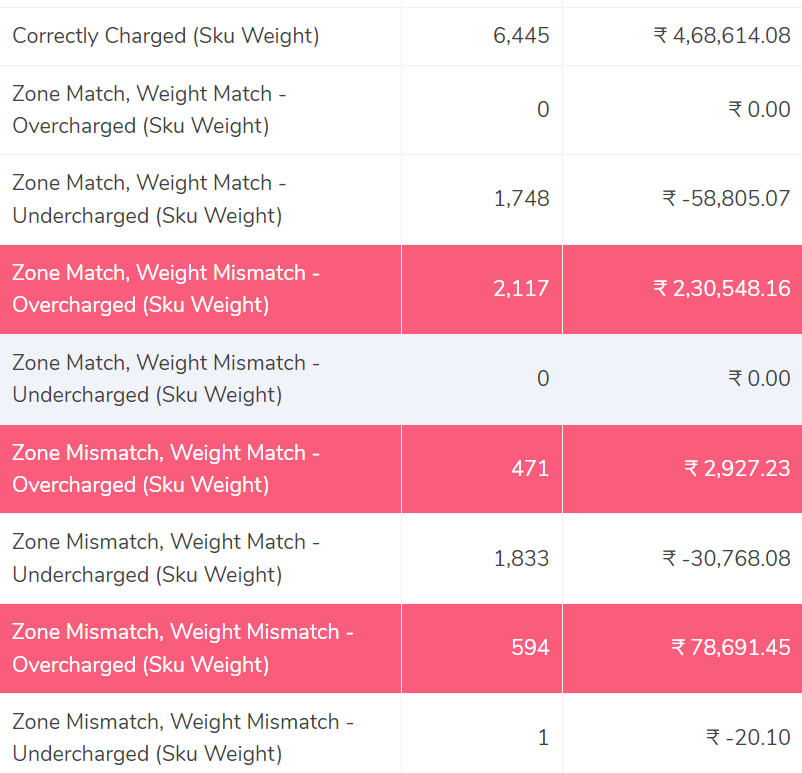

Correctly Charged

This denotes that the fee calculated with the help of the rate card matches the fee present in the Chronopost invoice. The software compares the ERP report and the Chronopost invoice report and shows the order deliveries where the zone and the weight of the product are correct.

Zone Match, Weight Match – Overcharged

In this case, the software compares the ERP report and the Chronopost report and shows that the zone of the product and the weight of the product match and yet the fee charged is wrong. In comparison to the calculated amount the invoice charges are more and hence it is overcharged.

Zone Match, Weight Match – Undercharged.

This denotes that after comparing the ERP report and the Chronopost report it shows that the zone of the product and the weight of the product match but the fee charged is wrong. Hence it is seen for these transactions a lesser amount is recorded in the invoice than calculated amount and hence the amount is undercharged.

Zone Mismatch, Weight Match – Overcharged

The software here compares the ERP report and the Chronopost report and shows that the zone of the product and fee does not match whereas the weight matches. Since the zone of the product does not match, the amount is over charged in this case compared to the calculated amount.

Zone Mismatch, Weight Match – Undercharged.

In this case, the software compares the ERP report and the Chronopost report and shows that the zone of the product and fee charged do not match the report whereas the weight matches, since the zone of the product and rate do not match, the amount is under charged in this case compared to the calculated amount.

Zone Match, Weight Mismatch – Overcharged

This denotes that after comparing the ERP report and the Chronopost report the weight of the product and fee do not match in both the reports, whereas the zone matches. Since the weight of the product and rate do not match, the amount is over charged in this case.

Zone Match, Weight Mismatch – Undercharged.

In this column, the software compares the ERP report and the Chronopost report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is under charged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP report and the Chronopost report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is higher than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

In this case, the software compares the ERP report and the Chronopost report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

In conclusion, Cointab’s software provides seamless accounting and financial management. The software helps in quickly automating the process of fee verification and since it is automated, there is no potential of error. In order to give you a clear understanding of your transactions and data, we formally compare and match your data across invoices, ERP reports, rate cards, SKU reports, and pin code reports. So your company can streamline data and automate the Chronopost shipping charges reconciliation process with ease and efficiency.

Click on the links below to view other Invoice Reconciliation Processes-

This denotes that the fee calculated with the help of the rate card matches the fee present in the Chronopost invoice. The software compares the ERP report and the Chronopost invoice report and shows the order deliveries where the zone and the weight of the product are correct.

Zone Match, Weight Match – Overcharged

In this case, the software compares the ERP report and the Chronopost report and shows that the zone of the product and the weight of the product match and yet the fee charged is wrong. In comparison to the calculated amount the invoice charges are more and hence it is overcharged.

Zone Match, Weight Match – Undercharged.

This denotes that after comparing the ERP report and the Chronopost report it shows that the zone of the product and the weight of the product match but the fee charged is wrong. Hence it is seen for these transactions a lesser amount is recorded in the invoice than calculated amount and hence the amount is undercharged.

Zone Mismatch, Weight Match – Overcharged

The software here compares the ERP report and the Chronopost report and shows that the zone of the product and fee does not match whereas the weight matches. Since the zone of the product does not match, the amount is over charged in this case compared to the calculated amount.

Zone Mismatch, Weight Match – Undercharged.

In this case, the software compares the ERP report and the Chronopost report and shows that the zone of the product and fee charged do not match the report whereas the weight matches, since the zone of the product and rate do not match, the amount is under charged in this case compared to the calculated amount.

Zone Match, Weight Mismatch – Overcharged

This denotes that after comparing the ERP report and the Chronopost report the weight of the product and fee do not match in both the reports, whereas the zone matches. Since the weight of the product and rate do not match, the amount is over charged in this case.

Zone Match, Weight Mismatch – Undercharged.

In this column, the software compares the ERP report and the Chronopost report shows that the weight of the product and fee do not match whereas the zone matches. Since the weight of the product and rate do not match, the amount is under charged in this case compared to the expected amount.

Zone Mismatch, Weight Mismatch – Overcharged

The software here compares the ERP report and the Chronopost report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is higher than the calculated amount in this case and so it is overcharged.

Zone Mismatch, Weight Mismatch – Undercharged

In this case, the software compares the ERP report and the Chronopost report and shows that the zone, fee and the weight of the product do not match. Hence the amount charged is lesser than the calculated amount in this case and so it is undercharged.

In conclusion, Cointab’s software provides seamless accounting and financial management. The software helps in quickly automating the process of fee verification and since it is automated, there is no potential of error. In order to give you a clear understanding of your transactions and data, we formally compare and match your data across invoices, ERP reports, rate cards, SKU reports, and pin code reports. So your company can streamline data and automate the Chronopost shipping charges reconciliation process with ease and efficiency.

Click on the links below to view other Invoice Reconciliation Processes-

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation