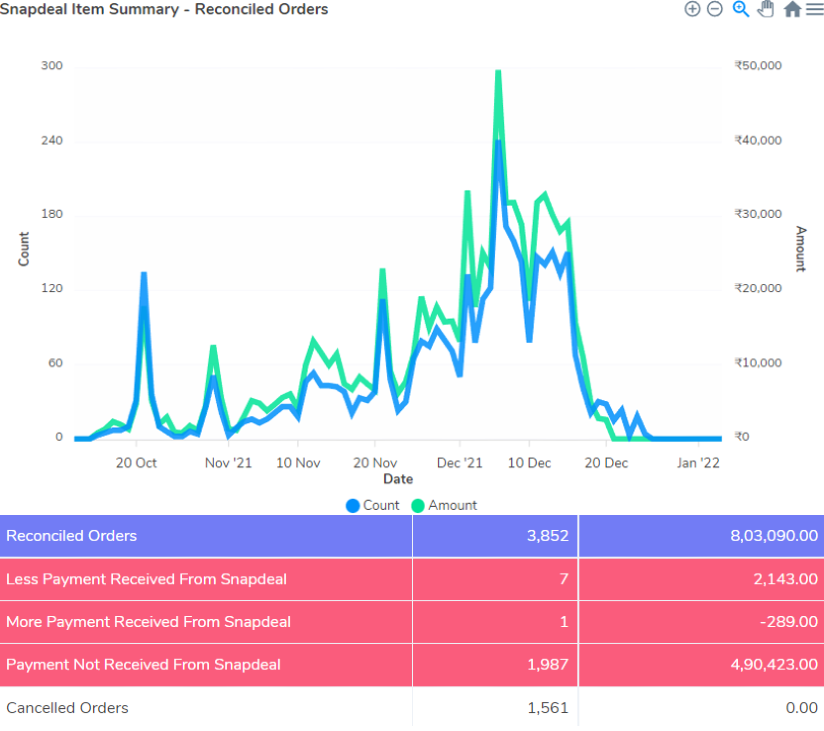

Snapdeal Marketplace Reconciliation

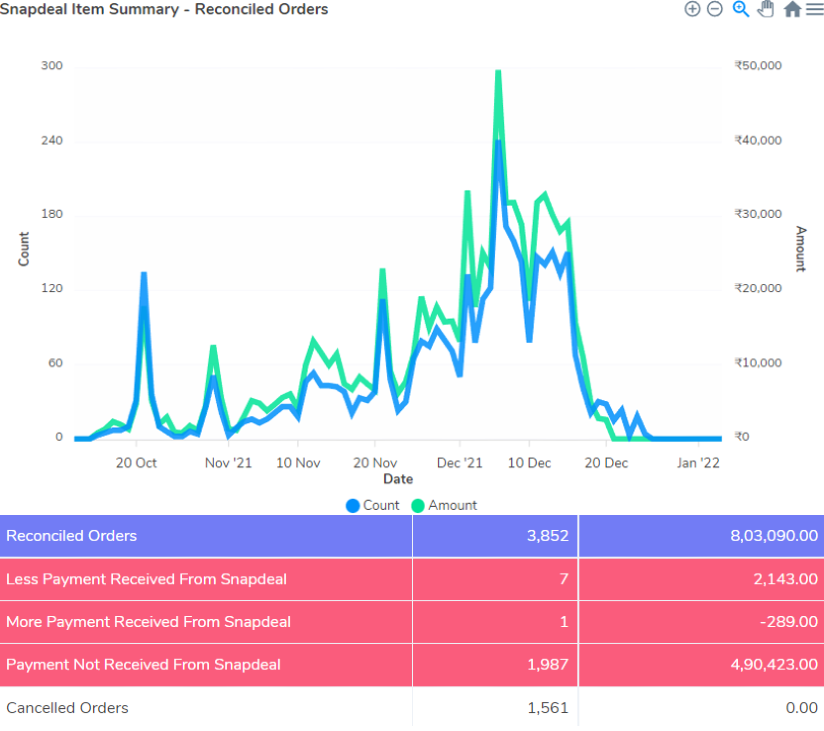

Payment Reconciliation

Reconcile Snapdeal Order report with Sales, Settlement reports.

- Verify payments for dispatched goods

- Verify inventory for RTO & Customer Returns

- Calculate net income and margin per Order

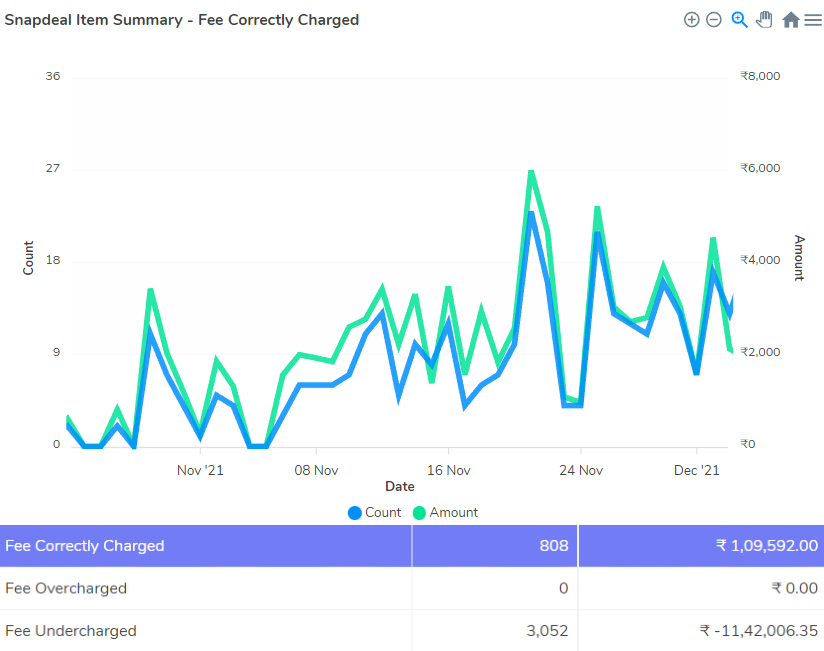

Fee Verification

Verify Snapdeal Commission, Courier, and Marketing fee per order.

- Verify the Commission fee based on Item Price

- Verify Marketing & Courier fees

- Identify orders where you have been overcharged and raise disputes with Snapdeal

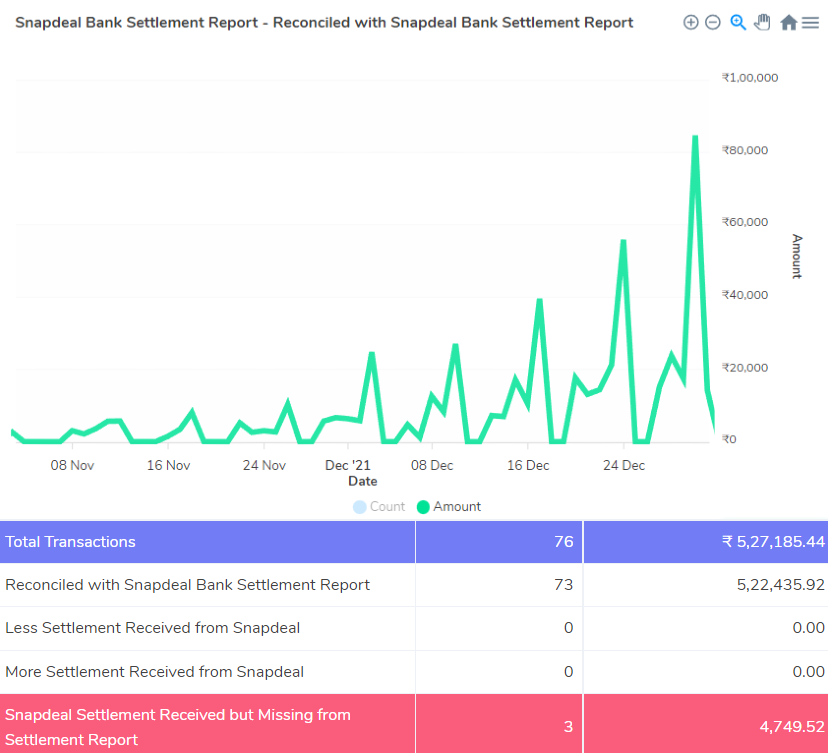

Bank Reconciliation

Reconcile Snapdeal settlement with Bank statement.

- Verify transaction level settlement with consolidated settlement

- Verify consolidated Snapdeal settlements in bank account

- Identify pending settlement with ageing

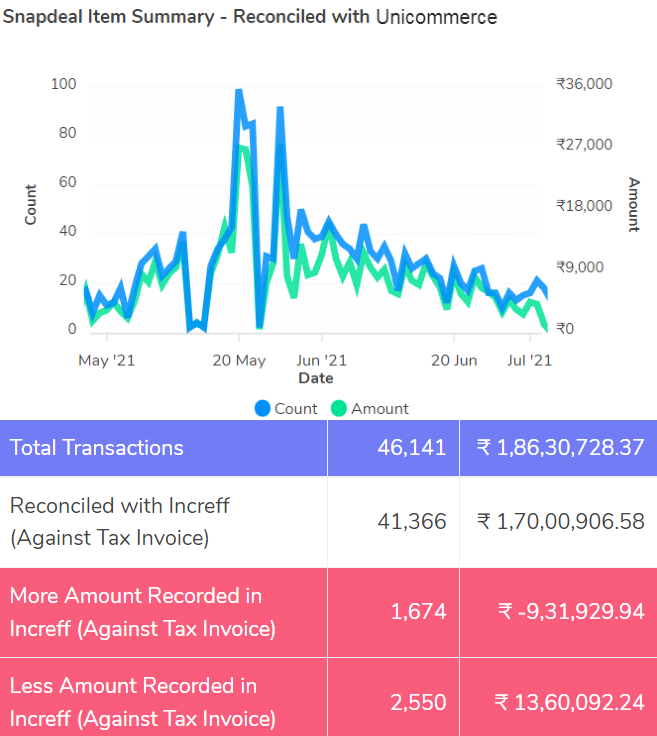

Reconciliation with OMS

Reconcile Snapdeal reports with Order Management System (OMS) reports.

- Verify all Snapdeal orders in OMS

- Identify any Snapdeal order missing in OMS

- Verify Snapdeal invoice & settlement amount with OMS order, invoice amount

- Reconcile Snapdeal RTO, customer returns with OMS return reports

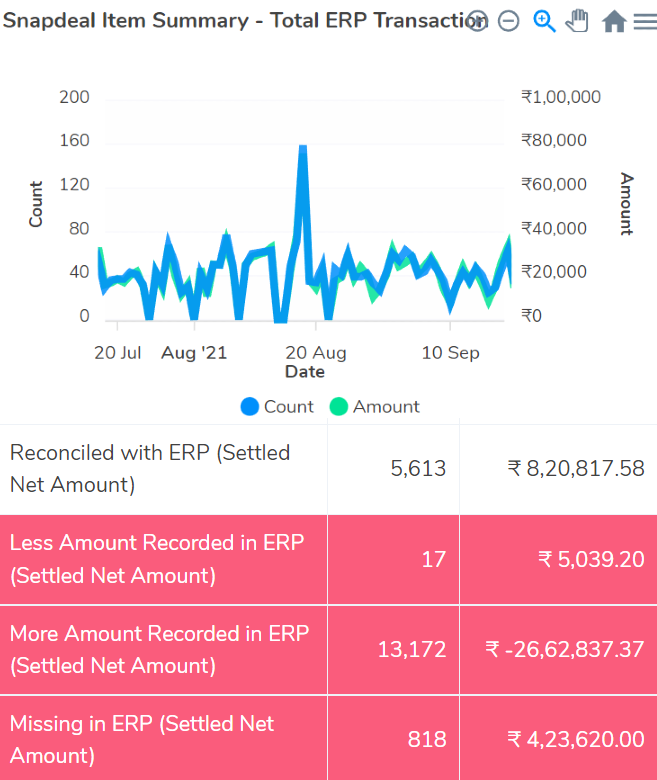

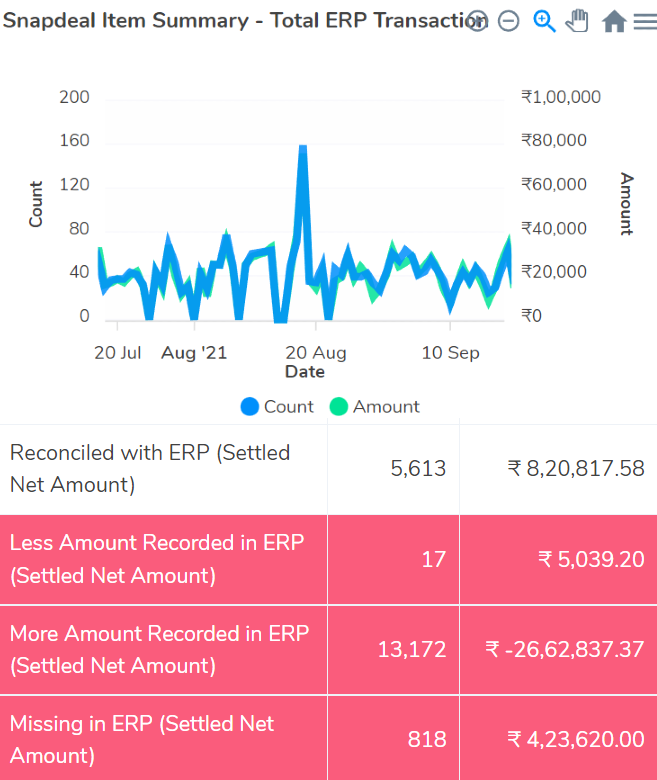

Reconciliation with ERP

Reconcile Snapdeal Sales reports with ERP sale and credit ledgers.

- Verify if all Snapdeal orders are recorded in ERP

- Identify any Snapdeal order missing in ERP

- Verify Snapdeal RTO, customer returns against ERP credit ledgers

- Verify net Snapdeal invoice amount with net ERP invoice amount

Reconciliation made Easier

Upload data

Analyze result

Resolve internal issues

Raise disputes with Snapdeal

Designed for Businesses

Reconcile multiple Snapdeal reports with each other, OMS, ERP

and Bank statement.

Verify

Verify if Snapdeal is paying you correctly for each order and deducting correct charges

Save time

Save time from data handling, cleaning and reconciling

Easy to Understand

Easily understand result between multiple systems

Raise Disputes

Easily raise disputes with Snapdeal for incorrect payment or deductions

Easy Access

Easy access to the data and output anytime and anywhere. Choose who can get access

Automation

Automate your data upload and start analyzing directly

Start Reconciling Snapdeal marketplace orders with Cointab

Contact Us