Skrill: A Streamlined Payment Gateway for Your Business

Skrill is a popular digital wallet solution offering a multitude of payment options and money transfer services. It empowers businesses to accept online payments seamlessly, securely, and cost-effectively, facilitating smooth cross-border transactions.

As your business volume with Skrill grows, managing and verifying a high number of transactions becomes crucial. This is where meticulous reconciliation comes into play. Reconciling financial transactions ensures the accuracy of payments received through the Skrill payment gateway.

Automated Reconciliation: A Time-Saving Solution

Reconciling reports manually can be a tedious and error-prone process. Thankfully, businesses can leverage automated reconciliation software like Cointab to streamline this task. Cointab automates the reconciliation process, significantly reducing the time it takes and eliminating the risk of errors. It flags discrepancies for your attention and delivers accurate results, freeing you to focus on core business activities.

Understanding Skrill Payment Gateway Reconciliation Reports

Effective reconciliation involves comparing reports from various sources, including:

Skrill Settlement Reports:

These reports detail orders placed and payments processed through Skrill.

Skrill Refund Reports:

These reports list orders that have been cancelled and refunded.

Website Reports: These reports contain information on all orders placed through your website.

ERP Reports:

These are internal company reports capturing detailed item-wise information.

Bank Statements:

These reports provide details on all transactions received from the bank via the payment gateway.

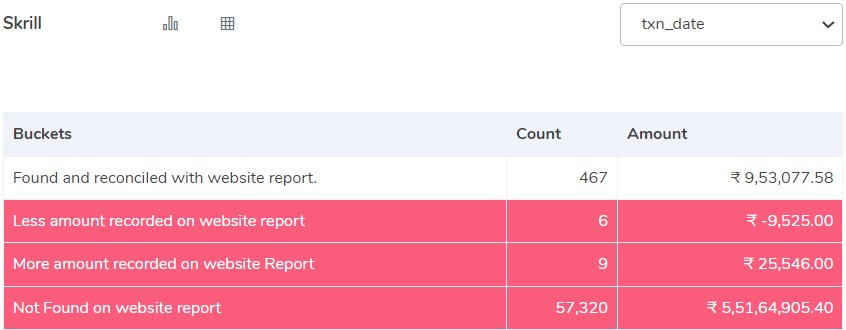

Reconciling Skrill with Your Website:

The reconciliation process between Skrill and your website reports can reveal various scenarios:

Found and Reconciled with Website Report:

These transactions appear in both the Skrill settlement report and your website report, indicating a successful match.

Discrepancies in Transaction Amounts:

Less Amount Recorded on Website Report:

This discrepancy signifies a lower amount recorded on your website compared to the Skrill settlement report.

More Amount Recorded on Website Report:

This indicates a higher amount recorded on your website report compared to the Skrill settlement report.

Missing Transactions:

Not Found in the Website Report:

These transactions are present in the Skrill settlement report but missing from your website report, requiring further investigation.

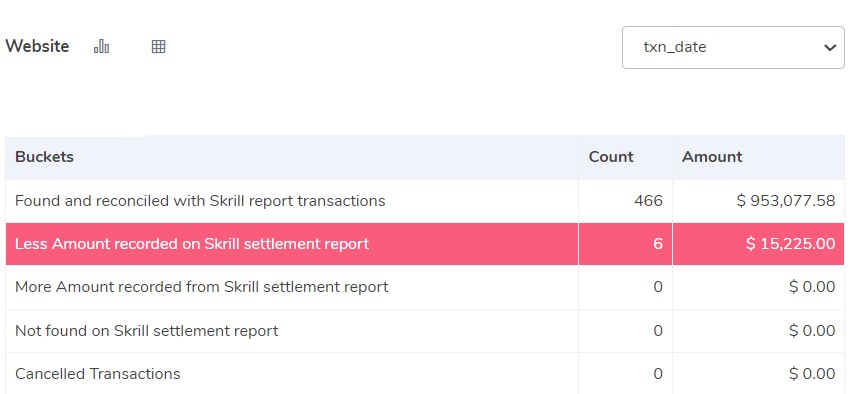

Reconciling Your Website with Skrill:

Here’s what reconciliation between your website and Skrill settlement reports might uncover:

Found and Reconciled Transactions:

These transactions appear in both reports, confirming a successful match.

Discrepancies in Transaction Amounts:

Less Amount Recorded on the Skrill Settlement Report:

This signifies a lower amount recorded on the Skrill settlement report compared to your website report.

More Amount Recorded on the Skrill Settlement Report:

This indicates a higher amount recorded on the Skrill settlement report compared to your website report.

Cancelled Transactions:

These represent orders cancelled by customers, appearing on your website report but missing from the Skrill settlement report as the payment was not processed.

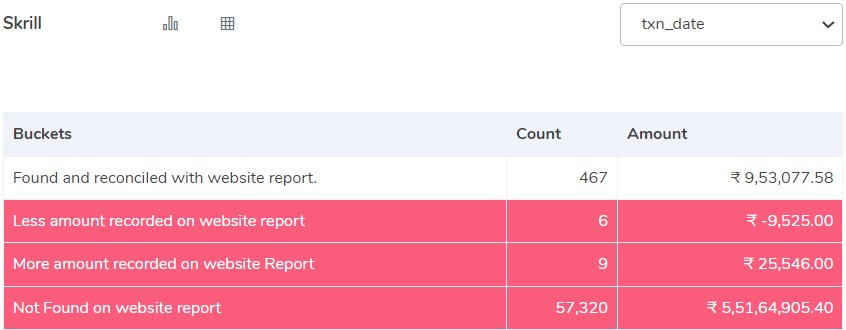

Reconciling Skrill with Your ERP System:

Reconciling Skrill reports with your Enterprise Resource Planning (ERP) system reports can identify the following:

Found and Reconciled Transactions:

These transactions appear in both the Skrill settlement report and your ERP reports, indicating a successful match.

Discrepancies in Transaction Amounts:

Less Amount Recorded on ERP Reports:

This signifies a lower amount recorded on your ERP reports compared to the Skrill settlement report.

More Amount Recorded on ERP Reports:

This indicates a higher amount recorded on your ERP reports compared to the Skrill settlement report.

Missing Transactions:

Not Found on ERP Reports:

These transactions are present in the Skrill settlement report but missing from your ERP reports, requiring further investigation.

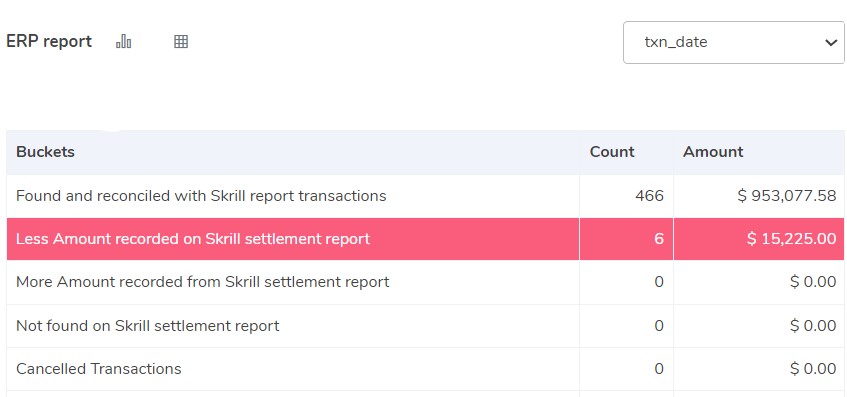

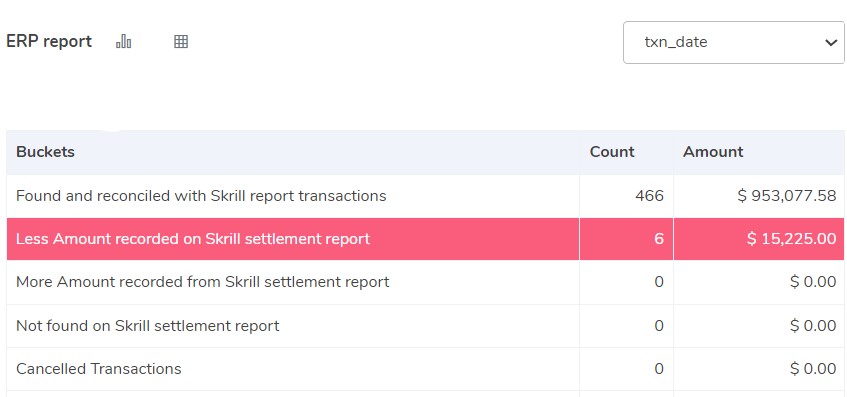

Reconciling Your ERP System with Skrill:

The reconciliation process between your ERP reports and Skrill settlement reports can reveal the following:

Found and Reconciled Transactions:

These transactions appear in both reports, confirming a successful match.

Discrepancies in Transaction Amounts:

Less Amount Recorded on Skrill Settlement Report:

This signifies a lower amount recorded on the Skrill settlement report compared to your ERP reports.

More Amount Recorded on Skrill Settlement Report:

This indicates a higher amount recorded on the Skrill settlement report compared to your ERP reports.

Missing Transactions:

Not Found on the Settlement Report:

These transactions are recorded in your ERP reports but missing from the Skrill settlement report, requiring further investigation.

Cancelled Transactions:

These transactions appear in the Skrill settlement reports but represent orders cancelled by customers and hence are not recorded in your ERP reports.

Reconciling Skrill with Your Bank Statements:

Reconciling Skrill reports with your bank statements can identify the following:

Found in Bank Statement:

These transactions appear in both your bank statements and the Skrill settlement reports, indicating a successful match.

Missing Transactions in Bank Statement:

These transactions are present in the Skrill settlement reports but not reflected in your bank statements, requiring

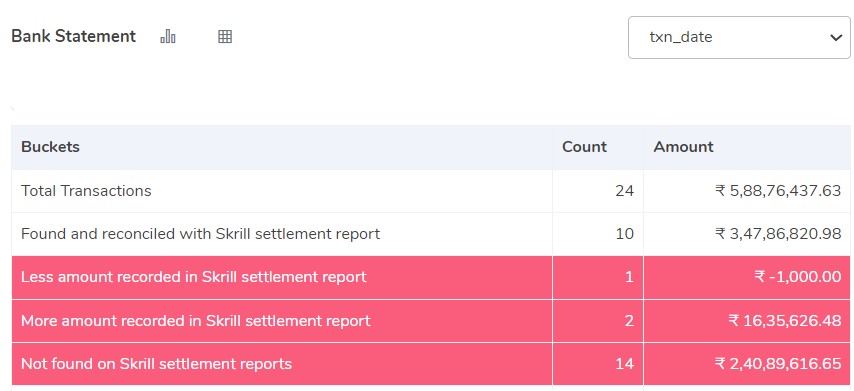

Reconcile Your Bank with Skrill for Seamless Accounting:

Reconciling your bank statements with Skrill reports is crucial for accurate financial records. Here’s what you might find:

Matched Transactions:

These transactions appear in both your bank statement and Skrill settlement report, confirming a successful match.

Discrepancies in Amounts:

Lower Amount in Skrill:

This indicates a discrepancy where the Skrill settlement report shows a lower amount compared to your bank statement.

Higher Amount in Skrill:

This signifies a discrepancy where the Skrill settlement report shows a higher amount compared to your bank statement.

Missing Transactions in Skrill:

These transactions are present in your bank statement but missing from the Skrill settlement report, requiring further investigation.

Automate Reconciliation and Save Time

Manual reconciliation is time-consuming and prone to errors. Invest in cutting-edge software like Cointab to automate the process. Cointab effortlessly verifies reports like Skrill settlements, refunds, website data, ERP systems, and bank statements.

Revolutionize Your Workflow with Effortless Reconciliation

Embrace automated reconciliation and free up valuable time for core business activities. Cointab ensures accuracy and simplifies financial management. Gain deeper business insights, improve customer satisfaction, and achieve better scalability with efficient reconciliation.

Boost Your Business with Cointab – Start Today!

Don’t let manual reconciliation hinder your growth. Contact Cointab for a free trial and experience the power of automated reconciliation. Streamline your finances and unlock valuable insights to propel your business forward.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation