TPSL Techpro is a payment gateway that is used by many companies to facilitate online payments for customers. It provides various service options like money transfer, recharge, Mutual fund investments etc. in addition to bill payment. This service is very important, especially in today’s digital age as many customers prefer online payments as many customers go cashless.

Payment gateways like TPSL Techpro generally charge a fee and tax on each payment they process. But as a company, it is quite difficult to keep track of the fee and tax charged on each order as there can be thousands of payments processed daily.

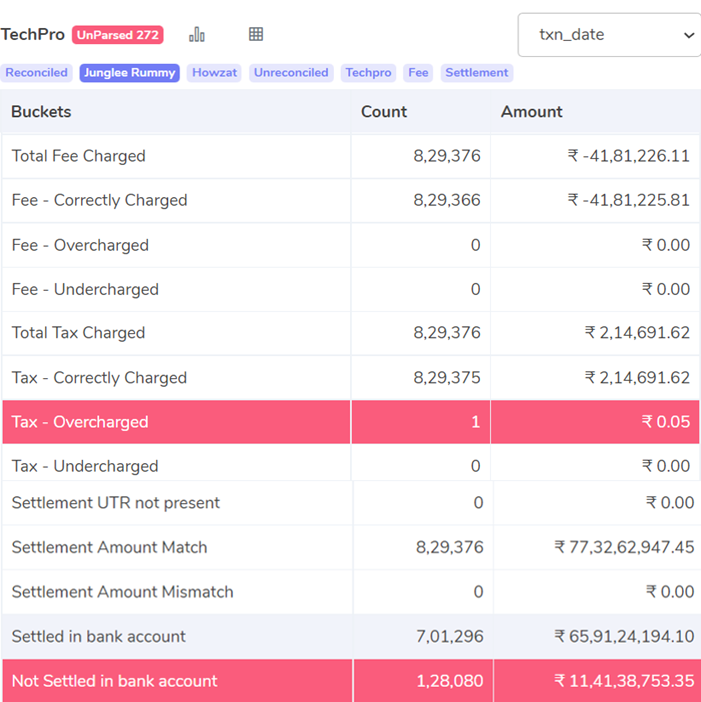

So, to simplify this process, you can use our automated reconciliation software. The software verifies the fee, tax and the amount settled in the bank by TPSL Techpro for you easily. Plus, it shows if any amount is overcharged or undercharged, which is extremely helpful for you to avoid overpaying any charge.

Reports Used for TPSL Techpro Payment Gateway Charges Verification

TPSL Techpro Payment Report

This report has information regarding the transaction amount, transaction date, fee and tax percentage, mode of payment, and issuing bank.

TPSL Techpro Rate Card

The TPSL Techpro card consists fee and tax percentage and its validity dates

TPSL Techpro Payment Gateway Charges Verification Result

Fee – Correctly Charged

The fee amount estimated for these orders matches the fee amount charged by TPSL Techpro. That implies that the amount mentioned in the TPSL Techpro matches the amount calculated.

Fee – Overcharged

The fee amount computed by the software differs from the fee amount charged by TPSL Techpro on these orders. It indicates that the charge on these orders exceeds what was estimated. As a result, the fee on these orders are overcharged.

Fee – Undercharged

The fee amount computed by the software differs from the fee amount charged by TPSL Techpro. It demonstrates that the charge is lower on these orders than what was anticipated. Therefore, the fee on these orders are undercharged.

Tax – Correctly Charged

The orders for which TPSL Techpro’s tax charge is correct under the conditions stipulated in the contract are displayed by our software. It indicates that the tax amount estimated and the tax amount recorded in the TPSL Techpro report are the same. The tax is computed as 18% GST on the fee.

Tax – Overcharged

These are the orders for which the tax amount listed in the TPSL Techpro report differs from the tax amount calculated. In this case, the tax amount TPSL Techpro charged exceeds the tax amount computed. The tax is computed as 18% GST on fee.

Tax – Undercharged

In the case of these orders, the tax amount recorded in the TPSL Techpro report does not correspond to the tax amount computed. For these orders, TPSL Techpro charged less tax than what was ascertained to be due. The tax is computed as 18% GST on fee.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

Using the stated formula, the software determines the settlement amount and checks it against the TPSL Techpro report. It lists the orders in this bucket for which the computed settlement amount matches the settlement amount listed in the TPSL Techpro report.

Settlement Amount Mismatch

The previously stated formula is used to determine the settlement amount. The software then compares the result to the TPSL Techpro report to verify it. It displays the orders in this bucket for which the computed settlement amount differs from the settlement amount listed in the TPSL Techpro report.

Settlement UTR not present

UTR is the identifier for the transaction made to the bank. The absence of the UTR for settlements, however, denotes the absence of any orders at all. The software in this bucket displays these orders.

Settled in Bank Account

The final settlement amount displayed in the TPSL Techpro report is compared to the amount reported on the bank statement by our software. The orders for which the total amount is the same in both reports are then presented. This shows that these order payments are settled by TPSL Techpro in your bank account.

Not Settled in Bank Account

As previously mentioned, the software uses the TPSL Techpro report and the Bank statement to confirm the settled amount. It displays the orders for which the amount that must be settled is missing from the bank statement. This indicates that these transactions have not yet been paid to your bank account by TPSL Techpro.

The final result, which shows the outcome of the reconciliation, is shown above. Because of the software’s concise results, finance teams can easily keep track of the fees, taxes, and amounts paid into the bank. The software also shows the overcharged or undercharged amount, helping you avoid making more needless payments.