Searching for an alternative to Onestream for reconciliation? In the following article, we have listed our top 5 recommendations for alternative software to OneStream so that you can evaluate all the alternatives in one place.

The tedious process of data reconciliation takes too much time and effort of the finance team. Due to this, they are unable to focus on other critical tasks that might need their attention. Hence, the need to switch to an automated solution arises. However, when picking a reconciliation software it is necessary to look for a software that will seamlessly integrate into your business.

The tedious process of data reconciliation takes too much time and effort of the finance team. Due to this, they are unable to focus on other critical tasks that might need their attention. Hence, the need to switch to an automated solution arises. However, when picking a reconciliation software it is necessary to look for a software that will seamlessly integrate into your business.

OneStream is software that covers various financial services which include data reconciliation. Its reconciliation system enables easy analysis and reporting, simplifying the process of matching transactions. The software is designed to replace spreadsheets, providing managers with statistical insights that aid in data analysis with its automation capabilities. Additionally, OneStream maintains a complete audit trail, reducing errors. The system imports data directly from the bank, providing a single location for viewing high-risk transactions. The managers can closely monitor transactions and send alerts for changes made in the trial balance. Onstream helps simplify the reconciliation process for your businesses easily.

In case OneStream is not the right pick for your business, then we have listed our top 5 alternatives for reconciliation to OneStream that you can evaluate and adopt into your business for reconciliation

In case OneStream is not the right pick for your business, then we have listed our top 5 alternatives for reconciliation to OneStream that you can evaluate and adopt into your business for reconciliation

1. Cointab

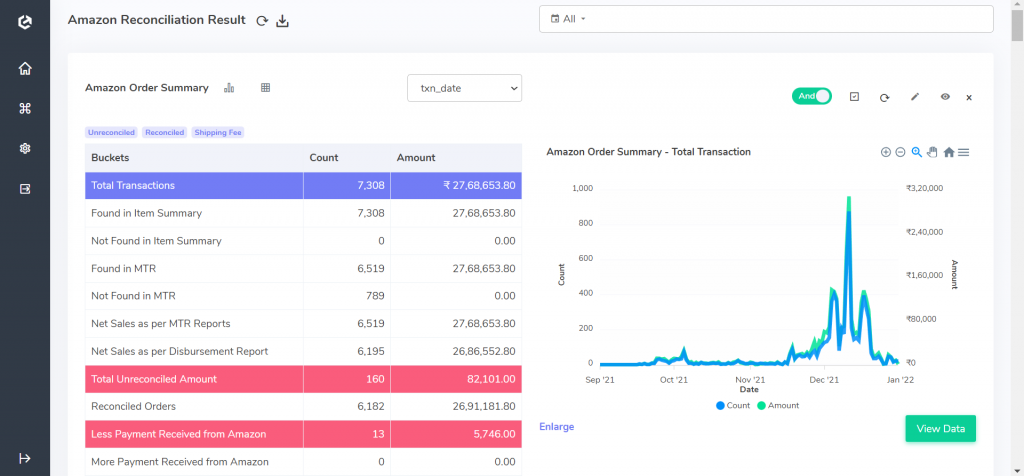

Cointab reconciliation is a software that is fully based on automating reconciliation processes. The main purpose is to make the reconciliation process easier so that the finance team saves time and effort in a repetitive process like reconciliation. The software automates data loading so no time is spent in individually uploading each file. The process itself can be scheduled to run whenever needed so the results are always ready on time. Along with these automations, the export of results can also be automated.The software has many customization options that help configure the reconciliation process to suit your business. It lets users pick a custom format for import and export of files such as XML, CSV, PDF, JSON etc. This makes it convenient for the users so that they are able to upload the file conveniently and export it directly in the file format they require. Along with this, the users can enter a custom rules engine for matching conditions so it suits their business rules and policies.

The results produced by the system are easy to interpret with graphs for analysis. The results highlight the transaction where the amounts mismatch so the finance team can monitor those transactions more closely. They can also add exceptions to transactions if these payments are to be settled manually. With Cointab reconciliation automate reconciliation easily.

2. ReconArt

ReconArt is a reconciliation software that is designed to help businesses automate and streamline their reconciliation processes. It provides a comprehensive platform that enables users to reconcile their accounts, identify discrepancies, and manage exceptions quickly and easily.

The software can automatically match transactions based on rules, algorithms, or reference data, and flag exceptions that require attention. Its workflow management capabilities allow users to assign and track tasks, and set reminders so errors can be resolved and expectations can be added to reconcile faster. To help ensure all information is accurate and safe the software maintains an audit trail and enables user permissions.

The software supports the reconciliation of multiple types of accounts, including bank accounts, credit card accounts, and general ledger accounts. It also integrates with various data sources, such as ERPs, banks, payment processors, and other financial systems, allowing users to import data from multiple sources into a single platform for reconciliation. features make it an ideal solution for organizations of all sizes and industries that need to reconcile large volumes of data quickly and accurately.

The software can automatically match transactions based on rules, algorithms, or reference data, and flag exceptions that require attention. Its workflow management capabilities allow users to assign and track tasks, and set reminders so errors can be resolved and expectations can be added to reconcile faster. To help ensure all information is accurate and safe the software maintains an audit trail and enables user permissions.

The software supports the reconciliation of multiple types of accounts, including bank accounts, credit card accounts, and general ledger accounts. It also integrates with various data sources, such as ERPs, banks, payment processors, and other financial systems, allowing users to import data from multiple sources into a single platform for reconciliation. features make it an ideal solution for organizations of all sizes and industries that need to reconcile large volumes of data quickly and accurately.

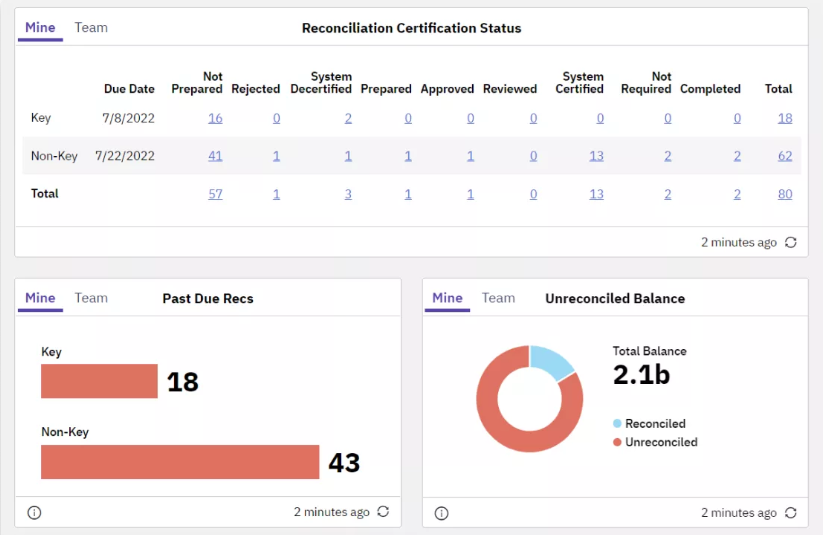

3. BlackLine

Blackline provides several financial close features, such as task management, financial reporting analysis, accounts reconciliation, and credit management. The process is made easier by its account reconciliation tool, which also improves accuracy and control. The finance team can use the standardized templates and workflows for preparation, approval, and review, well as internal documentation storage, ensuring improved collaborations. With the help of the rule-based workflow, users can quickly identify discrepancies and avoid manual errors.

BlackLine’s cloud-based dashboard provides transparency, enabling users to monitor results from anywhere at any time so there is no dependency on any internal personnel. Blackline also facilitates the grouping of ERPs and other entities while adhering to business rules. Along with all these features the system simplifies transaction matching with one-to-one and one-to-many matches, bulk data loading, configurable rules, and an exception-adding feature to ensure accurate transaction matching.

Users can view these matches of unreconciled and reconciled transactions on the dashboard. The software also maintains a complete audit trail so previous actions are recorded, this helps ensure security. Blackline’s automated reconciliation and simplified transaction matching provide efficiency and accuracy in the financial reconciliation process.

BlackLine’s cloud-based dashboard provides transparency, enabling users to monitor results from anywhere at any time so there is no dependency on any internal personnel. Blackline also facilitates the grouping of ERPs and other entities while adhering to business rules. Along with all these features the system simplifies transaction matching with one-to-one and one-to-many matches, bulk data loading, configurable rules, and an exception-adding feature to ensure accurate transaction matching.

Users can view these matches of unreconciled and reconciled transactions on the dashboard. The software also maintains a complete audit trail so previous actions are recorded, this helps ensure security. Blackline’s automated reconciliation and simplified transaction matching provide efficiency and accuracy in the financial reconciliation process.

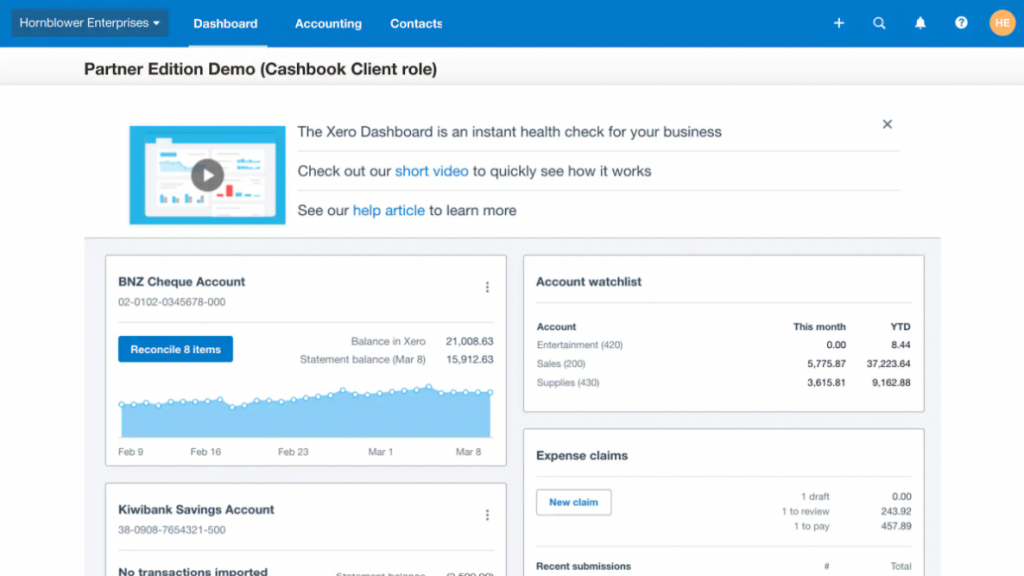

4. Xero

Xero offers a range of financial services that include bill payments, reimbursements, expense claiming, and bank reconciliation through the software. The Xero software mainly specialized in bank reconciliation. It enables users to import transactions directly from their bank accounts and reconcile them with the Xero ledger. This helps the team check the reconciled items on the dashboard easily. The results consist of metrics and graphs to aid in decision-making and analysis. So with the help of Xero bank reconciliation, users have the ability to review bank reconciliation results on a daily basis.

Xero’s reconciliation tool automatically categorises transactions, applies rules, and suggests matches that users can accept to reconcile transactions. With the help of these bulk transactions can be matched by allowing users to group transactions and apply rules to the group as a whole. Additionally, Xero’s reconciliation tool is integrated with other features such as cashbook, enabling clients to access and reconcile transactions while viewing the results. With Xero’s financial services, streamline bank reconciliation and carry out daily financial transactions efficiently.

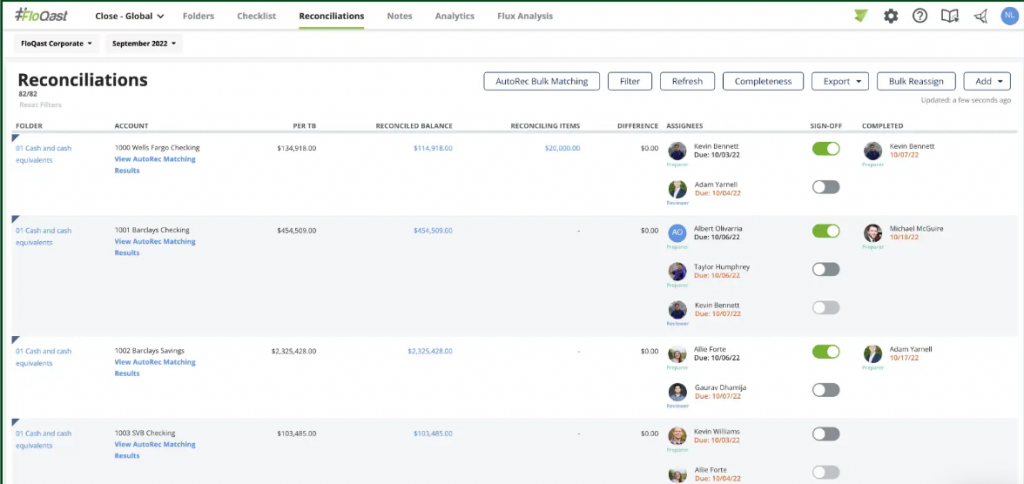

5. FloQast

FloQast is a comprehensive financial software solution that simplifies various financial functions such as financial close, reporting as well a providing audit readiness. Its automated account reconciliation tool provides an easy way to manage reconciliation and minimize the risk of errors in a centralized manner. Its reconciliation system tracks time and detects unknown errors, which can be promptly resolved by the finance team through centralized tracking. Additionally, the FloQast system sends alerts when reconciliations are due or ready for review, ensuring timely payment processing and error resolution. Users also can select the most appropriate reconciliation method for each account, ensuring that the reconciliation is carried out in the most efficient manner. The system provides a centralized view of each transaction, facilitating analysis by allowing the managers to review balances, make comparisons, and approve sign-offs. Automated controls are in place to track these sign-offs so that the source of errors can be identified if they occur. The FloQast reconciliation tool streamlines tie-outs with the general ledger and verifies trial balances, ensuring complete accuracy while reducing errors in the financial reconciliation process for finance teams.

With these alternatives available instead of OneStream, users will be able to easily pick the right software for their business. As evaluation is an important part of adopting a reconciliation software in your organization, it is necessary to set benchmarks as to what goals the software should fulfil which will help in drawing comparisons between the alternatives. If you feel that the software adds value to the daily operation and simplifies various tasks as per your business needs.

With these alternatives available instead of OneStream, users will be able to easily pick the right software for their business. As evaluation is an important part of adopting a reconciliation software in your organization, it is necessary to set benchmarks as to what goals the software should fulfil which will help in drawing comparisons between the alternatives. If you feel that the software adds value to the daily operation and simplifies various tasks as per your business needs.

TAGS : Blogs

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation