Reconciliation is an important part of financial operation for any business of any size. The reconciliation process consists of comparing transactions in various reports to check if they match correctly. However, the manual reconciliation process is time-consuming and error-prone. This questions the accuracy of the process. This has caused many businesses to shift to the automation of reconciliation. To automate reconciliation businesses have to pick a reconciliation software that will cater to their needs.

However, when looking at financial reconciliation software there are many options available in the market. Businesses need to evaluate all the alternatives and choose a software suitable for them. In this article, we cover two reconciliation softwares namely Cointab and Xero.

Both these softwares are designed to help automate the reconciliation process. These softwares streamline the reconciliation process while their valuable features add to them to help finance manage the process much more efficiently. Let’s take a closer look at the features of these softwares and their similarities and differences so that between these two options, you have a better idea of which one is right for you.

Cointab

Cointab is a reconciliation software that completely automates the reconciliation process while maintaining the accuracy of financial data. Cointab is a customizable software which helps businesses achieve maximum efficiency. The software accepts a custom data input format with automated data loading via integrations such as SFTP, API and Emails. Along with that, it lets users define their own rules engine for logic conditions to match their own business rules or policies. In the final reconciliation step, the software also lets the user select data fields and columns to customize results along with that they can pick file formats to export data. These customizations help users reconcile data in the way most suitable for their business.

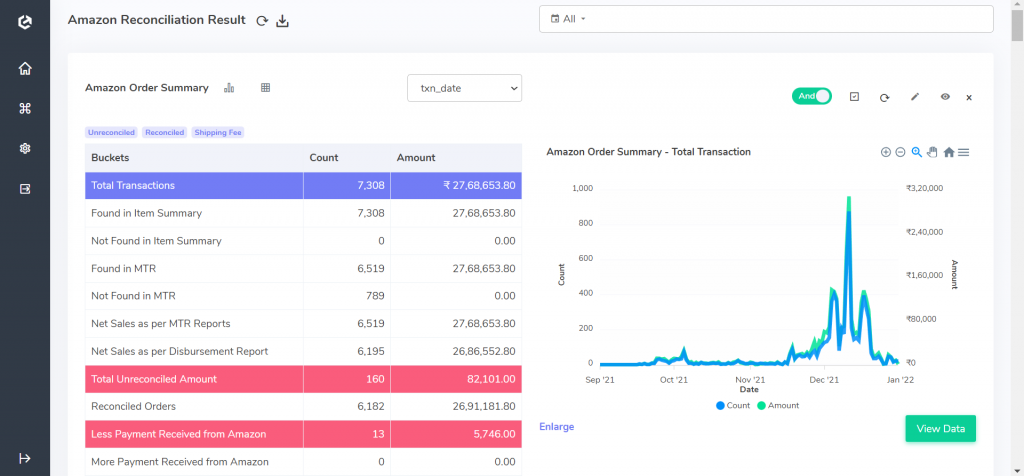

To fully automate this process managers can even schedule the reconciliation process to run in real-time, hourly, weekly or monthly. This way the team does not need to bother setting up to run the process and can have the results ready beforehand. The result produced by the software is in an easy-to-understand and analyse format. The software also lets you get a detailed view of each transaction. A particular transaction and its details can be viewed across all reports in a single place.

Lastly, Cointab automates the various reconciliation process some of which are payment gateway reconciliation, bank reconciliation, cash-on-delivery (COD Remittance) reconciliation, Marketplace Reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq and many more), fee verification, ERP reconciliation and order management system (OMS) reconciliation. Businesses can automate these processes to reconcile efficiently while saving the time and effort spent by the finance teams.

Xero

Xero is a financial accounting software that looks after various daily accounting operations. These financial services include bill payments, claiming expenses, accepting payments, tracking projects, paying runs and bank reconciliation. Along with these services it also provides Xero HQ, cashbook, ledger and a practice manager which are useful for accountants and bookkeepers. Let’s look at the reconciliation aspect of the software for proper comparison.

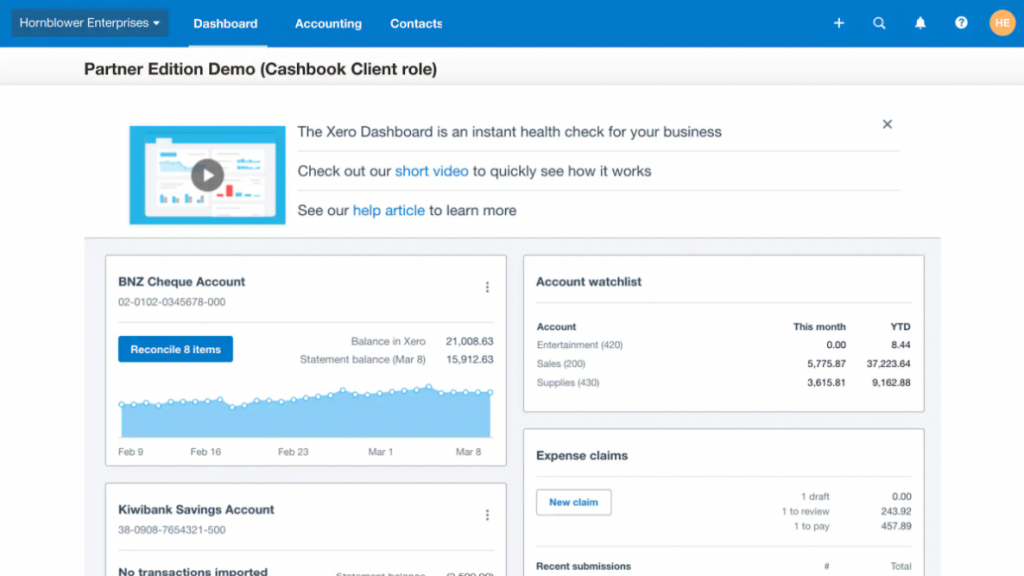

Xero specifically reconciles bank account transactions as the system directly imports transactions from the bank account and reconciles it with the Xero cashbook. With Xero users can reconcile every day and get up-to-date results. To simplify this even more, Xero has made a mobile app available which users can use for bank reconciliation.

The system has a unique feature called suggested matches, which gives you suggested matches of transactions. It suggests matches and categorizes transactions so that everything is recorded systematically. It then applies rules and reconciles data automatically. In Xero, the bank transactions can be matched with invoices and bill payments and a new transaction can also be created in the cashbook incase a transaction does not exist. This way no inaccurate records are maintained and if settlements are made they can also be added for reconciliation.

Conclusion

Both Xero and Cointab fulfill reconciliation functions and help automate the reconciliation process. However, Xero is an all-around accounting software which only does bank transaction reconciliation which is suited for small and medium-sized businesses. Whereas Cointab fully focuses on reconciliation so it can conduct any reconciliation process. In addition to that Cointab can it suitable for any type of business ranging from small to large. With these considerations, we aim to help with evaluating products for reconciliation so that you can choose the right software for your business.