Reconciliation of BlueSnap Payment Gateway Fee

Reconciliation of BlueSnap Payment Gateway Fee

BlueSnap empowers businesses to navigate the complexities of global payments. This comprehensive payment gateway simplifies e-commerce transactions, subscription billing models, and various online payment scenarios across diverse geographies and sales channels. However, as with any service provider, BlueSnap charges fees and taxes for its services. To ensure your business receives accurate billing, meticulous reconciliation of these charges is crucial.

This article delves into the importance of verifying BlueSnap payment gateway charges and introduces Cointab Reconciliation software, an automated solution that streamlines the process. We’ll explore the reports needed for verification, common discrepancies to watch out for, and the benefits of automated reconciliation.

Why Reconcile BlueSnap Payment Gateway Charges?

Reconciling your BlueSnap charges ensures you’re billed accurately and prevents potential undercharges or overcharges. Regular reconciliation safeguards your business finances and fosters trust with your payment processor.

Here’s a breakdown of the benefits:

Cost Control:

Identify discrepancies in fees and taxes, allowing you to claim any overcharges from BlueSnap.

Transparency:

Gain a clear understanding of your payment processing costs, enabling better financial planning.

Efficiency:

Automate the reconciliation process, freeing up valuable time and resources for core business activities.

Data-Driven Decisions:

Leverage insights from reconciliation reports to optimize your payment processing strategy and potentially negotiate better rates with BlueSnap.

Reports Required for BlueSnap Payment Gateway Charge Verification:

Effective reconciliation hinges on two essential reports:

BlueSnap Payment Report:

This report provides a comprehensive overview of your transactions, including the total number of transactions and the payment methods used (credit card, debit card, UPI, etc.).

BlueSnap Rate Card:

The rate card details the fees and percentages associated with each payment mode. This information serves as the benchmark for verifying the accuracy of BlueSnap’s charges.

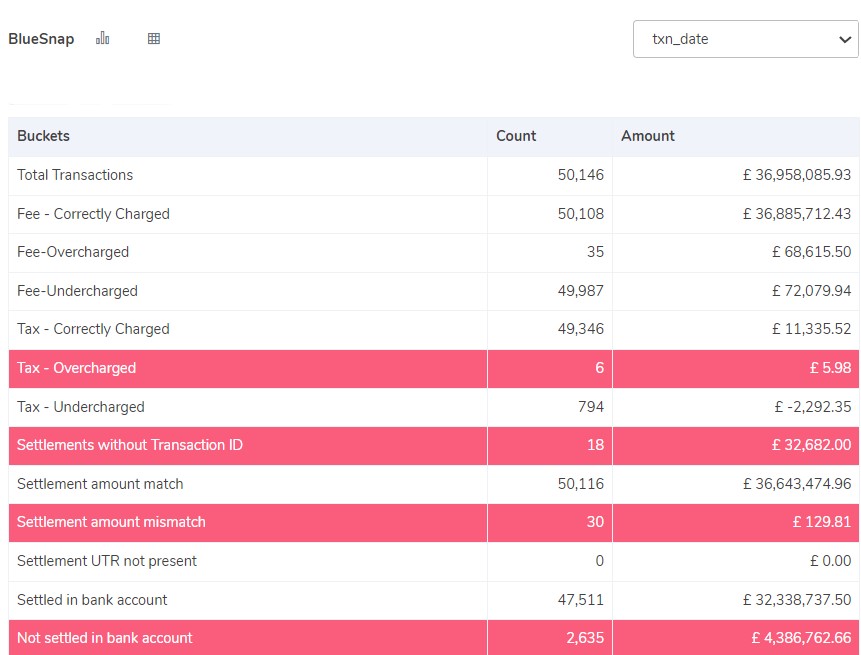

Results:

Key Verification Points for BlueSnap Charges:

By comparing the BlueSnap Payment Report with the Rate Card, you can verify various aspects of your charges:

Fees Correctly Charged:

In these transactions, the fees levied by BlueSnap should precisely match the amount calculated using the rate card.

Fees Overcharged:

If the fees charged by BlueSnap exceed the amount calculated based on the rate card, it indicates a potential overcharge.

Fees Under-charged:

Conversely, if the fees charged are lower than what the rate card specifies, your business might be undercharged.

Tax Verification:

Tax Correctly Charged:

The tax recorded in the payment report should align with the tax calculated as per applicable regulations (e.g., GST guidelines).

Tax Overcharge:

If the tax recorded in the report is higher than the calculated tax, it suggests a potential overcharge.

Tax Under-charged:

Similarly, a tax discrepancy where the reported tax is lower than the calculated tax signifies a potential undercharge.

Settlement Verification:

Settlement UTR (Unique Transaction Reference) Present:

The UTR is a crucial identifier for each transaction. Its absence in the payment report for specific transactions warrants investigation.

Settlement Amount Match:

The settlement amount represents the final amount deposited into your account after deducting fees and taxes. Ideally, this amount should match the corresponding figure in the BlueSnap report. (Settlement amount = Total amount – Fees – Taxes)

Settlement Amount Mismatch:

Discrepancies between the calculated settlement amount and the amount reported by BlueSnap require further examination.

Bank Reconciliation:

Settled in Bank Account:

The settlement amount should be reflected in both the UTR report and your bank statement.

Not Settled in Bank Account:

If the settlement amount appears in the UTR report but is absent from your bank statement, it necessitates immediate investigation.

Simplify Reconciliation with Cointab Reconciliation Software:

Manual reconciliation of BlueSnap charges can be a time-consuming and error-prone process. Cointab Reconciliation software automates this task, saving you valuable time and resources.

Here’s how Cointab streamlines the process:

Effortless Data Upload:

Upload your data in your preferred format, ensuring compatibility with the software.

Customizable Workflow:

Design a custom workflow tailored to your specific reconciliation needs.

Clear Data Visualization:

Easily view your data with clear and concise visualizations, highlighting discrepancies for swift action.

Minimal Effort, Maximum Accuracy:

Cointab minimizes the time and effort required for reconciliation while maximizing accuracy and efficiency.

By automating reconciliation, Cointab empowers you to:

Focus on Core Business Activities:

Free up valuable time and resources previously dedicated to manual reconciliation.

Gain Actionable Insights:

Utilize the insights gleaned from reconciliation reports to make informed decisions regarding your payment processing strategy.

Ensure Financial Accuracy:

Mitigate the risk of overcharges or undercharges, maintaining the financial health of your business.

Meticulous reconciliation of BlueSnap charges is an essential practice for businesses of all sizes. By leveraging Cointab Reconciliation software, you can automate this process, ensuring accuracy, efficiency, and cost control. With Cointab, you can gain valuable insights into your payment processing costs, optimize your strategy, and focus on growing your business. Take charge of your finances and streamline your payment processing journey with automated BlueSnap reconciliation using Cointab.