Streamline Your Payment Processing with Helcim

Helcim empowers Canadian and US businesses to accept credit card payments securely at competitive rates. Their diverse online and retail payment solutions cater to a wide range of needs.

Maintaining Financial Control with Automated Reconciliation

Verifying the accuracy of Helcim charges is crucial to avoid discrepancies and potential financial losses. Manual reconciliation, however, can be a tedious and error-prone process. Here’s where Cointab Reconciliation steps in to simplify your financial management.

Effortless Verification with Cointab Reconciliation

Cointab Reconciliation streamlines the verification process for your Helcim transactions, boosting your finance team’s efficiency. Our customizable software automates data entry, eliminating manual errors. It seamlessly compares data across your bank accounts, ERP reports, website reports, and Helcim invoices, ensuring you catch any overcharges or miscalculations.

Key Reports for Reconciling Helcim Transactions:

Helcim Settlement Reports:

These reports detail completed orders and corresponding payments.

Helcim Refund Reports:

Track refunded or canceled orders within these reports.

Website Reports:

Gain insights into all website orders placed, regardless of payment status.

ERP Reports:

Access your internal order data for comprehensive reconciliation.

Bank Statements:

Verify payments received from Helcim against your bank account records.

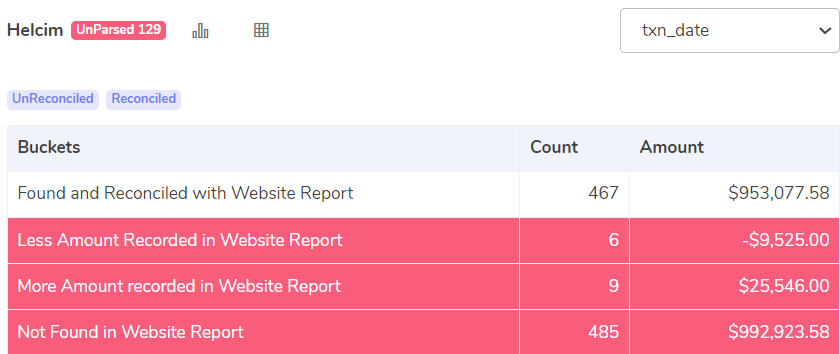

Helcim with website reconciliation

Website Report Comparison:

Matched Transactions: These transactions appear in both the payment gateway settlement report and the website report, indicating successful reconciliation.

Website Overcharge Discrepancy:

The website report reflects a higher amount compared to the settlement report. Investigate this difference to identify any errors.

Website Undercharge Discrepancy:

The website report shows a lower amount compared to the settlement report. Investigate this discrepancy to identify any errors.

Missing Transactions:

Transactions exist in the settlement report but are absent from the website report. This might require clarification from your payment gateway provider.

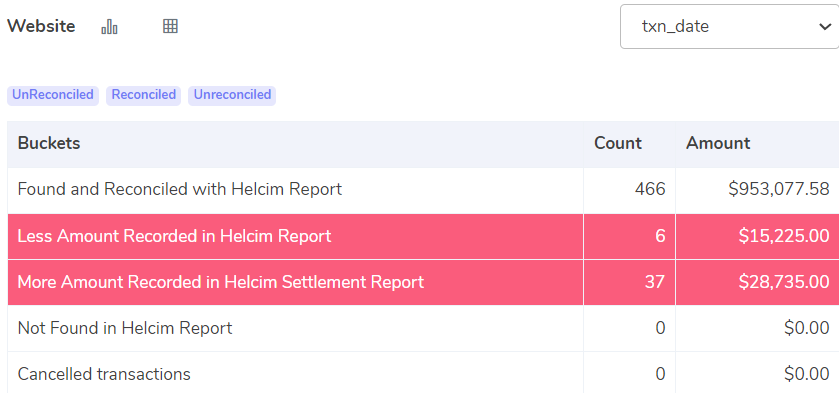

Website with Helcim reconciliation:

This section outlines potential scenarios when comparing your website report with your payment gateway’s settlement report:

Matched Transactions:

These transactions appear in both reports and signify a successful reconciliation.

Discrepancy:

Website Overcharge –

The website report reflects a higher amount than the settlement report. Investigate this difference to identify any errors (e.g., pricing mistakes, duplicate transactions).

Discrepancy:

Website Undercharge –

The website report shows a lower amount than the settlement report. Investigate this discrepancy to identify any errors (e.g., missing fees, discount codes not applied).

Missing Transactions: –

Transactions exist in the settlement report but are absent from the website report. This might require clarification from your payment gateway provider (e.g., manual adjustments, chargebacks).

Canceled Transactions: –

Transactions canceled by the customer might only be reflected in the website report and not the settlement report, as the payment wasn’t finalized.

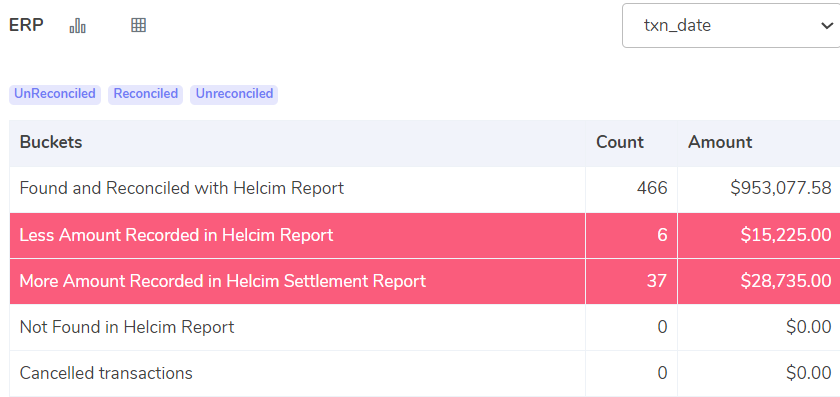

Helcim reconciliation with ERP

Matched Transactions:

These transactions appear in both the payment gateway settlement report and the ERP report, indicating successful reconciliation.

ERP Overcharge Discrepancy:

The ERP report reflects a higher amount compared to the settlement report. Investigate this difference to identify any errors (e.g., data entry mistakes in ERP).

ERP Undercharge Discrepancy:

The ERP report shows a lower amount compared to the settlement report. Investigate this discrepancy to identify any errors (e.g., missing transactions in ERP).

Missing Transactions:

Transactions exist in the settlement report but are absent from the ERP report. This might require investigating your ERP system for missing data entries.

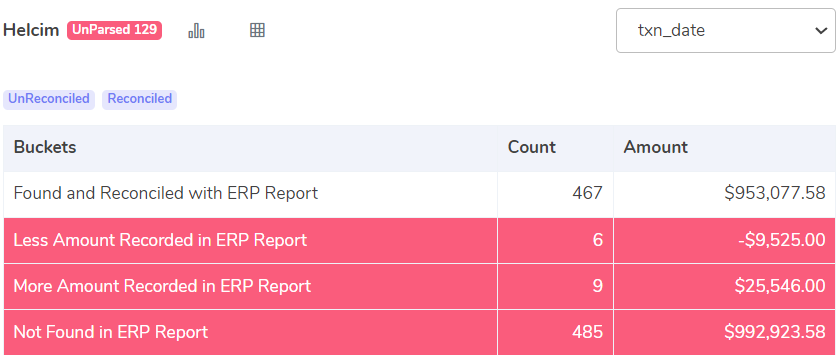

ERP report with Helcim reconciliation

This section outlines potential scenarios when comparing your Enterprise Resource Planning (ERP) report with your payment gateway’s settlement report:

Matched Transactions:

These transactions appear in both reports and signify successful reconciliation.

Discrepancy: ERP Overcharge –

The ERP report reflects a higher amount than the settlement report. Investigate this difference to identify any errors (e.g., pricing mistakes in ERP, duplicate entries).

Discrepancy: ERP Undercharge –

The ERP report shows a lower amount compared to the settlement report. Investigate this discrepancy to identify any errors (e.g., missing transactions in ERP, incorrect tax calculations).

Missing Transactions in Payment Gateway: –

Transactions exist in the ERP report but are absent from the settlement report. This might require clarification from your payment gateway provider (e.g., failed transactions, processing delays).

Canceled Transactions: –

Transactions canceled by the customer might only be reflected in the ERP report and not the settlement report, as the payment wasn’t finalized.

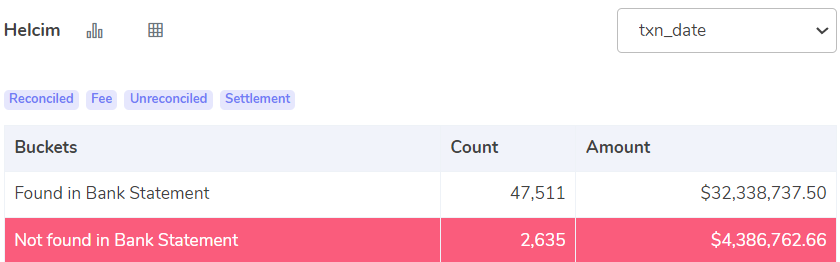

Helcim with Bank reconciliation

Settled:

These transactions appear in both the payment gateway settlement report and your bank statement, signifying successful reconciliation.

Not Settled:

These transactions are present in the settlement report but are missing from your bank statement. Investigate these discrepancies to ensure timely settlements.

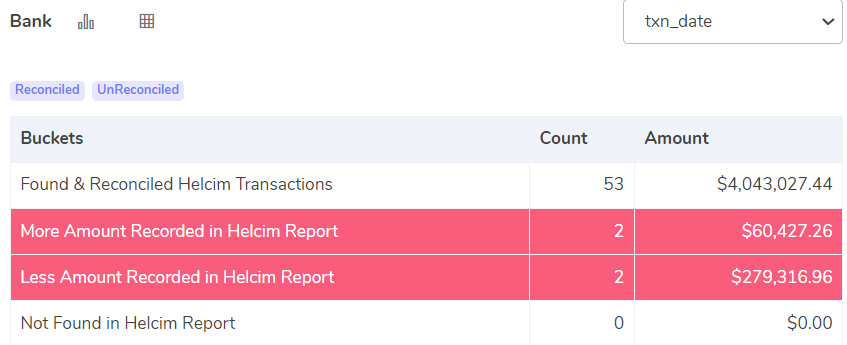

Bank reconciliation with Helcim

This section outlines potential scenarios when comparing your payment gateway’s settlement report with your bank statements:

Matched Transactions:

These transactions appear in both reports, signifying successful reconciliation.

Discrepancy: Gateway Overcharge –

The settlement report reflects a higher amount than your bank statement. Investigate this difference to identify any errors (e.g., gateway fees, refunds not reflected in the settlement report).

Discrepancy: Gateway Undercharge

The settlement report shows a lower amount compared to your bank statement. Investigate this discrepancy to identify any errors (e.g., missing transactions in the settlement report).

Missing Transactions in Gateway:

Transactions exist in your bank statement but are absent from the settlement report. This might require clarification from your payment gateway provider (e.g., unmatched deposits, duplicated settlements).

Struggling with manual reconciliation of complex financial data? Cointab Reconciliation can be your one-stop solution! Our software automates the entire process, eliminating the need for tedious manual comparisons between your payment gateway settlement reports, website reports, ERP systems, and bank statements. This not only saves you valuable time but also ensures error-free results.

Cointab Reconciliation seamlessly handles data loading and processing, providing a clear and comprehensive overview of all your transactions. Leverage its power to identify discrepancies quickly and maintain impeccable financial accuracy. Don’t wait to experience the efficiency of automated reconciliation – unlock a smoother path to financial control!

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation