Monzo, an innovative pioneer among app-based challenger banks in the United Kingdom, emerged as a trailblazer by introducing its services through a user-friendly mobile application and a prepaid debit card. Subsequently, upon securing a full banking license, Monzo expanded its offerings to include current accounts, thus solidifying its position as a leading financial institution in the digital banking landscape.

As a reputable payment gateway, Monzo facilitates numerous transactions for businesses and individuals alike. However, the manual reconciliation of these transactions can often prove to be a cumbersome and time-intensive task for organizations. Inevitably, discrepancies may arise, necessitating meticulous review and rectification by dedicated team members. In such scenarios, the implementation of Cointab Reconciliation software emerges as a transformative solution, leveraging automation to seamlessly reconcile transactions and rectify any discrepancies that may arise.

The reconciliation process facilitated by Cointab software serves as a crucial mechanism for ensuring accuracy and efficiency in financial operations, particularly in the context of Monzo payment gateway transactions. Through its automated features, Cointab streamlines the reconciliation process, significantly reducing the burden on organizational resources while enhancing overall operational effectiveness.

The reconciliation results provided by Cointab encompass various facets of Monzo’s payment gateway transactions, offering comprehensive insights into the financial activities facilitated through this platform. These include:

Monzo Settlement Reports:

Detailed summaries of orders placed and corresponding payments made, providing essential information for tracking and managing financial transactions.

Monzo Refund Reports:

Comprehensive documentation of transactions that have been refunded subsequent to order cancellations, offering clarity and transparency in financial dealings.

Website Reports:

In-depth analysis of customer order details originating from website transactions, offering valuable insights for optimizing online sales strategies and enhancing customer satisfaction.

ERP Reports:

Internal reports presenting itemized information pertinent to organizational operations, facilitating informed decision-making and resource allocation.

Bank Statements:

Comprehensive records of transactions reflecting payments received via the Monzo payment gateway, offering a comprehensive overview of financial inflows.

By leveraging Cointab Reconciliation software, organizations can streamline their reconciliation processes and mitigate the challenges associated with manual transaction management. This not only enhances operational efficiency but also ensures accuracy and compliance in financial operations, ultimately contributing to organizational growth and sustainability.

Monzo’s partnership with Cointab Reconciliation software represents a strategic alignment aimed at optimizing financial processes and enhancing overall operational efficiency. Through the integration of automated reconciliation solutions, businesses can unlock new levels of productivity and accuracy in managing Monzo payment gateway transactions, positioning themselves for sustained success in an increasingly digital-centric financial landscape.

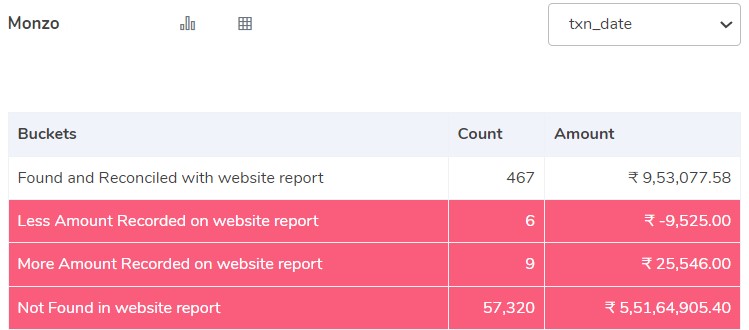

Website Reconciliation:

Discovering and reconciling transactions efficiently is crucial for businesses to maintain accurate financial records and ensure smooth operations. With our integrated system, combining website and Monzo settlement reports, businesses can streamline this process effectively.

Detecting Discrepancies:

One of the key challenges in transaction reconciliation is identifying any discrepancies between different sources of transaction data. Our system enables businesses to detect such variances, particularly concerning the amounts recorded in website reports versus Monzo settlements. Often, discrepancies arise where the amount recorded in website reports is less than what appears in Monzo settlements. By leveraging our integrated reports, businesses can easily identify and address such discrepancies, ensuring the accuracy of their financial records.

Optimizing Reconciliation:

Furthermore, optimizing the reconciliation process is essential for maximizing efficiency and resource utilization. Our system facilitates this optimization by providing insights into the reconciliation process. Specifically, it highlights instances where the amount recorded in website reports exceeds that in Monzo settlements. This information allows businesses to prioritize their reconciliation efforts, focusing on areas where discrepancies are more pronounced. By addressing these discrepancies promptly, businesses can streamline their reconciliation process and minimize the risk of financial inaccuracies.

Resolving Mismatches:

Resolving mismatches between different sources of transaction data is another critical aspect of transaction reconciliation. Our integrated system excels in this regard by identifying transactions present in Monzo’s settlement report but absent from website reports. This functionality is particularly valuable for businesses operating in e-commerce or online retail, where transactions may occur across multiple platforms. By ensuring that all transactions are accurately recorded and reconciled, our system helps businesses maintain financial integrity and compliance.

Additional Benefits:

In addition to facilitating transaction reconciliation, our integrated system offers several other benefits for businesses. For example, it provides real-time insights into transaction activity, allowing businesses to monitor their financial performance more effectively. Moreover, by automating the reconciliation process, our system helps businesses save time and resources that would otherwise be spent on manual reconciliation tasks. This enables businesses to focus their efforts on value-added activities, such as strategic planning and decision-making.

User-Friendly Interface:

Furthermore, our system is designed to be user-friendly and intuitive, ensuring that businesses can easily navigate and utilize its features. Whether reconciling transactions, generating reports, or accessing real-time insights, our system provides a seamless user experience that empowers businesses to make informed financial decisions.

Transaction reconciliation is a critical process for businesses to maintain accurate financial records and ensure compliance with regulatory requirements. Our integrated system, combining website and Monzo settlement reports, offers a comprehensive solution for businesses looking to streamline their reconciliation process. By detecting discrepancies, optimizing reconciliation efforts, and resolving mismatches, our system helps businesses maintain financial integrity and maximize operational efficiency. With its user-friendly interface and robust features, our system is the ideal solution for businesses seeking to enhance their transaction reconciliation capabilities.

Website with Monzo Reconciliation:

Ensuring precise reconciliation of financial transactions is vital for businesses aiming to maintain accuracy and operational efficiency. Our integrated system, combining website and Monzo settlement reports, facilitates this critical process effectively, optimizing performance and resource allocation.

Identifying Discrepancies:

A fundamental challenge in transaction reconciliation lies in pinpointing disparities across various data sources. Our system empowers businesses to discern such variances, particularly regarding recorded amounts in website reports versus Monzo settlements. Leveraging our integrated reports, businesses can readily identify and rectify disparities, fortifying financial accuracy.

Maximizing Reconciliation Efficiency:

Optimizing the reconciliation process is imperative for efficient resource allocation. Our system offers insights into reconciliation, illuminating instances where Monzo settlement reports exceed website reports. This prioritizes reconciliation efforts, streamlining processes and minimizing financial inaccuracies.

Resolving Mismatches:

Resolving discrepancies between transaction data sources is critical. Our system excels by identifying transactions in website reports absent from Monzo settlements. This functionality is vital for e-commerce, ensuring accurate recording and regulatory compliance.

Unlocking Additional Benefits:

Our system offers ancillary benefits, including real-time insights into transaction activity and automated reconciliation. This liberates businesses from manual tasks, empowering them to focus on strategic decision-making.

Seamlessly User-Friendly:

Boasting a user-friendly interface, our system facilitates seamless navigation and utilization. Whether reconciling transactions or accessing real-time insights, businesses can make well-informed financial decisions confidently.

Monzo Reconciliation with ERP:

Achieving meticulous transaction reconciliation is pivotal for businesses striving for financial accuracy and operational excellence. Our integrated system, harmonizing ERP and Monzo settlement reports, facilitates this pivotal process efficiently, optimizing performance and resource allocation.

Identifying Discrepancies:

A core challenge in transaction reconciliation is detecting disparities across diverse data sources. Our system empowers businesses to discern such variances, particularly regarding recorded amounts in ERP reports versus Monzo settlements. Leveraging our integrated reports, businesses can promptly identify and rectify disparities, fortifying financial precision.

Maximizing Reconciliation Efficiency:

Optimizing the reconciliation process is essential for efficient resource allocation. Our system offers insights into reconciliation, spotlighting instances where ERP reports reflect lesser amounts compared to Monzo settlements. This prioritizes reconciliation efforts, streamlining processes and minimizing financial discrepancies.

Resolving Mismatches:

Resolving disparities between transaction data sources is crucial. Our system excels by identifying transactions in Monzo settlements absent from ERP reports. This functionality is invaluable for businesses, ensuring accurate recording and regulatory compliance.

Unlocking Additional Benefits:

Our system offers supplementary benefits, including real-time insights into transaction activity and automated reconciliation. This liberates businesses from manual tasks, empowering them to focus on strategic decision-making and value-added endeavors.

Seamlessly User-Friendly:

Boasting a user-friendly interface, our system facilitates seamless navigation and utilization. Whether reconciling transactions or accessing real-time insights, businesses can make well-informed financial decisions with confidence and ease.

ERP Reports with Monzo Reconciliation:

Guaranteeing meticulous transaction reconciliation is essential for businesses to uphold financial integrity and operational efficiency. Our integrated system seamlessly harmonizes data from ERP and Monzo settlement reports, enabling thorough reconciliation processes and optimizing performance.

Streamlined Reconciliation:

Efficiently reconciling transactions found in both ERP and Monzo settlement reports is pivotal. Our integrated system streamlines this process, minimizing errors and ensuring financial accuracy across all records.

Discrepancy Identification:

Detecting disparities between ERP and Monzo settlement reports is paramount. Our system empowers businesses to pinpoint such variances, particularly regarding recorded amounts. It’s common for Monzo settlement reports to indicate lesser amounts compared to ERP records. By leveraging our integrated reports, businesses can promptly identify and address these discrepancies.

Proactive Resolution:

Promptly addressing disparities is critical for maintaining financial accuracy and compliance. Our system provides insights into reconciliation efforts, highlighting instances where Monzo settlement reports reflect higher or lower amounts compared to ERP records. This allows businesses to prioritize reconciliation efforts and take corrective action efficiently.

Comprehensive Reconciliation:

Resolving disparities between transaction data sources ensures accurate financial reporting. Our system excels in identifying transactions recorded in ERP reports but not reflected in Monzo settlements, and vice versa. This functionality ensures comprehensive reconciliation and regulatory compliance.

Handling Cancelled Transactions:

Cancelled transactions pose unique challenges to reconciliation efforts. Our system addresses this issue by identifying cancelled orders recorded in Monzo settlement reports but not reflected in ERP records. This ensures accurate accounting for cancelled transactions, minimizing discrepancies in financial reporting.

Leveraging Additional Benefits:

Beyond transaction reconciliation, our integrated system offers a range of supplementary benefits. These include real-time insights into transaction activity, automated reconciliation processes, and a user-friendly interface for seamless navigation. By leveraging these features, businesses can enhance their financial management practices and make informed decisions with confidence.

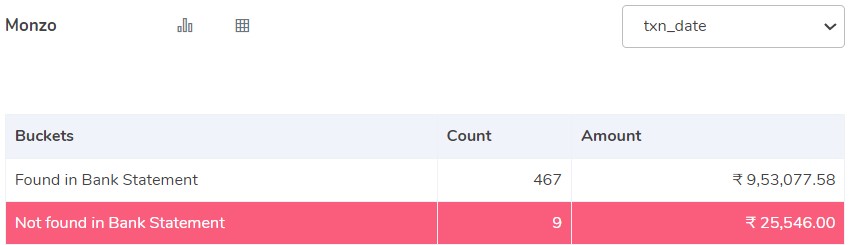

Monzo with Bank reconciliation:

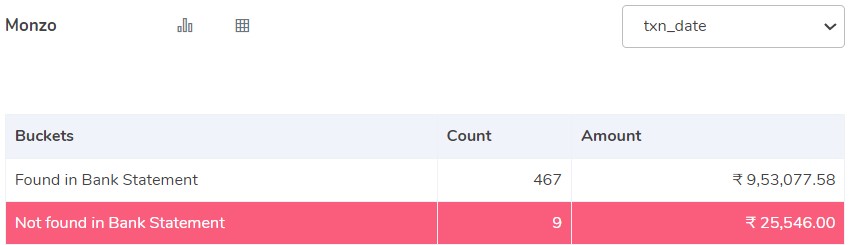

Discoverable in Bank Statements:

Transactions seamlessly appear in both bank statements and Monzo’s settlement reports, ensuring comprehensive record-keeping.

Absence in Bank Statements:

Despite being present in Monzo’s settlement reports, certain transactions do not reflect in bank statements, indicating a potential discrepancy in financial records.

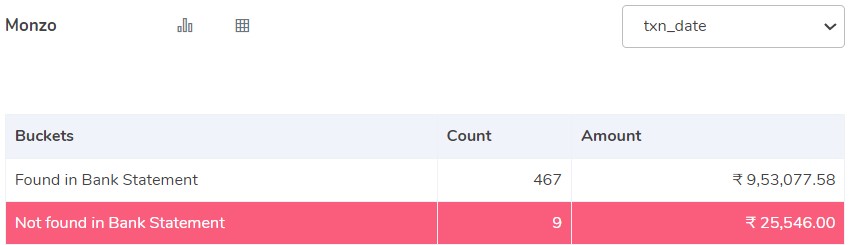

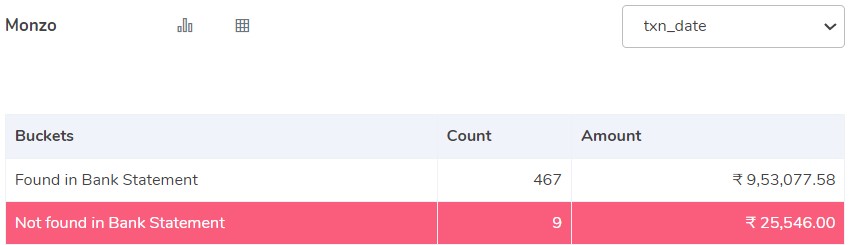

Bank reconciliation with Monzo:

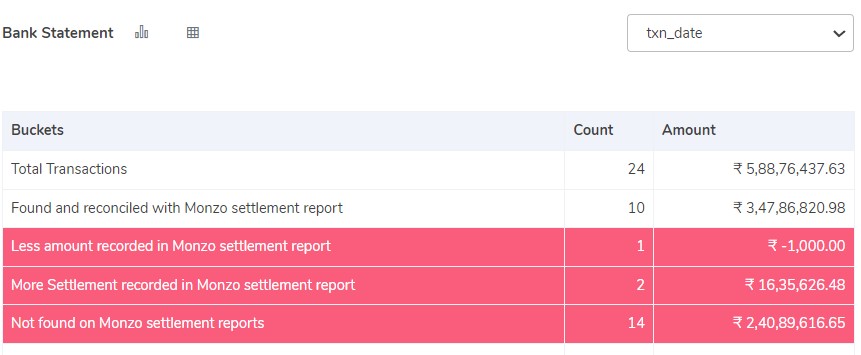

Found and reconciled with Monzo settlement reports:

Transactions are meticulously traced and reconciled across bank statements and Monzo settlement reports, ensuring comprehensive financial record-keeping.

More amount recorded on Monzo settlement report:

Instances arise where the amount documented in Monzo’s settlement reports exceeds the corresponding figures in bank statements, necessitating precise reconciliation practices.

Less amount recorded on Monzo settlement report:

Conversely, discrepancies may occur where the amount documented in Monzo’s settlement reports falls short of the figures in bank statements, highlighting the critical importance of accurate reconciliation.

Not found on the settlement report:

Certain transactions, evident in bank statements, may be absent from Monzo’s settlement reports, emphasizing the necessity for thorough investigation and rectification to maintain financial accuracy and regulatory compliance.

The meticulous reconciliation of transactions with Monzo settlement reports is essential for businesses to maintain financial accuracy and compliance. Whether reconciling discrepancies in amounts recorded or ensuring all transactions are accounted for, precision is paramount. By leveraging automation solutions like Cointab Reconciliation software, businesses can streamline their reconciliation processes, saving valuable time and resources while ensuring error-free results.

Furthermore, embracing advanced reconciliation tools not only enhances operational efficiency but also enables teams to focus on strategic initiatives. With Cointab’s ability to verify various reports and customize workflows according to specific requirements, businesses can adapt to evolving needs and drive growth in today’s competitive landscape. Overall, prioritizing accurate reconciliation practices and leveraging innovative solutions are key to maintaining financial integrity and achieving long-term success.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation