Does your business struggle with reconciling transactions processed through Chase Payment Gateway? Millions of transactions daily can make manual reconciliation a tedious and error-prone task. Cointab Reconciliation offers an automated solution to simplify this process, saving you time and ensuring financial accuracy.

Why Reconcile Chase Payment Gateway Transactions?

Enhanced Efficiency:

Automating data entry and cross-referencing eliminates manual work, freeing up your finance team for more strategic tasks.

Improved Accuracy:

Our software meticulously compares Chase settlement and refund reports with your website reports, ERP data, and bank statements, identifying any discrepancies or miscalculations.

Reduced Costs:

Timely identification of overcharges prevents financial losses and ensures you’re billed correctly.

Peace of Mind:

Gain confidence in your financial records with a clear overview of all transactions processed through Chase Payment Gateway.

Cointab Reconciliation: A Powerful Solution for Your Business

Our customizable software integrates seamlessly with your existing systems, automating the reconciliation process entirely. Here’s how it works:

Data Gathering:

Cointab securely retrieves transaction data from Chase settlement reports, refund reports, and your internal systems.

Automated Matching:

Our software automatically matches transactions across all your data sources, identifying any inconsistencies.

Detailed Analysis:

Cointab provides a comprehensive breakdown of all transactions, highlighting potential mismatches and overcharges.

Easy Reconciliation:

The user-friendly interface allows you to quickly reconcile matched transactions and investigate any discrepancies.

Chase Payment Gateway Reconciliation Reports:

Chase Settlement Reports: Details successful payment transactions processed by Chase.

Chase Refund Reports:

Tracks all refunded or canceled orders.

Website Reports:

Provides a record of all orders placed through your website.

ERP Reports: Internal reports containing your order data.

Bank Statements:

Reflects all transactions processed through Chase Payment Gateway.

Simplify Your Chase Payment Gateway Reconciliation Today

Don’t let manual reconciliation slow down your business or compromise your financial accuracy. Contact Cointab today to learn more about our automated solution and see how we can help you streamline your Chase Payment Gateway reconciliation process.

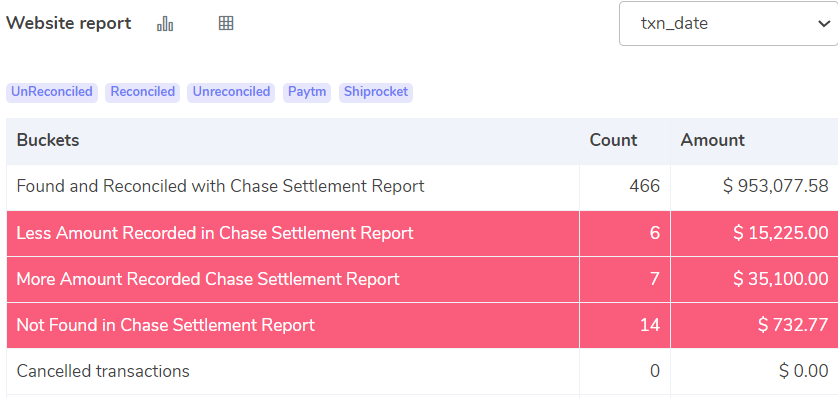

Chase Reconciliation with Website:

Reconciliation Results:

Identifying Discrepancies for Accurate Records

Matching transactions across your website reports and Chase data is crucial for reconciliation. Here’s how Cointab identifies discrepancies:

Matched Transactions:

These transactions appear in both the Chase settlement report and your website report, indicating a successful sale with accurate recorded amounts. This is the ideal outcome.

Website Discrepancies:

Overstated Website Amount: This occurs when your website reports a higher sales total compared to the Chase settlement report. This could indicate:

Order Modifications:

Did you offer discounts or refunds after the initial order placement on your website?

Tax Miscalculations:

Ensure your website tax calculations align with Chase’s applied rates.

Understated Website Amount:

When your website reports a lower sales total than the Chase settlement report, it might be due to:

Missing Orders:

Investigate if any website orders failed to sync with Chase.

Partial Refunds:

Did you process partial refunds that weren’t reflected on the website?

Missing Chase Transactions:

Transactions present in the Chase settlement report but absent from your website reports require investigation. This could be due to:

Test Transactions:

Did Chase process any test transactions that don’t reflect actual sales?

Fraudulent Activity:

Investigate the possibility of fraudulent orders processed through Chase.

By pinpointing these discrepancies, Cointab empowers you to take corrective actions and ensure your financial records accurately reflect all transactions.

Website Reconciliation with Chase:

Reconciling your Chase Payment Gateway transactions ensures your financial records accurately reflect your business activity. Here’s a breakdown of common reconciliation results to help you identify potential discrepancies:

Matched Transactions:

These transactions appear in both the Chase settlement report and your website report, indicating a successful sale with matching recorded amounts. This signifies a smooth transaction process.

Website Discrepancies:

Understated Chase Settlement Amount: This occurs when the Chase settlement report reflects a lower total compared to your website report. Potential reasons include:

Order Adjustments:

Did you offer discounts, refunds, or coupons after the initial order placement?

Tax Variations:

Ensure your website tax calculations match those applied by Chase.

Overstated Chase Settlement Amount:

When the Chase settlement report shows a higher total than your website report, it might be due to:

Missing Website Orders:

Investigate if any website orders failed to sync with Chase.

Incomplete Refunds:

Did you process partial refunds not reflected on the website?

Canceled Transactions:

These transactions appear only on your website report because customers canceled them before completion. These wouldn’t be reflected in the Chase settlement report as no actual payment was processed.

By understanding these reconciliation results, you can effectively manage discrepancies and ensure your financial records accurately reflect your business’s revenue.

Chase reconciliation with ERP

Reconciling your Chase Payment Gateway transactions with your Enterprise Resource Planning (ERP) system ensures all departments have a consistent view of your sales activity. Here’s how Cointab identifies discrepancies between Chase data and your ERP reports:

Matched Transactions:

These transactions appear in both the Chase settlement report and your ERP reports, indicating a successful sale with matching recorded amounts. This signifies seamless data flow between your systems.

ERP Discrepancies:

Overstated ERP Amount:

This occurs when your ERP reports reflect a higher total compared to the Chase settlement report. Potential reasons include:

Order Modifications:

Did you adjust order pricing or add shipping costs after the initial data entry in your ERP?

Inventory Discrepancies:

Ensure your ERP reflects accurate inventory levels to avoid discrepancies with processed sales in Chase.

Understated ERP Amount:

When your ERP reports show a lower total than the Chase settlement report, it might be due to:

Missing Sales Entry:

Investigate if any sales were processed through Chase but not recorded in your ERP.

Product Returns:

Did you process returns through Chase that weren’t reflected in your ERP?

Missing ERP Transactions:

Transactions present only in the Chase settlement report and absent from your ERP reports require investigation. This could be due to:

Direct Order Entry:

Did customers place orders directly through Chase, bypassing your usual sales channels?

Integration Issues:

Investigate any technical issues preventing data from syncing between Chase and your ERP.

Understanding these reconciliation results empowers you to maintain data consistency across your internal systems and ensure accurate financial reporting.

ERP Reconciliation with Chase:

Reconciling your Chase Payment Gateway transactions with your bank statements is crucial for maintaining accurate financial records. Here’s a breakdown of key results to help you identify potential discrepancies:

Matched Transactions:

These transactions appear in both the Chase settlement report and your bank statement, signifying a successful sale with matching recorded amounts. This is the ideal outcome.

Bank Statement Discrepancies:

Understated Chase Settlement Amount:

This occurs when the Chase settlement report reflects a lower total compared to your bank statement. Potential reasons include:

Chargebacks:

Did customers initiate chargebacks that weren’t reflected in the initial Chase settlement report?

Chase Fees:

Ensure you’ve accounted for any processing or transaction fees applied by Chase.

Overstated Chase Settlement Amount:

When the Chase settlement report shows a higher total than your bank statement, it might be due to:

Deposit Delays:

Investigate if any Chase deposits haven’t yet cleared in your bank account.

Settlement Adjustments: Did Chase make any adjustments to your settlement amount after the initial report?

Missing Transactions:

Missing Chase Transactions:

Transactions present in your bank statement but absent from the Chase settlement report require investigation. This could be due to:

Bank Errors:

Investigate any potential errors or discrepancies within your bank statement.

Unidentified Deposits:

Identify the source of deposits in your bank statement that don’t match Chase transactions.

Missing Bank Transactions:

Transactions present in the Chase settlement report but missing from your bank statement could be due to:

Outstanding Deposits:

These deposits may not have cleared in your bank account yet.

Reconciliation Errors:

Ensure you’ve accurately matched transactions between both reports.

By understanding these reconciliation results, you can effectively manage discrepancies and ensure your bank statements accurately reflect all Chase payment gateway transactions processed for your business.

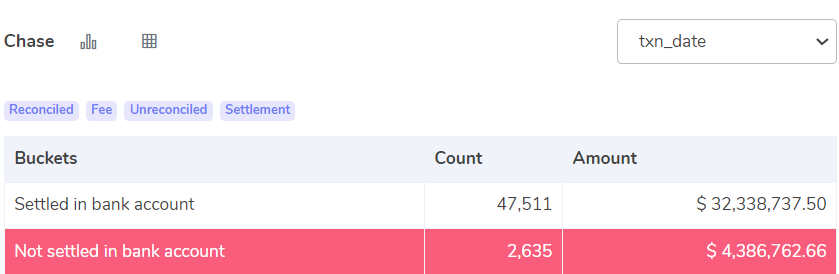

Chase Reconciliation with Bank:

Reconciling your Chase Payment Gateway transactions with your bank statements ensures received funds from Chase match your financial records. Here’s how Cointab interprets key results:

Settled Transactions:

These transactions appear in both the Chase settlement report and your bank statement, confirming successful deposits and matching recorded amounts. This signifies a complete transaction cycle.

Unsettled Transactions:

Transactions present in the Chase settlement report but absent from your bank statement require investigation.

Here’s why this might occur:

Outstanding Deposits:

Chase may have initiated the transfer, but the funds haven’t yet cleared in your bank account. These deposits will appear eventually.

Processing Delays:

Depending on your bank’s processing times, there may be a slight delay between the Chase settlement report and the reflected funds.

Investigative Actions:

Contact Chase:

If the timeframe for deposit clearance seems excessive, contact Chase to inquire about any potential delays or issues with your settlement.

Verify Bank Statement:

Double-check your bank statement for any errors or discrepancies that might explain the missing transaction.

By understanding these reconciliation results, you can effectively track settled funds and ensure your bank statements accurately reflect all Chase payment deposits.

Bank Reconciliation with Chase:

Chase Reconciliation:

Unmatched Transactions Explained for Accurate Reporting Reconciling your Chase Payment Gateway transactions with bank statements ensures your financial records reflect received funds accurately. Here’s how Cointab identifies discrepancies:

Matched Transactions:

These transactions appear in both the Chase settlement report and your bank statement, indicating successful deposits with matching recorded amounts. This is the ideal outcome.

Bank Reconciliation Discrepancies:

Overstated Chase Settlement Amount:

This occurs when the Chase settlement report reflects a higher total compared to your bank statement. Potential reasons include:

Outstanding Deposits:

Chase may have initiated the transfer, but the funds haven’t yet cleared in your bank account. These will appear eventually.

Settlement Adjustments:

Did Chase make any adjustments to your settlement amount after the initial report?

Understated Chase Settlement Amount:

When the Chase settlement report shows a lower total than your bank statement, it might be due to:

Chargebacks:

Did customers initiate chargebacks that weren’t reflected in the initial Chase settlement report?

Chase Fees:

Ensure you’ve accounted for any processing or transaction fees applied by Chase.

Missing Transactions:

Missing Chase Transactions:

Transactions present in your bank statement but absent from the Chase settlement report require investigation. This could be due to:

Bank Errors:

Investigate any potential errors or discrepancies within your bank statement.

Unidentified Deposits:

Identify the source of deposits in your bank statement that don’t match Chase transactions.

Missing Bank Transactions:

Transactions present in the Chase settlement report but missing from your bank statement could be due to:

Reconciliation Errors:

Ensure you’ve accurately matched transactions between both reports.

By understanding these reconciliation results, you can effectively manage discrepancies and ensure your bank statements accurately reflect all Chase payment gateway transactions processed for your business.

Cointab Reconciliation: Your Automated Solution for Streamlined Efficiency

Cointab simplifies the reconciliation process by automating data entry and cross-referencing Chase settlement reports, bank statements, and other relevant data sources. This eliminates manual work and ensures error-free results.

Our software provides a clear overview of all transactions, helping you identify potential discrepancies and overcharges. This empowers you to take corrective actions and maintain accurate financial records.

Cointab Reconciliation:Embrace Streamlined Reconciliation with Cointab

Don’t waste time and risk errors with manual reconciliation. Choose Cointab to automate the process, gain valuable financial insights, and achieve efficient financial management.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation